Among all Middle Eastern countries, Iraq ranks among those toward which Ukrainians have the least positive attitudes. These data were obtained from a sociological survey conducted by Active Group in April 2025 in cooperation with the information and analytical center Experts Club.

According to the results, 40.0% of Ukrainians have a negative attitude toward Iraq (30.1% — mostly negative, 9.9% — completely negative). Only 5.8% of respondents expressed a positive attitude (3.7% — mostly positive, 2.1% — completely positive). Another 46.2% of respondents chose a neutral position, and 8.0% were unable to answer.

“Ukrainians associate Iraq primarily with military conflicts, terrorism, instability, and geopolitical threats, rather than diplomatic or economic contacts. This shapes a persistent image of the country as a ‘risk zone,’” commented Maxim Urakin, founder of Experts Club.

The results indicate deep informational associations that need to be changed if countries plan to expand contacts in the peaceful, trade, or cultural spheres.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Shareholders of Arsenal Insurance (Kyiv) decided at a meeting on May 7 to allocate UAH 34.705 million of undistributed profits for 2021 and UAH 15.395 million for 2022 to dividend payments, the company reported in the information disclosure system (NSSMC).

As stated in the report, the dividend per ordinary share will be UAH 167. Dividends will be paid directly to shareholders in proportion to the number of shares held by each of them from May 29 to June 27, 2025.

Insurance Company Arsenal Insurance is the successor to Insurance Company Arsenal-Dnipro, which has been operating in Ukraine since 2005. It is represented in all regional centers and some major cities of the country.

According to the NBU, the company is one of the top ten insurers in Ukraine in terms of premiums collected for the first nine months of 2024.

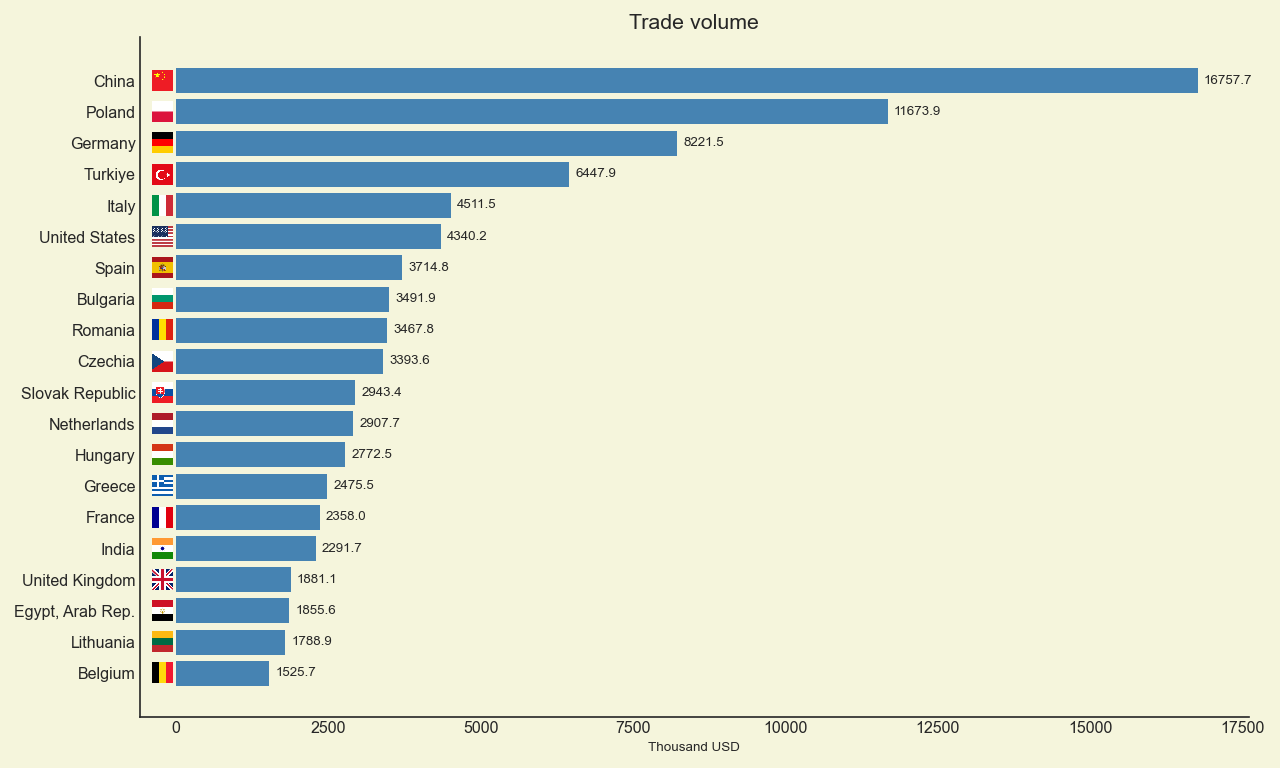

Geographic structure of Ukraine’s foreign trade (trade volume) in January-December 2024, mln. USD

