Imports to Ukraine of foreign alcoholic products labeled “Cognac”/”Cognac” have been suspended since November 1, 2022, as this name no longer meets the technical conditions for this drink, provided for by the Ukraine-EU Association Agreement.

As reported on the website of the Ministry of Agrarian Policy and Food of Ukraine on Tuesday, this agreement, which entered into force on September 1, 2017, provides for mutual protection between the countries of a certain number of geographical indications (GI) in Ukraine, among which there is Cognac.

Thus, from November 1, the use of the name “Cognac” / “Cognac” in Ukraine for products originating from third countries no longer meets the technical requirements for the production of the drink “Cognac” and is now prohibited on the territory of Ukraine.

It is recalled that on January 24, 2022, as a result of the adoption of new regulations that include GI protection, the name “Cognac” / “Cognac” was included in the customs register, which is a prerequisite for the introduction of GI protection on the territory of Ukraine.

In addition, a transitional period has been established so that importers can change the labels on their products to comply with this GI. The transitional period has been extended until October 31, 2022 (inclusive), taking into account the aggression of the Russian Federation and the imposition of martial law in Ukraine.

“Starting from November 1, 2022, the Ukrvinprom Corporation, together with the National Interprofessional Bureau of Cognac, is responsible for the protection of the State Institution Cognac in the country and abroad and will take the necessary measures against products imported and presented under the name Cognac / Cognac “if they do not meet the technical conditions established for this GI in accordance with the Association Agreement signed between the EU and Ukraine,” summed up the Ministry of Agrarian Policy.

The state budget of Ukraine for January-October 2022 was executed with a deficit of UAH 638.7 billion, including the general fund – UAH 643.4 billion against the deficit of UAH 1,121.6 billion planned by the general fund for January-October 2022 hryvnia, said the Ministry of Finance.

“In October, the actual deficit of the state budget amounted to UAH 143.4 billion, including the general fund – UAH 147.1 billion,” the agency said in a release on Tuesday.

According to the operational information of the State Treasury, as indicated by the Ministry of Finance, in January-October 2022, the cash expenditures of the state budget amounted to UAH 1,978.6 billion, including the general fund – UAH 1,817.4 billion, or 86.4% of the list of the reporting period .

“At the same time, in October 2022, cash expenditures of the state budget were made in the amount of UAH 231.7 billion, including the general fund in the amount of UAH 222.5 billion,” the Ministry of Finance specified.

According to him, the income of the general fund in October amounted to UAH 72.8 billion.

Sales of generators and power banks in September-October 2022 increased 10 times compared to the same period in 2021 in the ALLO national marketplace network, the company’s press service told Interfax-Ukraine.

“The demand for goods marketplace” ALLO during the war has changed a lot. Now Ukrainians are buying generators, heaters, lights, charging stations. They also continue to buy the necessary electronics, goods for remote work, study and everyday life – these categories of goods do not lose popularity, although overall demand has decreased. Sales of clothing, footwear, school uniforms, children’s products and toys fell by 90%. Until December, there will be a deficit for generators, solar panels, power banks,” said Natalya Pankratova, COO of ALLO Group and head of the allo.ua marketplace.

At the same time, generator sales increased 10 times in September 2022 compared to September 2021. In October, the jump has slightly decreased: the increase in sales this month is five times.

“The average bill (for generators) as a whole increased by 82% over the year and amounted to more than UAH 30,000,” Pankratova said.

Most often, Ukrainians choose compact generators of 2.5-2.8 kW. Owners of private houses prefer dual-fuel generators, diesel and gasoline, 5.5 kW or more.

Powerbank sales also increased 10 times compared to 2021. At the same time, the company noted that in the pre-war period, less capacious models were popular, now models with a capacity of 20,000 mAh, which are suitable for smartphones, start-watches and tablets, are in high demand.

According to the results of the third quarter of 2022, the average check in this category is UAH 2,000.

The company noted that during the war there was a demand for charging stations, before the war, consumers had enough power banks. The average bill of charging stations for the third quarter is UAH 28,000.

Partners of the national marketplace “ALLO” are thousands of Ukrainian entrepreneurs offering goods in more than 3 thousand categories. At the beginning of the Russian military invasion, demand for all goods, without exception, fell by 80-90%. Most partners of the ALLO marketplace did not work until April, now more than 75% of merchants have resumed work.

LLC “Allo” was founded in 1998. As of February 2022, the network consisted of 340 outlets in 140 cities of Ukraine. Now more than 270 outlets are open.

According to the latest data from the opendatabot resource, the participants of Allo LLC are PE Dniproinvest 2016 (95.19%), Dmitry Derevitsky (3.6%), Maxim Raskin (1.21%). The ultimate beneficiary is Derevitsky.

