JSC “Ukrtransnafta” has increased its stake in PJSC “Insurance Company Transmagistral” from 91.99% to 98.45%, according to the company’s information posted in the information disclosure system of the National Commission on Securities and Stock Market (NCSSM). As reported on February 28, 2025, IC “Transmagistral” has increased the authorized capital to UAH 248 million by conducting an additional issue for the amount of UAH 200 million Additionally, 20 million shares with a par value of UAH 10 for the amount of UAH 200 million were sold.

As reported, the decision on the issue was made by the shareholders at the meeting on November 29, 2024.

Earlier, the National Bank of Ukraine agreed to the state of Ukraine indirect ownership of 92.4059% of shares of PJSC Insurance Company Transmagistral. Prior to that, on January 8, the NBU confirmed the company’s ownership structure compliance with transparency requirements.

As noted on the company’s website as of Q3 2024 the shareholders of the company were JSC “Ukrtransnafta” – 91,992%, Primary trade union organization of JSC “Ukrtransnafta” (Kremenchug, Poltava region) – 5,1%.

IC “Transmagistral” was registered in 2003, specializes on rendering services in the sphere of risk insurance.

Issue No. 1 – March 2025

The purpose of this review is to provide an analysis of the current situation on the Ukrainian currency market and a forecast of the hryvnia exchange rate against key currencies based on the latest data. We analyze current conditions, market dynamics, key influencing factors, and likely scenarios.

Analysis of the current situation

Since the beginning of March, the Ukrainian currency market has undergone significant changes in the dynamics of the dollar and euro. While the dollar was gradually strengthening in February, it began to decline in early March, followed by a gradual recovery after March 10, and the euro, after relative stability, began to grow.

Domestic Ukrainian factors had virtually no impact on this situation, which reflects global processes in the international currency market.

The main international factors that influenced the exchange rate dynamics:

Ø The start and further escalation of tariff wars launched by the administration of the new US president, which pose risks to US economic growth and accelerating inflation. This encouraged global investors to exit the dollar in search of more stable assets.

Ø The dollar is weakening on the global market due to softer statements by the US Federal Reserve. Investors have begun to expect a likely rate cut later this summer, which has weakened support for the dollar.

Ø The European Central Bank (ECB) had previously signaled possible stimulus to support the economy, which led to the euro’s weakness. However, since the beginning of March, EU macroeconomic indicators have improved, pushing the euro to strengthen.

Key internal factors affecting the Ukrainian FX market:

Ø Decreased demand for the dollar after a large-scale import of cash currency in February: according to the NBU, $1.316 billion in cash dollars and the equivalent of $450 million in euros were imported into Ukraine.

Ø The NBU’s interventions help to smooth out exchange rate volatility and maintain a controlled market situation.

Ø Increased budget expenditures in March traditionally create additional demand for foreign currency, which may affect the correction of the hryvnia exchange rate.

Exchange rate dynamics

Ø Since the end of February, the dollar has been accelerating its pronounced downward trend, slipping from the average of UAH 41.42-41.97/$ to UAH 41.1-41.65/$. This downward trend primarily reflects the situation on the global currency market and the lack of domestic drivers for the dollar to hryvnia exchange rate amid decreasing pressure on the national currency and a temporary decline in demand for the dollar. The appreciation observed since March 10 may be only a temporary correction, which generally reflects the temporary volatility of the US currency.

Ø In contrast, the euro hryvnia exchange rate moved in the opposite direction. Since the beginning of March, it has soared from 43.35-44.05 UAH/€ to 44.46-45.15 UAH/€, effectively returning to the level of mid-January this year after a long slump. This behavior of the euro is also entirely due to external factors.

Much more informative for analyzing the state of the Ukrainian foreign exchange market is the dynamics of spreads between buying and selling rates, which are an indicator of market liquidity and allow us to diagnose the level of uncertainty among its key operators.

