Ukrainian banks in 2022 issued 2 thousand mortgages worth UAH 1.96 billion – this is 5.3 times less than in 2021 by the number of such loans and 4.3 times less by volume, the National Bank of Ukraine (NBU) said Thursday following a monthly survey of banks.

According to his data, in December 2022 issued 405 thousand mortgages worth 500 million UAH, which is the highest figure since the beginning of a full-scale war.

Information on the issuance of mortgages in December reported four banks, the regulator said.

It is indicated that two-thirds of the number of contracts were issued before the full-scale military aggression of the Russian Federation, in January and February, and in March no mortgages were issued at all.

In September and November the demand for mortgages began to recover, and banks issued 252 mortgages worth 280 million UAH.

The share of secondary market mortgages amounted to 99% of all mortgages issued in June and December.

The results of the survey show that the average size of a loan to buy housing in the primary market in 2022 rose to 954.875 thousand UAH from 898 thousand UAH in 2021, in the secondary market – to 974 thousand UAH from 809 thousand UAH.

In the regional context, more mortgage loans in 2022 were issued in Kiev and the Kiev region. – 241 contracts worth UAH 345 million (43% of the total amount), Volyn – 48 contracts worth UAH 60 million (8%), Vinnytsia – 37 contracts worth UAH 50 million (6%) and Chernihiv – 54 contracts worth UAH 47 million (6%).

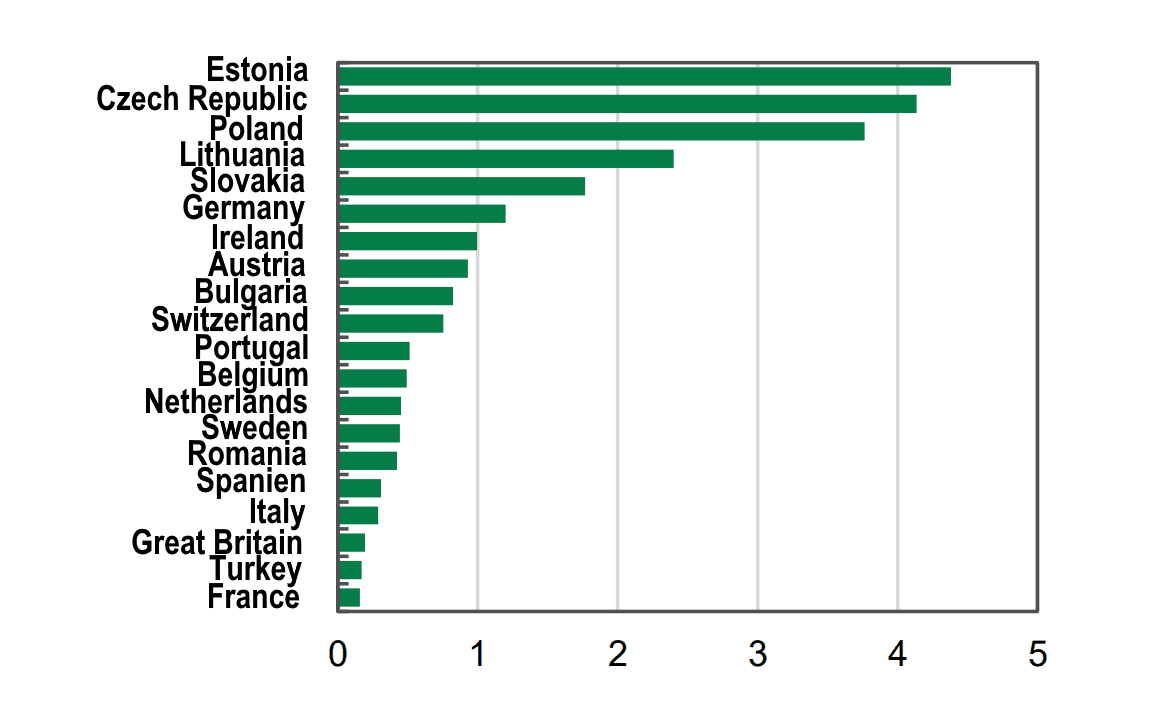

Ratio of number of Ukrainian migrants to population of recipient countries as of 03.10.2022, %

Source: Open4Business.com.ua and experts.news

Ukrainian President Volodymyr Zelensky notes the acuteness of the problem of humanitarian demining and announces simplifications for business in dozens of directions.

“The agricultural sector is a very acute issue of humanitarian demining of land. At the level of the Cabinet of Ministers an interdepartmental working group has been created to ensure the implementation of this activity – clearing soil of mines and unexploded ordnance,” he said in a video message on Wednesday.

“Held an economic meeting today on preparations for spring. A lot of issues that relate to Ukraine’s economic recovery, creating economic opportunities for our people, industries,” he said.

