Prices for new buildings will continue to grow in 2025, in the comfort class they can grow by more than 15% by the end of the year, said the press service of the developer Alliance Novobud.

“In business class prices will remain at about the same level, plus 5-10% due to the rise in the cost of building materials. At the same time, in the comfort class prices may increase by more than 15% by the end of the year”, – says Irina Mikhaleva, the company’s SMO.

According to her, the main factors that affect the cost per square meter are a significant increase in the cost of almost all types of building materials, works, as well as the shortage and, accordingly, the growth of labor costs.

She noted that the cost of building materials, prices of transportation services, electricity are constantly growing, and during construction, electricity, in particular, is used a lot. And it becomes even more expensive when generators are used or imported e/e is purchased at a higher price.

“There is a catastrophic shortage of people who can work on construction sites, this is a consequence of mobilization processes, the shortage of personnel is increasing,” Mikhailova listed the factors that have significantly affected the market.

As a consequence, developers are forced to adjust prices. In particular, according to the results of last year, the cost per square meter of housing in the comfort class increased by about 20%.

“This year we are again likely to see the rise in the price of construction materials, our suppliers are already sending new prices, therefore, for the year the cost of new housing in comfort class will again increase by at least 10-15%, and for some objects by 20%”, – she said.

Less growth is expected in business class, one of the factors of more restrained market reaction here is dumping on the part of the secondary market. For example, last summer a large number of “secondary” objects were put up for sale at prices many times less than pre-war prices.

According to Mikhaleva’s forecasts, in 2025 the construction of suburban housing will develop more actively: cottages, townhouses, etc.

“We are also considering the option of such construction, thinking about the possibility of cottage or townhouse project,” she said.

According to the data of the portal of new buildings LUN, Alliance Novobud was founded in 2006, since 2010 the company has commissioned 32 houses, in the process of realization of 9 houses and a country house project.

IC “Express Insurance” (Kiev) in January-February 2025 made payments in the amount of UAH 67,2 mln, which almost corresponds to the indicator for two months a year earlier, the insurer’s website reports. Including payments on CASCO amounted to UAH 53 mln (-12%), while premiums on this type of insurance grew by 21,4%.

Payouts on MTPL amounted to UAH 13 mln, on other insurance contracts – UAH 1,2 mln.

IC “Express Insurance” was founded in 2008 and is a part of the group of companies “UkrAVTO”. It specializes on automobile insurance. Stable high speed of events settlement in IC is provided by optimal interaction with partner service stations.

Since April, 2012 IC Express Insurance is an associated member of the Motor Transport Insurance Bureau of Ukraine.

More than 90% of what Denmark does in terms of support for Ukraine is related to weapons and defense equipment, this is a prerequisite for Ukraine’s survival as a nation, Danish Ambassador to Ukraine Ole Egberg Mikkelsen said.

“Denmark has been very active in terms of supporting Ukraine with defense equipment and weapons. I usually say that we do three things in Ukraine: weapons, weapons and weapons,” he said while speaking to the media on the margins of the U-Lead with Europe event on Tuesday.

At the same time, the ambassador stressed that Denmark also implements important civilian programs.

“But more than 90% of what Denmark does in Ukraine is related to weapons and defense equipment. And this, of course, is a prerequisite for Ukraine’s survival as a nation. If you are not armed, you cannot survive. This is very important for Denmark,” the diplomat emphasized.

And in addition, he recalled the implementation of the “Danish model” of support for Ukraine’s defense industry, which actually finances the purchase of weapons and defense equipment directly from Ukrainian manufacturers.

“And it turned out to be very, very innovative and very effective. This is something that we want to continue because we want Ukraine to stand firmly on its feet, including when it comes to weapons and defense equipment. And you have a huge potential,” the diplomat said.

