Philip Morris in Ukraine has brought a new factory in Lviv region to its planned capacity, which was launched in May 2024, the company said in a press release.

“Since January this year, our factory has reached full capacity. This means that we can fully provide the Ukrainian market with our own products. Also at the beginning of 2025, we have fully completed the contract with a partner company in Ukraine, which has been producing products under our brands for more than two years. We are grateful to our colleagues for cooperation, because thanks to this partnership we were able to maintain production in Ukraine and continued to pay taxes here”, – commented Maxim Barabash, CEO of Philip Morris Ukraine.

The company reminded that Philip Morris (PMI) invested $30 mln in the launch of the Lviv factory, where five production lines are installed and put into operation. Their planned capacity is 10 billion cigarettes per year. The company has created 250 jobs, to which employees from the company’s Kharkiv facility have already been fully relocated.

According to Barabash, the company’s investments in Ukraine are not limited to the factory. In 2025, PMI plans to invest an additional 60 million UAH in a full-fledged large shelter on the territory of the factory, so that people could stay there in comfort and safety. Works on its arrangement have already started. The construction is planned to be completed by May 2025.

In addition, the company helped to modernize the existing shelter on the territory of Lviv city territorial community for about UAH 1.3 million.

Philip Morris was spun off from Altria in 2008 and is among the world’s largest tobacco manufacturers. The company’s 2023 revenue grew by 10.7% year-on-year to $35.2 billion in 2022. The report indicated that Ukraine accounted for about 2% of total sales in volume terms and 1% in cash terms.

PMI reduced shipments in the Ukrainian market by 30.1% to 11.07 billion cigarettes and tobacco sticks in 2022 due to the war, but it managed to increase finished goods shipments by 8.4% in 2023, including a 14.9% increase in the fourth quarter. The company reported in October 2023 that its share of the Ukrainian market had recovered to 24%. Ukraine figures were excluded from PMI’s quarterly reports in 2024.

In addition to cigarettes, PMI develops and manufactures smokeless products – electrically heated tobacco products (EHT), nicotine-containing PODs, and oral nicotine products. Sales from smokeless products accounted for 39% of PMI’s total net revenue in the first quarter of 2024 and 38% in the third quarter.

Philip Morris Ukraine has been operating in the Ukrainian market since 1994 and has invested more than $750 million in the Ukrainian economy since the beginning of the full-scale invasion, allocating more than UAH 400 million for humanitarian projects.

Inflation in Italy, calculated according to national standards, accelerated to 1.7% in annual terms in February from 1.5% a month earlier, according to preliminary data from the Italian statistics agency Istat. The data coincided with the expectations of analysts polled by Trading Economics and pointed to the record pace of consumer price growth since September 2023.

Inflation, calculated according to European Union standards, was 1.7%, the same as in January, while experts had expected an acceleration to 1.8%.

According to the previous report, energy prices jumped by 31.5% this month after rising by 27.5% in January. Transportation services went up by 1.9% after rising by 2.5% a month earlier, and communication services by 0.5% after rising by 1.1%. Overall, services went up by 2.4% (2.6% in January). Food prices increased by 2.2% after rising by 1.7%.

Core inflation, excluding energy and food, remained at 1.8% in February.

http://relocation.com.ua/v-italii-pryskorylasia-infliatsiia/

The National Bank of Ukraine (NBU) has strengthened the official hryvnia exchange rate against the US dollar by 12 kopecks after the official hryvnia/US dollar exchange rate rose by 8 kopecks on Thursday. – to 41.4313 UAH/$1, according to data on the regulator’s website.

“The dollar exchange rate is expected to remain within the range of 41.50-42.20 UAH/$1. The main factors that will influence the market will be the NBU’s decision on the discount rate on March 6 and the US Fed policy,” analysts at currency exchange market operator KYT Group shared their expectations for the coming weeks in their February review.

In their opinion, the hryvnia may gradually weaken in spring, in particular, if the foreign trade deficit grows. Analysts forecast an average corridor for the U.S. dollar in the range of UAH 42.50-44.00/$1.

“The main risks remain possible delays in international financial assistance and the growth of the budget deficit,” KYT Group said.

The hryvnia-US dollar exchange rate will be at 44.50-45.50 UAH/$1 by the end of the year, experts believe.

The NBU set the reference rate at 41.4341 UAH/$1 at 12:00 Friday against 41.5274 UAH/$1 on Thursday.

Meanwhile, the dollar in the cash market has fallen in price today: when buying its rate decreased by 3 copecks, to 41.53 UAH/$1, and when selling – by 1 copeck, to 41.64 UAH/$1.

As reported, the Cabinet of Ministers has set the average annual indicator of the official exchange rate of the hryvnia to the US dollar in the state budget of 2025 at the level of UAH 45/$1.

In the 2024 budget, the government budgeted an annual average of 40.7 UAH/$1, and at the end of the year – 42.1 UAH/$1. The hryvnia weakened by 10.6% or UAH 4.02 to UAH 42.0390/$1 at the official exchange rate last year.

Ukraine’s international reserves as of February 1, 2025, according to preliminary data, amounted to $43 billion 3.1 million, in January they decreased by 1.8%, or $785 million, and net international reserves (NIR) – by $0.79 billion, or 2.7% – to $28.313 billion.

Source: https://interfax.com.ua/news/projects/1051560.html

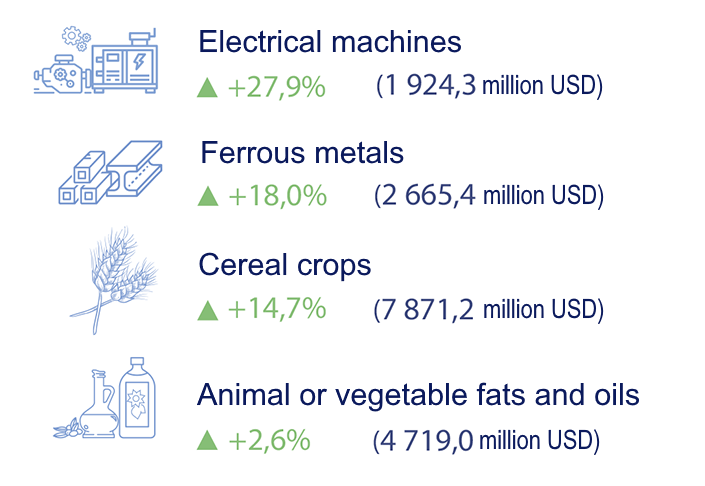

Dynamics of export of goods in January-October 2024 by the most important items in relation to the same period of 2023, %

Source: Open4Business.com.ua

Kiev citizens have been warned about heavy fog in the capital, drivers and pedestrians have been urged to be careful.

According to Ukrhydrometcenter, fog will remain in the capital till the end of the day, visibility will be 200-500 meters. Specialists recommend drivers to be careful while driving and follow the rules of the road in such conditions, in particular, reduce speed, turn on fog lights, keep a safe distance from other cars.

Pedestrians were urged to wear reflective elements – flickers to be visible to drivers during fog and at night.