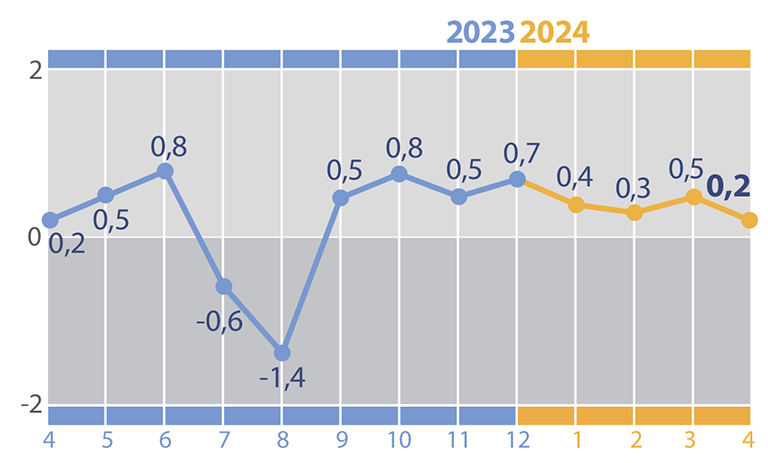

Change in consumer prices in Ukraine in 2023-2024

Source: Open4Business.com.ua and experts.news

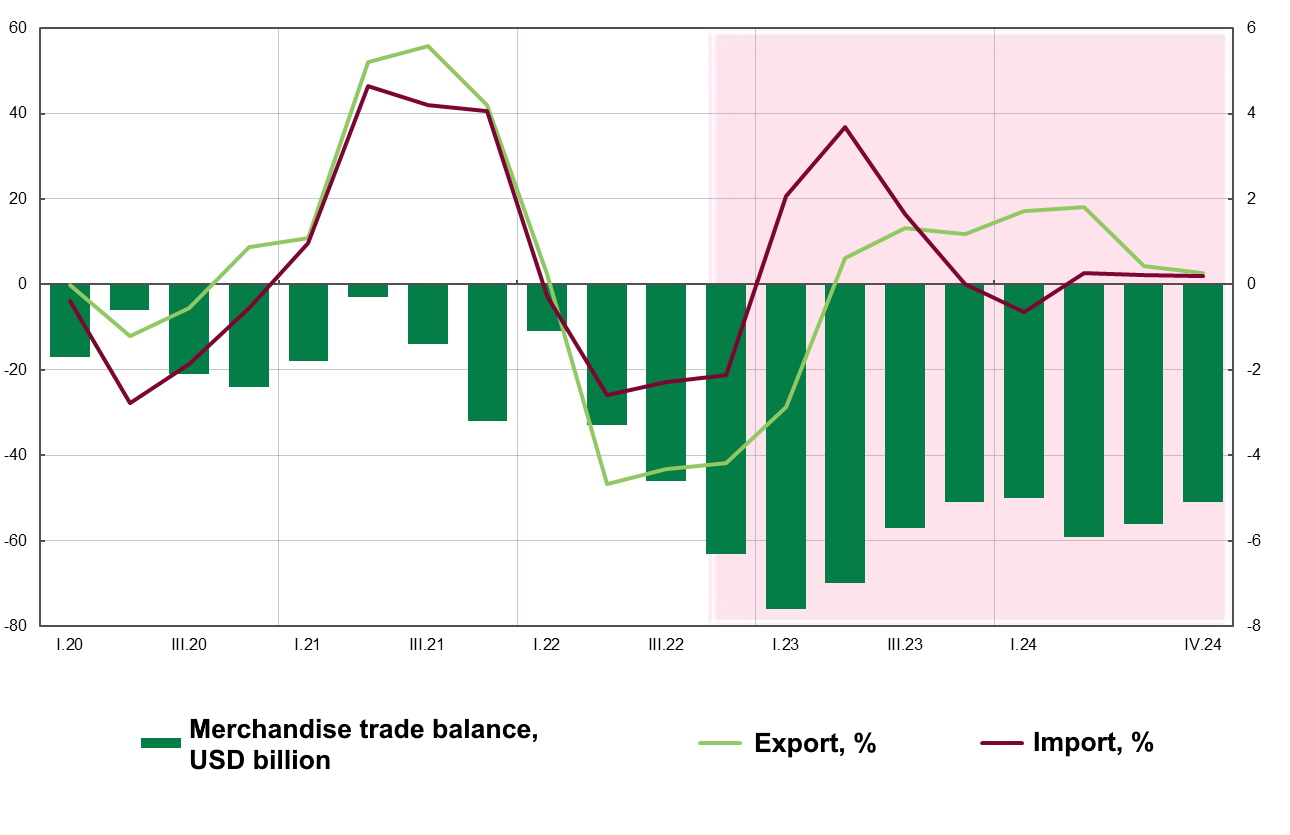

2022-2024 goods trade balance forecast (USD billion)

