Rental rates in the market of commercial space as part of residential complexes in Ukraine have almost reached the pre-war level, but only in hryvnia equivalent, market experts say.

“Rental rates in 2022 sagged by 30-40%, but since the middle of 2023 a gradual stabilization began. Today the rates are close to pre-war indicators, especially in densely populated areas,” Ramil Mehdiyev, CEO of the development company ENSO, told Interfax-Ukraine.

According to him, the company maintains flexibility of conditions for tenants. For example, there is a possibility of lease with the right to buy out the premises, individual approach to the payment schedule in the first months of business, in particular, the introduction of rent “vacations” for the first months.

Mehdiyev noted that the company reserves 20-30% of commercial space for further management or lease to fill the LCD with necessary services. For the rest of the premises there may be restrictions fixed in the contract, for example, a ban on opening nightclubs, pawnshops or establishments with harmful emissions.

A similar approach is practiced by KAN Development, its press service reported. Thus, the developer leases a certain share of premises to ensure the availability of key services – medical services, pharmacies, grocery stores. Agreements also fix restrictions for types of business, for example, a ban on noisy activities.

More recently, lease agreements are also often supplemented with special clauses that regulate relationships not during power outages or reimbursement of alternative energy costs, said Avalon Chief Operating Officer Jaroslaw Wozniak.

In general, rental rates for commercial lots in the residential complexes depend significantly on the specific object, its location, traffic and functionality, said commercial director of Intergal-Bud Anna Laevskaya. According to her, “Intergal-Bud” leaves in its own rental fund premises with a payback period of up to 12 years.

“In residential complexes with high occupancy the price may be even higher, because the flow of people and cars there is very large,” she explained.

About 50% of commercial premises in Perfect Group’s residential complexes remain in the developer’s ownership, said Alexey Koval, the company’s project manager. At the same time the share may vary depending on a particular residential complex and its location.

He emphasized that although now there are no “anti-crisis” discounts, which were offered to tenants at the beginning of the full-scale invasion, the developer still provides loyal rates for the first year of rent with a gradual increase in subsequent years, which is fixed in the contract.

According to Alexander Gorlach, founder of TKN-Consulting, rental rates were as high as 70% of pre-war levels at the end of 2024.

“In fact, rates have now almost recovered in hryvnia, but not in currency. However, commercial real estate in newly settled residential complexes is the most predictable investment. As of the end of 2024 the rates at some landlords were up to 70% of pre-war rates”, – he commented to the agency ‘Interfax-Ukraine’.

According to him, now the rates for commercial premises in the LCD are 800-1.5 thousand UAH/sq. m/month for the most popular format – premises up to 60 sq. m. with active traffic. Premises with inconvenient layout, stairs, low traffic are rented cheaper, for 200-500 UAH/sq. m/month.

The expert noted that today the most active solvent tenants are pharmacy chains and food direction (cafes, pizzerias, etc.), which choose lots with the area of 40-50 square meters. m.

At the same time, some development companies, in particular Alliance Novobud, do not lease commercial premises, but sell them completely.

“We do not lease commercial premises, but sell them. The owners of the space make their own decision on what exactly to do. Usually they study the already available business infrastructure, weigh their possibilities, studying supply and demand,” said Irina Mikhaleva, CMO of Alliance Novobud.

Ukraine’s largest private operator of railway transportation company “Lemtrans” plans to build a container terminal in Fastov (Kiev region), according to the company’s website.

“The terminal in Fastov will be a strategic link in the development of transportation logistics in the region. The project will allow: to optimize logistics chains, expand export opportunities for Ukrainian producers and create conditions for integration of local business into global trade,” said Alexander Tkachuk, director of terminal network development at Levada Cargo.

The company added that in 2024 it invested UAH 478 million in logistics and infrastructure projects – this is three times more than in 2023. The main focus is on the development of terminal and container business, where the amount of investments amounted to UAH 441 million.

Lemtrans Group completed the first phase of construction and opened “Vinnytsia Container Terminal” (KTV) in September 2024.

As reported, the total transportation volume of Lemtrans in 2024 amounted to 15.9 million tons, which is 6% less than in 2023.

Based on the results of activities in 2024, the companies that are part of the Lemtrans group transferred to the budgets of all levels of taxes and fees in the amount of more than UAH 712 million. “Lemtrans” in 2024 transferred to the state budget about 647 million UAH. Local budgets were replenished in the amount of UAH 66 mln. In addition, Lemtrans Group paid more than UAH 59 mln of unified social contribution.

