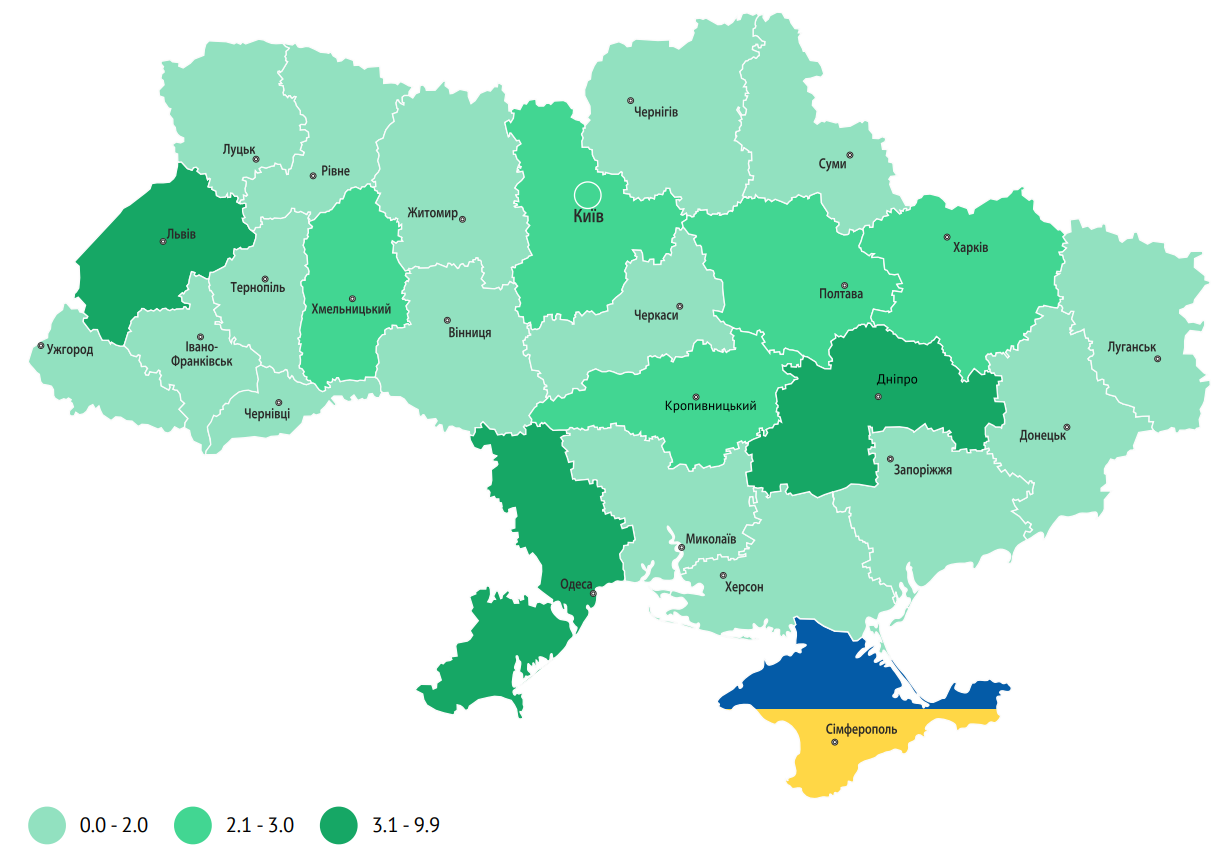

Number of vacancies as of 30.06.2024 (thousand units) according to the data of the state employment center

Open4Business.com.ua

The Ministry of Commerce of China confirmed the intention to increase duties on imports of cars with large engines. Earlier it became known that Beijing is considering such a possibility along with additional restrictions on supplies of whiskey from Europe to the country.

The representative of the Chinese Ministry of Commerce He Yadong said during a press conference on Thursday that there are significant differences between China and the EU regarding the recent decision of the European Commission to impose additional duties on imports of Chinese electric cars to Europe. Beijing has invited EU representatives to visit China for further talks, he said.

According to He Yadong, the Ministry of Commerce is considering the possibility of increasing duties on imports of high-volume gasoline-powered cars into China and will make a decision after studying relevant factors.

If Beijing makes such a decision, German automakers will be the most seriously affected, said Dongshu Cui, president of the China Passenger Car Association (CPCA).

Total imports of cars with engines larger than 2.5 liters from the EU fell 13% to $10.2 billion in the first eight months of this year, CPCA data showed.

