The charity fund “Okhmatdet – Healthy Childhood”, which collected money for the restoration of the National Children’s Specialized Hospital (NCHS) after its destruction by a missile attack on July 8, is not going to transfer it to the accounts of “Okhmatdet”, said the director of NCHS Volodymyr Zhovnir.

“Since morning we have learned that BO “Charitable Foundation ‘Okhmatdet – Healthy Childhood’, does not plan to transfer funds to the account of VATB ‘Okhmatdet’. That is, as of August 16, 2024 UAH 378 million remain in the account of the BO “Charitable Foundation ‘Okhmatdet – healthy childhood’,” he wrote on Facebook on Friday.

According to Zhovnir, to raise funds, the details of the fund were made public on the pages in social networks of the hospital and its employees, in the media, as well as on the websites and pages of public authorities, public organizations and just concerned citizens.

“The fact that the fund contains in its name the name of Okhmatdet NDSB became for the benefactors an additional confirmation that the collected money will be used for the intended purpose and in no case will go for purposes unrelated to the recovery process”, – emphasized Zhovnir.

He also noted that no one had any doubts about the honesty of the fund, as they had always interacted normally with the hospital in the past. However, he argued, starting with the first public scandals and requests to transfer money, communication with the organization began to deteriorate.

“We are deeply shocked by the foundation’s decision. The hospital’s name is synonymous with responsibility, professionalism and hope. In my opinion, neither VATB nor the foundation, which bears the name “Okhmatdet”, has the right to let down Ukrainian society. However, the participants of the foundation (among whom there is not a single NDSB employee!) decided otherwise,” he said.

Zhovnir demands from the charity organization to transfer the money collected for the restoration of “Okhmatdet” to the hospital’s accounts and says that they are currently considering the possibility of breaking legal relations with the foundation because of the fact that their actions are “dishonest, as well as probably fraudulent”.

Meanwhile, an official statement from the BF says all funds raised for the hospital’s rehabilitation will remain in its accounts.

“The key thing is that all funds collected for the restoration of Okhmatdet after July 8th remain on the account of the Okhmatdet – Healthy Childhood Foundation. The fund is ready to pay for any urgent need of the hospital: medical equipment or restoration of buildings damaged as a result of the Russian attack. But we have not received a single letter from the Okhmatdet hospital about any such targeted need,” the website reported on Friday.

Representatives of the fund are also asking for legal grounds for transferring funds to treasury accounts without assignment.

“The Ministry of Health in its demands refers to Article 5 of the law “On Charity and Charitable Organizations.” However, this article of the law does not provide a legal mechanism for transferring funds collected by a benefactor to any state or other accounts without grounds. If we fulfill the requirement of the Ministry of Health to transfer the funds, we will grossly violate the law,” the statement says.

To confirm its transparency, the foundation invites the First Lady of Ukraine, Olena Zelenska, to become a member of its nabsoviet board to oversee and control the implementation of the reconstruction of the Okhmatdet hospital after the Russian terrorist missile attack.

Director General of the National Children’s Specialized Hospital “Okhmatdet” Volodymyr Zhovnir has been suspended from duty, Health Minister Viktor Lyashko said.

“Zhovnir is suspended from his duties until the completion of inspections by the National Police of Ukraine, other law enforcement agencies and a commission of the Ministry of Health,” Lyashko wrote in Telegram on Saturday.

“About further decisions will be reported additionally, including personnel decisions. My position – the acting should be a person from the heads of departments, who will receive the greatest support of colleagues. Now I am holding consultations,” he added.

According to the Minister, the facts related to the restoration of buildings Okhmatdet after the missile attack and the actions of the Charitable organization “Charitable Foundation ‘Okhmatdet’ – healthy childhood” are being studied by the National Police, there is a pre-trial investigation, investigation of the NABU and internal inspection of the Ministry of Health.

The National Bank of Ukraine (NBU) has granted PJSC Insurance Company “Grandvis” (Chernihiv) permission to exit the market by executing the insurance portfolio and agreed on a plan for such exit, the regulator said on its website on Friday.

