Lithuania together with Great Britain, Norway, the Netherlands, Denmark, Sweden and Iceland took part in the purchase of air defense equipment for Ukraine worth a total of EUR 107.5 million, the Lithuanian Ministry of National Defense said on its website.

“Lithuania constantly finds various ways to support Ukraine. The air defense assets purchased by seven countries will strengthen Ukraine’s ability to protect critical infrastructure, civilians and soldiers,” National Defense Minister Arvydas Anušauskas said.

According to the ministry, Lithuania’s contribution to this purchase will amount to EUR 6 million.

The Lithuanian Defense Ministry notes that the purchase of air defense equipment for Ukraine is the first of five planned support packages in the second round of purchases by the International Fund for Ukraine (IFU). At the first stage, the IFU is buying combat and reconnaissance drones, which will arrive in Ukraine as early as this summer.

The UK, which manages the IFU, has pledged an additional EUR292m to the fund in the near future.

Oil prices are falling Thursday on data about a significant increase in U.S. inventories and signals that the Federal Reserve (Fed) has not yet ended its cycle of monetary policy tightening, despite a break in the rate hike at its June meeting.

The U.S. central bank kept rates in the 5-5.25 percent annual range at the end of Wednesday’s two-day meeting. Median forecasts from Fed policymakers suggest the rate will be 5.6% by the end of 2023 and 4.6% by the end of 2024.

August Brent crude futures on London’s ICE Futures exchange are at $73.01 a barrel by 8:05 a.m. Thursday, down $0.19 (0.26%) from the previous session’s closing price. Those contracts fell $1.09 (1.5%) to $73.2 a barrel on Wednesday.

The price of WTI futures for July oil fell by $0.17 (0.25 percent) to $68.1 per barrel at electronic auctions of New York Mercantile Exchange (NYMEX) by that time. The contract value fell by $1.15 (1.7%) to $68.27 per barrel at the end of previous session.

The pressure on the market caused by an increase in stocks is exacerbated by risks of weakening demand as a result of Federal Reserve policies, said Mizuho Bank Ltd. Vishnu Varathan, cited by Market Watch.

U.S. commercial oil inventories rose 7.92 million barrels to 467.12 million last week, the Energy Department said Wednesday. Commodity gasoline reserves rose 2.11 million barrels and distillates rose 2.12 million barrels.

Stocks at the Cushing terminal, where Nymex-traded crude is stored, rose by 1.5 million barrels last week, to a two-year high.

Zaporizhgas gas transmission system operator JSC announced a tender for voluntary motor vehicle insurance (hull insurance) and voluntary property insurance on June 13, according to the Prozorro electronic procurement system.

Expected tender price for hull insurance is UAH 85,4 thousand, for property insurance – UAH 147 thousand.

The last day to apply for participation is June 22.