Standard One, a company specializing in Build-to-Rent projects, announced the launch of a new product S1 REIT, which gives the opportunity to become a co-owner of square meters in S1 residential buildings, the company’s press service reports.

“We are the first in Ukraine to create and implement the concept of income houses in Build-to-Rent format. This is a high-class service for tenants and investors. The former get a high-quality living space with hotel service options, the latter – a stable passive income, which does not require involvement in the process of object management. The pilot project of S1 VDNG from 2019 testifies to the success of such a model, because the occupancy rate in the house reaches 99%,” explains CEO of Standard One Sergey Fitel.

According to him, S1 REIT is a step of scaling an existing concept. With a REIT (Real estate investment trust, IF-U), to join the project, one only needs to invest an amount equivalent to the approximate cost of 1 sqm. REIT provides not only an easy entry into the investment, but also, if necessary, a convenient exit. The company also creates a closed community for investors, where they can share experiences.

You can buy square meters for investment in Standard One’s first project – S1 VDNG. Already ready and inhabited by tenants, with almost zero vacancy, allows investors to receive from 8.2% in currency. The S1 Obolon fund is also scheduled to launch soon, with a projected 10% in currency.

“ Real estate investment funds are already on the market, their success confirms the demand for such instruments. While previously a significant amount of money was needed to invest in real estate, this opportunity is now open to many as the investment threshold has become minimal,” adds Fitel.

According to Oleg Bondar, CEO of S1 REIT, liquidity in the project is ensured by high demand for real estate from Standard One. In general, the rental market in Ukraine and especially in Kyiv is quite active, demand is increasing and rental rates are growing. In 2024, the increase in the average rental price of a one-bedroom apartment in the capital amounted to 21% in currency. Under these conditions, investing in real estate for rent becomes even more attractive.

“The potential capacity of the market is huge. Especially in the segment of new quality housing. The better the infrastructure and more advantages a project has – the higher its price. Such objects as S1 provide stable profitability without ‘downtime’,” summarizes CEO Standard One.

S1 is a project of the development company KDD Ukraine, S1 VDNG project has been operating since 2019, with three more projects in the pipeline.

Analysts at Deutsche Bank have also improved their gold price forecasts for 2025 and 2026 amid geopolitical and foreign trade uncertainty, which is contributing to increased demand for the protective asset. Experts expect gold to cost an average of $3140 per troy ounce this year and $3700 per ounce in 2026. The previous forecast was $2725 and $2900 per ounce, respectively. At the end of 2025, experts estimate that gold will cost $3350 per ounce.

Deutsche Bank’s forecast for 2026 is the most optimistic among the world’s leading banks.

Quotes of June gold futures on the Comex exchange are growing by 1.6% – to $3022 per ounce. On the eve of the precious metal price fell below the psychologically important mark of $3000 per ounce.

One of the factors supporting gold is the active demand for precious metals from the central banks of the world. According to Deutsche Bank estimates, central banks now account for about 24% of global demand for gold against 10% in 2022.

Last week, HSBC analysts improved their gold price forecast for 2025 to $3015 per ounce, but in 2026 they expect quotes to fall to $2915 per ounce.

Total dedicated reinsurance capital rose 5.4% last year to a new high of $769 billion, driven by growth in both traditional and alternative capital, according to the Reinsurance News website, citing data from reinsurance broker Gallagher Re. According to Gallagher Re’s analysis, dedicated reinsurance capital rose from $730 billion at the end of 2023 to $769 billion at the end of 2024.

From this new high, capital for companies that account for more than 80% of the industry’s capital increased 5.3% to $629 billion. Gallagher Re attributes this to retained earnings and high net income of $117 billion, somewhat offset by return of capital of $58 billion and amortization of unrealized investments of $23 billion.

Meanwhile, alternative reinsurance capital, which excludes life, accident and health and mortgage insurance, rose 6.6% year-over-year to $114 billion thanks to a record year for the catastrophe bond market.

“In addition to growth on an accounting basis, global reinsurers’ capital adequacy remains strong on an economic basis, a metric that Gallagher Re sees as better suited for decision-making by management teams,” the company said.