“After the completion of the procedure of exit from the market through the execution of the insurance portfolio “Grandvis” is obliged to apply to the National Bank with an application for annulment of the license for insurance activities,” the publication said.

It is specified that such a decision of the Committee on supervision and regulation of non-banking financial services markets of the NBU adopted on August 14. This was preceded by the decision of the company’s shareholders to withdraw from the market at the general meeting on August 9.

According to the regulator, in the first half of 2024, 86% of the insurance portfolio of IC “Grandvis” was formed at the expense of payments under hull insurance contracts, 8% – liability insurance and 4% – health insurance.

It is noted that the volume of insurance premiums of the company for January-June amounted to UAH 1,24 million, and formed insurance reserves – UAH 574 thousand. The NBU emphasized that the share of the insurer on the above-mentioned premiums in the market is 0.01%. For six months of 2024 IC “Grandvis” has paid out insurance indemnities in the amount of UAH 179 th.

IC “Grandvis” has been working in the insurance market since 1995. It specializes in risky types of insurance. The authorized capital of the company is UAH 14,3 mln.

As it was informed, in November 2023 the NBU has applied to PJSC IC “Grandvis” a measure of influence in the form of temporary suspension of licenses for activity on rendering financial services in the sphere of insurance.

The reason for the decision was the insurer’s failure to comply with the decision of April 24, 2023 on violation of accounting requirements and non-compliance with solvency and capital adequacy norms.

Scooter riders guilty of an accident are fined from 340 UAH to 17 thousand UAH and deprived of their driver’s license

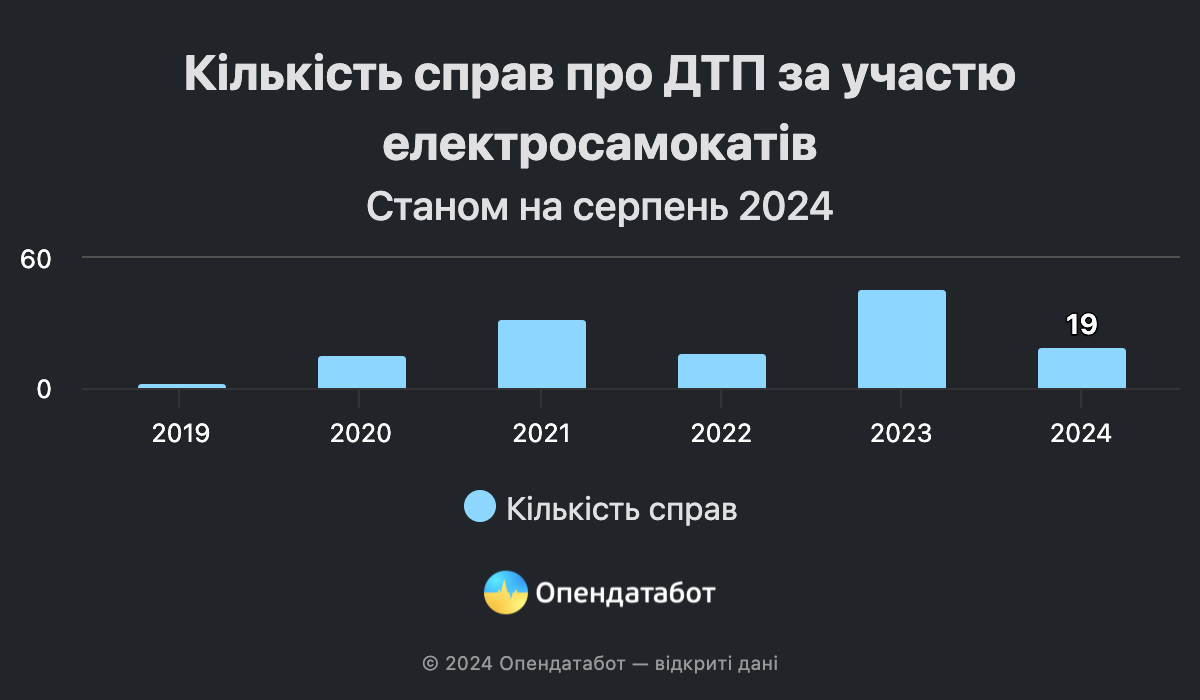

At least 130 cases of accidents involving electric scooters have been considered in courts over the past 5 years, according to the court register search engine Babusya. 34% of them were considered in 2023. Scooter drivers can be fined from UAH 340 to UAH 17,000 for violations and lose their driver’s license for a year.

