Chinese and EU authorities have agreed to resume talks on duties on electric cars, the Chinese Ministry of Commerce said at a press conference. The talks will resume as soon as possible to create favorable conditions for investment and cooperation between Chinese and European companies, the ministry said.

US President Donald Trump announced the day before that he would impose additional 34 percent duties on goods from China and 20 percent duties on EU shipments. Earlier, he also imposed 25% duties on all car imports. In turn, the EU imposed higher duties on Chinese electric cars last year, including 17 percent for BYD, 18.8 percent for Geely and 35.3 percent for SAIC.

In January, the three companies went to the Court of Justice of the European Union to appeal the new duties. Last November, Beijing and Brussels discussed the possibility of replacing duties for China with an obligation to sell electric cars at a minimum price.

Chinese authorities, duties on electric cars, EUROPEAN UNION

PJSC “Ukrainian Fire Insurance Company” (UFCI) in 2024 attracted insurance payments totaling UAH 559 mln, which is 17% higher than in 2023, as reported on the website of the Rating Agency IBI-Rating in the information on confirmation of the long-term credit rating of the company at the level of “uaAA”, forecast “in development”.

According to RA data, the strategic types of insurance for the company are transport insurance (MTPL, CASCO and other motor liability) – 50% of premiums, as well as medical and health insurance (9% and 7% respectively). Channels of sales of the insurer are well diversified that promotes stable dynamics of receipts of insurance payments, RA indicated.

Last year, UPIC made insurance payments in the amount of UAH 139.8 mln, which is 7.6% less than in 2023. The company’s profit amounted to UAH 15.8 mln against UAH 22.6 mln in 2023.

It is reported that the agency for analytical research for the purpose of updating the rating of the company used materials of UPIC, in particular, financial statements for 2022-2024 and other necessary internal information, as well as data from open sources, which RA considers reliable.

RA has attributed to positive factors of the insurer’s activity a significant stock of assets, which can be represented by insurance reserves on deposits in banking institutions (in particular state-owned) with credit ratings corresponding to high investment level according to the national rating scale.

PJSC UPIC has been operating in the insurance market since 1992. The majority shareholder and the Chairman of the Supervisory Board is Alexander Mikhailov.

The insurer is a member of the Motor (Transport) Insurance Bureau of Ukraine and works with 25 risks within 18 classes of insurance.

