PJSC “Ukrhazvydobuvannya” (Kiev) on March 26 announced a tender for services on insurance of liability of subjects of transportation of dangerous goods in case of negative consequences during transportation of dangerous goods.

As reported in the system of electronic public procurement Prozorro, the expected cost of the purchase of services is 996.834 thousand UAH.

According to the system, the last day for submission of tender offers is April 3.

The U.S. economy expanded at a 2.4% annualized rate in the fourth quarter of 2024, the Commerce Department said in its final report. A smaller rebound of 2.3% was previously reported. Analysts polled by Trading Economics did not expect a revision to the previously announced estimate.

GDP growth slowed from the third quarter, when it was 3.1%.

Consumer spending, which accounts for two-thirds of the U.S. economy, rose 4% in October-December (previously reported at 4.2%). The increase was the highest since the first quarter of 2023. This included a 6.2% increase in spending on goods (previously reported at 6.1%) and a 3% increase in spending on services (up 3.3%).

Government spending growth was 3.1% rather than 2.9%.

Investment in fixed assets fell 1.1% (previously reported down 1.4%). The decline was recorded for the first time since the end of 2022. This included investment in non-residential assets down 3%, while residential investment rose 5.5%. Investment in intellectual property was down 0.5% and equipment was down 8.7%.

Exports were down 0.2% and imports were down 1.9%. Earlier it was announced that the first indicator decreased by 0.5%, the second – by 1.2%.

Corporate profits in the U.S. in October-December increased by 5.9% quarter-on-quarter to $3.312 trillion, after a decline of 0.4% quarter earlier. On a year-over-year basis, corporate profits rose 6.8%.

The PCE Consumer Price Index increased 2.4% in the fourth quarter from the previous three months, the figure was not revised.

The PCE Core index (change in consumer prices excluding food and energy costs), which is closely monitored by the Federal Reserve when assessing inflation risks, rose 2.6%, not 2.7%.

For all of 2024, the U.S. economy expanded 2.8% after climbing 2.9% a year earlier.

Preliminary data on U.S. GDP trends for the first quarter of 2025 will be released on April 30.

The European Union has expanded the sanctions list against Belarus, including seven legal entities and 25 individuals.

The corresponding decision of the Council of Europe was published in the Official Journal of the EU on Thursday.

The list of sanctioned companies includes: Integral, the managing company of Integral Holding (a major manufacturer of microelectronics), Planar (a major manufacturer of microelectronics, including military purposes), the state enterprise Plant of Precision Electromechanics (part of the State Military Industrial Committee of Belarus, according to the EU, produces, including ballistic missiles).

The list also includes SE “Belarusian Lotteries” (part of the Department of Presidential Administration of Belarus, has the exclusive right to organize lotteries), the company “Belbet” (online casino, managed by SE “Belarusian Lotteries”), LLC “Ridotto” (develops applications for online games), LLC “Tsybulka-Bel” (agricultural company, according to the EU, owned by German citizen Jorg Dornau).

The sanctions were also imposed on Sergei Avakov (CEO of Planar), Yuri Chorny (director of the Plant of Precision Electromechanics), Dmitri Shvedko (entrepreneur, majority shareholder and director of Ridotto), Mikhail Denisenko (director of the State Enterprise Belarusian Lotteries).

In addition, sanctions were imposed on the Central Election Commission of Belarus, its members, a number of judges, the manager of the presidential affairs of Belarus, Yuri Nazarov and his deputies.

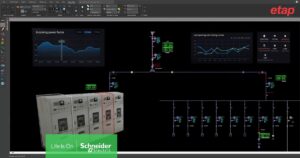

– The digital twin provides enhanced insight and control over the electrical systems and energy needs of an AI factory.

– The product collaboration integrates ETAP’s advanced digital twin technology with NVIDIA Omniverse™ Cloud APIs.

– Operators can benefit from improved energy efficiency, predictive maintenance, and lower total cost of ownership.

Boston (USA), March 18, 2025 – Schneider Electric, a leader in digital transformation for energy management and automation, and ETAP, an industry and technology leader in the design and operation of energy systems, are introducing an innovative digital twin that can accurately design and model the energy needs of artificial intelligence factories (or AI factories). Using the NVIDIA Omniverse™ Blueprint for AI Factory Digital Twins, Schneider Electric and ETAP are enabling the development of digital twins that combine multiple inputs for mechanical, thermal, network, and electrical systems to simulate how an AI factory operates. This collaboration aims to transform the design and operation of AI factories by providing improved understanding and control over electrical systems and energy needs, opening up opportunities for significant advances in efficiency, reliability, and sustainability.