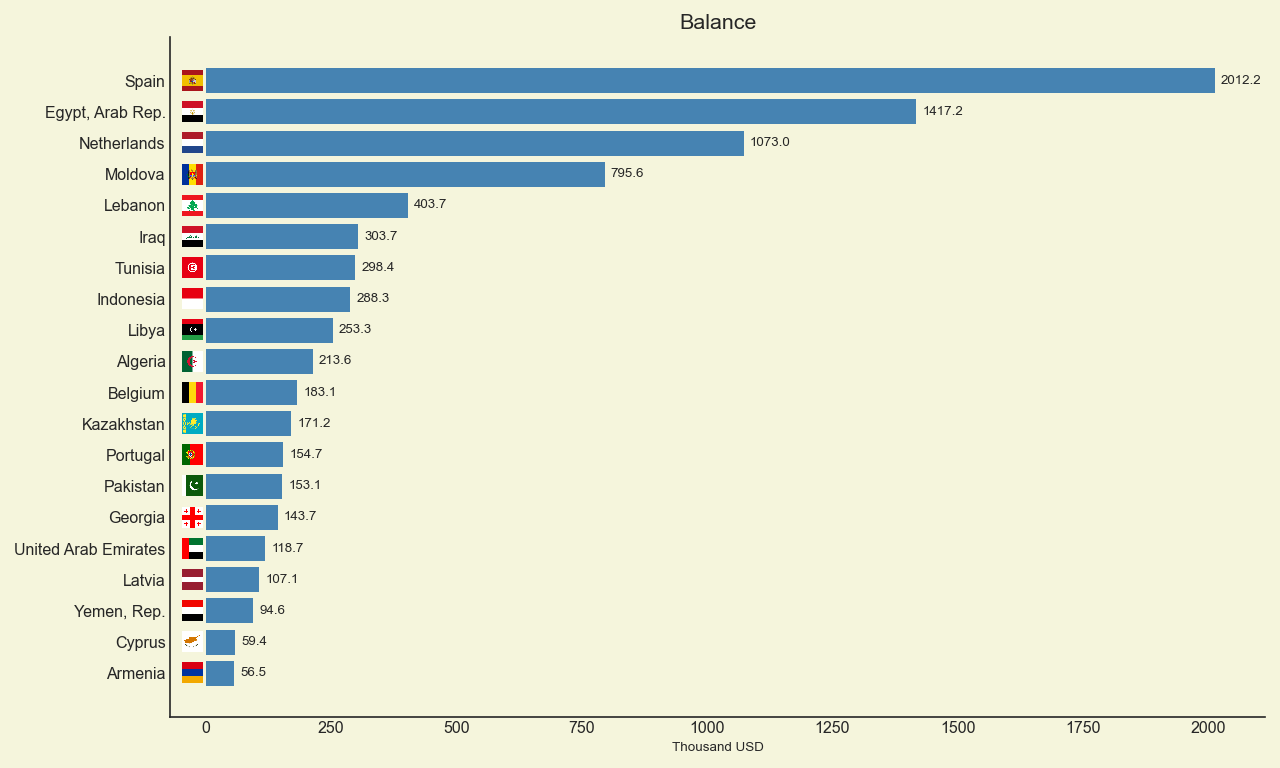

Geographical structure of Ukraine’s foreign trade (surplus) in January-December 2024, million USD

Egypt is a country that Ukrainians perceive as mostly neutral, with a slight positive bias. This is evidenced by the results of a sociological survey conducted by Active Group in collaboration with the Experts Club think tank in April 2025.

According to the survey, 68.2% of respondents expressed a neutral attitude toward Egypt, which is one of the highest figures among all countries. A total of 17.6% of Ukrainians have a positive attitude toward this country (13.8% mostly positive, 3.7% completely positive), while 7.1% have a negative perception (6.0% mostly negative, 1.1% completely negative). Another 7.1% of respondents abstained from answering.

“Egypt is traditionally associated in Ukraine mainly with tourism, but it has no significant political or humanitarian presence in the context of the war. This explains the high level of neutrality,” commented Oleksandr Pozniy, co-founder of Active Group.

In turn, Maxim Urakin, founder of Experts Club, noted that Egypt has been one of our country’s most profitable trading partners for many years, based on the positive trade balance. However, according to the expert, trade is currently a secondary factor in the minds of Ukrainians compared to moral and political support in the international arena.

At the same time, the neutral-positive perception of Egypt opens up opportunities for deeper cooperation at the diplomatic and cultural levels if the parties so desire.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Among all countries covered by the sociological survey, Algeria turned out to be one of the least known to Ukrainian society, as evidenced by a record high level of neutral responses. These results were published by Active Group in partnership with the Experts Club think tank in April 2025.

According to the survey, 73.6% of Ukrainians said they had a neutral attitude toward Algeria. Only 8.2% of respondents have a positive opinion of the country (6.5% mostly positive, 1.7% completely positive), while 8.8% expressed a negative opinion (6.4% mostly negative, 2.4% completely negative). Another 9.3% were unable to answer.

“Algeria remains terra incognita for most Ukrainians — a country about which there is a lack of information in the Ukrainian media, which explains the extremely high level of neutrality,” said Maxim Urakin, founder of Experts Club.

These results demonstrate the potential for developing intercultural dialogue, but also point to the limited diplomatic and humanitarian presence of Algeria in Ukraine.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN