The State Agency of Automobile Roads of Ukraine (Ukravtodor) intends to implement three priority projects in Zakarpattia region under a Hungarian loan, the allocation of which was confirmed by Minister of Foreign Economy and Foreign Affairs of Hungary Peter Szijjarto during his working visit to Ukraine on Wednesday.

As the press service of Ukravtodor told Interfax-Ukraine, among these facilities, in particular, is the construction of a new 10-kilometer road of the first technical category from the Hungarian border to the M-24 highway, and then to the highway M-06 Kyiv-Chop.

“This will be a continuation of the Hungarian M3 motorway from Budapest to Vásárosnamény, which, in turn, is part of the Fifth Pan-European Transport Corridor that passes through the territory of Ukraine,” the agency said.

The expected traffic intensity on the site is 12,000 vehicles. The construction of three interchanges is envisaged. Another checkpoint on the Hungarian-Ukrainian border is envisaged as well.

According to Ukravtodor, the designed-estimated documentation for this project is being examined. The estimated cost of construction is UAH 3.8 billion.

Another priority object is the construction of a bypass road around the town of Berehove and further to the Luzhanka checkpoint on the border with Hungary. The estimated cost of construction is UAH 1.5 billion. The designed-estimated documentation is at the final stage.

In addition, the modernization of the bridge across the river Tysa at the checkpoint Tysa-Záhony is a priority.

According to Ukravtodor, the start of the implementation of these projects is scheduled for 2021.

In general, in 2020, some 282 km of roads were repaired under the Big Construction program in Zakarpattia region.

As reported, Minister of Foreign Economy and Foreign Affairs of Hungary Peter Szijjarto confirmed the allocation of EU50 million to Ukraine for the development of road infrastructure in Zakarpattia region.

The U.S. rocket and space technology developer Firefly Aerospace Inc., owned by Ukrainian businessman Maksym Polyakov plans to raise $350 million to scale up production and work on a medium-class launch vehicle – Firefly Beta.

Firefly Aerospace CEO Tom Markusic spoke about these plans during the IPO Edge webinar, the company’s press service said on Thursday.

“In the next five years we want to take Firefly from a $1 billion with Alpha to being on the order of a $10 billion company with a set of different launch vehicles,” Markusic said.

The company said $125 million of the funding would go toward production enhancements, such as facilities and tooling needed to ramp up launch vehicle production. The other $225 million would support growth initiatives, in particular a medium-class vehicle capable of placing 10 tonnes into orbit, about ten times more than the capacity of Alpha.

“Our development phase was $200 million, and that was funded by Maksym Polyakov and Noosphere Venture Partners […] Now we are considering expanding the list of investors in order to raise an additional $350 million, without impeding our ability or fundamentally changing our culture as a nimble, fast-moving space development company,” Markusic said.

He also confirmed plans for Alpha’s inaugural launch soon.

As reported, Firefly Aerospace has already performed checkouts of the Alpha launch vehicle.

As reported, Firefly Aerospace Inc. signed a Launch Services Agreement (LSA) with equipment and avionics company Adaptive Launch Solutions (ALS), which includes four launches of the Alpha rocket starting in 2021.

Ukraine’s Space Electric Thruster Systems (SETS) will provide its SPS-25 propulsion system for the inaugural launch of the Alpha rocket made by a rocket and space technology developer Firefly Aerospace Inc.

Top 20 countries Ukraine has posted the highest surplus of trade in goods in Jan-Oct of 2020 (thsd USD).

SSC of Ukraine

The Cabinet of Ministers of Ukraine in 2020 provided the State Agency of Automobile Roads of Ukraine (Ukravtodor) with state guarantees for UAH 23.5 billion.

According to the information on the state guarantees provided in January-December 2020, published on the website of the State Treasury Service, on April 28, 2020, Ukravtodor received a state guarantee for UAH 19.274 billion (with additional guarantee of interest income), on December 18 for UAH 1 billion and on December 22 for UAH 2.25 billion and UAH 1 billion (all three – with additional guarantee of all payment obligations).

According to the data on the total amount of state and state-guaranteed debt for 2020, Ukravtodor placed 12-month bonds for UAH 5.78 billion in April last year, for UAH 5.08 billion in June and for UAH 3.5 billion in November. In total, from the placement of this type of bonds, the state agency raised UAH 14.36 billion of funds.

In addition, in August, Ukravtodor placed three-year bonds worth UAH 2.87 billion, and in November five-year bonds for UAH 2 billion.

According to Ukravtodor, 12-month bonds were redeemed by Ukreximbank for UAH 5.782 billion at 10.5% for one year, for UAH 5.081 billion at 9.99% for two years and for UAH 2.872 billion at 9.99% for three years.

In December, the state agency raised UAH 4.25 billion from three state-owned banks: UAH 1 billion each from Ukrgasbank and Ukreximbank, as well as UAH 2.25 billion from Oschadbank.

The State Agency of Automobile Roads of Ukraine ensures the implementation of the state policy in the field of road facilities and road management.

The net profit of Alfa-Bank (Kyiv) in 2020 amounted to UAH 1.21 billion, which is 1.6 times less than in 2019 (UAH 1.93 billion).

According to the bank, in the fourth quarter of last year, the bank received UAH 433.645 million of net profit, which is 1.4% less than in the same period in 2019 (some UAH 440 million).

Alfa-Bank’s assets over the past year increased by 35.6%, to UAH 97.5 billion, including the bank’s loan portfolio by 22%, to UAH 47.82 billion, due to loans provided to business entities, the volume of which increased by 51.4% to UAH 19.6 billion. At the same time, the volume of highly liquid assets increased by 39.5%, to UAH 7.2 billion, due to an increase in cash balances by 74.7%, to UAH 5.1 billion.

It is indicated that the balances on the account in the National Bank as of January 1, 2021 amounted to UAH 2.1 billion, while the liabilities to the National Bank reached the level of UAH 9.9 billion.

According to the statistics, the volume of balances placed on correspondent accounts in other banks increased 4.2 times, to UAH 8.3 billion.

The bank’s liabilities increased by 38.5% to UAH 87.8 billion, including the volume of legal entities’ funds by 34.8%, to UAH 30.4 billion, and funds of individuals by 19.4%, to UAH 41.5 billion.

The bank’s capital increased by 18.1%, to UAH 9.7 billion, and the regulatory capital as of January 1, 2021 amounted to UAH 8.8 billion.

As of October 1, 2020, Alfa-Bank ranked sixth in terms of total assets (UAH 101.64 billion) among 74 banks operating in the country.

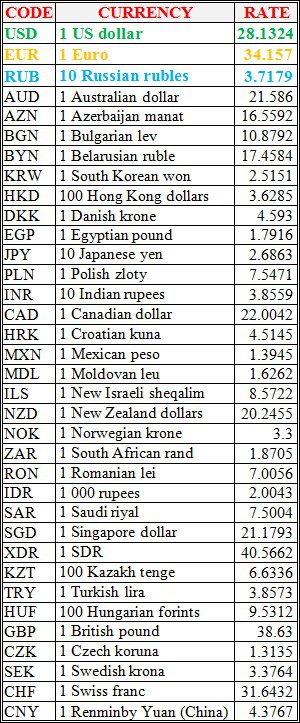

National bank of Ukraine’s official rates as of 01/02/21

Source: National Bank of Ukraine