Almost 31 thousand sole proprietorships ceased operations in the first 4 months of 2024. The most frequently closed businesses are in Kyiv, Kharkiv and Dnipro regions. More than 23% of newly established businesses closed in 2024.

30,904 businesses ceased operations in the first 4 months of 2024. However, the number of new businesses opened is twice as high – more than 74 thousand in the first quarter of this year.

The most frequent closures are in the retail sector – 10,773 (34.9%). Computer programming and wholesale trade are also in the top three, with 10.1% and 6.2% respectively.

Kyiv has the highest number of businesses closing – more than 3,800 or 12.4%. The second place in the anti-rating is occupied by Kharkiv region – almost 2.4 thousand businesses (7.7%). And Dnipropetrovs’k region closes the top, where almost 2.4 thousand businesses, or 7.7%, have also ceased their activities.

Odesa and Lviv regions are also in the anti-top, with 7.7% and 6.8% respectively.

More than 23% of the newly created PEs last year ceased operations in 2024, which is 7.3 thousand businesses.

Ukrgazvydobuvannya (UGV) has launched two more high-yield wells with a flow rate of 270,000 cubic meters and 120,000 cubic meters of gas per day, the press service of Naftogaz Group said Tuesday. According to it, the wells are 6,200 meters and 6,225 meters deep, drilled in the same field, in the same reservoir and almost simultaneously, so they are called “twins” in technical slang.

Thanks to the use of modern drilling machines, the skill of Ukrburgaz specialists and the reduction of accidents during the work, the wells were drilled in 8 months, whereas previously it took 2-3 years.

“New seismic and drilling data allowed our specialists to create a high-quality 3D model, which is one of the best in “Ukrgasvydobuvannya” and allows us to effectively plan the directions of further development of this field. The works on the field continue, and drilling of the next appraisal and production well will be completed soon”, – Oleg Tolmachev, Head of UGV, noted.

In total, since the beginning of 2024, UGV has already put into operation seven new high-yield wells, including twin wells.

As reported, UGV launched 86 new wells during 2023, of which 24 – with an initial flow rate of more than 100 thousand cubic meters.

In 2022, UGV produced 12.5 billion cubic meters of natural gas (marketable), which is 3% less than in 2021. At the end of 2023, the company’s marketable gas production amounted to 13.224 billion cubic meters, which is 0.679 billion cubic meters more than in 2022. The target for 2024 is 13.75 billion cubic meters.

Naftohaz Ukrainy owns 100% of Ukrhazvydobuvannya.

In May, JSC OTP BANK introduces a new service – the sale of domestic government bonds in the OTP Bank UA application from the Bank’s own portfolio. Thus, the purchase of domestic government bonds will be available at any time, regardless of the date of the Ministry of Finance of Ukraine’s auctions.

According to Valeria Ovcharuk, OTP Bank product owner, the new service will give customers more opportunities to choose the optimal bond rate and maturity. “Last fall, OTP Bank provided its customers with the opportunity to buy domestic government bonds directly at auctions of the Ministry of Finance through the OTP Bank UA application. To offer even more opportunities for investing in government securities, we have developed a functionality that will allow individuals to buy government bonds from the Bank’s portfolio online. We conducted an internal study within the Bank, analyzed requests from our customers regarding the desired maturity and currency for investments, and based on this, we formed a portfolio of securities for sale. This way, customers will be able to combine the optimal rate and investment period. The service is at the testing stage and will be available to users in May,” said Ms. Ovcharuk.

She emphasized that buying government bonds in OTP Bank is convenient and fast. “Just a few clicks in the application and government securities are in your bond portfolio. At the same time, you are making a profitable and reliable investment in the future, as the repayment of government bonds is 100% guaranteed by the state. At the same time, it is an opportunity to help the Ukrainian economy,” emphasized Ms. Ovcharuk.

The service will be available online to all customers who have opened a securities account at any branch of OTP Bank.

As a reminder, according to the Ministry of Finance of Ukraine, OTP Bank was ranked fourth among Ukrainian banks in the overall rating of primary dealers in 2023.

The status of a primary dealer provides the exclusive right to participate in the placement of domestic government bonds conducted by the Ministry of Finance, both on its own behalf and for clients of individuals and legal entities, as well as banks and financial companies that do not have such a status.

To learn more about investing in domestic government bonds through the OTP Bank UA app, please follow the link.

