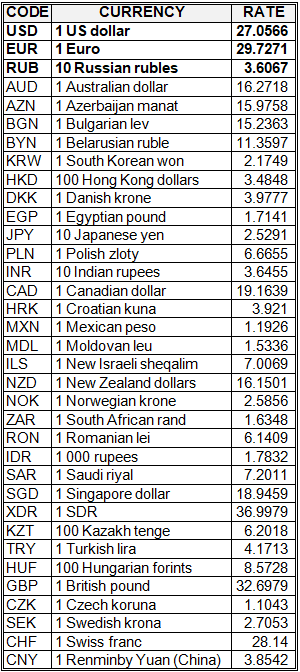

National bank of Ukraine’s official rates as of 18/03/20

Source: National Bank of Ukraine

The mobile communications operator Kyivstar jointly with Doctor Online company will make consultations of doctors in the eponymous application free of charge for subscribers of all telecom operators.

The Kyivstar’s press service reported on Wednesday that users, regardless of location, will be able to consult with more than 40 qualified doctors and receive treatment recommendations using a chat, video or audio call 24/7 for free.

“Today, people around the world are forced to fight against new viruses and difficulties. Since it is now not recommended to go outside, use public transport and contact with a large number of people, we decided to facilitate the process of visiting a doctor so that one does not have to visit hospitals unless one has to. Our application will be useful to elderly people and families with small children, those who live outside the city or stay abroad,” the press service said, citing Kyivstar Chief Marketing Officer Pavlo Daniman.

According to the operator, a series of updates has also appeared in the Doctor Online application. In particular, now during a video or audio consultation the patient has the opportunity of sending files to the doctor (tests for interpretation, photos, previous appointments, etc.).

In addition, if the doctor recommends taking tests, the user can immediately sign up for a test in the laboratory in the application and pay with a bank card.

A history of past consultations and the ability to leave feedback on the work of a doctor are also added.

Kyivstar said that over 3,000 users have downloaded the Doctor Online application in three months. Family doctors and pediatricians lead among calls to doctors. During this time, patients most often treated with symptoms of acute respiratory viral diseases (ARVI), problems with pressure and laryngotracheitis.

The Doctor Online application is a telemedicine application developed by the eponymous company with the support of Kyivstar. In the application, users can: turn to a specialist for advice either via chat, or via video or audio call, receive an order to undergo screening to the Synevo partner laboratory, order drug delivery from a partner in the Liki24.com application, and also schedule the drug uptake in the calendar and at the right time the application will remind of the need for taking a drug.

The application is available for use by subscribers of all mobile operators. Megabytes for use will be charged according to the tariff plan.

Kyivstar said that all user personal data is protected. The Doctor Online adheres to the best world practices of interpretation, storage and protection of information. A secure chat-audio-video communication platform is used, which provides storage and non-disclosure of users’ personal data in accordance with the User Agreement and in accordance with legislation on the protection of personal data.

President of Ukraine Volodymyr Zelensky has announced a list of cities abroad, from which Ukrainians will be able to return to their homeland for free or at reduced prices.

“We have formed so-called hub points. Once you get there, you will be able to get to Ukraine for free or at discounted prices. These are the cities of Istanbul, Dubai, Abu Dhabi, Prague, Berlin, Warsaw, Przemyśl, Vienna, Bratislava, Riga and Vilnius,” he said in his address in connection with the introduction of quarantine in the country.

The number of Ukrainian users of the Instagram social network in 2019 increased by 4.5%, to 11.5 million (about 11 million in 2018), the number of Facebook users by 7.7%, to 14 million. Such research data of the Ukrainian audience of social networks was released by PlusOne communications agency on its website.

According to the study, the main increase in Instagram audience was due to users 19-27 years old, and the increase in Facebook audience was mainly due to users aged 39 or more. Moreover, in almost all regions of Ukraine, except for Kharkiv region, Facebook is more popular than Instagram, and most users prefer the mobile version of the network rather than desktop.

“Ukraine ranks second in the world in the number of women registered in popular social networks. It ranks second in the world in the number of women who are Facebook users and is in the top ten countries in the number of Instagram users. In addition, the female audience of Facebook and Instagram outweighs the male in all age categories,” according to the report.

According to the PlusOne study, in October-December 2019, as well as January 2020, the Facebook Messenger audience in Ukraine increased by 1.5 million users, to 8.7 million.

At the same time, the report indicates that the total audience of Ukrainians available to advertisers through Facebook instruments is 19.5 million users.

Instagram, according to the study, achieved the highest penetration in Kyiv (45%), Odesa (36%) and Kharkiv (34%) regions. Whereas Facebook is the most popular in Kyiv (penetration is 55%), Lviv (44%), and Zakarpattia (40%) regions.

President of Ukraine Volodymyr Zelensky has reported that he urged the large business to help the country, which “has been feeding it for many years” with finances, namely a separate fund will be set up for purchase of medicine and other necessary means during coronavirus spreading.

“We urgently need 50 ambulances. This is the amount that is not enough for our hospitals. We talked about certain means … Honestly, I spoke frankly with them that this country has been feeding them for many years – it’s time you (large businessmen) to help the country,” he said on the air of the Freedom of Speech program on ICTV.

Zelensky said that a separate fund was setting up “and UAH 12-13 billion is needed from businessmen for medicine.”