In January-June 2024, Ukraine exported $10.97 billion worth of goods to the European Union, which is 9.7% less than in the first half of 2023, Deputy Minister of Economy and Trade Representative of Ukraine Taras Kachka said.

“This is an obvious correlation of transportation routes. Exports to the EU decreased the most to neighboring countries – to Poland by 25.7%, to Slovakia by 21.3%, to Hungary by 67.2%, and to Romania by 50.2%. On the other hand, exports to Spain (81.1%), Italy (24.7%), and the Netherlands (22.4%) increased significantly,” he wrote on Facebook.

Kachka pointed out that this correlation makes it possible to clearly see trade with the EU without forced transit to third countries.

“This will allow us to resolve a lot of problems that have accumulated in relations with neighboring countries,” he suggested.

The Ukrainian trade representative emphasized that the existing problems show that in 2022-2024 Ukraine has significantly narrowed the range of “sensitive” goods in trade. Before the war, these included steel, which was subject to trade protection, and 36 categories of agricultural products that were subject to temporary liberalization, or quotas.

He reminded that under the current phase of autonomous trade measures, the number of such sensitive products has been reduced to seven: poultry, eggs, sugar, honey, corn, oats, and cereals.

Commenting on the European Commission’s quotas on Ukrainian sugar and eggs, Kachka noted that active exports from Ukraine have reached certain thresholds.

“If the sugar trade with the EU is suspended to normalize trade in accordance with the decision of the Ukrainian side, the export of eggs will continue. We expect that the general EU quota within the WTO will apply to Ukrainian products and a reduced duty of EUR15.2 per 100 kg (quota 09.0154) will be applied,” he wrote, adding that all these nuances have been discussed with both the EU and the market.

The Ukrainian trade representative emphasized that Ukraine’s common goal is to resolve all sensitive issues with the EU and define clear parameters of trade under the Association Agreement by June 5, 2025.

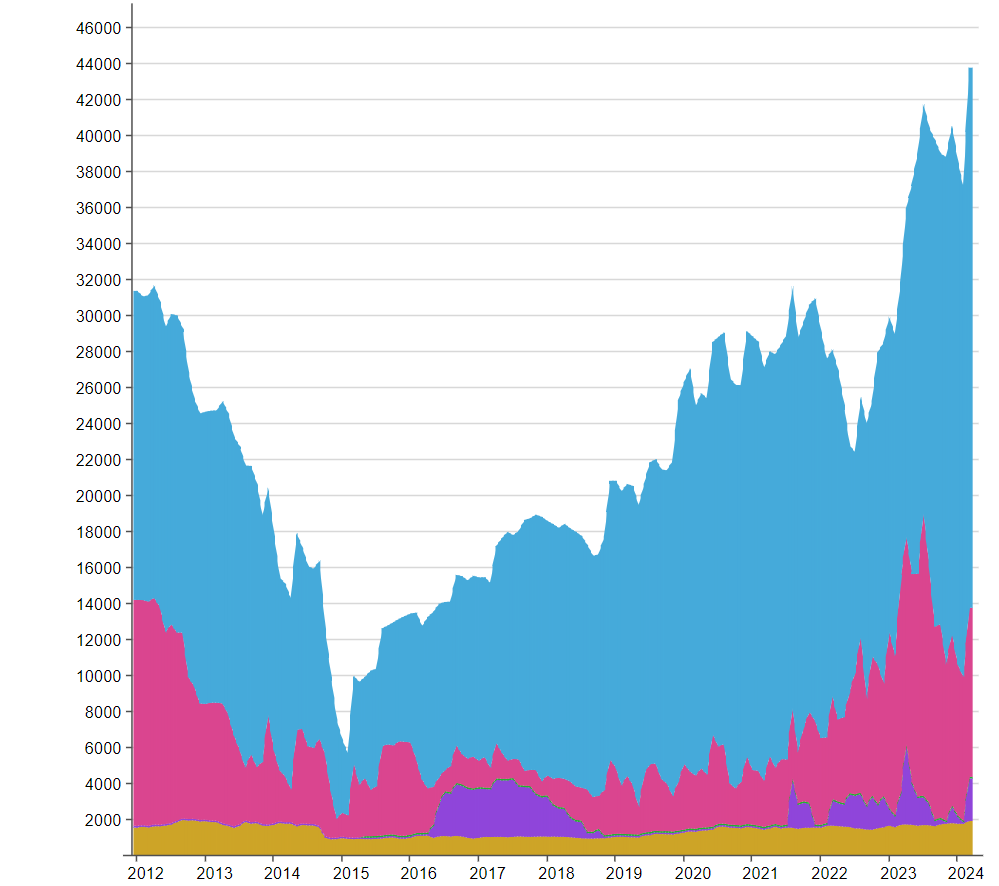

Dynamics of reserves of Ukraine from 2012 to 2024, mln USD

Source: Open4Business.com.ua and experts.news

In January-June this year, Zaporizhzhia-based Zaporizhstal Iron and Steel Works increased its rolled steel output by 46.1% year-on-year to 1 million 233.5 thousand tons from 844.2 thousand tons.