According to Zelensky, “Businesses will get simplifications in dozens of ways. This applies to various bureaucratic permits and licenses. Steps are also being prepared to create jobs. Every job is an aid to our resilience and a way for our people to come back to Ukraine.”

The US dollar is moderately declining against major world currencies on Thursday morning as investors are assessing U.S. economic data and its possible influence on the Federal Reserve’s (Fed) policy.

The index calculated by ICE, which shows the U.S. dollar dynamics against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and the Swedish krona), fell by 0.2% during morning trading. The day before the indicator reached its highest in five weeks.

The euro/dollar pair was trading at $1.0709 at 7:58 a.m. against $1.0688 at the close of Wednesday’s session, with the euro adding about 0.2%.

The day before, the U.S. Commerce Department reported that retail sales in the country rose 3% last month versus December, the fastest pace since March 2021.

Meanwhile, U.S. industrial production in January remained unchanged from the previous month, according to a Federal Reserve report released Wednesday. Experts’ consensus forecast called for an increase of 0.5%.

Recent statements from members of the Federal Reserve Board indicate that they generally support a further increase in the key interest rate to fight inflation. In particular, the head of the Federal Reserve Bank of Richmond, Thomas Barkin, and his colleague from the Federal Reserve Bank of Dallas, Laurie Logan, spoke about it.

Barkin said in an interview with Bloomberg that the Fed “needs to do more to fight inflation,” while Logan noted that the central bank “will have to raise the rate longer than previously expected.”

The pound sterling is up 0.1 percent, trading at $1.2049 versus $1.2032 at the close of last session.

The dollar-yen exchange rate is down 0.2% at 133.87 yen from 134.17 yen the day before.

The head of the US Department of State’s Interagency Assistance Department, Daphne Rand, has confirmed that Washington intends to provide Ukraine with an additional $9.9bn in budget support.

“The U.S. has provided $13 billion in budget support to the government of Ukraine, and we are working with Congress to provide another $9.9 billion in the coming months,” Rand told reporters.

She added that Washington “remains committed to working with the government of Ukraine to maintain its operational capacity and provide additional budget support as needed.”

The Washington Post reported earlier this week that the U.S. government is working to have Congress approve an additional $10 billion military aid package for Ukraine.

The newspaper noted that the next military aid package is expected to be announced next week, almost simultaneously with the announcement of additional sanctions against Russia.

At the same time, the newspaper wrote that a number of U.S. officials who visited Ukraine recently told Kiev that despite promises to support Ukraine “as long as necessary,” Washington expects to use the aid already provided more effectively.

Rand did not say what was planned to be included in the new aid package to Kiev. At the same time, U.S. Defense Secretary Lloyd Austin said on the sidelines of a contact group meeting on Ukraine’s defense in Brussels that the West’s current urgent task is to provide Kiev with air defense equipment.

“We know that Russia has a significant number of aircraft and a lot of capacity,” he told reporters. – That’s why we stressed that we need to do everything in our power to provide Ukraine with as much air defense capability as possible.”

Oil prices are rising Thursday morning, recovering from a moderate decline the day before, triggered by data on a sharp increase in U.S. oil inventories last week.

The price of April futures on London’s ICE Futures Exchange stood at $85.85 per barrel by 7:05 a.m., $0.47 (0.55%) above the previous session’s closing price. Those contracts fell by $0.2 (0.2%) to $85.38 per barrel at the close of trading on Wednesday.

The price of WTI futures for March at electronic trades of the New York Mercantile Exchange (NYMEX) is $79.16 per barrel by that time, which is $0.57 (0.73%) above the final value of the previous session. The previous day the contract fell by $0.47 (0.6%) to $78.59 per barrel.

According to the report of U.S. Department of Energy published on Wednesday, oil reserves in the country last week jumped by 16.28 million barrels. Gasoline inventories declined by 2.32 million barrels and distillates by 1.28 million barrels.

Experts expected an increase of oil reserves by 2 million barrels, gasoline reserves by 1.5 million barrels and distillates by 1 million barrels.

At the same time, the Energy Department explained that the data on oil reserves includes an upward adjustment of 1.967 million barrels per day, or about 14 million barrels for the whole week.

Matt Smith, a senior analyst at Kpler, told MarketWatch that the adjustment “was the result of previous underestimation of imports and/or production and overestimation of exports and/or refinery capacity.”

Meanwhile, the International Energy Agency (IEA) raised its forecast for oil demand growth in 2023 by 94,000 bpd, according to its monthly report.

Thus, analysts have increased the estimate of demand in 2022 compared to the previous report by 107 thousand b / s – up to 99.96 million b / s, and the forecast for 2023 increased by 202 thousand b / s – to a record 101.92 million b / s. Thus, the IEA expects global oil demand to increase by 1.96 mln bpd this year compared to 1.87 mln bpd a month earlier.