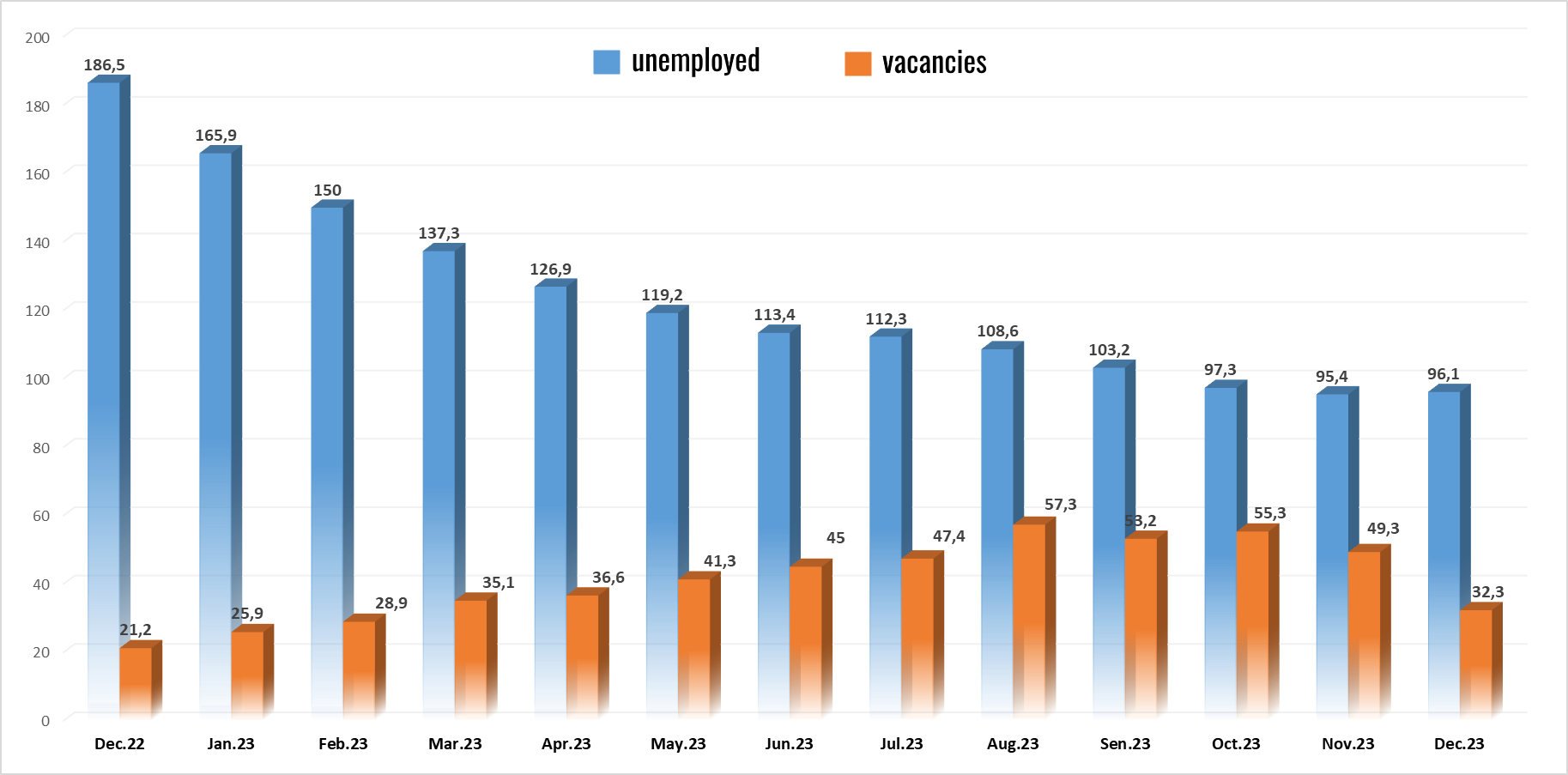

Number of unemployed in Ukraine and job opportunities, November 22 – December 23

Source: Open4Business.com.ua and experts.news

Head of the Office of the President of Ukraine Andriy Yermak held a meeting with the US Ambassador to Ukraine Bridget Brink.

“Held a meeting with Ambassador Extraordinary and Plenipotentiary of the United States in Ukraine Bridget Brink. Told about massive Russian shelling of Ukraine’s energy infrastructure and the difficult situation in several regions of our state,” Yermak wrote in his Telegram channel on Saturday.

“Thanked for Ukraine’s support in these super difficult times,” Yermak added.