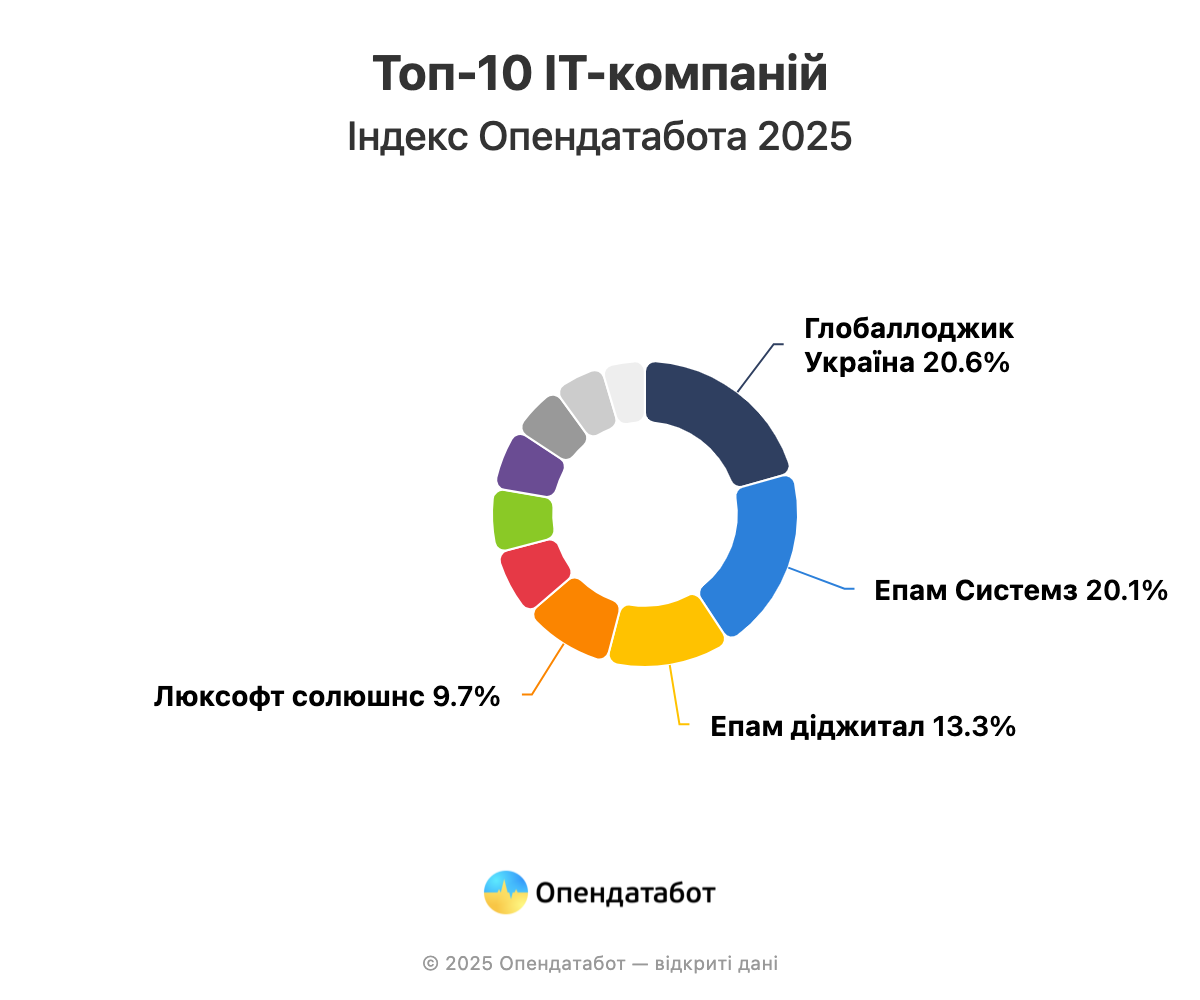

UAH 56.48 billion was the total revenue of the best IT companies in the Opendatabot 2025 Index. The top three leaders belong to American companies, with Globalogic Ukraine taking the first place. Also, 2 companies left the top 10, one of which was included in the Index for 2 years. 7 out of 10 companies in the Index are in the Diia City register

GlobalLogic Ukraine , owned by the American Bonus Technology INC, debuted on the first place in terms of revenue. Revenue for the year changed slightly to UAH 11.66 billion (+2%), while profit decreased by 28% to UAH 653 million. Despite the fact that the company has been in the Index for 3 years, it took the leading position for the first time.

