Issue #2 – January 2025

The purpose of this review is to provide an analysis of the current situation on the Ukrainian currency market and a forecast of the hryvnia exchange rate against key currencies based on the latest data. We analyze current conditions, key influencing factors, and likely scenarios.

Analysis of the current situation

The hryvnia exchange rate has stabilized in the Ukrainian currency market after the traditional seasonal increase in demand for the currency in December. As of the end of January, the US dollar on the cash market has rolled back after peaking in the middle of the month to the level of UAH 41.8-42.3/$, while the euro continued to grow to UAH 43.57-44.32/€. This is generally within our previous forecast, although in some places higher rates were recorded, which did not reflect the general market trend.

The increase in the NBU’s key policy rate to 14.5% signals the regulator’s attempts to curb inflationary and devaluation expectations of businesses and households. At the same time, the NBU revised its own inflation forecast upward to 8.4%, which may offset its stabilization measures.

An important factor in market stability remains the record volume of cash imports by banks. In December, banks imported USD 1.58 billion, which helped meet high demand and reduce the risk of speculative pressure on the exchange rate. In total, USD 15.9 billion was imported in 2024, which indicates a high level of dollarization of the Ukrainian economy and savings of households and businesses.

The steady deepening of dollarization and the overall currencyization of the economy indicates a low level of confidence among economic agents in statements about currency stability. At the same time, however, there are no factors that would create noticeable distortions in the FX market or a stir that could upset the balance.

The external context also plays an important role, and at the same time, it remains highly dynamic – there are regular reports that can significantly affect the ratio of key currencies, and thus their dynamics in the Ukrainian market. Some of the most notable recent events:

– The European Central Bank (ECB) cut interest rates by 25 basis points, which will affect the attractiveness of the euro for investors.

– Stagnation in the eurozone economy remains an important driver of the euro’s weakening.

– The US Federal Reserve is still maintaining a tight monetary policy, which supports the dollar.

– Potential “exchange rate wars” between the US and the EU could affect global currency markets.

Dollar exchange rate forecast

Short-term forecast

The hryvnia exchange rate against the dollar is expected to enter the range of 41.5-42 UAH/$ in the coming weeks. Demand for currency from businesses and households remains the main driver of exchange rate fluctuations. The NBU’s consistently high foreign exchange reserves, which allow it to quickly manage the market situation, act as a deterrent.

The current spread between the USD buying and selling rates is UAH 0.45, which indicates the stability of the foreign exchange market. Changes in this indicator may signal changes in the supply and demand balance.

Medium-term outlook

In the first half of 2025, the exchange rate is likely to gradually move to 44 UAH/$.

– The risk to the hryvnia will increase if the population continues to actively buy up foreign currency amid high devaluation expectations.

– A possible Fed rate decision in the second quarter of 2025 will have a direct impact on the dollar.

Euro exchange rate forecast

Short-term outlook

The euro is likely to move towards the level of 43.8-44.8 UAH/€.

– The ECB’s rate cut to 2.75% makes the euro less attractive to investors.

– The stable average spread between buying and selling the euro at UAH 0.525 indicates that there are no prerequisites for sharp changes in the euro exchange rate.

Medium-term outlook

Further euro depreciation is possible if:

– Eurozone stagnation deepens due to weak economic activity.

– Further cuts in ECB rates, which will make the euro less competitive against the dollar.

If the ECB continues its policy of gradual easing, the hryvnia exchange rate against the euro may remain more stable than against the dollar.

Key factors influencing the foreign exchange market

1. The NBU’s monetary policy – raising the key policy rate affects liquidity and restrains inflation.

2. Demand for foreign currency – households and businesses continue to buy foreign currency, which is the main internal driver of devaluation and a key factor of pressure on the hryvnia exchange rate.

An exclusive from the KYT Group analyst team for our newsletter recipients: how Ukrainians’ preference for different currencies is changing.

As one of the largest foreign exchange market operators , KYT Group presents its own cross-section of the share of transactions in different currencies that we observed in our network covering approximately 30 major cities of Ukraine, where almost one hundred currency exchange offices operate.

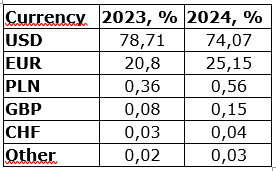

Below is a comparison of the percentage of transactions in different currencies in KYT Group’s FEAs.

Now let’s make a brief analysis of the available data that can be considered representative:

1. Decrease in the share of the US dollar (USD) from 78.71% to 74.07%. Despite this, the US dollar remains the dominant currency of transactions, but its share has decreased, which may indicate an increase in the role of the euro and other currencies in the foreign exchange market.

2. An increase in the share of the euro (EUR) from 20.80% to 25.15%. There has been an increase in the use of the euro, which may be a result of large emigration of economically active Ukrainians to the euro area, more active foreign trade with the EU, changes in business payment preferences, or diversification of household savings.

3. A significant increase in the Polish zloty (PLN) from 0.36% to 0.56%. This may be due to the activity of labor migrants, deepening business ties between the countries, and the growth of financial flows between Ukraine and Poland.

4. An increase in transactions with the British pound (GBP) from 0.08% to 0.15%. This is likely to be a sign of growing interest in British assets or an increase in the share of cross-border settlements between Ukrainians and some economic agents with the UK.

5. The Swiss franc (CHF) increased slightly from 0.03% to 0.04%, indicating a consistently low demand for this currency in the Ukrainian financial segment.

6. The share of other currencies (among which we most often record the forint, Czech koruna, Romanian and Moldovan lei) increased from 0.02% to 0.03%, indicating a slight increase in the use of alternative currencies in settlements or cross-border transactions.

Overall conclusion

The US dollar retains its leadership, but its share is declining, while the euro and Polish zloty are becoming more popular. This may indicate a reorientation of financial flows to the EU, as well as attempts by businesses and individuals to diversify their currency transactions.

This material was prepared by the company’s analysts and reflects their expert, analytical professional judgment. The information presented in this review is for informational purposes only and cannot be considered as a recommendation for action.

The Company and its analysts make no representations and assume no liability for any consequences arising from the use of this information. All information is provided “as is” without any additional guarantees of completeness, obligations of timeliness or updates or additions.

Users of this material should make their own risk assessments and informed decisions based on their own assessment and analysis of the situation from various available sources that they consider to be sufficiently qualified. We recommend that you consult an independent financial advisor before making any investment decisions.

REFERENCE

KYT Group is an international multi-service product FinTech company that has been successfully operating in the non-banking financial services market for 16 years. The company’s flagship business is currency exchange. KYT Group is one of the largest operators in this segment of the Ukrainian financial market, is among the largest taxpayers, and is one of the industry leaders in terms of asset growth and equity.

More than 90 branches in 16 major cities of Ukraine are located in convenient locations for customers and have modern equipment for the convenience, security and confidentiality of each transaction.

The company’s activities comply with the regulatory requirements of the NBU. KYT Group adheres to EU standards, having a branch in Poland and planning cross-border expansion to European countries.