Quotes of futures for US stock indices are rising on Tuesday, investors are waiting for the results of the November meeting of the US Federal Reserve System (FRS) and evaluate corporate reporting.

The Fed meeting will end on Wednesday evening. As expected, following its results, the key interest rate will be raised again by 75 basis points, up to 3.75-4% per annum. The main attention of market participants will be focused on statements by Fed Chairman Jerome Powell regarding the further pace of policy tightening, writes The Wall Street Journal.

Since March, the US Central Bank has already increased the rate by 3 percentage points, the highest rate since the early 1980s, to slow inflation.

The Institute for Supply Management (ISM) will release the October value of the US ISM Manufacturing Index at 5:00 p.m. Thursday. Analysts polled by Trading Economics predict that the indicator fell to 50 points from September’s 50.9 points.

The price of Pfizer Inc. (SPB: PFE) increases by 3.5%. The pharmaceutical giant posted a 5.7% increase in third-quarter net income, with better-than-expected adjusted figures and revenue.

Another pharmaceutical company, Eli Lilly and Co. (SPB: LLY), downgraded its full-year guidance, sending shares down 3.3% despite strong quarterly performance.

Shares in medical device maker Abiomed (SPB: ABMD) soared 51% in pre-trade on news that Johnson & Johnson (SPB: JNJ) (J&J) is acquiring the company for $16.6 billion.

The market value of Uber Technologies (SPB: UBER) jumped 12%. The taxi and food delivery company posted a loss in the third quarter of 2022, but its revenue increased more than expected, and its forecast for the current quarter was also better than analysts’ estimates.

Herbalife Nutrition Ltd stock quotes. decrease by 1%. The supplement maker withdrew its full-year guidance, reporting a decline in net income and revenue in the third quarter of 2022, and also announced the departure of the chief executive officer.

Paper Goodyear Tire & Rubber Co. (SPB: GT) become cheaper by 8%. The tire maker cut its net income by a factor of three in the quarter, with adjusted earnings and revenue falling short of analysts’ forecasts.

The value of the December E-mini futures on the Dow Jones index by 15:26 qoq increased by 0.7% and amounted to 33,005 points. Quotation of the December E-mini futures on the S&P 500 rose by this time by 1.06%, to 3924.25 points. Futures on the Nasdaq 100 for December jumped 1.35% to 11,602.25 points.

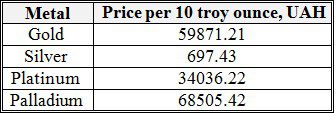

Central bank official rates of banking metals as of November 1

One troy ounce=31.10 grams

Stock indices of Western European countries are growing steadily at the beginning of trading on Tuesday after the release of quarterly reports of companies.

Investors are also waiting for the results of the US Federal Reserve and Bank of England meetings this week. Market participants hope that central banks will signal a slowdown in monetary tightening, writes Trading Economics.

The composite index of the largest companies in the Stoxx Europe 600 region rose by 1.26% by 11:00 a.m. to 417.4 points.

The British stock index FTSE 100 grows by 1.48%, the German DAX – by 1.02%, the French CAC 40 – by 1.74%. The Italian FTSE MIB and the Spanish IBEX 35 added 1.64% and 1.07% respectively.

British oil and gas company BP Plc (SPB: BP) in the third quarter increased its profit by 2.5 times in annual terms, announced a $2.5 billion buyback program for its shares. BP shares are rising by 0.5% at the beginning of the session.

Shares of British IT company Osirium Technologies jumped 30% after it reported growth in its customer base and revenue in the past quarter.

Shares of British online supermarket owner Ocado Group jumped 30% on news of a partnership with South Korea’s Lotte Shopping Co. As part of the agreement, Lotte will develop its online business on the Ocado platform.

The value of the Naspers Ltd. holding, which owns various Internet assets, rises by 7%. The company said that media reports about the sale of its stake in China’s Tencent (SPB: 700) Holdings Ltd. are speculative and false.

British automaker Aston Martin Lagonda Global has appointed two members of Saudi Arabia’s Public Investment Fund as directors on its Supervisory Board. Aston Martin Lagonda shares are up 3%.

Switzerland-based IWG, which provides office space rental services, increased revenue by 34% in July-September amid strong demand for offices due to the adoption of a hybrid mode of operation. Paper IWG nevertheless become cheaper by 1.7%.

Among the Stoxx 600 components, Ocado was the top performer, along with German food delivery service Delivery Hero SE (+9.1%) and Dutch Prosus N.V. (+7.6%), which is the parent company of Naspers.