On average, three people a day ask to be declared insolvent

The number of people deciding to declare themselves bankrupt is growing in Ukraine. According to the Supreme Court, more than 2,900 Ukrainians have become bankrupt in the last five years. 577 Ukrainians have already filed for bankruptcy in the first six months of 2025. In 52% of cases, it is men who are asking to be declared insolvent. The highest number of bankruptcies this year is in Kyiv, Kyiv Oblast, and Lviv Oblast.

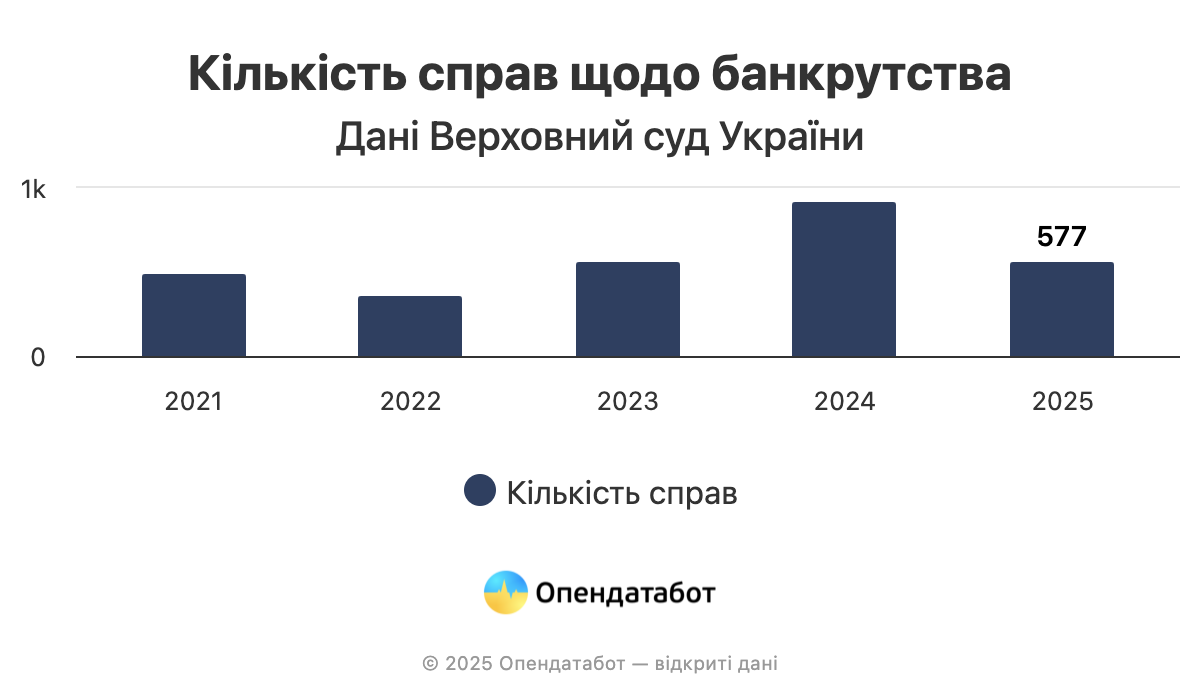

577 Ukrainians went bankrupt in the first half of 2025 in Ukraine. Such cases increased by 33% compared to the same period in 2024. In general, the largest number of people went bankrupt last year: 926 cases, but this year risks catching up with these figures.

On average, three new bankruptcy cases are opened every day this year.

A total of 2,948 bankruptcy cases involving citizens have been opened in the last five years. Although the bankruptcy procedure was officially introduced in 2019, Ukrainians only began to actively use it in 2021.

Fifty-two percent of cases since 2021 involve men, and 48% involve women. The gender gap is not critical and remains almost the same every year. For example, in 2021, men dominated (57.9%), while in 2022 and 2025, women slightly outnumbered men.

