Global demand for gold, excluding over-the-counter (OTC) transactions, amounted to 1.31 thousand tons in the first quarter of 2025, which is 16% higher than the result for the same period last year, according to the World Gold Council (WGC). Demand for jewelry fell to its lowest level since the COVID-19 pandemic in 2020 due to high prices. However, a sharp influx of gold into ETFs increased investment demand 2.7 times to 552 tons, the highest level since the first quarter of 2022. Demand for coins and bars also remains above average.

Gold production reached a record high for the first quarter of 856 tons. Overall, supply grew by 1% to 1,206 thousand tons. The market deficit was covered by OTC.

The National Bank of Ukraine (NBU) added four insurance and/or reinsurance brokers to the Register of Insurance Intermediaries in accordance with their electronic applications.

According to the NBU website, the following companies were added to the register: Dobrobut ta Zakhyst LLC, Willis Insurance Brokers LLC, Risk and Life Consulting LLC, and the representative office of SIA Yulisire.

The National Bank also removed these companies from the State Register of Insurance and Reinsurance Brokers and revoked their certificates of entry in this register.

The relevant decisions were adopted by the Committee on Supervision and Regulation of Non-Bank Financial Services Markets on April 25, 2025.

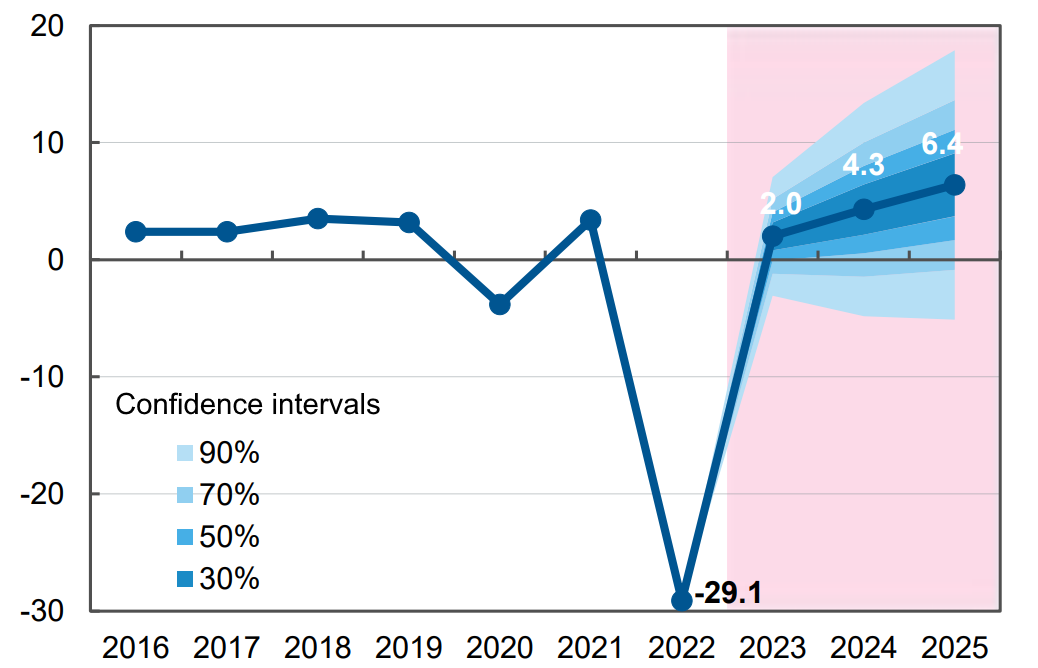

Forecast of dynamics of changes in Ukrainian GDP in % for 2022-2025 in relation to previous period

Breast implant sales statistics show no trend toward “naturalness” in aesthetic medicine, according to plastic surgeon and founder of the Lita Plus clinic Sergey Derbak.

“We often discuss this issue with colleagues. I’ll be frank: I am well aware of the statistics on implant placement in Ukraine. Our clinic performs the largest number of breast augmentation surgeries in the country, so we see the real figures. And I can say with confidence that talk of ‘naturalness’ is mainly a PR stunt by bloggers and opinion leaders who want to stand out amid the general popularity of plastic surgery. In fact, there is currently a real boom in breast and lip augmentation, and it is not abating. There is no statistical evidence of a mass rejection of plastic surgery,” he said in an interview with Interfax-Ukraine.

Derbak noted that implant sales statistics show that “the smaller the implant, the more patients want a natural look.”

“In Latin America, the average implant volume exceeds 450 ml, which is approximately a size 4 breast. In Germany, the average volume is about 220 ml, which is in line with the trend toward naturalness. In Ukraine, the average implant volume is 350-400 ml, which is larger than a size 3 breast. Interestingly, round implants sell better than anatomical ones, and this trend has been growing over the last three years, since the start of the full-scale war,” he said.

According to Derbak, ”today, compared to before the war, the volume of implants has increased.”

“Over the past year, the average implant size has been plus or minus 400 ml. So I would say that stories about naturalness are more a case of wishful thinking. In reality, this is not the case,” he said.

