On March 30, an appeal will be filed with the Appeals Chamber of the High Anti-Corruption Court. After that, former Boryspil Airport CEO Yevhenii Dykhne, Head of the Airport’s Lease Relations Service Olesia Levochko, and their lawyers Oleksii Nosov (Miller Law Firm) and Artem Krykun-Trush (Rostrum Law Firm) are invited to a press briefing.

On March 1, the High Anti-Corruption Court issued a guilty verdict against Yevhen Dykhne, former head of Boryspil International Airport State Enterprise, and Olesya Levochko, head of the lease agreements department.

This decision caused a great deal of resonance not only in legal circles, but also among the thinking part of society. First of all, because Yevheniy took over the airport in 2014 with a loss of UAH 500 million. Already in 2017, the airport’s profit amounted to UAH 1.7 billion.

In addition, during this period, Borspil Airport doubled its passenger traffic, doubled its budget contributions, became one of the largest taxpayers in Ukraine, and began to take the top spot in the ACI Europe airport growth ranking. This is the first court decision to convict for efficiency and activity instead of inactivity.

The only way to restore justice in this situation is to overturn the decision of the court of first instance and justify effective decisions made even under imperfect legislation.

In the case of Olesia Levochko and Yevhenii Dykhne, the HACC did not find corruption; it was not proven that they acted intentionally and jointly; neither did they prove that they pursued their own selfish interests nor the interests of third parties. They did not harm the state. Instead, they were accused of the fact that the state could have earned more if “incompetent and inefficient employees of the State Property Fund” had not acted.

Why is this decision a dangerous legal precedent for all public servants without exception?

The day before, Miller Law Firm published a legal analysis of the HACCU decision with important arguments of the defense that were not ignored in the verdict. The material is available here.

During the press briefing, the lawyers plan to present all the case materials so that all interested parties can use them as a case study.

The press conference will be held on Thursday, March 30, 2023, at 11:00 a.m. at Miller’s office at 4 Vvedenska St., office. 1, Kyiv.

Please note: Media representatives are kindly requested to register for the event by calling Miller’s PR department:

+380 (66) 024 12 94 and in any messenger convenient for you.

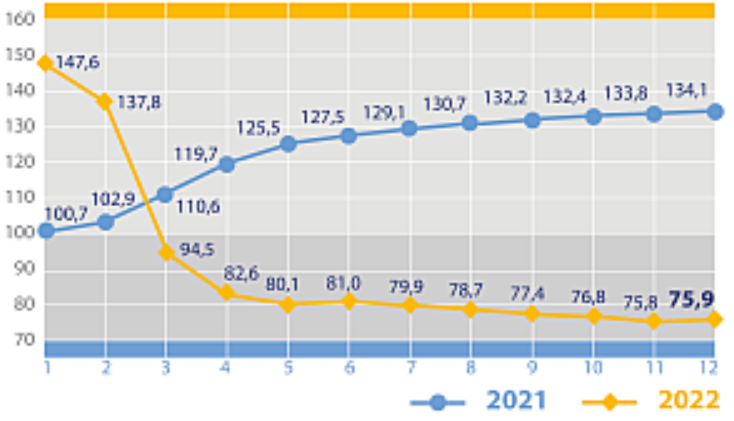

Import changes in % to previous period in 2021-2022

Source: Open4Business.com.ua and experts.news

Oil prices rise for the third session in a row on data about reduction of fuel reserves in the USA and easing of fears about the crisis in the banking sector, writes MarketWatch.

The cost of May futures for Brent at London’s ICE Futures Exchange is $78.83 a barrel by 8:05 a.m., which is $0.18 (0.23%) above the previous session’s closing price. Those contracts rose $0.53 (0.7%) to $78.65 a barrel at the close of trading on Tuesday.

The price of WTI futures for May at electronic trades on the New York Mercantile Exchange (NYMEX) is $73.64 per barrel by that time, which is $0.44 (0.6%) above the final value of the previous session. The day before, the contract rose $0.39 (0.5%) to $73.2 a barrel.

“Market participants were trying to assess what effect the collapse of Silicon Valley Bank and the merger of Credit Suisse and UBS would have on the overall market,” wrote Price Futures Group senior analyst Phil Flynn. – However, the effect could be positive, as the banking crisis could force the world’s central banks to slow the pace of rate hikes.”

The American Petroleum Institute (API) data released on Tuesday night, Wednesday, indicated a 6.08 million-barrel decline in U.S. oil inventories for the week ended March 24. Gasoline inventories fell 5.89 million barrels and distillates rose 548,000 barrels.

The official report on energy reserves in the United States will be released at 5:30 pm on Wednesday. Analysts polled by Trading Economics expect a slight increase in oil reserves by about 100,000 barrels.

Oil prices growth was also pushed up by the decision of the International Chamber of Commerce arbitration court in a lawsuit against Turkey, which challenged the export of oil from Kurdistan. The export of oil from the North of Iraq was halted on March 25. The volume of transportation through Turkey was about 400 thousand barrels of oil per day.

Ukraine’s aggregate public debt in February shrank by 0.5%: by $0.59 billion to $116.01 billion in dollar terms and by UAH 21.62 billion to UAH 4.24 trillion, according to the Ministry of Finance.

According to them, the direct national debt last month decreased by 0.2% – to $106.18 billion, or 3.88 trillion UAH and amounted to 91.5% of the total public debt and publicly guaranteed debt.

It is reported that the external direct debt decreased by $0.56 billion – to $67.01 billion, while the domestic direct debt increased by UAH 11.99 billion to UAH 1.43 trillion (the equivalent of $39.17 billion).

