BlackRock Investment Company has completed the first stage of the conceptual and design phase of the future Ukraine Development Fund (UDF) and presented it at the Ukraine Recovery Conference (URC2023) in London.

“We are now moving on to the second stage, which will be very important in terms of regulatory details, rules: how is it organized? how is it regulated? what kind of people will manage the fund? how to ensure good governance at the supervisory level?” – said Philipp Hildebrand, Vice Chairman of BlackRock, at the conference.

According to him, other important issues include the creation of a due diligence mechanism to process the flow of transactions and ensure that there is a sufficient flow of transactions to invest capital after it is attracted to the fund.

Speaking about the possible volume of private investments, Hildebrand mentioned the amount of $50 billion to $60 billion.

“We would like to start with concessional capital, maybe a couple of billion,” he said.

The BlackRock representative noted that these funds could be used to make the first few deals that would prove the concept, show real investment flows, and on their basis it would be possible to scale up the work.

According to him, attracting such concessional capital will reduce risks, which is necessary to mobilize large pools of investment. In addition to the flow of projects, impeccable management is also needed, Hildebrand added.

He said that the first pledge to contribute to the fund during URC2023 was made by Andrew Forrest, an Australian businessman, chairman of the investment company Tattarang and Fortescue Metals.

The BlackRock vice chairman expressed hope that in 20 years, the UDF will be as important an institution as Temasek in Singapore.

“But we need to start with realistic numbers and start with an actual proof of concept by identifying actual investments,” he reiterated.

Hildebrand emphasized that some kind of peace perspective is also needed. “If you want to mobilize private capital on this scale, there has to be a prospect,” the investment banker explained.

He clarified that BlackRock is doing this work on a pro bono basis, advising the government, and expressed a wish that European financial institutions would participate in the project in the future.

Giovanni Salvetti, Managing Director of Rothschild & Co Middle East Limited, also emphasized the importance of several pilot successful deals that could make the front page of the Financial Times, serve as an example and a better incentive for other investors than various conferences.

“Courage is contagious. Not only in defense of the homeland, but also in business,” said the investment banker.

According to him, he is currently working on three possible deals worth more than $100 million with investors who are ready to consider investing in real assets in Ukraine until the war is over, but they also want to have a long-term perspective. In this regard, the emergence of instruments to insure investments against military risks is very important, Salvetti added.

In general, he said that over the past 15 years, Rothschild & Co. has been involved in 80% of deals in Ukraine worth $53 billion, so the company has access to information about what investors want and what they are looking for.

According to the investment banker, he sees three types of investors looking at Ukraine at the moment. First, super-speculative investors who invest in Eurobonds and want to double their money in a year.

“These people don’t need anything you are preparing, they have already invested hundreds of millions of dollars five days after the war started. And they’ve doubled, tripled their money as we speak,” Salvetti said, noting that such investments bring nothing to the domestic market.

He called the second category of investors not so speculative, but brave investors who are ready to invest until the war is over and have not yet decided, while the third category is basic investors. According to a representative of Rothschild & Co, it will be quite difficult to attract the third category today, because they need security, macroeconomic prospects and very firm legal norms.

“Therefore, I think we should focus on the one (category of investors) that can already take risks,” Salvetti summarized.

Ukraine’s largest mobile operator Kyivstar will receive $600m of investment from its parent company VEON over the next three years to implement infrastructure projects, including in the liberated territories, expand 4G coverage, focus on 5G reconstruction, support operator services and charity.

VEON announced the investment commitment at the Ukraine Recovery Conference in London (URC2023), according to a statement on the company’s official website Wednesday.

“Global digital operator VEON will invest the equivalent of $600 million in its subsidiary Kyivstar over the next three years. The investment will cover Kyivstar’s infrastructure projects, providing essential communications and 4G services across the country, developing high-quality digital services available to all Ukrainians, and community support projects,” the statement reads.

The company notes that investments will be made to support Kyivstar services as well as digital verticals that will have a positive social impact on the Ukrainian society. They will allow to expand the operator’s network from “LTE everywhere” and fiber to the reconstruction focused on 5G, to provide high-quality Internet coverage for millions of users.

With the planned expansion of 4G networks Kyivstar plans to increase 4G coverage to 98% in Ukraine, including in small and remote settlements in three years. The investments will be used to expand the network connectivity.

In addition, Kyivstar will continue to provide funds for charity support. In VEON reminded that from the beginning of the full-scale invasion, the operator has allocated 1.1 billion UAH (about $32.5 million) for these purposes.

