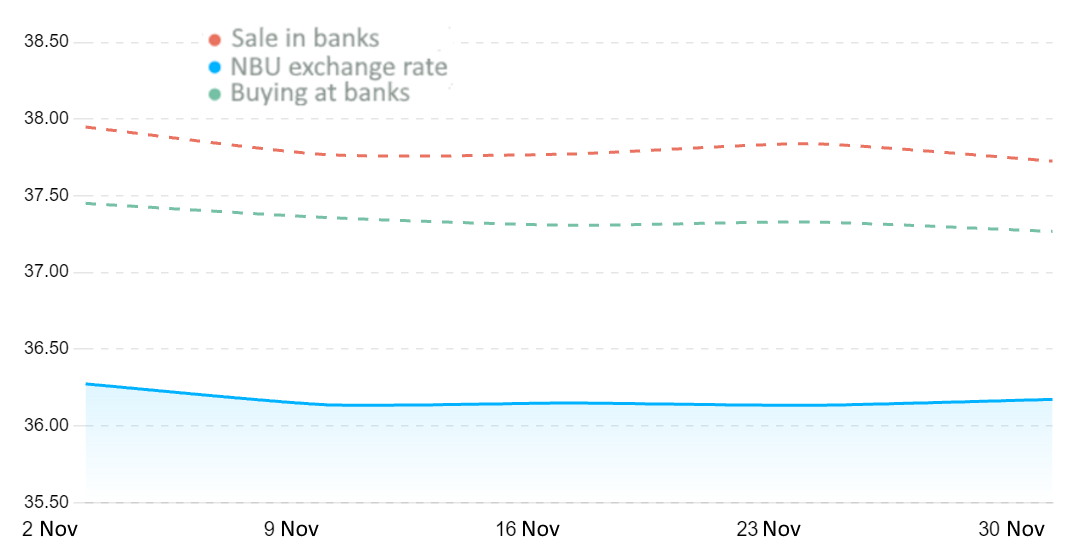

Quotes of interbank currency market of Ukraine (UAH for $1, in 01.11.2023-30.11.2023)

Source: Open4Business.com.ua and experts.news

The blockade of a road on the Lithuanian-Polish border by farmers on March 1 may violate the European Union principle of free movement of goods and people, Lithuanian Economy and Innovation Minister Aušrine Armonaitė said, LRT writes.

“As far as I understand, the flow of people will not be stopped, but we are still members of the free European Union, where the movement of goods and people should be free. Any impediment to that movement has the potential to disrupt freedom of movement,” the minister said.

She noted that trucks at the border would be directed to additional parking lots for inspection, which could lead to queues.

A nationwide strike of farmers started in Poland on February 9. The main demands of the strikers are to adjust the “green” course of the European Commission, to limit the inflow of Ukrainian agricultural products to the Polish market, as well as to increase the profitability of agricultural production. During the protests, farmers block Ukrainian-Polish border crossings.

Since March 1, Polish farmers have been preparing for two new blockades – at the former Polish-German border crossing in Svec and on the road near the former Lithuanian-Polish border crossing “Kalwaria-Budzisko”. Farmers will check the contents of trucks, especially agricultural goods.

According to Ausris Macijauskas, chairman of the Lithuanian Grain Producers Association, Polish farmers’ suspicions that Ukrainian grain brought from Poland to Lithuania is being returned or processed and re-exported as Lithuanian goods are justified.

Via Baltica is a 970-kilometer section of European route E67 between Tallinn and Warsaw. It provides road links between the Baltic countries. E67 connects Helsinki (Finland) and Prague (Czech Republic).

The Suvalki Gap is a strip of land about 100 kilometers long on the Lithuanian-Polish border, which is wedged between the Russian exclave of Kaliningrad in the west and Belarus in the east.

Maciauskas said earlier that Lithuanian farmers for their part would not contribute to the Polish protest. According to him, the biggest problem of Lithuanian farmers is Russian grain.

Ten Ukrainian and two leading German hospitals have agreed on a medical partnership.

As the Ministry of Health of Ukraine reported on its website, during the international conference on medical partnerships, which took place on February 26-27 in Berlin, a memorandum of cooperation with Charité Clinic was signed by the Regional Clinical Center of Neurosurgery and Neurology in Uzhgorod, Lviv National Medical University named after Danil Halytskyi, Ternopil Regional Clinical Psychoneurological Hospital, Bogomolets National Medical University, Institute of Neurology, Psychiatry and Addiction Medicine of the National Academy of Medical Sciences of Ukraine.

Memoranda of cooperation with the German network of hospitals BG Kliniken, specializing in the treatment and rehabilitation of victims of severe trauma, signed clinical hospital “Feofania”, Ivano-Frankivsk Regional Clinical Hospital, NDSB “Okhmatdet”, City Clinical Hospital № 4 Dnipro, Institute of Spine and Joint Pathology named after Sitenko NAMNU.

The development of the International Medical Partnership is an initiative of the First Lady of Ukraine Olena Zelenska. It was launched during the third summit of First Ladies and Gentlemen in Kyiv on September 6, 2023.

Currently, the International Medical Partnership Program with Ukraine is supported by 18 countries. Within the framework of the program 34 memorandums of cooperation have been signed. Medical Partnership in Germany was made possible thanks to the assistance of the German Society for International Cooperation (GIZ) through their funded Hospital Partnership Program.