“We are honored to continue and develop our business in Ukraine, as we understand the high price of such an opportunity. GlobalLogic in Ukraine unites thousands of talented engineers. It is their intelligence, education, diligence and high efficiency that helps the company grow in Ukraine and pay taxes to our country’s economy. Our engineering teams in Ukraine create high-tech solutions in the areas of artificial intelligence, automotive, medical, semiconductors, and more. These developments are highly valued by our customers in the US and Europe,” comments Anna Shcherbakova, COO of GlobalLogic Ukraine.

The remaining top 3 positions were shared by two companies of Epam, founded by Arkadiy Dobkin. They account for a third of the top ten earnings. Epam Systems , which previously topped the Index for 2 years in a row, went down a notch with revenue of UAH 11.35 billion. This is 10% less than in 2023. At the same time, its profit increased by 27% to UAH 1.67 billion.

At the same time, Epam Digital ‘s revenues and profits are growing year on year. With revenue of UAH 7.5 billion (+25%) and profit of UAH 838 million (+11%), the company ranked third in the Index. It is worth noting that this legal entity was founded only in December 2021.

“EPAM Ukraine has been a leader in the IT industry for several years in terms of key indicators: the number of specialists, revenue, and the amount of tax payments to the country’s budget. Last year, we paid over UAH 1 billion in taxes, which confirms our position as one of the largest taxpayers in the Ukrainian IT sector. Since the start of the full-scale invasion, the company has committed $100 million to support its Ukrainian team, their families, Ukrainian defenders and the country’s critical needs,” comments Stepan Mitish, Vice President, Head of EPAM Ukraine

For the second year in a row, Luxoft Solutions, a subsidiary of Swiss Luxoft founded by Dmytro Loshchynin, remains fourth in the Index. Its revenue fell by 7% to UAH 5.45 billion, while profit decreased by 12% to UAH 263.6 million.

The Institute of Information Technologies “Intellias” took the 5th place with a revenue of UAH 4.06 billion (-6%). At the same time, the company’s profit increased by 18% to UAH 300.7 million. The business is owned by ITE Limited, whose ultimate owners are Vitaliy Sedler and Mikhail Puzrakov.

SoftServe Technologies, founded by Lviv residents Taras Kitsmey and Yaroslav Lyubynets, moved up two places last year: 6th place. The company’s revenue grew 1.6 times over the year to UAH 3.83 billion, while profit remained the same at UAH 210 million.

Thefintech band, owned by Monobank founders Oleg Gorokhovsky and Mikhail Rogalsky, lost two positions in the Best Index this year. Due to a significant decrease in revenue – by one and a half times – the company was ranked seventh: UAH 3.71 billion. Profits decreased even more significantly: by 2.7 times to UAH 1.15 billion.

Infopulse Ukraine, founded by Oleksiy Sigovyi and Andriy Anisimov, took the ninth place. It is now owned by the Swedish company NUK HOLDING AB. The company’s revenue decreased by 5% to UAH 3.06 billion, while profit decreased by 14% to UAH 332.7 million.

At the same time, this year’s iteration of the Opendatabot Index also includes newcomers that debuted with stunning results. With revenues of UAH 3.22 billion and a record profit of UAH 2.4 billion among the top 10 companies, Highload Solutions (formerly Favbet Tech) by Dmitry Matyukha appeared in the Index. The company, registered in January 2022, accounts for a third of the total profit of the ranked companies.

Another newcomer to the Index rounds out the top ten is the young company Squad Ukraine (SQUAD), established in August 2022. The business is owned by the Cypriot company Squad IT Limited, owned by Ukrainians Lyubomyr Vasyliev and Yuriy Katkov. Last year, Squad’s revenue grew 2.8 times year-on-year to UAH 2.6 billion, and its profit grew 3.4 times to UAH 80.6 million.

It is worth noting that 7 of the top companies chose the Diia City legal regime, except for Epam Systems, Luxoft Solutions, and the Institute of Information Technologies “Intellias”. This means that these companies do not enjoy special tax benefits, a simplified administrative process, and other tools for the development of the IT sector from the state.

At the same time, this year the IT Companies Index was dropped:

https://opendatabot.ua/analytics/index-it-2025