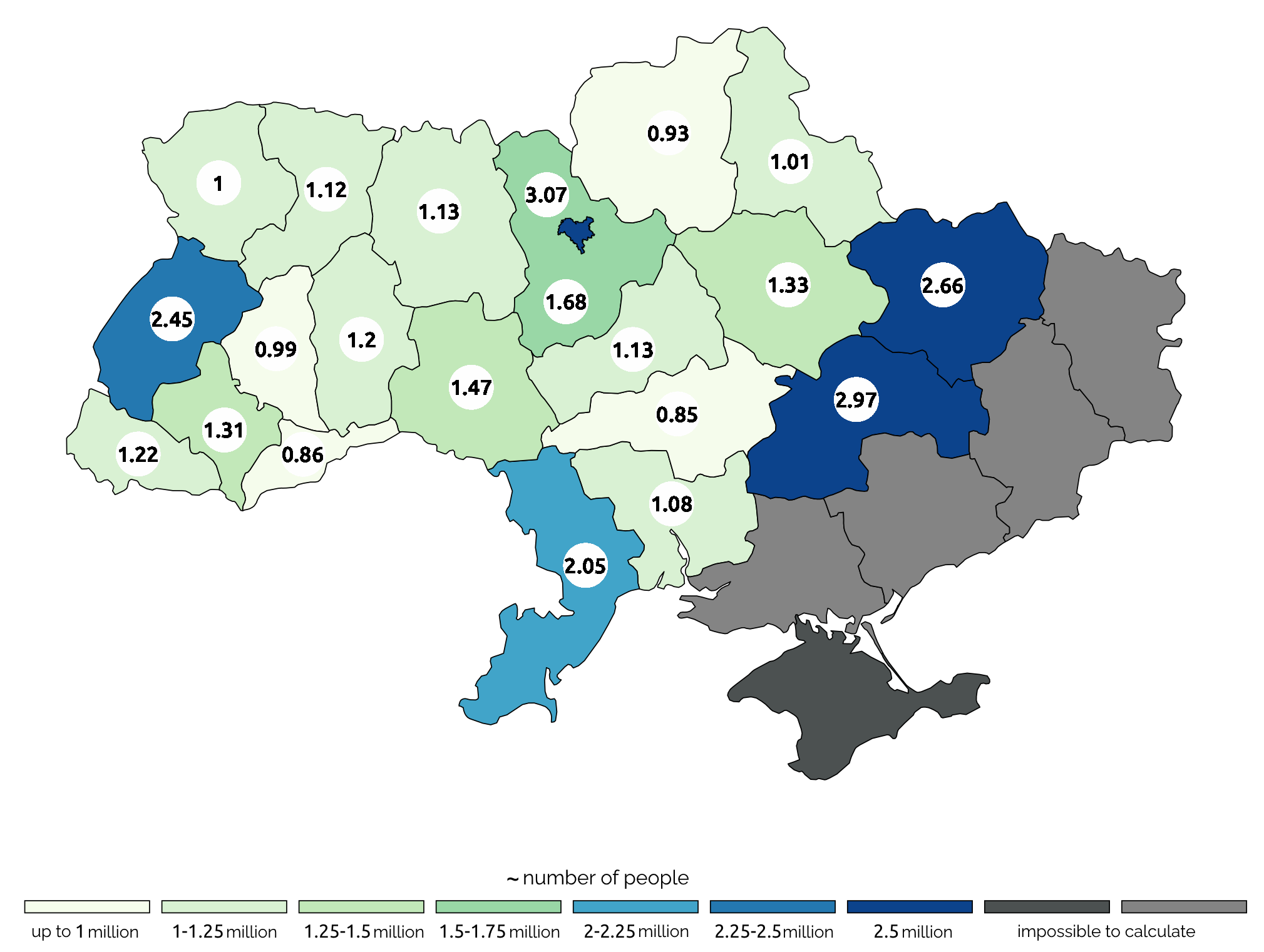

Estimated number of population in regions of Ukraine based on number of active mobile sim cards (mln)

Source: Open4Business.com.ua and experts.news

Ukrainian Parliament Speaker Ruslan Stefanchuk is on an official visit to Turkey on May 13-15.

According to the press service of the Ukrainian parliament’s apparatus, Stefanchuk will hold a number of bilateral meetings and negotiations in Ankara, including with the chairman of the Grand National Assembly of Turkey, Numan Kurtulmuş.

During the meetings will touch upon the topics of realization of the Formula of Peace of Ukrainian President Volodymyr Zelensky, the reconstruction of Ukraine, in particular, the involvement of Turkey in the reconstruction process.

“The purpose of the visit is to deepen strategic cooperation between Ukraine and Turkey, to expand interparliamentary cooperation, as well as to overcome the negative consequences of Russian aggression, which threatens stability and development in the Black Sea region”, – stated in the message of the press service.

Shareholders of PJSC Insurance Company Satis (Kyiv) will consider the issue of voluntary withdrawal from the market by fulfilling the insurance portfolio, according to the agenda of the meeting scheduled for May 29. According to the announcement of the company in the information disclosure system of the National Commission on Securities and Stock Market (NCSSM), the shareholders also plan to approve the plan of insurance portfolio fulfillment and terms of its implementation, appointment of the person responsible for the implementation of measures on voluntary exit from the market, to sign the application for authorization for these actions and the plan of their implementation.

IC Satis has been operating in the Ukrainian market since 1995 and specializes in risk insurance.

According to the data of NCSSM as of Q3-2023, the shareholders of the company were Iryna Yakhnytsya, who owns 24,234% of the insurer’s shares, Alexander Yakhnytsya with 23,494% of shares, Elena Yakhnytsya and Yuriy Baskakov, who own 8,472% each, Igor Yakhnytsya with 8,803% and PE “Finvest” with 9,948%.