Binance Research, the analytical division of the world’s leading blockchain ecosystem Binance, has published a report for August 2024 that highlights the main trends shaping the cryptocurrency market.

Cryptocurrency market dynamics in August 2024

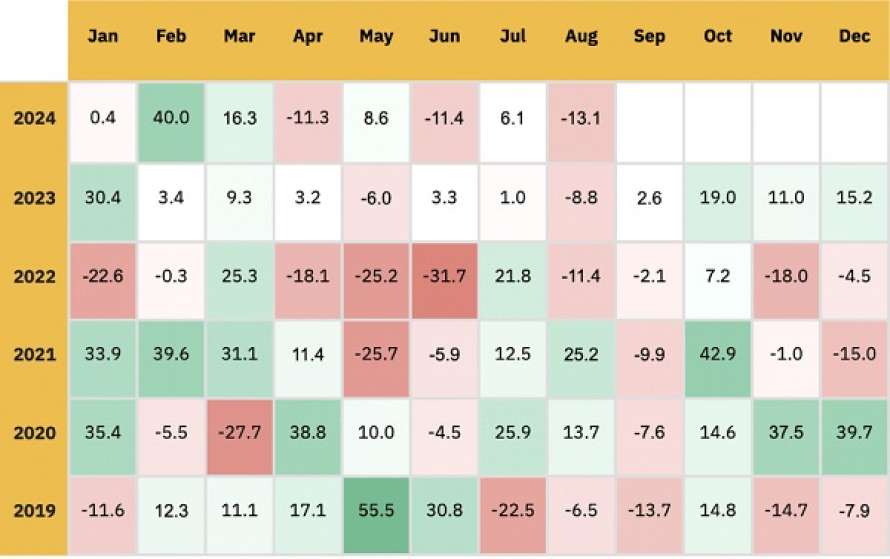

In August 2024, the cryptocurrency market experienced a significant drop of 13.1% of the total market capitalization. It was triggered by global macroeconomic problems and weak unemployment in the United States, which increased fears of a recession. The Bank of Japan’s decision to raise interest rates on August 5 caused significant disruptions in global stock markets. Asian indices, such as the MSCI Asia Pacific and Japan’s Nikkei 225, were particularly affected, suffering sharp losses throughout the day. This volatility also spread to the cryptocurrency market, leading to liquidations of more than $819 million in one day.

Source: CoinMarketCapAs (as of August 31, 2024)

Despite this “quick crash,” the market began to stabilize after US Federal Reserve Chairman Jerome Powell hinted at a possible interest rate cut in September. In addition, the U.S. Bureau of Economic Analysis revised its second-quarter GDP growth rate to 3%, which exceeded expectations.

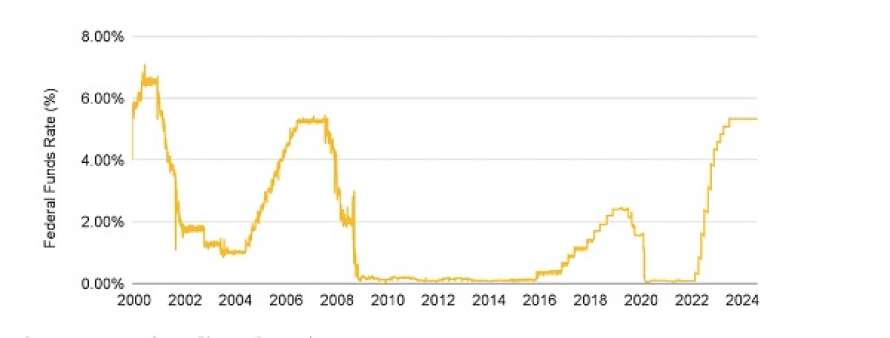

Expected rate cut: a signal for economic growth and lower unemployment

The US federal funds rate was at its highest level since 2001 after a significant rate hike cycle between March 2022 and July 2023. After holding rates steady for 8 consecutive meetings, all eyes are on a rate cut at the next meeting on September 17. -18. For context, the Fed adjusts the target federal funds rate in line with economic conditions. This is done to fulfill their dual mandate of maintaining stable prices (i.e., keeping inflation under control) and supporting maximum employment. Now that inflation in the US has come down significantly from its highs and is rapidly approaching its 2% target, the Fed has turned its attention to unemployment. The hope is that lowering the target rate (i.e., the price of credit) should lead to a new influx of money into the economy, which could lead to more hiring and improved employment figures.

Source: macrotrends.net, Binance Research (as of August 31, 2024)

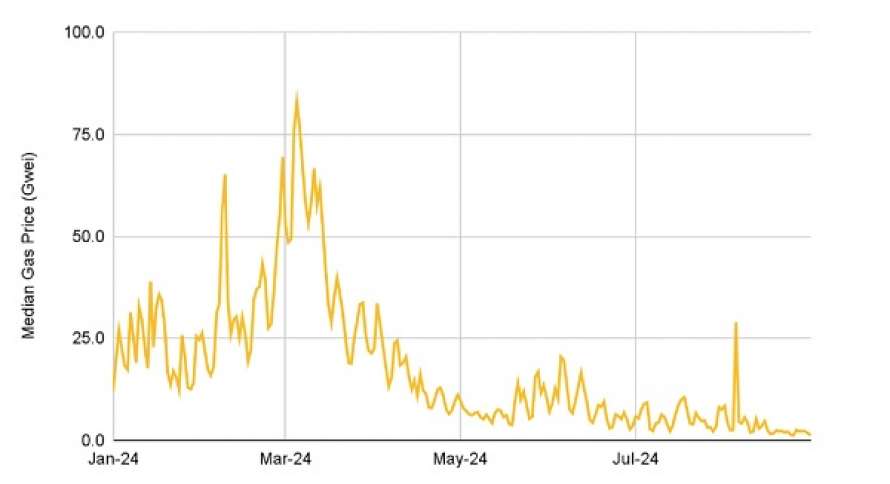

Historic decline in Ethereum fees: impact of the Dencun update and reduced network activity

Transaction and smart contract fees on the Ethereum network at the Layer-1 level have reached their lowest levels in more than five years, with several low-priority transactions costing one gwey or less in recent weeks. The decline in fees can be attributed to reduced network activity and the introduction of blobs during the Dencun update in March, which not only reduced fees at the Layer-2 level but also reduced congestion at the Ethereum Layer-1 level, thereby contributing to the overall decline in fees.

