The capital’s restaurant business felt the consequences of enemy shelling and power outages the most. Many interesting and unique establishments were forced to suspend or even stop their activities. However, the opening of new locations, in particular the expansion of the restaurant chain of Mediterranean cuisine “Porto Maltese“, gives hope for the future.

Restaurant “Porto Maltese” is located in the city center at the address: Lesia Ukrainka Boulevard, 30 B.

The main idea of the establishment is to create the atmosphere of a Mediterranean town in the business center of the capital, which helps to distract the visitor from the stormy life of the city and set up for a leisurely visit, immersion in the atmosphere of a small European port, with the opportunity to dive into the depths of the sea, warm up in the warm company of close friends, share a delicious dinner, enjoy the blue waves and emerge refreshed in anticipation of the next visit to the port.

The complex shape of the restaurant immediately suggests the motive of the future design – two halls, like the bays of the port city, flow into each other, connected by a fish market with fresh catch right under the sails of fishermen, and completed with a summer terrace – an exit from the port to the city. And there is nothing better in the traditions of the Mediterranean than the combination of fresh fish with the family winery.

The atmosphere of the port is also created by the snow-white sails of the ships, the wall with the image of the terrible ruler of the seas, the whale from the “History of Animals” by Konrad von Gesner, which was tamed to protect the exquisite treasures of our restaurant – a collection of bottles of selected wine, which according to legend is created on the neighboring hills. Jellyfish lamps hover slowly over the bar against the backdrop of a rusty ship, waiting for guests.

The interior is soaked in deep sea blue with bright white accents of sails and tablecloths.

On the ceiling, uniting both halls, the sea waves fluctuate in smooth curves, play with rays of warm, like sunlight from a set of bulbs, twist into a whirlpool, drawing the visitor to explore the entire space, explore both halls, and the columns-cables – carefully stacked gear, without which the life of the port is impossible, attract attention with the skill of their performance.

The restaurant’s menu offers a variety of shellfish and fish: sea tongue, mullet, sunfish, stingray wings, turbot and others. Guests can choose the cooking method: sauté, soup, siciliano, in parchment, grilled, homemade and in salt, and then watch the cooking process in the open kitchen.

As well as fresh salad, meat dishes, freshly baked bread, homemade desserts and a wide selection of wines. A unique culinary “route” awaits you – from seafood delicacies, through delicious Serbian cuisine to fresh salads prepared with special care.

The guests of the restaurant have already decided on the favorite of the menu – seafood sauté.

Sommelier will select a wine pair for each position to emphasize the refined taste of the dish. The wine list contains the best samples of wines from around the world.

Mediterranean cuisine, Porto, Porto Maltese Restaurant, RESTAURANT, SEAFOOD, WINE

The next strategic document to be adopted by the Ukrainian Foreign Ministry in 2023 will be the Latin American Strategy, Ukrainian Foreign Minister Dmytro Kuleba said.

“We have heard a signal from the Brazilian side, we will actively work with them. As well as with other countries of this region. And in general this year Latin America will be a priority for us. This is the last region of the world that we haven’t plowed over thoroughly,” Kuleba said during an online briefing on Wednesday.

The Minister explained that the visit of the Ukrainian delegation to Brazil, where the inauguration ceremony of Luiz Inácio Lula da Silva was held on January 1, demonstrates Ukraine’s interest in resetting the Ukrainian-Brazilian dialogue and giving an additional impetus to the trade and economic relations.

Thus, Kuleba recalled that the MFA already has an “Asian strategy” and “African strategy”, which are being implemented. The next strategic document to be adopted by the Foreign Ministry this year will be the Latin American strategy, the minister stressed.

“You will see a powerful return of Ukraine to the space of South America this year. Stay tuned, President Zelensky is paying a lot of attention to this issue,” he added.

Registrations in Ukraine of new and used electric cars in 2022 increased 1.5 times compared to 2021 – up to 13.318 thousand units, including new ones accounted for 16.9% against 14.2%, said the Federation of Automobile Industry of Ukraine (FAU) based on data from the Ministry of Internal Affairs.