Ukraine’s total external public debt in February 2023 decreased by 1.2%, or $0.9 billion – to $74.88 billion, while the total internal debt increased by 0.8%, or 11.44 billion UAH – to 1.50 trillion UAH.

As a result, the share of total external public debt in February decreased from 65.0% to 64.6%.

According to the Ministry of Finance, the share of obligations in euros at the end of February decreased to 24.07%, in Canadian dollars – to 1.24%, in SDR – to 12.31%, in Yen – 0.84%, while in U.S. dollars it increased to 29.07%, in UAH – 32.45%, and in British pounds remained at 0.02%.

The Ministry also clarified that 64.42% of the state debt has a fixed interest rate, while 12.31% is tied to the IMF rate, 6.51% – to SOFR, 2.07% – to Libor, 3.32% – to EURIBOR.

Another 3.42% of the government debt is tied to the consumer price index, while 7.6% is tied to the NBU discount rate. We are talking about government bonds from the portfolio of the National Bank, the most recent were securities linked to the discount rate, which the NBU bought within the framework of the emission financing of the budget.

Finally, 0.35% of the government debt has a rate linked to the Ukrainian index of rates on deposits of individuals, used in the programs of portfolio guarantees.

Kyivstar, Ukraine’s largest mobile operator, will build 170 and upgrade more than 1,000 base stations in the first quarter of 2023, this work is largely due to significant migration to cities and villages in the west of the country, company president Alexander Komarov said in Facebook on Tuesday.

“The level of availability of the network “Kyivstar” in the free territory of Ukraine is more than 99%. This corresponds to the level until February 24, 2022. Nevertheless, there are difficulties in maintaining this quality of communication, the solution of which we are actively working on, “- said the head of the company.

According to him, from time to time the company has difficulties with maintaining an appropriate level of network availability because of bad weather and related warning blackouts, and sometimes the difficulties are caused by security issues, irresponsible attitude of landlords and problems getting access to the network.

Komarov pointed out that Kyivstar does not reduce the rate of battery replacement and connection of new generators, bringing the total number of the latter to about 1,900, as the threat of blackouts remains, and the current improved situation with power supply is a seasonal phenomenon associated with the successful actions of the air defense and a surplus in generation.

The head of the company also said that in the Kharkiv and decouped territories of the Kherson region, grid restoration work is in its final stage.

As reported, in 2022 Kyivstar built 659 new base stations, which roughly corresponds to the level of 2021. In total, the company has about 14 thousand base stations and other network facilities.

Komarov said at Business Wisdom Summit on March 15 that Kyivstar installed 1,790 generators, of which 700 were provided by the business on crowdfunding terms. Their total capacity reached 40 MW.

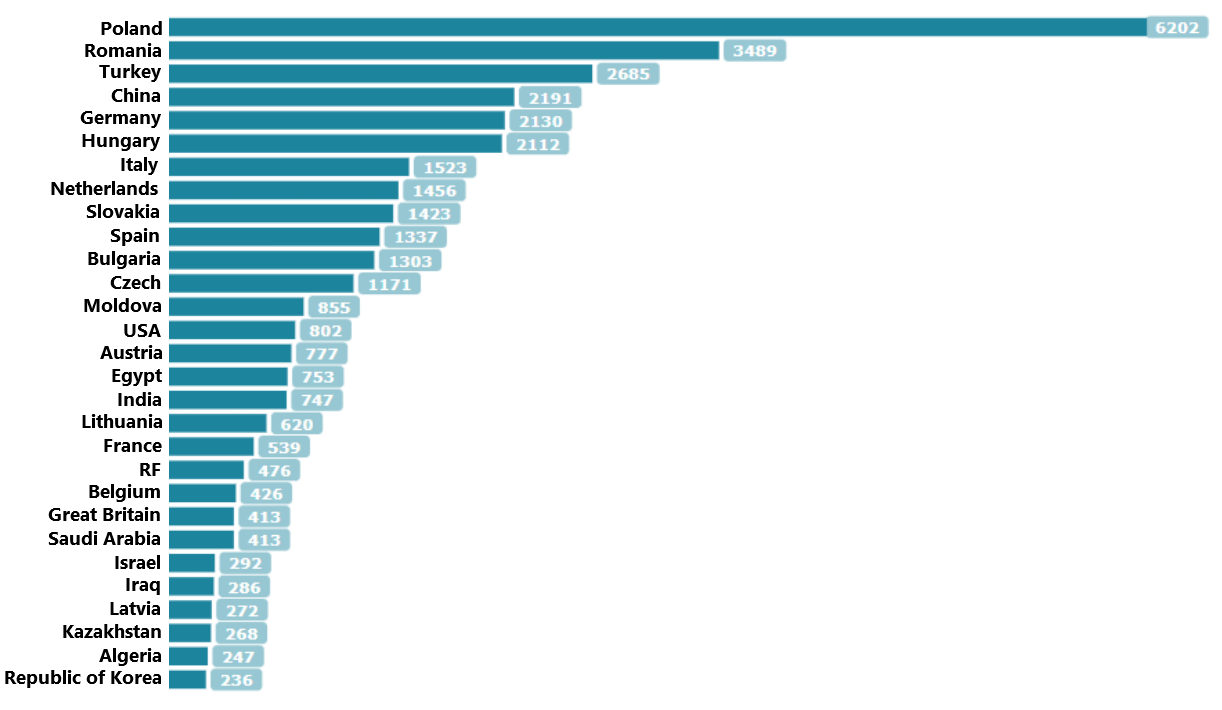

Export of Ukraine by countries in Jan-Nov 2022

Source: Open4Business.com.ua and experts.news