Andriy Yermak, Brigitte Brink, Office of the President, U.S. AMBASSADOR, UKRAINE

The top ten steel-producing countries at the end of February are as follows: China (81.181 million tons, up 3.5% on Jan-Feb-2023), India (11.799 million tons, up 11.4%), Japan (6.989 million tons, up 1.1%), USA (6.453 million tons, down 1.2%), Russia (5.7 million tons, down 4, 4%), South Korea (5.128 million tons, down 1.5%), Germany (3.124 million tons, up 4.4%), Turkey (3.084 million tons, up 46.6%), Brazil (2.779 million tons, up 13.1%), and Iran (2.239 million tons, up 14.3%).

Cumulatively, steelmaking in February 2024 increased by 3.7% y-o-y to 148.838 million tons in 2023.

In January-February 2024, the top ten steel-producing countries are as follows: China (167.960 million tons, up 1.6% on Jan-Feb-2023), India (24.469 million tons, up 10%), Japan (14.253 million tons, up 0.8%), USA (12.998 million tons, down 2.6%), Russia (11.738 million tons, down 3, 2%), South Korea (10.849 million tons, up 0.2%), Turkey (6.332 million tons, up 34.5%), Germany (6.194 million tons, up 4.6%), Iran (4.842 million tons, up 26.5%) and Brazil (5.506 million tons, up 6.4%).

Overall, in 2M-2024, steelmaking increased by 3% y-o-y to 306.883 million tons.

Ukraine produced 1.076 million tons of steel in 2M-2024, which is 52% higher than in the same period of 2023 (708 thousand tons in 2M-2023). The country is ranked 21st in 2M-2024.

As reported, for 2023 China produced 1 billion 19.080 mln tons at the level of the previous year), India (140.171 mln tons, +11.8%), Japan (86.996 mln tons, -2.5%), USA (80.664 mln tons, +0.2%), Russia (75.8 million tons, +5.6%), South Korea (66.676 million tons, +1.3%), Germany (35.438 million tons, -3.9%), Turkey (33.714 million tons, -4%), Brazil (31.869 million tons, -6.5%), and Iran (31.139 million tons, +1.8%).

In total, 71 countries produced 1 billion 849.734 million tons of steel in 2023, 0.1% less than in 2022.

At the same time, Ukraine produced 6.228 million tons of steel in 2023, which is 0.6% lower than the volumes for 2022. The country is in 22nd place for 2023.

In total, 64 countries produced 1 billion 831.467 million tons of steel in 2022, 4.3% less than in 2021.

The government of Ukraine proposes to increase the excise tax rate for alcoholic beverages classified as “intermediate products” from 8.42 to 12.23 UAH per 1 liter, i.e. to the level of the rate for sparkling and carbonated wines.

As reported by the Ministry of Finance, the corresponding bill with amendments to the Tax Code, the Cabinet of Ministers approved at a meeting on Friday.

“Revision of excise duties is due to the need to bring national legislation closer to the legislation of the European Union, which is relevant in view of Ukraine’s status as a candidate country for EU membership,” the Finance Ministry said.

The document provides for bringing in compliance with the norms of the EU Council Directive No. 92/83/EEC classification of alcoholic beverages in the part concerning the definition of the term “intermediate products” – wines and other fermented beverages referred to codes 2204, 2205, 2206 according to the Ukrainian classification of goods for foreign economic activity. In particular, we are talking about vermouth, cider and perry.

The Ministry of Finance predicts an increase in revenues from such an increase at the level of 4.5 million UAH per month.

The international company Unilever has started construction of a new factory in Bila Tserkva, Kyiv region. Today a commemorative capsule was laid at the site of the future enterprise in the industrial park “Bila Tserkva”, the Head of Kyiv Regional State Administration Ruslan Kravchenko said on his Facebook page on Friday.

It is also reported that the amount of investment in the factory is € 20 million. Almost 100 new jobs will be created at the enterprise. The factory will produce personal care products, shampoos and shower gels, the goods will be mainly oriented for the Ukrainian market. Potentially, the enterprise will produce products for other markets in Europe.

The report notes that the total area of the site for the development is 4.2 hectares. The production capacity of the enterprise is more than 5000 tons per year. The construction of the factory is planned to be completed at the end of 2024. Erection will take place taking into account the highest environmental standards. There will be comfortable working conditions, office space is designed to meet the needs of immobile groups. A ground mobile shelter has already been arranged for safe work, and in time an underground shelter will also be built.

“The construction site of the new factory in the industrial park was not chosen by chance – there are all necessary communications and road infrastructure. The development of industrial parks supports the restoration of industry in Kyivshchyna during Russia’s war against Ukraine. The opening of new production facilities contributes to the income and well-being of local communities, increases tax revenues and stimulates the development of small and medium-sized enterprises in the region”, – said Ruslan Kravchenko.