According to information on the Federation’s website, including in December compared to the same month-2021, the market increased by 68% to 1,559 units, which was also 9.6% higher than in November-2022.

“The firings, the power outage, the crisis – didn’t bring the market down. It showed another increase. And something happened in the top 10 that seemed impossible a few years ago – the leader has changed. And this is not Tesla, which came on the heels of Nissan – in first place went Volkswagen, rising for the year by four steps, “- said in the FAU.

At the end of the year VW took 20.7% of the market of electric cars, increasing sales by more than five times – up to 2.754 thousand units. The leader of the previous year Nissan with a share of 18.8% became the second, and sales of this brand grew by 13% – to 2,509 thousand units. Tesla, which was in second place in 2021, was the third with an increase in sales by a quarter – to 2,089 cars and the market share of 15.7%.

Fourth place, like a year before, went to Renault – 6,5% of the market, and the fifth place went to Honda (+6 positions) with a share of 5,7%, having increased registration almost five times – to 756 units.

At the same time, Chevrolet, which ranked third in 2021, moved down to #10 with a two-fold decrease in registrations to 397 units by the end of 2022.

The other brands in the top 10 from the sixth to the ninth place (Hyundai, BMW, Mercedes-Benz, Audi) increased their registrations.

At the same time, Nissan Leaf continues to hold the first place in the ranking of models with a large gap (the share decreased to 17.8% from 24.6% a year earlier), and VW id4 came in second place with a share of 10.7%. The Tesla Model 3 lost one position in the ranking and took 7.1% of the market. The VW e-Golf and Renault Zoe are on the fourth and fifth positions.

Chevrolet Bolt EV being in the top three in 2021 moved to the ninth position with the market share of 2.6% (against 8.9%).

According to the statistics, the structure of electric vehicle registrations by year of manufacture, last year the most registered cars were 2021 cars – 2,642 units, followed by 2022 cars, 2019 cars – 2,268 units. – 2,268 units, 2019. – 1,490 units, and 2020. – 1281 cars.

As reported with reference to FAU data, in 2021, registrations of electric cars in Ukraine increased by 18.9% compared with 2020 – up to 8,541 units, including new cars accounted for 14.2% against 8.9% a year earlier.

Ukraine last year exported, according to preliminary data, agricultural products worth at least $20 billion, which is about half as much as in 2021, Ukrainian Minister of Agrarian Policy and Food Nikolay Solsky said on the air of the national telethon on Wednesday.

He also stressed that this is still a very significant amount, especially taking into account the Russian Federation’s aggression and other circumstances under which Ukraine has performed external deliveries.

Solsky noted that in 2021 most of the foreign exchange earnings went to the Ukrainian agribusiness sector, while in 2022, infrastructure and logistics companies, including foreign ones, received a significant portion of the margin from crop exports.

“The ships that go with Ukrainian grain, insurance services and everything else, because of military risks and the conditions in which we live, have gone up significantly. But it is still the No. 1 item in foreign exchange earnings of the country, and there is a good chance that next year the situation will be similar,” the minister stressed in a video interview.

As reported, according to preliminary data Deputy Minister of Economy – Trade Representative of Ukraine Taras Kachka last year Ukraine exported 99.8 million tons of products and goods of all kinds totaling $ 44.1 billion, which is respectively 38.4% and 35% less than in 2021.

Most of the revenue was received from the export of agricultural products – corn at $5.94 billion (+1% compared to 2021), sunflower oil at $5.46 billion (- 14.4%), wheat – $2.6 billion (-44.7%), rapeseed – $1.54 billion (-8.6%), sunflower seeds – $1.26 billion (33 times growth), soybean – $862 million (+43%), poultry – $852 million (+19%).

krainian coke and chemical plants (CCP) in January-November this year reduced production of gross coke with 6% moisture by 58.1% compared to the same period last year – to 3.66 million tons.

As reported to Interfax-Ukraine by Anatoliy Starovoyt, director general of Ukrkoks association of coke-chemical enterprises (Dnipro) in November they produced 235,000 tonnes of gross coke, including 204,000 tonnes of metallurgical coke,

According to him, over 11 months of 2022, production of metallurgical coke amounted to 3.14 million tons.