According to the company’s information on Tuesday, steel production during this period increased by 45.9% to 1 million 486.4 thousand tons, and pig iron by 33.3% to 1 million 527.3 thousand tons.

In June, Zaporizhstal produced 237 thousand tons of iron, 236.7 thousand tons of steel, and shipped 183 thousand tons of rolled products.

As reported, in 2023, Zaporizhstal increased its rolled steel output by 57.2% compared to 2022, to 2 million 54.7 thousand tons, steel by 65.4%, to 2 million 466.9 thousand tons, and pig iron by 35.3%, to 2 million 718.9 thousand tons.

“Zaporizhstal is one of the largest industrial enterprises in Ukraine, whose products are in great demand among consumers both in the domestic market and in many countries of the world.

“Zaporizhstal is in the process of integration into Metinvest Group, whose major shareholders are System Capital Management (71.24%) and Smart Holding Group (23.76%).

Metinvest Holding LLC is the management company of Metinvest Group.

KMZ Industries (Karlivka Machine-Building Plant, KMZ, Poltava region) has agreed with the Ukrainian subsidiary of Fairfax Financial Holdings Limited, ARX (the largest insurance company in Ukraine), to insure its elevators against military risks to reduce the risks of losses for agricultural producers, the company’s press service reported on Facebook.

“Today, Ukrainian farmers continue to build and expand capacities at their own risk (…), as the consequences of arrivals can be of different scales. Since 2022, our specialists have carried out a number of repair and restoration works at elevators damaged by debris, and therefore we know how big business losses can be due to this factor,” KMZ Industries Deputy CEO for Development Borys Rybachuk explained, as quoted in the statement.

He emphasized that although KMZ Industries, thanks to the experience gained during the military invasion of the Russian Federation, offers its customers solutions that will optimize and reduce the cost of repairs for farmers, the availability of insurance can fully or partially save them from financial costs in the event of an insured event.

KMZ Industries expects that the war risk insurance service will be relevant and in demand among both small farms and large companies, as they will be able to obtain insurance coverage for a small payment compared to the indemnity limit.

The Property Insurance against Military Risks service provided by ARX covers loss or damage to the insured property solely as a result of direct and/or indirect impact from missiles, UAVs of any type, aircraft munitions, air and missile defense equipment, and any of their fragments.

The annual insurance fee is calculated individually, taking into account the location, area and value of the property.

ARX Insurance Company is a part of the international Canadian insurance group Fairfax Financial Holdings, which has been operating in the Ukrainian market for 26 years, 11 of which have been under the AXA Insurance brand.

KMZ Industries manufactures flat-bottomed and conical-bottomed silos, flour storage silos, Brice-Baker (British-designed) and DSP (Ukrainian-designed) shaft grain dryers, transportation equipment (elevators, chain, belt and screw conveyors), grain cleaning separators, assembles and automates elevator equipment and technological processes at grain storage facilities.

Dragon Capital Investments Limited (Cyprus), whose ultimate beneficiary is Tomas Fiala, owns 80% of KMZ shares, while Variant Agro Bud LLC owns 20%.