Ø In March, we saw the average spread for the dollar narrow below February’s levels, from 50-60 kopeks to 40-50 kopeks, and in some cases to 30 kopeks. This indicates a balanced supply and demand for the US currency.

Ø For the euro, the average spread increased from 50-60 kopeks to 70-80 kopeks, as the sharp rise in the euro made the market less predictable, forcing banks and exchange offices to put in higher margins.

Thedeviation of the market rate from the NBU’s official exchange rate remained insignificant, confirming that the regulator’s currency policy is in line with the market balance. However, for the euro, this deviation increased in the second half of March, indicating that the market reacts more quickly to global factors, often outpacing the NBU’s official exchange rate adjustments.

USD exchange rate outlook

Ø In the short term, over the next 2-4 weeks, the dollar is likely to remain in the range of UAH 41.30-42.30 per dollar. The main factor that will influence the situation will be the policy of the National Bank of Ukraine, as well as possible decisions of the US Federal Reserve regarding the discount rate. If the NBU continues to actively intervene in the market through interventions, exchange rate fluctuations will be minimal.

Ø During the spring months, in the medium term (2-4 months), the dollar may move to the range of UAH 41.50-42.50 per dollar. In this period, the demand for foreign currency is expected to increase, in particular due to increased budget spending and import activity by businesses. An additional, though unlikely, risk is possible delays in international financial assistance, which could put temporary pressure on the hryvnia.

Ø In the longer term, i.e., over 6 months, the dollar has the potential for gradual appreciation due to the persistence of key factors of depreciation pressure on the hryvnia. If economic conditions remain unchanged, it may return to the range of UAH 42.50-44.00 per dollar, but we should remember the budget exchange rate target of UAH 45 per dollar, which leaves room for the exchange rate to be used for fiscal purposes to manage budget revenues. At the same time, the US Federal Reserve’s policy may affect global dollar liquidity: if the regulator begins to ease monetary policy, the US currency will remain relatively stable despite the hryvnia’s devaluation.

Euro exchange rate forecast

Ø In the coming weeks, the euro is likely to reach and stabilize in the range of UAH 44.80-45.70 per euro. After a sharp jump, the market may enter a correction phase where there will be no significant fluctuations.

Ø In the medium term, over the next 2-4 months, the dynamics of the euro will largely depend on the policy of the European Central Bank. If the ECB continues its measures to support economic growth, the euro may remain in the range of UAH 44.50-46.00 per euro. At the same time, the euro may weaken somewhat if there are prerequisites for a stronger dollar or if negative economic news from the EU.

Ø In the long run, the euro has the potential for relative stability or moderate growth. If the economic situation in Europe improves, the euro may remain in the range of UAH 45.00-46.50 per euro. However, as in the case of the dollar, macroeconomic factors and risks to the European economy may have a significant impact on the euro’s further dynamics.

Recommendations for businesses and investors

Diversifying your portfolio across currencies and assets is more important than ever: consider your individual needs first. Depending on where and how long before you plan to spend your foreign exchange in euros or dollars, this currency should be the dominant currency in your savings portfolio to avoid conversion losses. Other reserve currencies in your portfolio should act as a stabilizer: when one currency falls, the other rises, compensating for at least part of the exchange rate losses.

Regularly analyze and revise the structure of foreign currency savings: in the current turbulence and poor predictability in international currency markets, you should analyze the appropriateness of the current portfolio structure at least once a month and adjust it if necessary.

Currency speculation: In general, the current situation is quite favorable for cautious speculation, but it will require careful monitoring of key indicators and information signals to respond to changes in market trends in a timely manner. Experienced investors can take advantage of the current opportunities, while inexperienced investors should stick to conservative strategies focused on preserving their savings.

As for the hryvnia, we reiterate our recommendation to hold it only in the amount necessary to finance current expenses, service short-term financial obligations, and for unforeseen expenses in special life situations.