111 administrative and 22 criminal cases related to accidents with electric scooters were found in the court register as of July 2024.

The largest number of accidents involving scooters was recorded last year: 36 administrative and 10 criminal cases. However, the number of such proceedings is only increasing from year to year: more criminal cases have already been opened this year than in the entire year of 2021. Since the beginning of this year, the courts have already heard at least 16 administrative and 3 criminal cases involving scooters.

The most common types of accidents where scooter drivers are to blame are pedestrian collisions or property damage. In such cases, drivers mostly get off with a fine of UAH 340 to 850.

At the same time, the number of cases when scooter drivers are caught driving while intoxicated is increasing. For example, last year, a driver of a rented scooter hit a woman on the sidewalk. During the test, he was found to have 0.9 ppm of alcohol, which is about the same as after drinking 250 ml of vodka. The offender was fined UAH 17 thousand and deprived of his driver’s license for a year.

However, violators cannot always be fully prosecuted: drivers may not have a driver’s license and simply do not know the traffic rules. For example, a courier on an electric scooter rushing to deliver an order with 0.33 ppm in his bloodstream argued in court that he was sober and that the scooter was not a vehicle. However, these arguments did not help him avoid a fine of UAH 17 thousand. The driver’s license could not be confiscated, as required by law, because the offender never had one.

Our editorial team asked how the scooter rental business reacts to such statistics. Bolt and Jet companies said that the law does not require scooter riders to have a driver’s license, but according to the rules of their services, the driver must be an adult. It is worth noting that the services do not require documentary proof of age: users must enter their date of birth during registration.

Both companies noted that all trips are insured against damage to life or property of third parties. At the same time, if a minor is involved in an accident and pretends to be older when registering (as in the case of a teenager who rammed a car in Kyiv), the consequences of the accident are either not covered by insurance at all (Jet) or, depending on the circumstances, the service reserves the right to make a final decision (Bolt).

“At themoment, it is very important to develop clear and understandable traffic rules for electric scooters and liability for their violation at the legislative level. We don’t track all incidents with electric scooters, but we do monitor insurance claims – this year it is less than 0.001% of all trips,” comments Anton Milka, Head of Sharing Services Development at Bolt in Ukraine.

Context

As a reminder, in 2023, scooter drivers were legally recognized as full-fledged road users – but special rules for them have not yet been approved. Drivers of electric scooters, monowheels, etc. must move as far to the right of the roadway as possible, use reflective elements and helmets. At the same time, such vehicles are prohibited from driving on sidewalks and pedestrian paths.

https://opendatabot.ua/analytics/scooters-dtp-2024

Ukrainian companies increased imports of tin and tin products by 7.8% in January-July – up to $1.536 mln (in July – $185 thousand),

According to customs statistics released by the State Customs Service of Ukraine, exports of tin and products amounted to $331 thousand (in July – $150 thousand) against $53 thousand in the same period a year earlier.

In 2023, exports of tin and products totaled $159 thousand vs. $424 thousand for 2022.

Tin is used primarily as a safe, non-toxic, corrosion-resistant coating in pure form or in alloys with other metals. The main industrial uses of tin are in white tinplate for food containers, in solder for electronics, in house piping, in bearing alloys, and in coatings made from tin and its alloys. The most important tin alloy is bronze (with copper). Another well-known alloy – pewter – is used for the manufacture of tableware.

Ukrainian enterprises in January-July decreased imports of lead and lead products by 14.4% to $610 thousand ($50 thousand in July).

According to customs statistics released by the State Customs Service of Ukraine, exports of lead and lead products decreased by 27.8% to $6.492 million (in July – $1.089 million).

Ukraine’s imports of lead and lead products decreased by 65.2% to $989 thousand in 2023.

Lead is currently mainly used in the production of lead-acid batteries for the automotive industry. In addition, lead is used to make bullets and some alloys.