Barcelona, February 29, 2024: VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a global digital operator providing mobile and fixed-line services, today announced that Kyivstar, its subsidiary in Ukraine, has won the GSMA’s Global Mobile Award at the annual Global Mobile Awards (GLOMO) in the category of Best Mobile Innovation in Support of Emergencies or Humanitarian Situations for its network resilience project.

The award was presented to Kyivstar CTO Volodymyr Lutchenko at a ceremony organized as part of the Mobile World Congress (MWC24) in Barcelona. The GLOMO award recognizes Kyivstar’s hard work and exemplary performance in providing connectivity in Ukraine, its meaningful investments in its network and digital services during the war, and its overcoming of severe challenges to support Ukraine’s resilience.

In his speech, Mr. Lutchenko recognized the work of the Ukrainian telecommunications industry, noting that “This is an award not only for Kyivstar, but for all Ukrainian telecommunications operators.

VEON would like to thank all the nominees of this year’s GLOMO award, as well as the mobile industry in general, for their work aimed at solving humanitarian problems and helping communities overcome emergencies. “I am honored to receive the GLOMO award for the extraordinary work of the Kyivstar team in providing vital communications for Ukraine. Our communication and digital services are extremely important for communities, in humanitarian crises and emergencies. We are honored to be part of an industry that is committed to meeting this challenge,” added Kaan Terzioglu, CEO of VEON Group.

Kyivstar is the largest telecommunications operator in Ukraine, providing services to 24 million mobile subscribers and more than 1.1 million home Internet subscribers. As a leading operator in the Ukrainian telecom market, the company maintains over 90% network availability in the government-controlled areas of Ukraine, providing communications not only to its customers but also to the population of Ukraine as a whole.

VEON International Group owns 100% of Kyivstar. VEON and Kyivstar have committed to investing $600 million over the next three years to rebuild and restore Ukraine.

About VEON

VEON is a digital operator that provides mobile, fixed-line and digital services to nearly 160 million customers. Operating in six countries with more than 7% of the world’s population, VEON changes lives by providing technology services that empower people and drive economic growth. Headquartered in Amsterdam, VEON is listed on the NASDAQ and Euronext stock exchanges.

For more information, please follow the link: https://www.veon.com.

About Kyivstar:

Kyivstar is Ukraine’s largest electronic communications operator, serving 24 million mobile subscribers and more than 1.1 million Home Internet subscribers as of September 2023. The company provides services using a wide range of mobile and fixed technologies, including 4G, Big Data, Cloud solutions, cybersecurity services, digital TV, etc. Kyivstar helps subscribers, society and the country to overcome the challenges of wartime. Since the beginning of the full-scale war, the company has allocated UAH 1.8 billion to support the Armed Forces, society and subscribers. Kyivstar’s sole shareholder is the international VEON Group. The Group’s shares are listed on NASDAQ (New York) and Euronext (Amsterdam). Kyivstar has been operating in Ukraine for 25 years and is recognized as the largest taxpayer in the telecom market, the best employer and a socially responsible company. For more information: pr@kyivstar.net, www.kyivstar.ua

The Republic of Cyprus has extended until March 4, 2025 the temporary protection status for persons who already have this status.

“The Ministry of Interior informs all interested parties that, based on the relevant decision of the Council of Ministers, the right to temporary protection is automatically extended for one year for those persons who have obtained such a right in Cyprus, i.e. until March 4, 2025”, – stated in the official announcement of the Refugee Service on the relevant website.

And it is specified that “thus, for those who have already received temporary protection, there is no need to submit a new application to the Refugee Service or to issue a new biometric residence permit at the Department of Population and Immigration.

Those who wish to apply for temporary protection for the first time must apply either electronically at http://www.moi.gov.cy/asylum or in person at the Refugee Service head office in Nicosia.

The Unity Facility insurance mechanism for grain transportation by Ukrainian sea corridor, announced in mid-November 2023, has been extended to ships carrying not only grain but any other cargoes from February 2024, Oliver Wyman partner Crispin Ellison said.

“By combining the efforts of the industry and the government, we’ve been able to create a mechanism (facility) where prices are well under half of those in the normal commercial market. And now, this month, February, we’ve expanded that facility to include transportation of all cargoes, not just grain,” he said at a Wednesday webinar on political risk insurance organized by the U.S.-Ukraine Business Council (USUBC) and the U.S. Department of Commerce.

He said this will be formally announced on Friday, but the option is already available and effectively triples the mechanism.

Ellison recalled that after Russia withdrew from the Black Sea Grain Initiative, insurance rates increased for the military risk element alone to about 5%, which was completely unaffordable and led to a halt in shipping in July and August.

Established using a public-private partnership (PPP) in which the Ukrainian government provided a $20 million reimbursement fund, the Unity Facility insures approximately 1,000 vessels per year with a maximum insured value of $50 million for each vessel, supporting the export of approximately 30 million tons of grain. The reimbursement fund is accessed through a letter of credit with Ukrainian banks and DZ Bank.

According to Ellison’s submission, a parallel mechanism for cargo coverage, supported by EBRD financing for the Ukrainian government, is being considered.

The expert emphasized that the relatively small amount of insurance capital allowed exporting goods worth about $20 billion, and its estimate is 6-8% of Ukraine’s GDP.

As reported, the Unity Facility was created with the support of the UK government, international reinsurance broker Marsh McLennan and over a dozen more British insurance companies.

According to the Ministry of Restoration, the sea corridor created by the Navy of the AFU and the Danube since August 2023 provided for the export of almost 26 million tons of cargo, of which more than 18 million tons – the products of Ukrainian agrarians. It was specified that from the ports of “Greater Odessa” 854 ships were sent to 42 countries.