Previously, basic visualization of electrical systems was possible, but the integration of ETAP and NVIDIA Omniverse technologies enables a comprehensive digital twin of an AI factory where multiple speakers interact seamlessly. ETAP’s sophisticated modeling technology creates a virtual replica of the data center’s electrical infrastructure and combines it with real-time power system data, advanced analytics, and insights. Intelligent algorithms analyze and predict energy consumption and distribution patterns, providing unprecedented insights:

– Advanced design and modeling of electrical systems

– Dynamic analysis of “what if” scenarios

– Real-time monitoring of electrical infrastructure performance

– Optimization of energy efficiency

– Predictive maintenance and system reliability assessment

– Infrastructure needs based on energy usage, which can help reduce total cost of ownership

Regardless of where it is deployed, whether in specialized high-end AI clusters or edge solutions, AI is driving a rapid increase in data center capacity. Unlike traditional computing tasks, AI tasks require a significant increase in electrical power, both for a single server rack (100 kW or more) and for the data center as a whole.

As the adoption of AI accelerates, startups, enterprises, colocation providers, and Internet giants must rethink data center design and management to address the growing need for energy efficiency.

ETAP and NVIDIA’s collaboration introduces an innovative network-to-chip approach that addresses the critical challenges of energy management, performance optimization, and energy efficiency in the AI era. Currently, data center operators have access to rack-level estimates of average energy consumption, but the new digital twin of ETAP aims to increase the accuracy of modeling dynamic load behavior at the chip level to improve power system design and optimize energy efficiency.

This joint effort underscores both ETAP and NVIDIA’s commitment to driving innovation in the data center sector, enabling businesses to optimize their operations and effectively manage the challenges of AI workloads. The collaboration aims to increase data center efficiency, as well as improve network reliability and performance.

“As AI workloads grow in complexity and scale, precise energy management is critical to ensure efficiency, reliability, and sustainability,” said Dion Harris, senior director of HPC and AI Factory solutions at NVIDIA. “Through our collaboration with ETAP and Schneider Electric, we are giving data center operators unprecedented visibility and control over energy dynamics, enabling them to optimize their infrastructure, accelerate AI adoption, and improve operational resiliency.”

“This collaboration represents more than just a technology solution,” said Tanuj Khandelwal, CEO of ETAP. “We are fundamentally rethinking how data centers can be designed, managed, and optimized in the AI era. By combining electrical engineering with advanced virtualization and AI technologies, we are creating a new paradigm for infrastructure management.”

Pankaj Sharma, Executive Vice President, Data Center, Networking and Services, Schneider Electric, added: “Collaboration, speed, and innovation are the driving forces behind the transformation of digital infrastructure required to handle AI workloads. Together, ETAP, Schneider Electric, and NVIDIA are not only advancing data center technology, we are enabling businesses to optimize their operations and seamlessly manage AI energy needs.”

About ETAP

ETAP provides market-leading software solutions for electrical systems, from design and engineering to operations and maintenance.

Through its integrated digital twin electric system platform, ETAP delivers best-in-class, continuous customer experience and cloud-enabled technologies, providing universal access for designers, engineers, and operators, accelerating their digital transformation of the power industry even in the most regulated environments.

More than 20,000 enterprises worldwide rely on ETAP to achieve full efficiency and sustainability across all life cycle stages for utilities, infrastructure, industry, and buildings. For more than 38 years, driving excellence, innovation and customer satisfaction, ETAP’s deep expertise is supported by the dedication of more than 1,000 employees and a strong community of active users.

ETAP is headquartered in Irvine, California, with regional operations around the world to support local customers.

About Schneider Electric

Schneider’s purpose is to create impact by empowering everyone to make the most of our energy and resources, ensuring progress and sustainability for all. We call it Life Is On.

Our mission is to be a trusted partner in sustainability and efficiency.

We are a global technology leader, bringing world-class expertise in electrification, automation and digitalization to smart industries, reliable infrastructure, future-proof data centers, smart buildings and intuitive homes. Drawing on our deep industry expertise, we provide integrated end-to-end AI-enabled industrial IoT solutions with connected products, automation, software and services, creating digital twins to drive profitable growth for our customers.