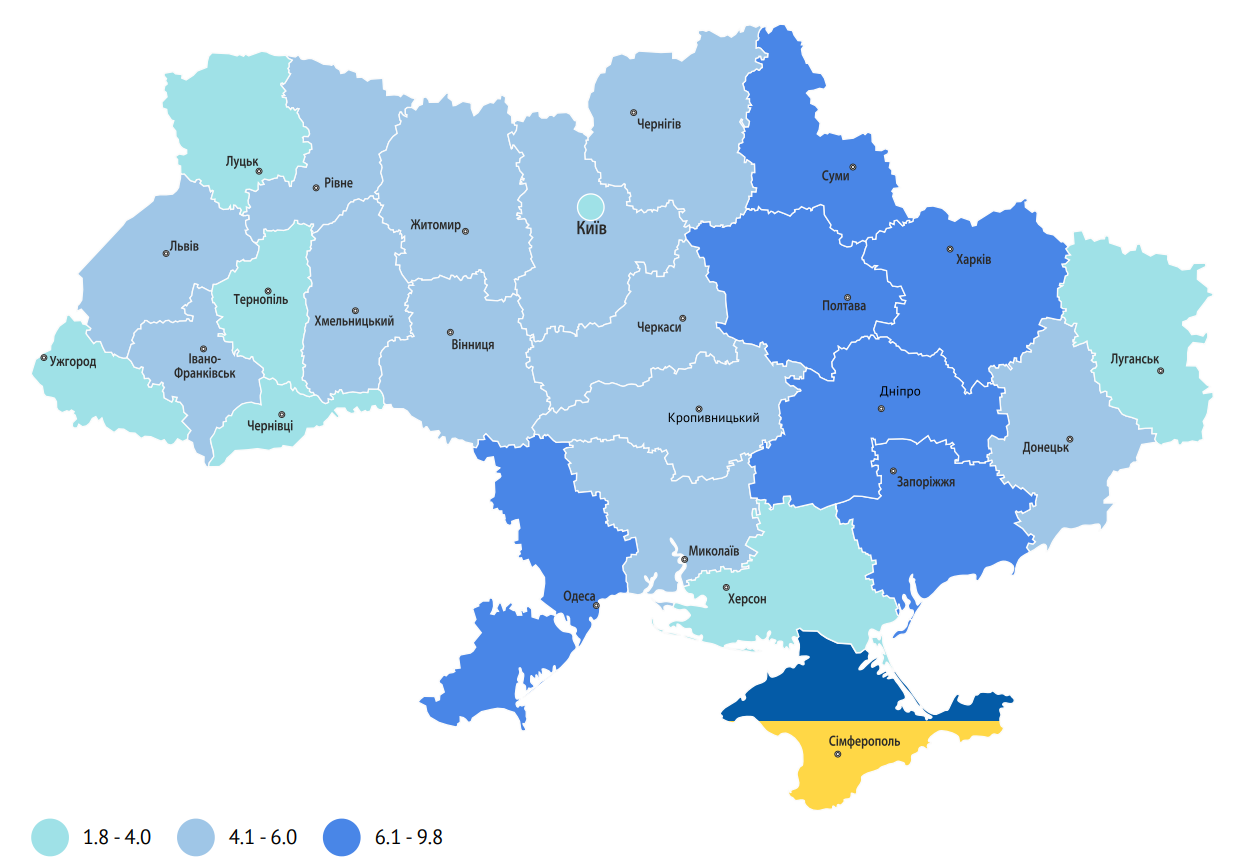

Number of unemployed people registered in public employment service as of 30.06.2024 (in thousands)

Open4Business.com.ua

A quarter of pensioners receive a pension of $66

There are 10.34 million pensioners in Ukraine as of October 1, 2024, according to the Pension Fund of Ukraine (PFU). 25% of Ukrainian pensioners receive about UAH 2,760 ($66 at the time of writing). Pensioners from Kyiv have the highest payments, while those in the western regions have the lowest.

10.34 million pensioners receive payments from the state. Currently, almost every fourth pensioner continues to work – 2.8 million Ukrainians. The average payment for working pensioners is about UAH 6,257. For comparison, the average pension in the country is UAH 5,851 or $141.

43% of pensioners in Ukraine receive payments of less than $100. More than half of them receive only $66 or 2,760 UAH per month.