“As part of its investment commitment, Kyivstar will continue working with leading Ukrainian NGOs and community initiatives, supporting charitable projects with donations and socially responsible business partnerships,” the press release said.

“The last 16 months have shown the world that communications really is a lifeline for Ukraine. Thanks to the dedication of our team of 4,000 people and the support of our parent company VEON, Kyivstar plays a key role in ensuring the sustainability and recovery of Ukraine from February 24, 2022,” Kyivstar President Alexander Komarov is quoted in the statement.

On his Facebook page, Komarov also noted that the parent company’s investment will allow Kyivstar to restore communications in territories that will be vacated, build new network facilities, increase 4G coverage in the suburban area and on highways, and develop new digital products and services for Ukraine and local communities.

“Kyivstar is the largest mobile communications operator in Ukraine with 24.3 million mobile subscribers and over 1.1 million home internet subscribers. The company provides services based on mobile and fixed-line technologies, including 4G, as well as innovative services such as Big Data, IoT, cloud solutions, digital TV, digital health, etc.

Since the full-scale invasion, Kyivstar’s technicians performed about 150 thousand repairs, which is twice as much as before the invasion, reconnected 800 settlements, modernized and deployed about 10 thousand 4G base stations and installed 32 thousand new batteries to ensure the continuity of communication in case of the blackout.

Kyivstar is 100% owned by VEON, an international group headquartered in the Netherlands.

VEON is a global digital operator that currently provides convergent communications and online services to more than 160 million customers in six dynamic emerging markets VEON is listed on NASDAQ and Euronext Amsterdam.

Medical furniture is needed by 79% of Ukrainian healthcare facilities.

Natalia Tulinova, founder of the Zdorovi National Humanitarian Aid Agency, told Interfax-Ukraine that this is evidenced by the results of the Barometer survey.

According to her, in particular, clinics in the de-occupied territories and clinics located in regions affected by flooding after the Kakhovka hydroelectric power station dam was blown up are in particular in need of medical furniture.

“After the terrorist attack on the Kakhovka hydroelectric power plant, the number of hospital patients increased dramatically, so we, together with our partners, are concentrating our efforts to help Kherson’s medical facilities cope with the terrible consequences of military aggression,” Tulinova said.

In particular, the agency provided medical furniture from the Nova Ukraine Foundation to the Gorbachevsky Kherson Regional Infectious Diseases Hospital. Gorbachevsky Regional Infectious Diseases Hospital.

“This medical institution has experienced a several-fold increase in workload as a result of the Kakhovka hydroelectric power plant disaster,” Tulinova said.

According to her, “Kherson reflects the situation in Ukraine itself, and the Zdorovi agency will focus on restoring the destroyed medical infrastructure and updating the healthcare system.”

According to Tulinova, since the beginning of the full-scale invasion, the Zdorovi humanitarian aid agency has been active in the field of charity to support the medical sector. The organization has official memorandums and agreements on cooperation with the Ministry of Health, the Ministry of Internal Affairs, military administrations and hospitals in all regions of Ukraine.

The agency’s partners include, among others, the International Renaissance Foundation, RAZOM for UKRAINE, NOVA Ukraine, Americares, USAID, PHILIPS and other charitable foundations and organizations.

