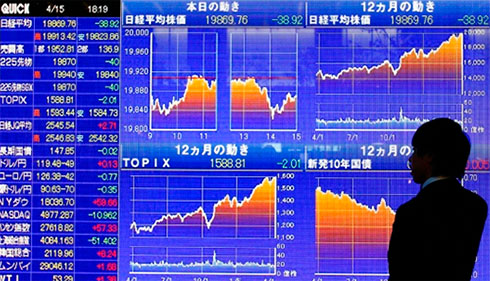

Stock indices of the largest countries in the Asia-Pacific region on Friday declined after the negative dynamics of the U.S. stock market.

Consumer prices in Japan rose 3.2 percent year on year in March, according to the country’s Ministry of Internal Affairs and Communications. Thus, inflation slowed down from February’s 3.3% and was the lowest since September 2022.

Consumer prices in Japan, excluding fresh food (a key indicator tracked by the country’s central bank), rose 3.1% in March compared with the same month a year earlier. That matched both the February figure and analysts’ average forecast, Trading Economics reported.

Meanwhile, inflation excluding food and energy increased to 3.8% from 3.5%.

Japan’s Nikkei 225 index was down 0.25% by 8:30 a.m. ET.

Shares of carmakers Nissan Motor Co. (-3.3%) and Mazda Motor (-2.5%) and Internet company Rakuten (-2.6%) were among the leaders of the fall.

In addition, members of the financial industry are getting cheaper, including Mizuho Financial Group Inc. – by 2.3%, SoftBank Group, Dai-ichi Life Holdings Inc. and Mitsubishi UFJ Financial Group Inc. – by 2.1 percent.

Meanwhile, Tokyo Gas Co. (+5.3%), chip maker Advantest Corp. (+3.6%), transportation firm Kawasaki Kisen Kaisha Ltd. (+1.8%) and retailer J. Front Retailing Co. (+1.8%).

China’s Shanghai Composite had fallen 1.4 percent by 8:35 a.m. QE, marking its third straight negative session.

Hong Kong’s Hang Seng index is losing about 1.2%, also due to a decline in the technology sector.

Among them, shares of chipmakers Semiconductor Manufacturing International Corp. and Sunny Optical Technology Group Co. – by 4.1% and 2.9%, respectively, aluminum producer China Hongqiao Group by 4.5%, retailer Alibaba (SPB: BABA) by 3.5%, insurer Ping An Insurance by 3.2% and consumer electronics maker Xiaomi (SPB: 1810) by 2.8%.

South Korea’s Kospi index was down 0.75% by 8:31 a.m. ET.

Shares of steelmaker Posco plummeted 5.9%, automaker Hyundai Motor – 1.3%.

At the same time, the share price of Samsung Electronics Co., one of the world’s largest chip and electronics manufacturers, rose 0.3%.

Australia’s S&P/ASX 200 index was down 0.3 percent by 8:31 a.m. ET.

The capitalization of the world’s largest mining companies BHP and Rio Tinto are down 2.5% and 3.5%, respectively.

Rio Tinto in the first quarter decreased its iron ore shipments by 6% compared to the previous three months and diamond production by 28%. The company cut its 2023 copper output forecast to 590,000-640,000 tons from the previously expected 650,000-710,000 tons.