Decrees “On the decision of the National Security and Defense Council of Ukraine dated October 19, 2022 “On the application and amendment of personal special economic and other restrictive measures (sanctions)” have been published on the website of the President of Ukraine.

These decisions impose sanctions on 2,507 individuals and 1,374 legal entities, most of which are Russian citizens and Russian legal entities.

Decree No. 726\2022 imposes sanctions against politicians, public figures, military personnel, among whom is Putin’s daughter Yekaterina Tikhonova. The same decree introduces sanctions against Russian legal entities.

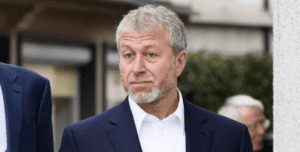

Decree No. 727\2022 imposes sanctions against oligarchs, including against Roman Abramovich.

The main stock index of Western European countries is falling on Thursday, falling for the second day in a row on fears about the global economy and weak reporting of large companies.

The composite index of the largest companies in the region Stoxx Europe 600 by 11:09 QoQ fell by 0.3% and amounted to 396.54 points. The day before, the indicator lost about 0.5%.

The British stock index FTSE 100 by this time fell by 0.06%, the German DAX – by 0.65%, the Spanish IBEX 35 – by 0.03%. Meanwhile, the French CAC 40 rose by 0.04%, the Italian FTSE MIB – by 0.06%.

The Fed’s Beige Book regional survey published on Wednesday showed that forecasts for the US economy have become more pessimistic amid growing concerns about weakening demand.

Economic activity in the country at the beginning of autumn generally slightly increased, but the situation was different in different industries and regions. Four of the twelve Federal Reserve Banks (FRB) said that activity in their districts did not change, and two reported a decrease. Negative factors were higher interest rates and inflation, as well as disruptions in supply chains.

Despite the weakness in the US economy, the Fed, by all accounts, will again raise its key rate by 75 basis points at the November meeting.

Shares of Ericsson AB fall 14.5%, leading the decline in the Stoxx 600 index. The Swedish telecommunications equipment manufacturer’s net profit in the third quarter of 2022 fell by 7% and was worse than the market forecast.

The capitalization of its Finnish competitor Nokia Corp. (SPB: NOK) is down 4.6%, although the company posted a 22% increase in net income last quarter and a 16% increase in revenue.

Pernod Ricard SA drops 1.3% despite the fact that one of the world’s largest alcohol producers reported a 21.7% increase in revenue in the first quarter of fiscal 2023.

Swedish concern Volvo AB, which ranks second in the world in terms of production of trucks, increased its net profit last quarter, but the figure was slightly below market forecasts. The company’s shares are down 4%.

Swedish Match AB’s market value climbed 1.6% on media reports that tobacco maker Philip Morris plans to raise its bid for the company.

The growth leaders among the components of the Stoxx Europe 600 index are the shares of the fertilizer producer Yara International (+5.5%) and the Spanish bank Sabadell (+4.1%).

The value of the US currency against the yen jumped to a maximum since August 1990 after the Japanese Central Bank announced an unscheduled redemption of government bonds. This decision was made following the jump in the yield of 10-year Japanese government bonds above the upper limit of the Central Bank’s target range of 0.25% per annum.

The dollar against the yen soared to 149.98 yen compared to 149.9 yen at the close of the previous session.

The Bank of Japan maintains an ultra-loose monetary policy, thus seeking to support the country’s economic recovery from the effects of the COVID-19 pandemic. His policy is seriously at odds with the actions of other world central banks, raising rates to curb inflation, notes Trading Economics. This continues to put pressure on the yen and requires the Japanese Central Bank to adjust the policy of controlling the yield curve of government bonds.

The ICE-calculated index, which shows the dynamics of the dollar against six currencies (the euro, the Swiss franc, the yen, the Canadian dollar, the pound sterling and the Swedish krona), lost 0.14% on Thursday, the broader WSJ Dollar Index lost 0.05%.

The euro/dollar pair is trading at $0.9792 as of 9:15 Moscow time, compared to $0.9775 at the close of the market on Wednesday.

The pound sterling fell by this time to $1.1221 against $1.1218 the day before.

The dollar remains strong and any downward adjustments will be short-lived as long as the Federal Reserve (Fed) continues to raise the base rate, said ING analyst Francesco Pesole, quoted by Dow Jones.

The Fed’s Beige Book regional survey published on Wednesday showed that forecasts for the US economy have become more pessimistic amid growing concerns about weakening demand.

Economic activity in the country at the beginning of autumn generally slightly increased, but the situation was different in different industries and regions. Four of the twelve Federal Reserve Banks (FRB) said that activity in their districts did not change, and two reported a decrease. Negative factors were higher interest rates and inflation, as well as disruptions in supply chains.

Power cuts have been introduced in Kyiv city and region in order to avoid accidents, the press service of DTEK Kyiv Regional Grids has reported.

“NPC Ukrenergo introduced blackouts in Kyiv region in order to avoid accidents from 23.34 on October 19,” the company said.

The blackouts will reportedly last no more than 4 hours per customer.

