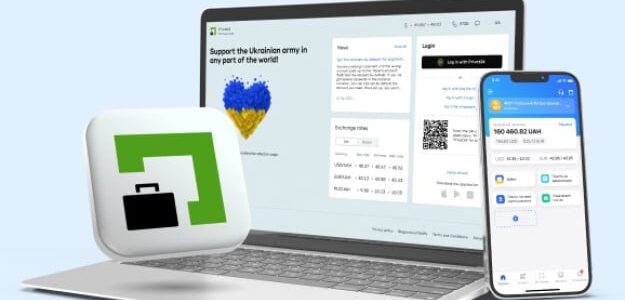

PrivatBank, which launched the purchase and sale of domestic government bonds (OVDP) in the Privat24 web app a year ago, has expanded this service to its mobile app.

“The new functionality allows you not only to invest, but also to fully control your portfolio: view securities balances, transaction history, coupon receipts, and redemption payments,” the bank said in a statement on its Telegram channel on Thursday.

According to the message, a new investment section called “Bonds” has been opened, where customers can buy and sell government bonds and manage their securities.

PrivatBank reminded that you can invest in government bonds in Privat24 starting from UAH 1,000. According to the message, the section offers a wide selection of bonds in hryvnia, dollars, and euros without tax fees and without additional purchase commissions. To get started, simply select the desired OVDP issue, fill in the details, and sign the documents via SmartID. Purchase and sale applications are accepted 24/7.

According to the bank, its customers are actively investing in OVDPs: since the beginning of 2025 alone, they have invested over UAH 21 billion in government securities. The most popular remain six-month and one-year hryvnia bonds, as well as US dollar-denominated securities. Most clients who receive redemption payments immediately reinvest them in new issues of the Ministry of Finance, the report says.

As reported, PrivatBank topped the Ministry of Finance’s rating of primary dealers in the OVDP market in 2024. As of early September 2025, it owned OVDPs worth UAH 344.51 billion, or 39% of the total bank OVDP portfolio.

According to the Settlement Center for Servicing Contracts on Financial Markets (RC, Kyiv), last year the number of registered investors in Ukraine increased from 166,120 to 197,790, and as of November 1, it reached 216,680.

As of October 2025, PrivatBank’s active customer base consisted of 18.1 million individuals, which is 220,000 fewer than at the end of 2024, and the number of users of the Privat24 mobile app decreased by 150,000 to 13.61 million people. On the other hand, the number of business clients increased by 20,000 during this period, to 930,000.