Ourmain resource is our 150,000 employees and more than a million partners operating in more than 100 countries to ensure proximity to our customers and stakeholders. We support diversity and inclusion in everything we do, guided by our meaningful purpose of a sustainable future for all.

– The brand new premium portable power station is designed for outdoor adventurers and those who need reliable backup power at home.

– The Schneider OffGrid provides backup power for mobile devices and small appliances in a compact and lightweight package.

– Sustainable approach – Schneider OffGrid is designed with sustainability in mind: 60% of the plastic in its construction is recycled and the packaging is 100% recyclable.

Paris, Rueil-Malmaison, France, March 24, 2025 – Schneider Electric, a leader in digital transformation in energy management and automation, is presenting its innovative power protection solution to European consumers – Schneider OffGrid. This is a new portable power plant with a long battery life and versatile connection options, designed to reduce environmental impact. As a leader in backup power, Schneider Electric is strengthening its innovation in personal power by building on its brand heritage and commitment to quality in the consumer segment.

Designed for a connected world, Schneider OffGrid delivers reliable power in a compact and lightweight design, providing electricity in an age where it has become a vital necessity – for everyday life and outdoor adventures alike. In today’s mobile world, people want to enjoy the outdoors while staying connected – whether they’re camping or traveling across Europe.

With the new generation valuing experiences that require energy – for music, cooking and charging devices – continuous access to electricity is becoming a necessity. Schneider OffGrid offers solutions to support a variety of lifestyles, from digital creators and DIYers to professionals working remotely, providing power for creative tools such as cameras and drones, as well as for social media and blogging to share new experiences in real time.

With a long-life battery, this premium portable power station keeps phones, laptops, cameras and small appliances running – whether you’re off-grid or in a situation where you need backup power. The Schneider OffGrid is equipped with a wide range of charging ports, including a car socket, USB-A, USB-C, AC outlets, DC ports, and even wireless charging, allowing you to power virtually any mobile device or small appliance.

“Whether you’re hiking, camping, or need power in an emergency, Schneider OffGrid will provide power for your devices no matter where you are, ensuring that your daily life and adventures remain uninterrupted,” said David Mann, director of category management, Secure Power Europe at Schneider Electric.

The ability to charge the portable power station using compatible solar panels makes it an ideal source of energy for use in both outdoor and everyday life. Its compact yet powerful battery keeps appliances running, and its quiet and environmentally friendly operation makes Schneider OffGrid a better alternative to a traditional generator.

Schneider OffGrid is based on reliability, environmental friendliness and adaptability:

– Reliable, long-lasting power: As one of the lightest models on the market, the OffGrid portable power plant delivers more power and lasts significantly longer than other alternatives, offering high capacity in a compact and robust package. The Schneider OffGrid also features LED lighting and a flashing SOS mode for increased visibility and emergency preparedness.

– Environmentally friendly by design: The Schneider OffGrid reduces waste and environmental impact with a 60% recycled plastic construction and 100% recyclable cardboard and paperboard packaging. The energy-efficient design conserves energy and extends battery life with an automatic shutdown function in Eco Mode.

– Adaptive charging on the go: The Schneider OffGrid supports flexible charging options including solar panels, USB-C, car and wall outlets, making it versatile and convenient. The device can be connected to a wide range of gadgets, ensuring compatibility and ease of use. The intuitive LCD display provides clear and accessible information, simplifying control and user experience.

The most sustainable company in the world

Recognized as the World’s Most Sustainable Company for the second time by Corporate Knights, Schneider Electric demonstrates its continued leadership in smart, sustainable and reliable energy solutions with the new Schneider OffGrid portable power plant, which offers an innovative way to stay connected to energy while reducing environmental impact.

About Schneider Electric

Schneider’s purpose is to create impact by empowering everyone to make the most of our energy and resources, ensuring progress and sustainability for all. We call it Life Is On.

Our mission is to be a trusted partner in sustainability and efficiency.

We are a global technology leader, bringing world-class expertise in electrification, automation and digitalization to smart industries, reliable infrastructure, future-proof data centers, smart buildings and intuitive homes. Drawing on our deep industry expertise, we provide integrated end-to-end AI-enabled industrial IoT solutions with connected products, automation, software and services, creating digital twins to drive profitable growth for our customers.

Ourmain resource is our 150,000 employees and more than a million partners operating in more than 100 countries to ensure proximity to our customers and stakeholders. We support diversity and inclusion in everything we do, guided by our meaningful purpose of a sustainable future for all.