More than 28 thousand self-employed people are currently registered in Ukraine, according to the State Tax Service. This is a record figure for the last 5 years. The number of self-employed has increased by 1.1 thousand since the beginning of the full-scale reform. Over UAH 292 million of tax has already been paid by professionals engaged in independent professional activities in the first five months of 2025. The largest number of such professionals is in Kyiv, Dnipro and Odesa regions.

As of the beginning of June 2025, 28.3 thousand professionals engaged in independent professional activities – i.e. self-employed – were registered in Ukraine. These are lawyers, private teachers, translators, architects, notaries, psychologists, artists, scientists, doctors, and other professionals who do not have the status of a sole proprietor but work independently.

This is a record figure for the last five years. The peak number of such specialists was previously recorded in November 2021 – 27.9 thousand. However, in December, their number decreased by 700 people, after which the figure began to grow again, albeit with a pause in the first months of the full-scale invasion. Since the beginning of the full-scale invasion, the number of self-employed professionals has increased by 1,100, or about 4%.

It is worth noting that the Unified Register of Lawyers alone currently contains more than 71 thousand professionals. However, not all of them are registered as self-employed, but, for example, they can work in law firms or associations, or work as private individuals.

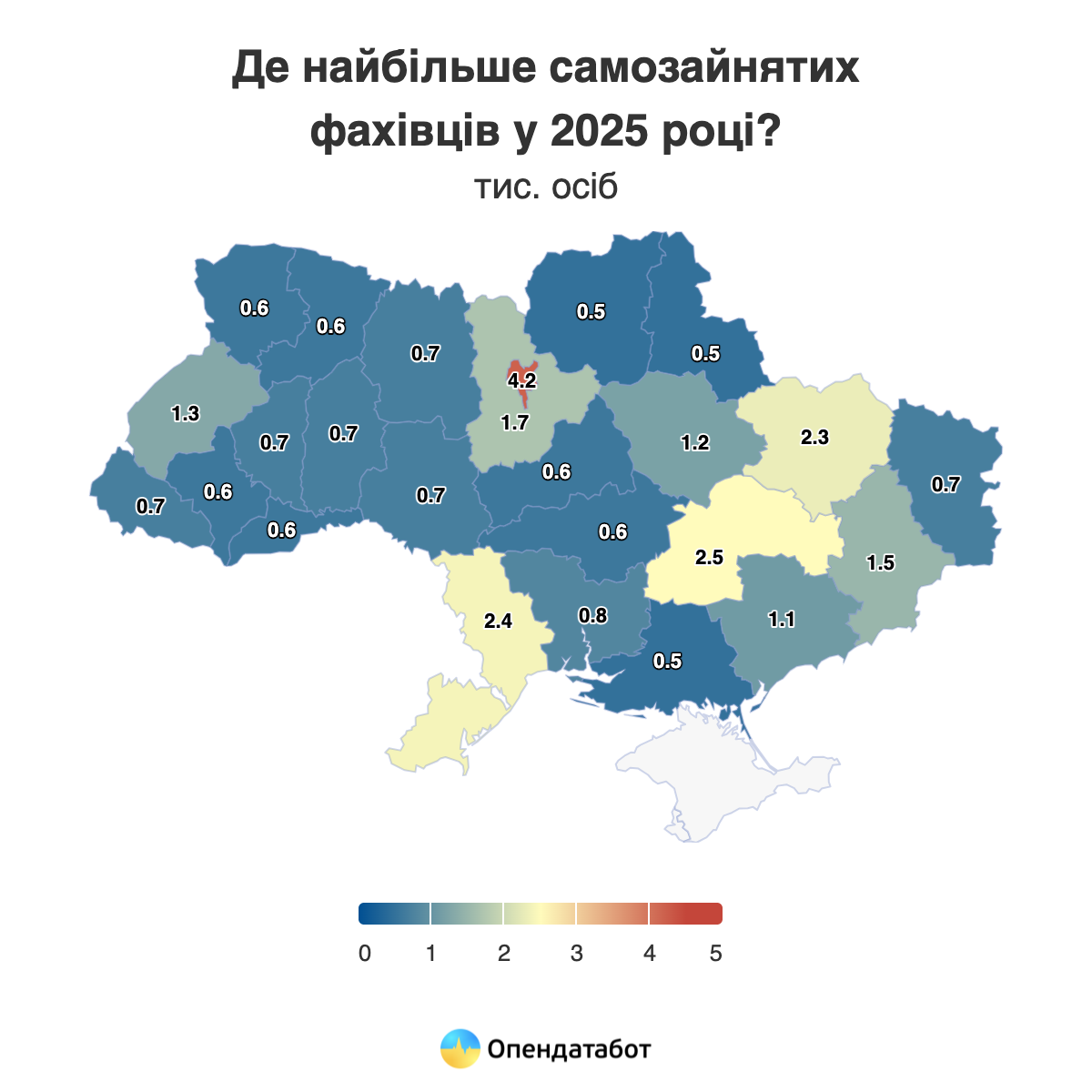

The largest number of such specialists works in Kyiv – 4.2 thousand people. This is followed by Dnipropetrovs’k region – 2.5 thousand and Odesa region – 2.4 thousand.

The self-employed paid UAH 292.29 million in taxes to the budget in the first five months of 2025. This is 33% more than in the same period last year. It is worth noting that the amount of taxes paid in Kherson, Volyn, and Kyiv regions almost doubled. In total, such specialists paid UAH 603.16 million in taxes in 2024. This is 1.6 times more than in 2023 and 1.2 times more than before the full-scale campaign.

The leaders in terms of taxes paid are Kyiv – UAH 140.5 million (23% of the total amount), Lviv region – UAH 49.8 million (8%), and Dnipropetrovs’k region – UAH 49.6 million (8%). However, while in Lviv region this amount was paid by 1.3 thousand people, in Dnipropetrovs’k region 2.5 thousand self-employed people paid almost the same amount.

On average, one self-employed person in Lviv region paid UAH 38 thousand in taxes in 2024. In Kyiv – UAH 33 thousand, in Vinnytsia region – UAH 31 thousand. The lowest average amounts were in Luhansk, Donetsk, and Kherson regions.

However, these calculations are conditional – it is impossible to give an accurate estimate, because it is not known how many of the people who are certified as self-employed actually work and earn income.

It is worth noting that independent professionals account for only 1.4% of all self-employed persons in Ukraine (together with sole proprietors). Their share of tax revenues is only 0.6% of the total amount paid by the self-employed.

Banks regularly check the self-employment status of their clients, which is important for assessing their financial profile, taxation, and regulatory compliance.

Opendatabot offers a service that allows you to check whether a person is an entrepreneur or self-employed, as well as to receive a corresponding statement.

Context

In April, the Cabinet of Ministers approved a draft law on the introduction of an international automatic exchange of information on income received through digital platforms. It provides for the taxation of self-employed people’s income received from activities on digital platforms such as Uklon, Bolt, OLX, Prom, Rozetka, etc.

https://opendatabot.ua/analytics/self-employed