The basic recommendation for all currencies is to keep all savings as liquid as possible, avoiding long-term investments. This will ensure freedom of maneuver in the face of currency turbulence and poor predictability that will accompany us at least in the medium term.

This material was prepared by the company’s analysts and reflects their expert, analytical professional judgment. The information provided in this review is for informational purposes only and should not be construed as a recommendation for action.

The Company and its analysts make no representations and assume no liability for any consequences arising from the use of this information. All information is provided “as is” without any additional warranties of completeness, obligations of timeliness or updates or additions.

Users of this material should make their own risk assessments and informed decisions based on their own assessment and analysis of the situation from various available sources that they consider to be sufficiently qualified. We recommend that you consult an independent financial advisor before making any investment decisions.

REFERENCE

KYT Group is an international multi-service product FinTech company that has been successfully operating in the non-banking financial services market for 16 years. One of the company’s flagship activities is currency exchange. KYT Group is one of the largest operators in this segment of the Ukrainian financial market, is among the largest taxpayers, and is one of the industry leaders in terms of asset growth and equity.

More than 90 branches in 16 major cities of Ukraine are located in convenient locations for customers and have modern equipment for the convenience, security and confidentiality of each transaction.

The company’s activities comply with the regulatory requirements of the NBU. KYT Group adheres to EU standards, having a branch in Poland and planning cross-border expansion to European countries.

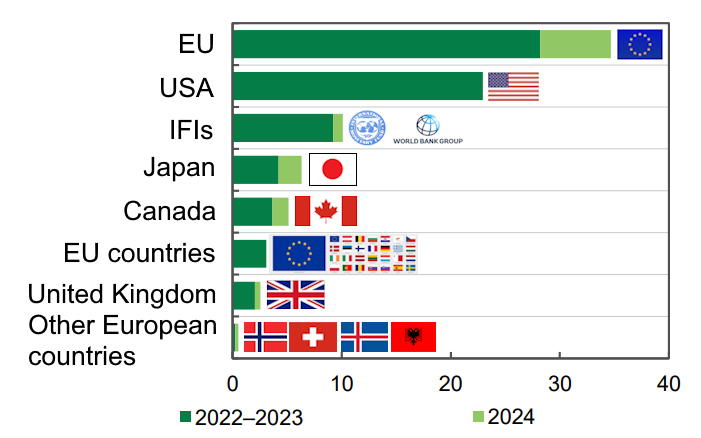

External financing of the state budget as of 01.06.2024, billion USD

Source: Open4Business.com.ua

Kyiv Cardboard and Paper Mill is taking another step towards sustainable production by turning industrial waste into cost-effective fuel. Thanks to investments from an Austrian owner, the company has established the use of shredded film as an alternative energy resource, which allows the plant’s partners to reduce the cost of traditional energy sources.

Energy efficiency and environmental friendliness are the basic principles of the sustainable development strategy of PrJSC Kyiv Cardboard and Paper Mill, developed jointly with the Austrian beneficiary Pulp Mill Holding. In the context of the war and economic crisis in Ukraine, it is the rational use of resources that can be a lifeline for the domestic industry.

As a closed-loop industrial enterprise, Kyiv Cardboard and Paper Mill depends on stable investments. Despite the challenging economic environment, PMH Director Dr. Heinz Zinner initiated a large-scale program to upgrade production lines. During the war, the plant invested EUR 15 million in re-equipment, including about EUR 10 million in 2024.

One of the key vectors of KCPM’s modernization is to increase production efficiency. Last year, the plant launched an ambitious environmental project aimed at the rational use of resources – the installation of a high-tech shredder for harness processing, which allows separating waste in the recycling process and obtaining valuable secondary materials: alternative SRF fuel and metal wire.