“However, it can be repeated within a day after 4 hours if Ukrenergo does not cancel the use of stabilization blackouts. For example, if your house was disconnected from 10:00 to 14:00 in the morning, if the stabilization blackouts continue throughout the day, the second blackout will be from 18.00 to 22.00 and from 02.00 to 06.00,” DTEK said.

The list of settlements, which may be affected, is posted on the DTEK website.

“To support the power system, we urge all residents of the region to consume electricity moderately – turn on energy-intensive appliances one by one, reduce electricity consumption as much as possible in the evening from 17.00 to 23.00. We ask business clients to limit the use of outdoor lighting on the facades of offices, restaurants, shopping centers,” the company again said, noting that it will help reduce the need for blackouts or the number of homes that are disconnected.

Stock indices of the largest countries in the Asia-Pacific region (APR) are mainly falling during trading on Thursday, the only exception is the Shanghai indicator, which shows a weak positive trend.

Hong Kong’s Hang Seng Index fell 1.5% by 8:15 a.m. China’s Shanghai Composite added 0.2%.

Shares of biopharmaceutical company Wuxi Biologics (Cayman) Inc. are traded among the drop leaders in Hong Kong. (-8.4%), Internet companies Baidu Inc. (SPB: BIDU) (-7.5%) and video game developer Netease Inc. (SPB: NTES) (-5%).

Papers of casino operator Sands China (SPB: 1928) Ltd. cheaper by 1% after the release of quarterly reports. The company increased its net loss in the third quarter due to continued covid restrictions in Macau.

Shares of sports equipment manufacturer Li Ning Co. lose 4% in value despite the fact that the company reported solid sales growth in the third quarter. Analysts note that Li Ning’s Q4 outlook is rather weak due to anti-coronavirus restrictions.

Meanwhile, the People’s Bank of China (PBOC, the country’s central bank) on Thursday kept its base interest rate on loans (LPR) for a period of one year at 3.65% per annum. And the rate on five-year loans was left at 4.3% per annum, the NBK said in a statement.

The value of the Japanese Nikkei 225 index fell by 1%.

The leading decline among the components of the index are the shares of the manufacturer of electric cables Fujikura Ltd. (-5.4%), manufacturer of diagnostic medical equipment Hoya Corp. (-3.2%) and sanitary ware manufacturer Toto Ltd. (-3%).

Market capitalization of Shinsei Bank Ltd. jumped by 7.6%. The Japanese media reported that the “parent” company of the bank – SBI Holdings Inc. is considering delisting its shares from the stock exchange.

The volume of Japanese exports in September increased by 28.9% compared to the same month last year and reached 8.819 trillion yen (about $59 billion), data from the Ministry of Finance of the country showed. Imports soared 45.9% last month to a record 10.913 trillion yen. Japan’s foreign trade deficit reached 2.094 trillion yen in September compared to 636.9 billion yen a year earlier. Thus, the negative balance of the foreign trade balance is recorded for the 14th month – the longest such period since 2015.

South Korean index Kospi fell by 0.7%.

The market value of the largest automakers in the country Kia Corp. and Hyundai Motor are down 1.2% and 0.3% respectively.

The Australian S&P/ASX 200 fell 1%.

Shares of the world’s largest mining companies BHP Group and Rio Tinto fell 2.3% and 1.9%, respectively.

Oil and gas producers Woodside Energy and Santos jumped 6.2% and 2% on third-quarter output growth.

The unemployment rate in Australia in September remained unchanged compared to August and amounted to 3.5%, according to the country’s statistical office. Analysts also did not expect a change, writes Trading Economics. The number of employed last month increased by only 900 people.

The Verkhovna Rada on Wednesday adopted law No. 7737 that brings the Customs Tariff of Ukraine in line with the requirements of the International Convention on the Harmonized Commodity Description and Coding System in the 2022 version.

According to information on the website of the parliament, 289 MPs voted “for” with the required minimum of 226 votes.

The head of the Rada committee on the fuel and energy complex, Andriy Herus, proposed exempting from customs duties the import of equipment by companies engaged in the transportation, production and distribution of gas and electricity as humanitarian aid, but was not supported.

Hanna Kolesnyk, who represented the position of the committee, pointed out that the list of goods proposed by Herus is too broad and needs to be revised, that exemption from import duties is provided by the Customs Code and does not relate to the regulation of the Customs Tariff, while the Ministry of Finance and the Ministry of Economy are against supporting this proposal.

As the Ministry of Economy explained earlier, the current Customs Tariff of Ukraine is based on the international system of the 2017 version, while most countries of the world (China, the USA, the EU, Turkey, Switzerland) have already switched to the 2022 version. In this regard, there are a number of complications associated with differences in commodity codes in the customs clearance of imported products or when comparing the customs statistics of Ukraine and trading partners.

The ministry clarified that the law introduces more than 350 changes to commodity codes, mainly in relation to agricultural, chemical, forestry goods, textiles, non-ferrous metals, engineering, transport, etc.

It was emphasized that the new customs tariff does not provide for changes in the rates of import duty on goods.