Source: Open4Business.com.ua and experts.news

In Kiev on Oleksandr Konisky Street unknown persons demolished a house with the help of heavy construction equipment, the circumstances of demolition of a historical building in the center of the capital are established by the police in the framework of criminal proceedings.

As reported on Saturday by the National Police of Kiev in facebook, law enforcers are now conducting priority investigative actions. The equipment, which was used to demolish the building, has been seized. On this fact is investigated criminal proceedings, initiated under Part 2 of Article 298 of the Criminal Code of Ukraine.

In the evening on Friday the police in Kiev received a report that unknown persons demolished a house built at the end of XIX century on Oleksandr Konisky Street with the help of heavy construction equipment. At the scene of the incident, the operational duty officer immediately sent an investigative team.

The police officers identified the location of the equipment and seized it, the question of its arrest is being resolved. On this fact investigators of Shevchenkivsky police department are investigating criminal proceedings initiated under part 2 of article 298 of the Criminal Code of Ukraine. All circumstances of the incident are being established.

The National Bank of Ukraine (NBU) this week increased its net sale of foreign currency on the interbank market to $949.9m from $532.1m the previous week, according to the regulator’s data. According to them, the volume of currency purchases by the central bank remains paltry at $0.27m, while its sales rose to $950.2m.

Over the week, the official hryvnia exchange rate weakened to a record 41.4912 UAH/$1 from 41.0107 UAH/$1.

Since the beginning of 2024, the dollar at the official exchange rate has become more expensive by 9.2%, or by UAH 3.49, and since the transition of the National Bank on October 3, 2023 to the regime of managed flexibility – by 13.4%, or by UAH 4.93.

On the cash market, the hryvnia weakened by about 70 cents during the week. – To 41.95 UAH/$1.

According to the data that the NBU managed to publish during this period, from Monday to Thursday the negative balance between the volume of currency purchases and sales by households increased from $36.5 million to $52.9 million, following the weakening of the hryvnia.

Ukraine’s international reserves fell by $1.14 billion to $37.89 billion in June, according to the NBU’s preliminary estimates, while the National Bank’s net interventions totaled $2.99 billion, down from $3.07 billion in May.

Twelve industrial parks have already been registered in Kyiv region, the region has one of the largest networks of such parks across Ukraine, OBA chief Ruslan Kravchenko said.

“Despite the war, the Kiev region is creating better conditions for companies to continue investing in the region’s economy. This week we opened offices of two large well-known companies and registered an industrial park,” the OBA quoted Kravchenko as saying.

Green Industrial Park will appear in Vyshgorod district. It will create about 3 thousand jobs. The amount of investments is almost 6 billion hryvnias. On its territory will be created enterprises that will produce building structures, metal products, food products.

Turkish manufacturer of generators and compressors Dalgakiran has opened an office and working facilities in Buchanskiy rayon. The amount of investments is almost UAH 400 mln. 50 jobs were created.

Alfatech company opened an office in Fastivskyi district. It specializes in sales and service of construction, road and industrial machinery. 40 jobs were created here.

US presidential candidate from the Republican Party Donal Trump commented on his phone conversation with Ukrainian President Volodymyr Zelensky.

“Today, President Zelensky and I had a very good phone conversation with President Zelensky of Ukraine…. I appreciate President Zelensky reaching out to me because as your next President of the United States, I will bring peace to the world and end a war that has cost so many lives and destroyed countless innocent families. Both sides will be able to come together and make an agreement that will end violence and pave the way for prosperity,” Truth wrote on social media after speaking with Ukrainian President Zelensky on Saturday night

Trump also mentioned that Zelensky congratulated him on the success of the Republican National Convention and on becoming the Republican Party’s nominee for President of the United States.

“He condemned the heinous assassination attempt that took place last Saturday and noted that these are times when the American people come together in a spirit of unity,” Trump emphasized.