On April 28, 2025, federal elections were held in Canada, resulting in a victory for the Liberal Party led by Mark Carney, which won 155 seats in the House of Commons out of 343. However, this is not enough to form a majority, which requires 172 seats, meaning that a minority government will have to be formed or coalition agreements sought. Distribution of seats by party

Party Leader Seats Change

Liberal Party Mark Carney 155 +3

Conservative Party Pierre Poilievre 133 +13

Bloc Québécois Yves-François Blanchet 21 -11

New Democratic Party Jagmeet Singh 5 -20

Green Party Elizabeth May and Jonathan Pedne 1 -1

Independents and others 28 —

Possible scenarios for forming a government

Given the results, the Liberal Party does not have an absolute majority and must seek support from other parties to form a stable government. Possible options:

Minority government: The Liberals may try to govern without a formal coalition agreement, securing the support of other parties on key issues.

Coalition with the New Democratic Party: Despite significant losses, the NDP could become a partner of the Liberals, as has happened in the past.

Cooperation with the Bloc Québécois: Although the Bloc Québécois lost some seats, its support could be critical for the Liberals, especially on issues related to Quebec.

Implications for the opposition

The Conservative Party, led by Pierre Poilievre, improved its position, winning 133 seats, but this was not enough to secure victory. Poilievre also lost his seat in the Carleton riding, which could affect his leadership of the party.

The New Democratic Party suffered significant losses, reducing its representation to five seats. Party leader Jagmeet Singh announced his resignation after losing in his riding.

The election took place against a backdrop of heightened tensions with the US, particularly after President Donald Trump’s statements about the possible annexation of Canada as the 51st state. Mark Carney strongly criticized Trump, stressing the need to protect Canadian sovereignty and strengthen national unity.

International leaders, including representatives from the UK, the EU, Ukraine, and China, congratulated Carney on his victory and expressed hope for stronger cooperation in trade, defense, and democratic values.

Earlier, the Experts Club think tank released a video analysis dedicated to the most important elections in the world in 2025. For more details, see here —

https://youtu.be/u1NMbFCCRx0?si=K4EMR3-a5cYQM_Ab

The Volyn District Administrative Court upheld the claim of the Osokorki Ecopark public organization and decided to revoke the construction permit issued to Kontaktbudservis LLC and Budevolutsia LLC for the construction of a residential complex. The developer Stolitsa Group announced its intention to appeal the decision.

“On April 25, 2025, the Volyn District Administrative Court revoked the construction permit issued to Kontaktbudservis LLC for the territory of the Osokorky Ecopark. We have once again proven that construction on the territory of the ecopark is illegal. The court’s decision revoked the construction permit for the H2O residential complex,” the Osokorky Ecopark public organization said on Facebook on Tuesday.

According to the published court decision, the court concluded that the defendant did not provide the results of an environmental impact assessment to obtain a construction permit in a protected landscape area, did not coordinate the construction project with the State Service for National Cultural Heritage and the Ministry of Culture of Ukraine, and did not coordinate the construction plans with the current General Plan of the city.

Thus, the court’s decision revoked the permit of the State Architectural and Construction Inspection of Ukraine (GASI) No. IU113181171313 dated April 27, 2018, for the comprehensive development of microdistricts 1, 2, and 2a of the Osokorki-Tsentralni residential area in the Darnytskyi district of Kyiv.

In turn, the project developer Stolitsa Group announced its intention to appeal this decision in the near future. In its opinion, the court assessed the case as insignificant and did not take into account previous decisions of the Supreme Court regarding urban planning conditions and the detailed plan of the territory in this case.

“The company considers the decision of the Volyn District Administrative Court of First Instance to be a gross violation of procedural and substantive law, and it has not entered into legal force and will be appealed in the near future,” the company said in a statement on its Telegram channel.

The developer emphasized that work on the construction site is being carried out in accordance with the approved schedules and commitments made to buyers. In addition, the company continues to fulfill its obligations under the signed memorandum on the completion of the bankrupt Arkada facilities, the statement said.

As reported, in November 2018, the Kyiv District Administrative Court dismissed the claim of the Osokorki Ecopark public organization to revoke the State Architectural and Construction Inspection’s permit for the construction of the Patriotika na Ozerakh residential complex in the Osokorki-Tsentralny residential area in the Darnytskyi district of Kyiv, issued to Kontaktbudservis LLC and Budevolutsia LLC. This decision was overturned on appeal in 2019, and later in 2020, the Supreme Court overturned both decisions and sent the case back for reconsideration.

In 2019, Kyiv City Council deputies supported the decision to create the Tyaglo Lake Landscape Reserve to preserve valuable natural complexes of flora and fauna in the Dnipro floodplain on the left bank of the capital.

Later in 2021, a memorandum was signed on the completion of the bankrupt Arkady’s projects by Stolitsa Group LLC: the Eureka, Patriotika, and Patriotika na Ozerakh residential complexes.

On January 20, 2025, Stolitsa Group opened sales in the N2O residential complex in the capital’s Osokorki district between the Tyaglo and Nebrezh lakes (the former Patriotyka na Ozerakh project from Arkada). The chief architect of the project was Alexei Kutsalo from KUB Arkhteks.

Sources: https://reyestr.court.gov.ua/Review/126877273, https://www.facebook. com/ecoparkosokorky/posts/pfbid02HQ1SYBsTGKpcNfUFTqxpupRE2geJcpc7KDGbk29UxxGb688zAikndaggEAwWy5gol, https://t.me/stolitsa_group/2564