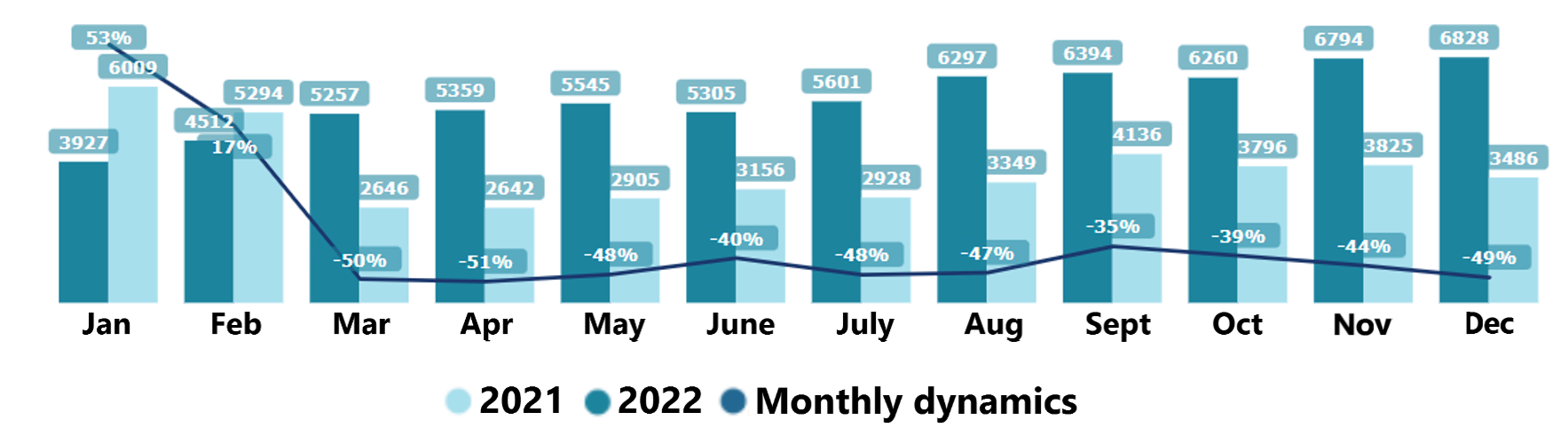

Dynamics of export of goods in 2021-2022

Source: Open4Business.com.ua and experts.news

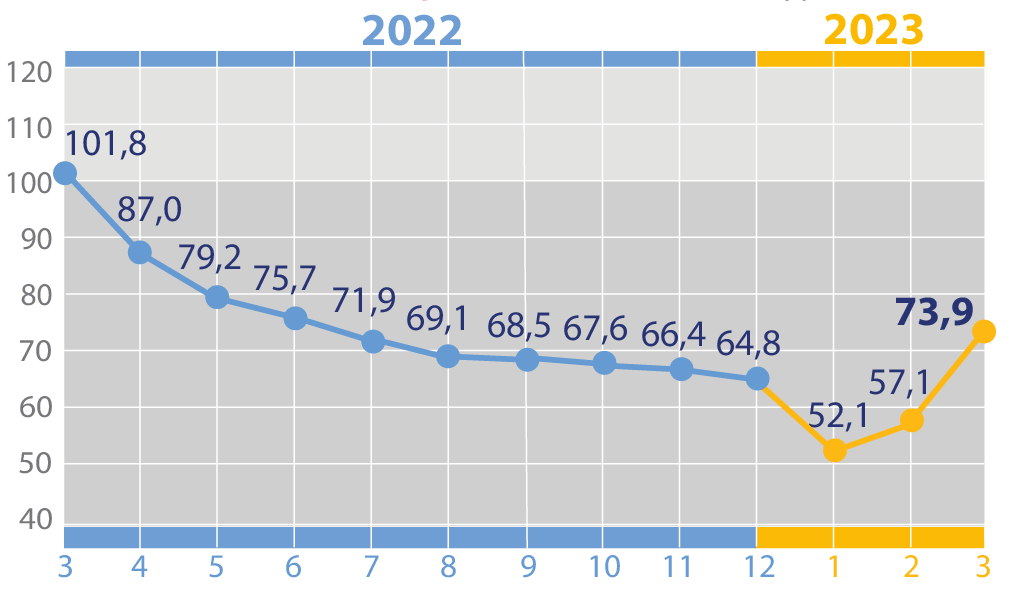

Export changes in % to previous period in 2022-2023

Source: Open4Business.com.ua and experts.news

ArcelorMittal Krivoy Rog (Dnipropetrovsk Region) has reduced its production to 15-20% of its pre-war level from 30-40% achieved recently due to problems with technical water supply after Russian occupants blew up the Kakhovska hydroelectric dam.

“From an industrial, industrial point of view, we are certainly feeling the effects. We can use what we have – the reserves. But still, you remember we were working, we had somewhere between 30-40% recently, now we’re back to 15-20% of our labor force. And we don’t see the opportunity to get more orders right now,” said ArcelorMittal Krivoy Rog (AMKR) CEO Mauro Longobardo at a discussion organized by the European Business Association (EBA) on Wednesday on “The Kakhovskaya HPP blast: implications for business.”

He said the company will focus on fulfilling earlier orders and implementing projects to provide the plant with water from alternative sources. Longobardo estimates it will take at least six months to implement projects that provide alternatives.

“We will do our best to fulfill previous orders. With the new orders, we’re waiting for the situation to normalize. We have yet to see the Dnieper water level stabilize – every day there is a decrease in the level, and we don’t expect things to return to previous levels anytime soon. But to start using water from other reservoirs, it takes time – we will need pumping stations. That is about half a year at least. Certain preparatory work is already underway,” said the AMKR CEO.

As one of the measures to minimize the negative effects, the company intends to make a change in production planning so that there are periods with high consumption and lower consumption. If during normal times the water consumption at the plant was 2.4 thousand cubic meters per hour, now it has dropped to 1 thousand cubic meters per hour or less, Longobardo specified.

In this case, the top manager noted that even though the customers are concerned, they are sympathetic to the situation, and assured that with the available reserves the company will meet all current orders.

In turn, Sergey Plichko, the financial director of ArcelorMittal Krivoy Rog, during the discussion explained that such a significant drop in water consumption was due to the lowering of its pressure, which was applied in connection with the need to save water in the southern reservoir, through which also meets the water needs of 70% of the population in Krivoy Rog.

“In order to adapt to these conditions, we had to stop some units. At first we stopped production of steel and rolled products. Now we understand that we will be able to restart some rolling mills. We will try to put one of them back in operation tomorrow. Then we’ll look at the level of consumption and whether we can launch some other units,” he said.

According to Plichko, the situation is better in the company’s mining department due to the fact that process water is used in a closed circuit. “The situation in the mining department is better – there is a closed circuit of water consumption. The water used in the production process is settled and fed back into production. There is only minor consumption to replenish this level. But there are also sufficient reserves after the spring floods. At least for the next 2-3 months the mining department is provided with water for work”, – specified the financial director of ArcelorMittal Krivoy Rog.

Earlier it was reported that ArcelorMittal Kryvyi Rih PJSC (Dnipropetrovsk region) is returning people to normal mode after sending some personnel to remote work due to the termination of water supply to some units because the occupants blew up the Kakhovskaya HPP dam. It was also reported that the company suspended steel smelting to reduce water consumption under critical conditions.

“ArcelorMittal Krivoy Rog is the largest producer of rolled steel in Ukraine. It specializes in the production of long products, particularly rebar and wire rod.

ArcelorMittal owns in Ukraine the largest mining and metallurgical plant “ArcelorMittal Krivoy Rog” and a number of small companies, in particular PJSC “ArcelorMittal Beryslav”.