Ruslan Kravchenko thanked the CEO of Unilever Ukraine Vasyl Bovdilov and the founder of UFuture, which includes the industrial park “Bila Tserkva”, Vasyl Khmelnitsky for the example, which “should be followed by other investors and joint efforts to develop the economic potential of Kyiv region”.

Earlier it was reported that Unilever Plc will allocate EUR20 mln for the construction of a factory in the Kiev region to produce personal care products, shampoos and shower gels under the brands Dove, Axe, TRESemmé and Clear,

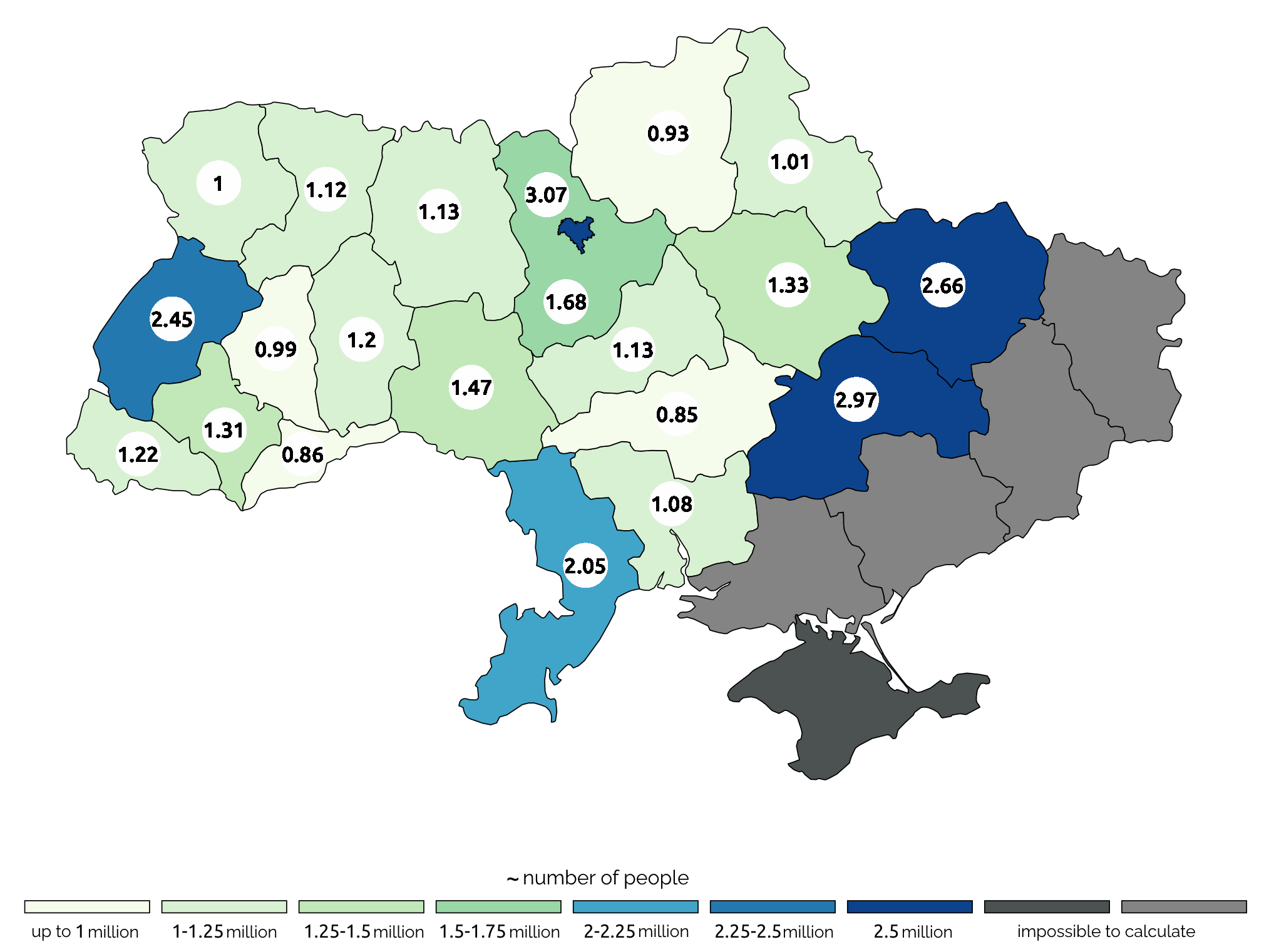

Estimated number of population in regions of Ukraine based on number of active mobile sim cards (mln)

Source: Open4Business.com.ua and experts.news