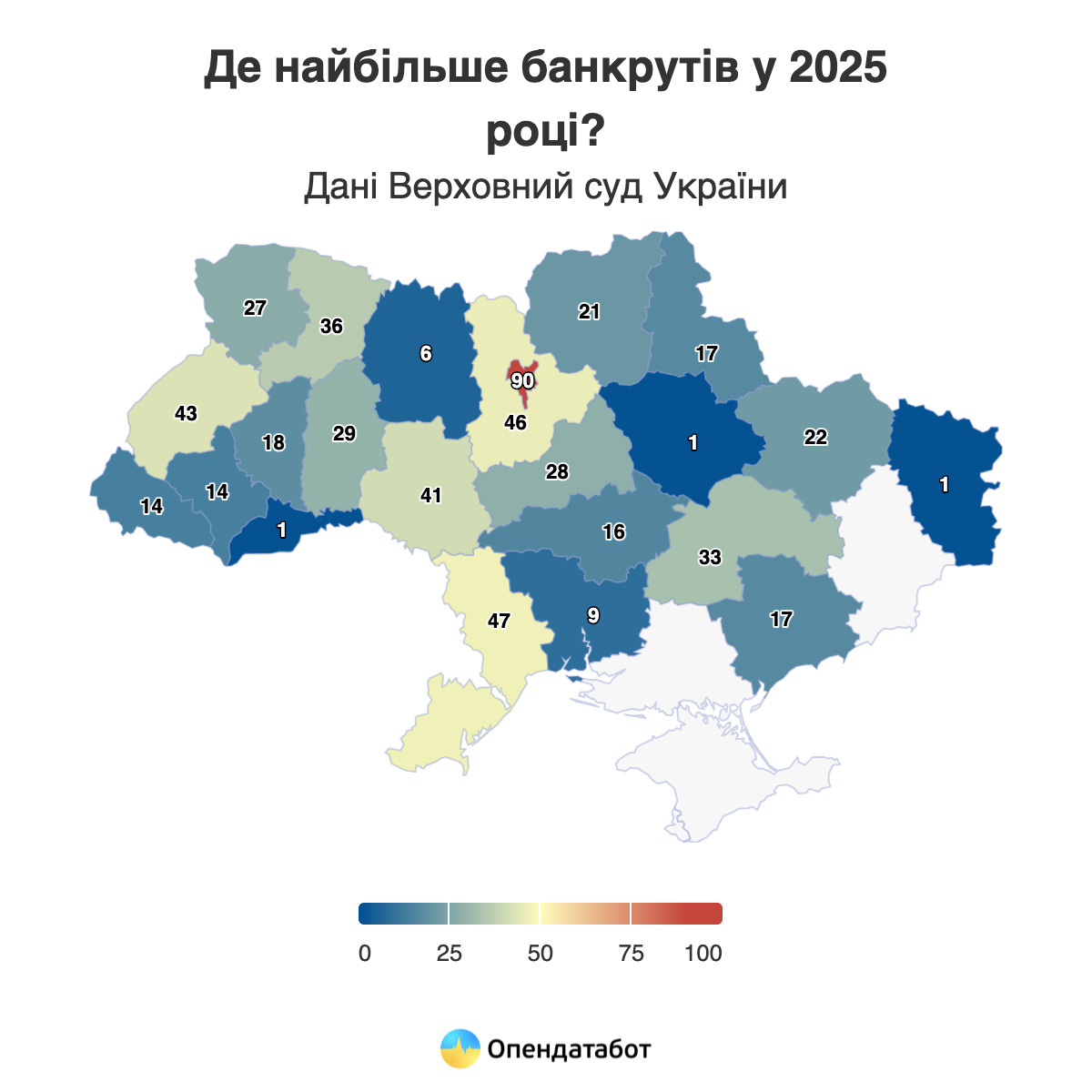

The largest number of bankruptcy cases in 2025 were opened in Kyiv — 128. Kyiv region is in second place with 83 cases, followed by Lviv, where 73 applications were filed.

You can check whether a person is bankrupt in OpenDataBot — just enter their TIN and you will receive complete information in a matter of seconds.

“The current increase in the number of bankruptcy cases is part of a steady trend that has been going on for several years. The procedure is gradually becoming more predictable: judicial practice is being developed, participants in the process are gaining experience, and the mechanism itself is working more smoothly. At the same time, creditors — banks and financial institutions — are becoming more demanding in terms of debt write-off or restructuring conditions. It is important to understand that bankruptcy is not a panacea for easy and painless “debt write-offs.” The consequences of insolvency will affect a person for at least several years,” comments Denys Pavlovych Lykhopok, lawyer, arbitration manager, member of the Qualification Commission of Arbitration Managers, and bankruptcy specialist.

According to him, there are still gaps in the procedure that need to be addressed. In particular, these relate to the tax consequences of restructuring and debt write-offs, as well as interaction with enforcement proceedings and other related court cases, which often remain outside the scope of insolvency cases.

https://opendatabot.ua/analytics/bankrupts-2025-6