Qatar is perceived by Ukrainians as mostly neutral, although there is a noticeable positive trend. This is evidenced by the results of a sociological survey conducted by Active Group in collaboration with the Experts Club think tank in April 2025.

Thus, 13.1% of Ukrainians have a positive attitude towards Qatar (11.0% — mostly positive, 2.1% — completely positive), while 6.7% express a negative opinion (5.0% — mostly negative, 1.7% — completely negative). At the same time, 69.0% of respondents remain neutral, and 11.2% abstained from answering.

“The high level of neutrality indicates limited awareness of Qatar among Ukrainians, but the existing positive trend creates opportunities for the development of bilateral relations,” said Oleksandr Pozniy, co-founder of Active Group.

These results open up prospects for deepening humanitarian, cultural, and economic cooperation between Ukraine and Qatar.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

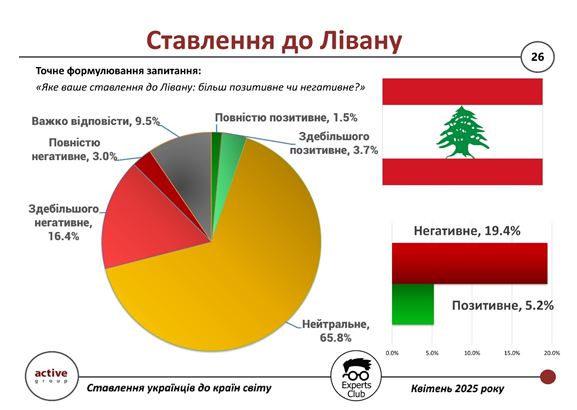

Lebanon evokes a predominantly neutral, but somewhat cautious attitude among Ukrainian citizens. This is evidenced by the results of a survey conducted by Active Group in cooperation with the Experts Club think tank in April 2025.

According to the survey, 65.8% of Ukrainians expressed a neutral position towards Lebanon. Only 5.2% of respondents spoke positively about the country (3.7% mostly positive, 1.5% completely positive), while 19.4% expressed a negative attitude (16.4% mostly negative, 3.0% completely negative). Another 9.5% of respondents were unable to answer.

“Ukrainian society perceives Lebanon through the prism of regional instability and religious and political conflicts in the Middle East. This affects the country’s image in the information field,” said Oleksandr Pozniy, co-founder of Active Group.

These data demonstrate both the insufficient level of contact between the two countries and the influence of global stereotypes on public perception.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Kuwait remains a country with limited influence on public opinion in Ukraine. This is evidenced by the results of a sociological survey conducted by Active Group in April 2025 in cooperation with the Experts Club think tank.

According to the survey, 71.8% of Ukrainians have a neutral attitude toward Kuwait. Only 8.0% of respondents had a positive attitude (6.2% mostly positive, 1.9% completely positive), while 10.1% expressed a negative opinion (7.3% mostly negative, 2.8% completely negative). Another 10.1% of respondents were unable to answer.

“Attitudes toward Kuwait are not clearly formed due to the lack of public manifestations of cooperation, assistance, or cultural presence of this country in Ukraine,” said Maxim Urakin, founder of Experts Club.

This creates potential for Kuwait to make itself known in Ukraine through diplomatic, investment, or humanitarian initiatives, if such a goal is set by the state.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

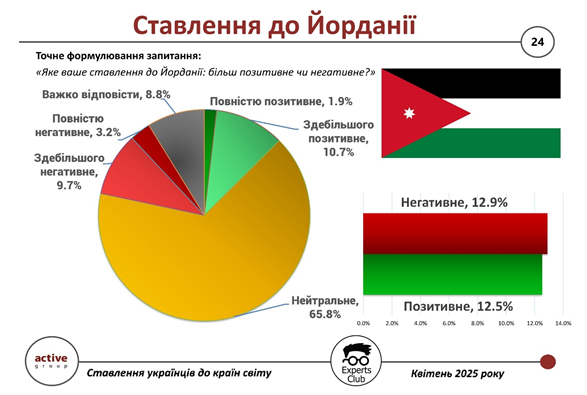

Jordan occupies a moderate position in the perception of Ukrainian society—without any strong positive or negative emotions. This is evidenced by the results of a sociological survey conducted by Active Group in partnership with the Experts Club think tank in April 2025.

According to the survey, 65.8% of respondents expressed a neutral attitude toward Jordan — one of the highest rates among countries outside Europe. A positive attitude was declared by 12.5% of Ukrainians (10.7% — mostly positive, 1.9% — completely positive), negative — 12.9% (9.7% — mostly negative, 3.2% — completely negative). Another 8.8% abstained from answering.

“Ukrainians generally do not have a formed image of Jordan — it is mostly associated with regional affairs in the Middle East, but is not the subject of deep public interest. This explains the high proportion of neutral responses,” said Oleksandr Pozniy, co-founder of Active Group.

These data create opportunities for the development of new areas of Ukrainian-Jordanian cooperation, primarily in the cultural and humanitarian contexts.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

The National Bank of Ukraine has increased the financing opportunities for foreign representative offices of Ukrainian companies: previously, this was possible within the limits of actual transfers in 2021, but now it is possible either within these limits or up to EUR 1 million per year, whichever is greater.

“This relaxation will not affect Ukraine’s currency market, as such transfers will only be allowed using the business’s own currency. At the same time, it will enable Ukrainian companies to step up their efforts to promote their products on foreign markets,” the National Bank said on its website on Saturday.

The regulator has also allowed such transfers for relatively young companies, setting a restriction that at least 12 months must have passed between the date of their state registration and the date of the transaction.

“In the long term, the changes will contribute to the growth of the country’s export potential by expanding cooperation between Ukrainian businesses and foreign partners and increasing trade,” the NBU said.

In addition, the central bank has allowed payments related to legal proceedings for non-compliance by non-residents with the terms of import and export contracts.

“The decisions adopted allow legal entities of all forms of ownership to purchase foreign currency and transfer it abroad to pay registration, arbitration, court fees, and other payments and expenses during enforcement proceedings for non-compliance by non-residents with the terms of import and export contracts,” the National Bank explained.

He added that, based on a customer survey conducted by banks this year, the impact on the currency market is not expected to be significant. On the other hand, businesses will be able to protect their property and other rights and interests in foreign jurisdictions in a timely and adequate manner when resolving issues related to the return of foreign currency proceeds under export contracts or prepayments under import contracts.

The NBU clarified that the relevant amendments to “military” Resolution No. 18 of February 24, 2022, were introduced by Resolution No. 53 of the regulator’s board on May 9 of this year and came into force on May 10.

The National Bank of Ukraine has increased limits on corporate card payments abroad. Cash withdrawals of up to UAH 17,500 (equivalent) are now permitted, whereas the previous limit was UAH 12,500.

“The expansion of limits will not have a significant impact on the currency market of Ukraine, given that the increase in demand for foreign currency for corporate card transactions is likely to be offset by a decrease in demand through other, less convenient channels,” the National Bank said on its website on Saturday.

It added that the second easing was an increase in the limit for payments for goods, works, and services with corporate cards abroad from UAH 100,000 to UAH 150,000 per month.

For personal cards, the limits remain unchanged: UAH 12,500 for cash withdrawals per week and UAH 100,000 for non-cash payments.

The NBU clarified that the relevant changes to “military” Resolution No. 18 of February 24, 2022, were introduced by Resolution No. 53 of the regulator’s board on May 9 of this year and came into force on May 10.