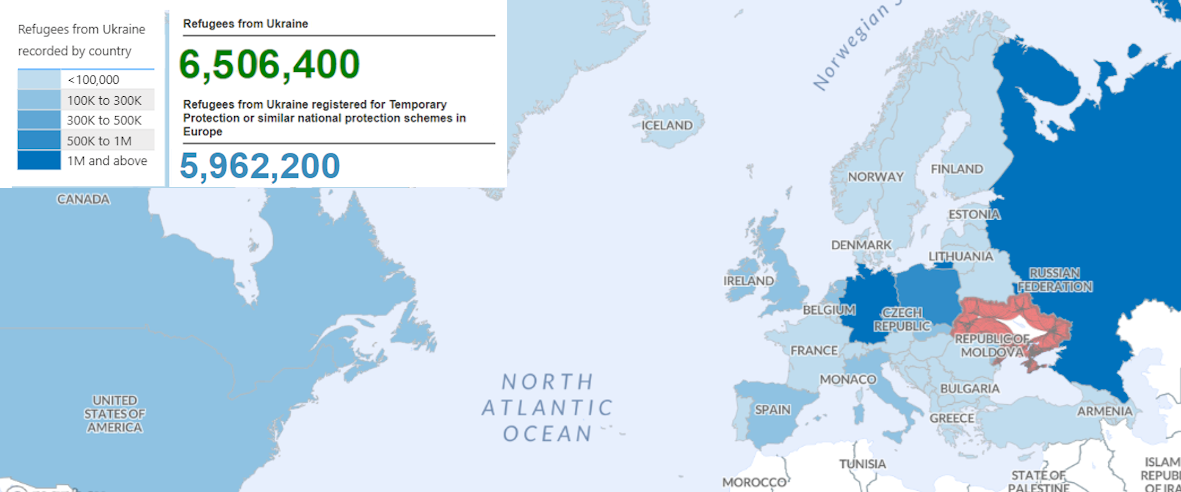

Number of refugees from Ukraine in selected countries as of 30.04.2024

Source: Open4Business.com.ua and experts.news

After two years of full-scale war, a majority of Ukrainian small and medium-sized enterprises (SMEs) surveyed for a study published by the European Bank for Reconstruction and Development (EBRD) have managed to stabilise their operations, demonstrating remarkable adaptivity to wartime conditions.

The survey indicates that 85 per cent of active enterprises are now fully operational and 14 per cent are partially operational, up from 57 per cent and 37 per cent, respectively, in the first year of the war.

Conducted in two stages, the research involved a qualitative survey (16 expert interviews) and quantitative representative research (150 telephone interviews) of SMEs in the production and service sectors across Ukraine, excluding the temporarily occupied regions. The results as at the end of April 2024 identify both positive and negative trends, key challenges and business needs. The research report is available here.

Donor funding for the survey was provided by Switzerland through the EBRD Small Business Impact Fund* and the European Union (EU) via the Women in Business programme.

Despite ongoing challenges, the share of SMEs reporting reduced profitability has halved, while the share expecting business to continue has increased. At the same time, one in five (19 per cent) SMEs reports higher profits on the year. Notably, the workforce reduction rate has decreased significantly, from 55 per cent to 34 per cent.

The survey also highlights that if the conflict persisted for another year or more, 64 per cent of SMEs would maintain current activity levels, while the proportion planning to diversify or expand has tripled to 12 per cent. Major issues identified include reduced demand, uncertainty in forecasting, increased costs and worker shortages.

The outlook if the war continues is quite diverse: 49 per cent of respondents believe that their business will remain unchanged in the near term, while 24 per cent expect a decline, 17 per cent expect growth and 2 per cent believe they will have to close. Nine per cent of company directors say they are unable to predict what will happen in future. Compared with last year, the share of positive forecasts has increased (up 11 per cent), while the share of those unable to make any forecasts has decreased (down 12 per cent).

Some of the war-caused negative trends include sales that are slow to rebound, a lack of workers due to conscription and migration, a lack of investment and increased competition from donor-funded non-governmental organisations.

The EBRD continues to support Ukrainian SMEs with development and financial assistance, through grants, relocation assistance, participation in international exhibitions, crisis-management advice, direct and indirect financing, and more. At the beginning of 2024, EBRD direct financing for SMEs and loans guaranteed through partner banks totalled about €450 million.

The Bank has made more than €4.5 billion available to Ukraine since the start of the war. EBRD shareholders recently agreed to a €4 billion paid-in capital increase to enable the Bank to continue investing at current levels in wartime, with the potential for more investments when reconstruction starts. Supporting the private sector is one of the EBRD’s strategic priorities in the country, along with maintaining energy security, vital infrastructure, food security and trade.

Donors that provided funding for the research in previous years include: the EU, the United States of America through the EBRD Small Business Impact Fund* and Sweden through the Women in Business programme.

*Donors to the EBRD Small Business Impact Fund include Italy, Ireland, South Korea, Luxembourg, Norway, the United States of America, Switzerland, Sweden, Japan and the TaiwanBusiness-EBRD Technical Cooperation Fund.

The EBRD is a multilateral bank that promotes the development of the private sector and entrepreneurial initiative in 36 economies across three continents. The Bank is owned by 73 countries as well as the EU and the EIB. EBRD investments are aimed at making the economies in its regions competitive, inclusive, well-governed, green, resilient and integrated. Follow us on the web, Facebook, LinkedIn, Instagram, X and YouTube.