payments to clients, PJSC UPIC, Ukrainian Fire Insurance Company

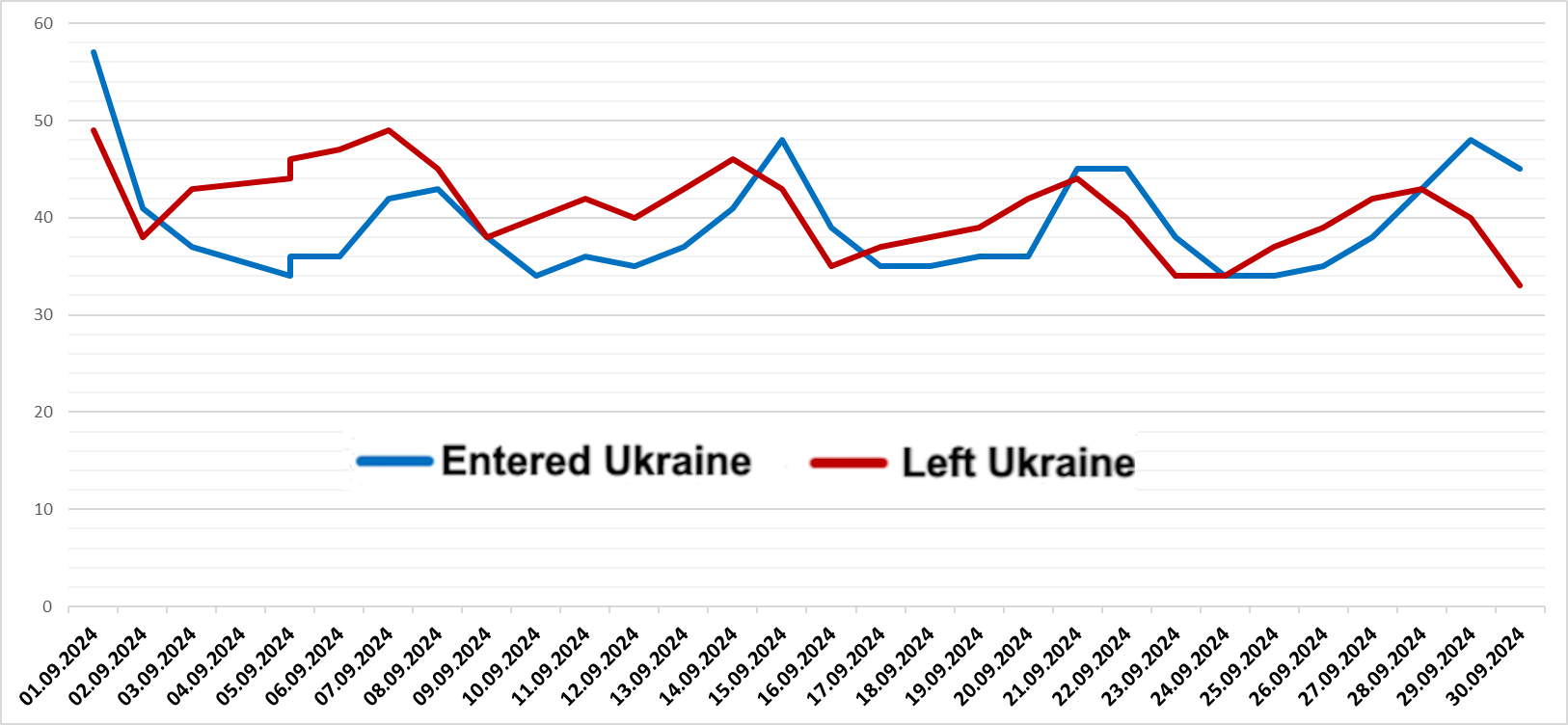

Passenger flow through western border of Ukraine in September 2024, thousand

More than 2.1 thousand declarations with cryptocurrencies were filed by Ukrainian officials in 2024. This is 2.2 times more than before the full-scale campaign. Representatives of the National Police of Ukraine are particularly active in declaring cryptocurrencies. Tether (USDT), Bitcoin (BTC, XBT), and Ethereum (ETH) remain the most popular cryptocurrencies among officials.

Ukrainian officials are increasingly mentioning cryptocurrencies in their declarations. Thus, 2113 declarations with cryptocurrency were filed by officials in 2024. This is 2.2 times more than before the full-scale campaign. The number of such declarations increased by 10% over the year.

Representatives of law enforcement agencies are particularly active in declaring cryptocurrencies. The National Police of Ukraine is the most active: 322 declarations mentioning cryptocurrency. This is 15% of all such declarants.

The prosecutor’s office is not far behind: cryptocurrency is listed in 240 declarations. Judges filed 227 such documents, and there were 119 officials with digital assets in city councils. Among the representatives of the Armed Forces, cryptocurrency was listed in 77 declarations. In another 38 cases, crypto was declared by NABU representatives.

If we look at the geography of crypto declarations, everything is more predictable. Kyiv and the region are in the lead with 582 and 185 officials with cryptocurrencies. In Kharkiv region, 172 civil servants declared crypto, and in Dnipropetrovs’k region, 167. Lviv region rounds out the top five with 133 cryptocurrency declarants.

The most frequently declared crypto-dollars are Tether (USDT) – 802 civil servants. Bitcoin (BTC, XBT), despite all the exchange rate fluctuations, consistently ranks second with 731 declarations. Ethereum (ETH) was declared by 713 officials.

The most bitcoins were declared by Oleh Bondarenko, chairman of the Verkhovna Rada Committee on Environmental Policy. He has 80 BTC on his account, which is equal to UAH 279.4 million as of April 1. The leader in the Ethereum (ETH) category is MP Serhiy Maisel, who owns 200 tokens equivalent to UAH 15.5 million. However, the record for the number of crypto dollars belongs to Vitaliy Brovko, head of a department at the Prosecutor General’s Office, who has 847,908 USDT in his declaration, which is estimated at UAH 35 million.

It is also worth noting that there are several ex-officials who could have made it to the top, but indicated that they had lost access to their crypto assets. 380.95 bitcoins – a record amount among Ukrainian officials – were reported and lost in 2021 by Roman Saramaga, Deputy Head of the State Service of Geology and Subsoil of Ukraine. This is about UAH 1.33 billion in hryvnia equivalent as of April 1, 2025.

The largest amount of ethereum – 1,800 units or more than UAH 140 million as of April 1 of this year – belongs to Ihor Osipov, a deputy of the Podil District Council of Odesa Oblast. However, in last year’s declaration, the official noted that he had lost access to his assets.

https://opendatabot.ua/analytics/crypto-2025

US cryptocurrency company Circle has filed for an IPO on the New York Stock Exchange (NYSE), according to documents on the US Securities and Exchange Commission (SEC) website. JPMorgan Chase and Citigroup are the lead underwriters of the offering, and Circle’s shares will trade under the ticker “CRCL.”

According to unofficial reports cited by CNBC, the company expects a valuation of up to $5 billion.

This is its second attempt to go public. In late 2022, amid regulatory concerns, it declined to go public through a merger with SPAC (Specialized Mergers and Acquisitions Company) investor Bob Diamond’s Concord Acquisition Corp. At the time, the terms of the deal implied a $9 billion valuation for Circle, the Financial Times noted.

Circle’s revenue rose to $1.68 billion in 2024 from $1.45 billion the year before and $772 million two years earlier. Net income fell to about $156 million last year from $268 million the year before.

Circle was founded in 2013. The company initially focused on products to facilitate cryptocurrency payments. In 2018, it partnered with cryptocurrency exchange Coinbase to launch the Center Consortium project to create a stablecoin (stablecoin is a generic name for cryptocurrencies that are backed by national currencies and assets) USD Coin (USDC) and build infrastructure for related services.

USDC is pegged to the U.S. dollar at a 1:1 exchange rate and is backed by cash and short-term obligations of the U.S. Treasury. It is the second most capitalized steiblcoin in the world ($60 billion, or 26% of all steiblcoin capitalization) after Tether (67%). At the same time, its capitalization jumped by 36% this year against the growth of 5% for Tether.

If the IPO is successful, Circle will become one of the leading U.S.-listed issuers with businesses centered on cryptocurrencies, CNBC writes. Coinbase went public in 2021 and has a market value of about $44 billion.