Currently, Yuzhkoks, Kametstal (formerly DKHZ), DMZ (Dneprokoks), Zaporizhkoks and coke-chemical production at ArcelorMittal Kryvyi Rih are operating.

The general director also said that during 11 months of 2022, the domestic coke plants supplied 4.254 million tons of coal concentrate (11M-2021 – 11.834 million tons), including Ukrainian production – 2.853 million tons, from Russia imported (before the war) 623.9 thou. tons, from Kazakhstan (before the war) – 65.4 thousand tons, Poland – 36.3 thousand tons, the Czech Republic – 38.8 thousand tons, the United States – 448.6 thousand tons and Australia – 187.3 thousand tons. Including 308 thousand tons of concentrate supplied in November, including 299 thousand tons of Ukrainian production.

As reported, Ukraine in 2021 decreased coke output by 1.3% compared with 2020 – to 9.543 million tons.

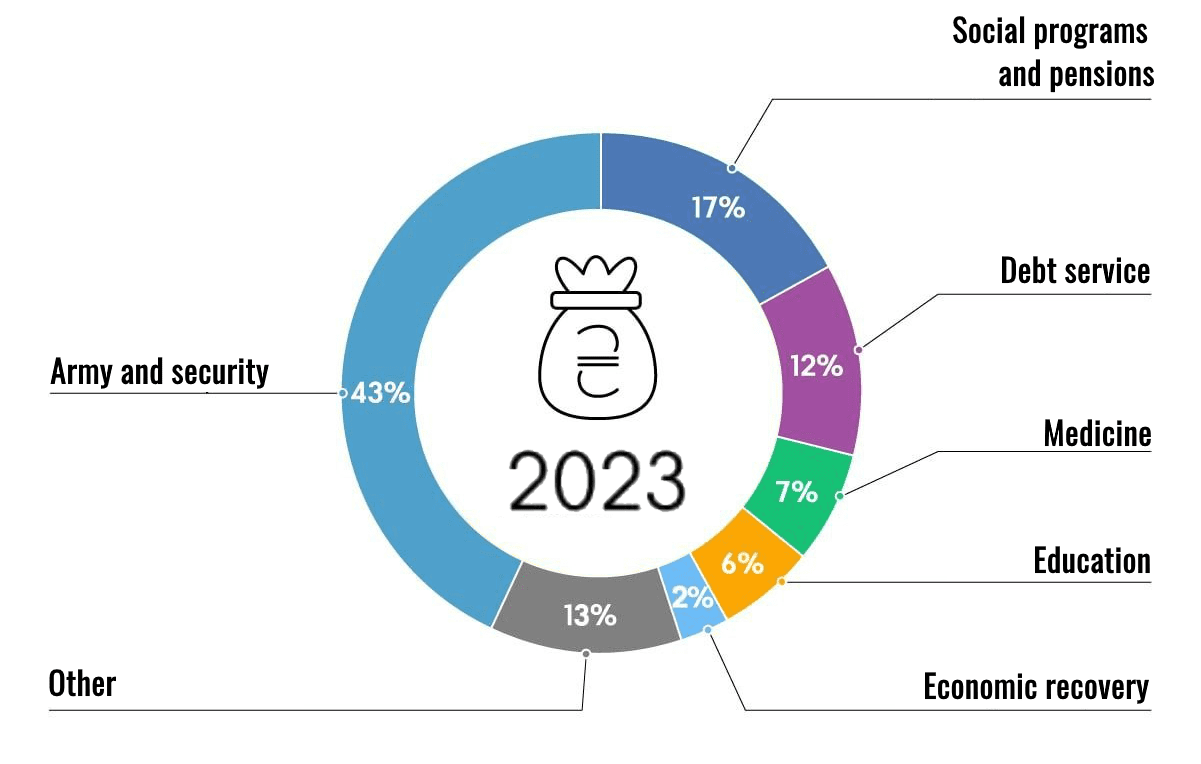

Structure of approved ukrainian state budget expenditures for 2023