25.6% or 2.64 million pensioners receive between 5,000 and 10,000 UAH. The average pension in this group is 6,860 UAH or $165.

18.6% or 1.92 million pensioners receive between 4,000 and 5,000 UAH. The average pension in this group is UAH 4,414 or $100.

Only 12.7% or 1.31 million Ukrainians have pensions of more than UAH 10,000. On average, pensioners in this group receive 15,354 UAH or $370.

The highest pensions are in Kyiv – UAH 7,971. This is 36% higher than the national average. Rivne (UAH 7276) and Donetsk (UAH 7158) regions are also among the leaders.

At the same time, Ternopil (UAH 4460), Chernivtsi (UAH 4664), and Zakarpattia (UAH 4697) regions have the lowest payments.

80% of Ukrainians receive their pensions in banks. Privatbank (57.8%) and Oschadbank (31.8%) account for the largest share of these payments.

https://opendatabot.ua/analytics/pensions-2024-10

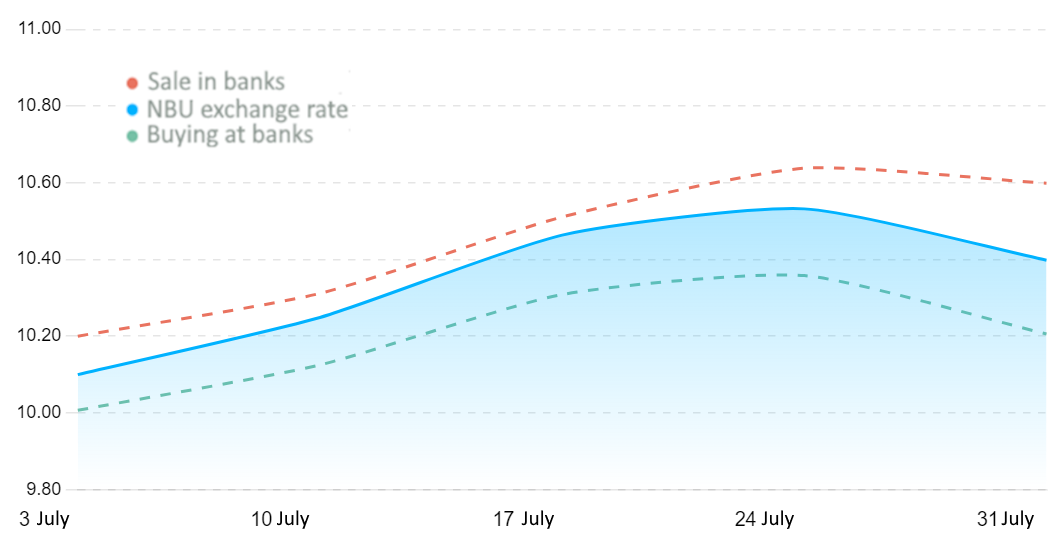

Quotes of interbank currency market of Ukraine (uah for 1 pln, in 01.07.2024-30.07.2024)

Open4Business.com.ua

Insurers in 2024 will focus on increasing investment in private markets, clean energy infrastructure and innovative technologies. According to the Reinsurance News website, this is according to the 13th annual Global Insurance Report by asset management company BlackRock.

For the third consecutive year, the report found that the majority of insurers plan to increase private market allocations, with 91% of respondents indicating they will do so in the next two years.

That figure reaches 96% for insurers in Asia Pacific and North America. The report is based on information from 410 insurance investors in 32 markets managing approximately $27 trillion in assets.

“With 2024 expected to be a landmark election year, insurers are increasingly concerned about how political uncertainty could impact macroeconomic risks, citing regulatory changes (68%) and rising geopolitical tensions and fragmentation (61%) as top concerns,” the report notes.

In addition, market risks such as interest rate volatility (69%) and liquidity problems (52%) were identified as critical.

Despite these challenges, 74% of insurers have no plans to change their current risk profiles. Many insurers cited the value of partnerships in improving their internal expertise for risk assessment and portfolio management, with 40% of respondents emphasizing that an investment partner that understands both their insurance business and operating model is critical to achieving their strategic goals.

In the public markets, 42% of insurers plan to increase investments in government and agency bonds, while 33% focus on inflation-linked bonds, as 46% view inflation as a significant macroeconomic risk. In addition, 44% of insurers are looking to increase their holdings in cash and short-term instruments to maintain liquidity.

BLACKROCK, clean energy, INNOVATION, INSURERS, INVESTMENT, private markets