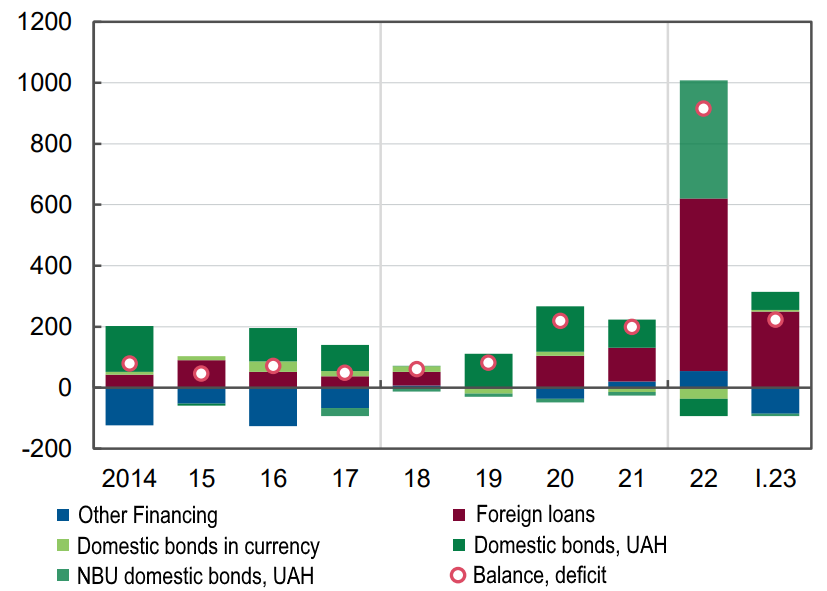

Financing state budget deficit, bln UAH

Source: Open4Business.com.ua and experts.news

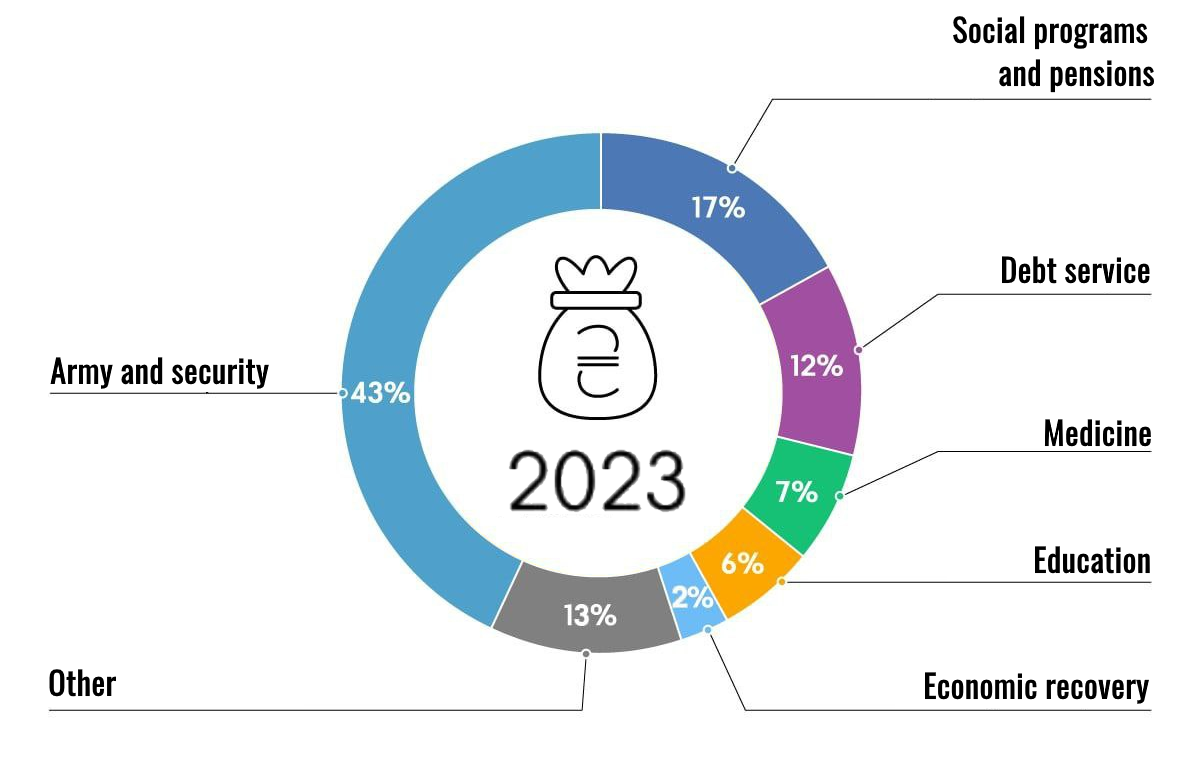

Structure of approved ukrainian state budget expenditures for this year

Source: Open4Business.com.ua and experts.news

Ukraine, the European Commission, Switzerland, Norway, the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD) signed a Statement of Intent to restart the private insurance market to support Ukraine’s sustainability and recovery, Prime Minister Denis Schmigal said

“Rebuilding Ukraine will be the largest recovery project since World War II. We are involving all of our international partners in this process, as well as the private sector. It will be the engine of Ukraine’s reconstruction. Today on the margins of the conference in London, together with the European Commission, Switzerland, Norway, the EIB and the EBRD signed a Statement of Intent to restart the private insurance market to support the sustainability and recovery of Ukraine,” Shmygal wrote in the Telegram channel.

According to him, it will kick-start business insurance against military risks when investing in Ukraine.

“At the expense of donor support will be able to attract Ukrainian and international insurance and reinsurance companies again. Such an important step will help in the return of foreign investment in Ukraine. It means economic recovery, jobs and taxes to support our army,” he concluded.