Source: Dune Analytics, Binance Research (as of August 31, 2024)

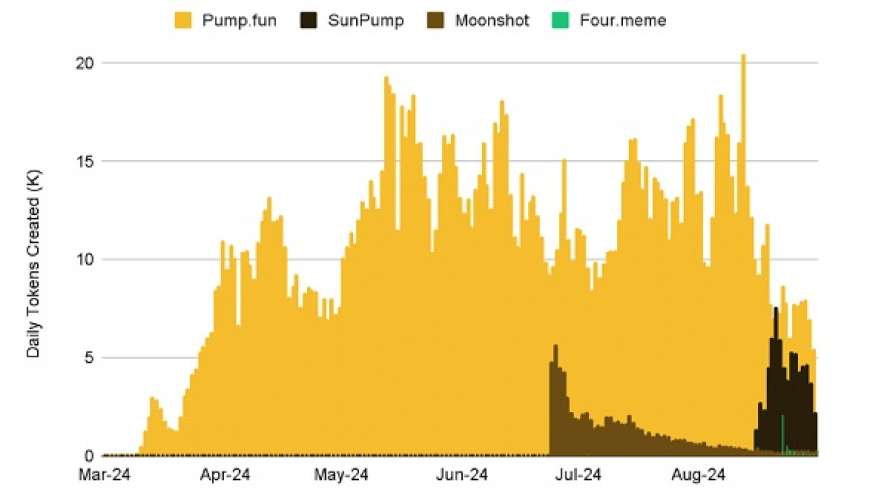

Pump.fun maintains leadership among meme coin launch platforms despite growing competition

Despite the emergence of competitive meme token platforms, Pump.fun remains the leader, setting a new record this month with more than 20 thousand tokens created in a single day. The platform has already launched nearly 2 million tokens and has been powering more than 60% of daily transactions on Solana-based decentralized exchanges since mid-August. As competition intensifies, it will be interesting to see if Pump.fun can maintain its dominant position as the leading meme token launch platform.

Source: Dune Analytics, Binance Research (as of August 31, 2024)

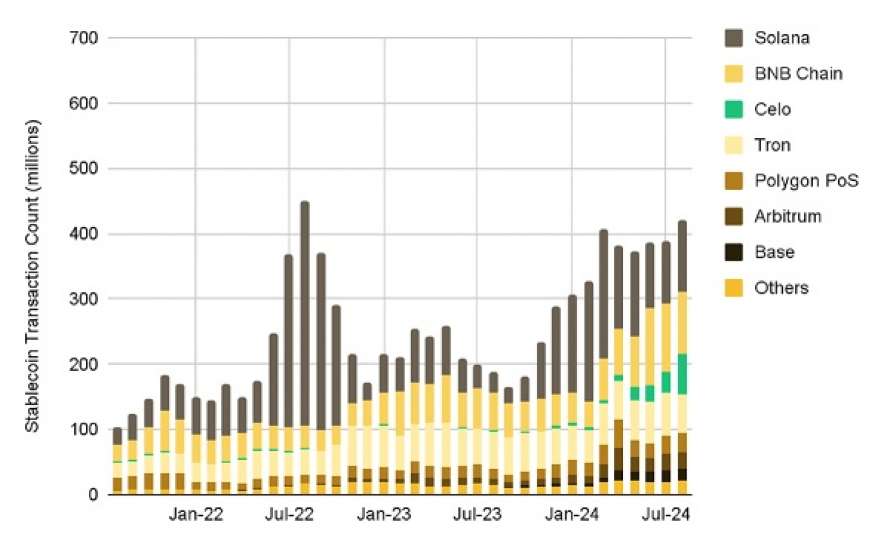

The stablecoin market continues to grow: new transaction records in the CELO and Solana ecosystems

The stablecoin market continues to grow rapidly, with the number of transactions approaching historic highs. Significant growth is observed in the CELO and Solana ecosystems. While the supply on USDT CELO has quickly reached the USD 200 million mark, Solana is leading the way in terms of transaction volume, helping PayPal’s PYUSD reach a market capitalization of USD 1 billion. As stablecoins gain popularity around the world, it is important to keep an eye on how macroeconomic factors and regulatory changes will affect the development of this sector.

Source: Binance Research (as of August 31, 2024)

The full report is available here.

About Binance

Binance is the world’s leading blockchain ecosystem and cryptocurrency infrastructure provider with a suite of financial products that includes the largest digital asset exchange by volume. Trusted by millions of people around the world, Binance’s platform aims to bring the freedom of money to users and has an unrivaled portfolio of crypto products and offerings, including: trading and finance, education, data and research, social good, investment and incubation, decentralization, infrastructure solutions, and more. For more information, please visit: https://www.binance.com.

Source: https://lenta.ua/kriptovalyutniy-rinok-u-serpni-analiz-vid-binance-research-163691/