Shredded film – ready-made SRF fuel

Kyiv-based CPM is moving towards the most environmentally friendly and efficient production model. At the initiative of Dr. Heinz Zinner, the plant invested EUR 710 thousand in the purchase of a shredder. The new equipment is now processing over 200 tons of harness per month. It is planned that in the near future the Obukhiv plant will be able to increase this figure to half a thousand tons.

This approach opens up several strategic opportunities for Kyiv Cardboard and Paper Mill:

● First, it is an important step towards a completely waste-free production;

Secondly, the plant expands its customer network, as the film converted into SRF fuel can be sold to cement plants and other industrial enterprises interested in reducing energy costs.

Paper production waste is now 100% recyclable

SRF is a solid fuel produced by Kyiv Cardboard and Paper Mill from waste paper recycling. Today, Ukraine has already implemented more than 40 European standards that regulate the production, use and commercial circulation of SRF fuel.

In addition to the environmental benefits, SRF allows KCPM’s customers to save money by replacing traditional, more expensive and scarce energy sources such as coal and gas with an affordable and efficient alternative. The fuel made from recycled film has a high calorific value and, as a result, significant energy value at an affordable price.

Thus, a responsible approach to recycling and optimizing energy consumption creates new market opportunities not only for Kyiv Cardboard and Paper Mill but also for its partners.

Heinz Zinner, KPK, Kyiv Cardboard and Paper Mill, Kyiv Pulp and Paper Mill, Pulp Mill Holding

Italian insurer Assicurazioni Generali SpA cut net profit by 0.6% in 2024, with adjusted and operating profit rising to record highs. According to a press release from the insurer, net profit for 2024 was €3.72 billion, up from €3.75 billion a year earlier.

Adjusted net income rose 5.4% to a record €3.77 billion, or €2.45 per share, from €3.58 billion, or €2.32 per share, in 2023.

Generali’s operating profit rose 8.2% to €7.3 billion last year, also a record.

The company’s adjusted and operating profit matched its consensus forecast.

Generali’s gross premiums amounted to €95.19 billion in 2024, up 14.9% year-on-year. Premiums in the life insurance segment increased by 19.2%, in the property and casualty division by 7.7%.

The capital adequacy ratio of the insurer within the framework of the Pan-European requirements “Solvency-2” (Solvency II) at the end of December amounted to 210% compared to 220% at the end of the previous year. The company explains the decrease in the indicator by the effect of acquisitions, as well as from the buyback of shares in the amount of 500 million euros.

Generali plans to increase its dividend by 11.7% to €1.43 per share. The company expects a compound annual growth rate of 8-10% for its adjusted earnings per share and more than 10% for dividends in 2025-2027. Generali intends to repurchase €500 million worth of shares in 2025, and at least €1.5 billion worth over three years. Generali’s capitalization has risen about 17% since the beginning of the year to 49.96 billion euros, while Italy’s FTSE MIB index has added about 12% over the period.

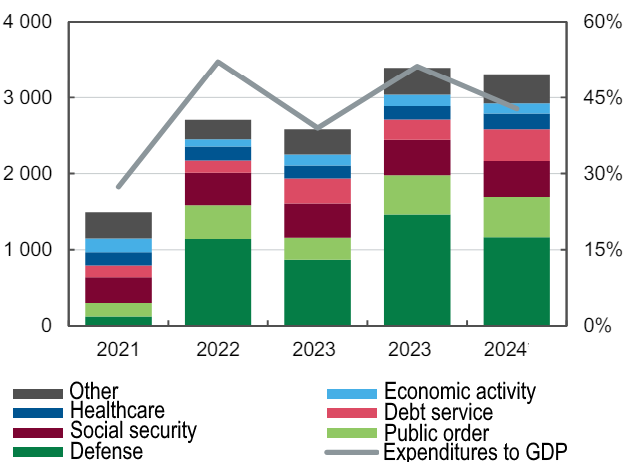

Components of state budget expenditures in 2021-2024, UAH billion

Source: Open4Business.com.ua