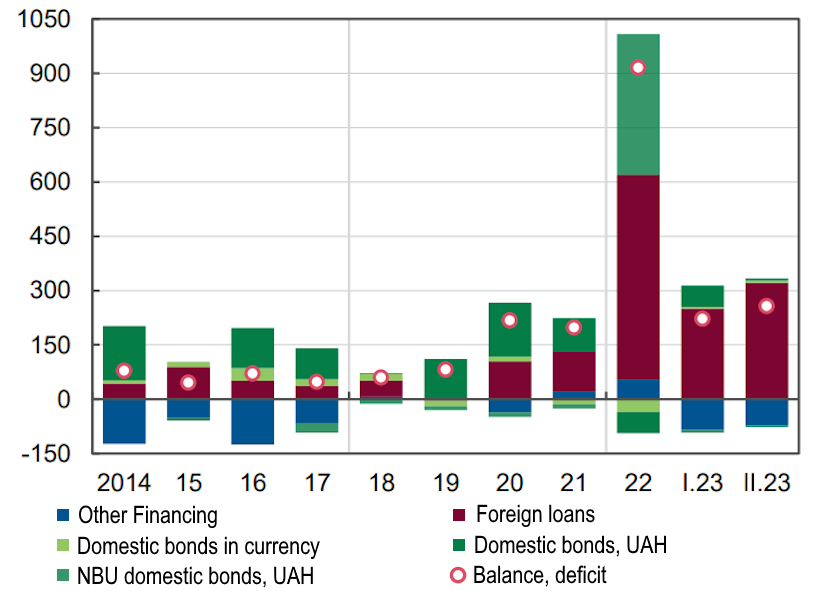

Financing state budget deficit, bln UAH

Source: Open4Business.com.ua

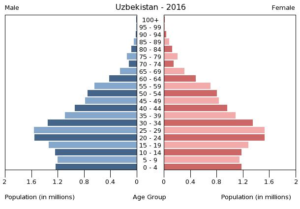

According to the National Statistical Committee, as of January 1, 2025, the number of permanent residents of the Republic of Uzbekistan amounted to 37.5 million people.

The permanent population of the Republic of Uzbekistan by years (as of January 1):

– 1920 – 4.4 million people

– 1930 – 4.9 million people

– 1940 – 6.6 million people

– 1950 – 6.2 million people

– 1960 – 8.4 million people

– 1970 – 11.8 million people

– 1980 – 15.8 million people

– 1990 – 20.2 million people

– 2000 – 24.5 million people

– 2010 – 28.0 million people

– 2020 – 33.9 million people

– 2025 – 37.5 million people

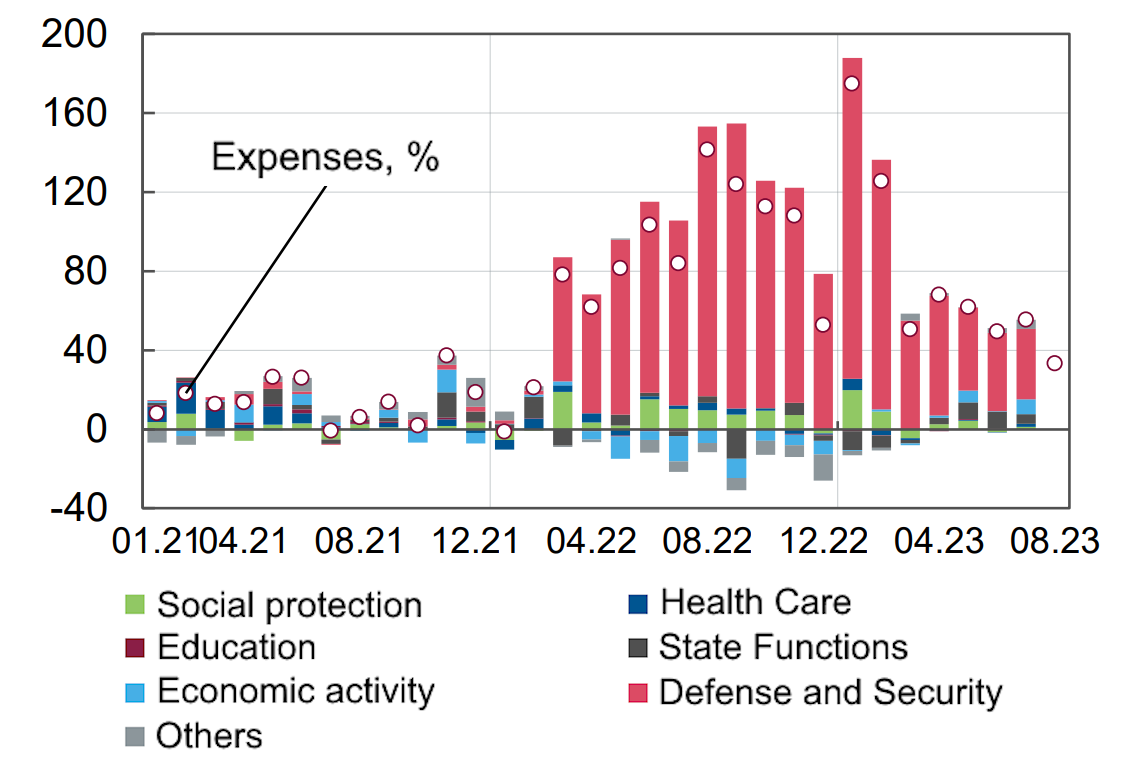

Changes in consolidated budget expenditures in 2021-2023 (%)

Source: Open4Business.com.ua