Oil prices continue to rise on Tuesday, the market is waiting for the meeting of the OPEC + states, during which a decision may be made to reduce the quota for oil production.

Bloomberg reports, citing sources in OPEC+, that the alliance will discuss the possibility of cutting production by more than 1 million barrels per day (b / d).

The meeting of the OPEC+ Ministerial Monitoring Committee (JMMC), as well as the OPEC+ Ministerial Meeting, will be held in person at the OPEC Secretariat in Vienna on October 5. Since March 2020, meetings have been held via videoconferencing.

The cost of December futures for Brent oil on the London ICE Futures exchange by 8:10 am UTC on Tuesday is $89.27 per barrel, which is $0.41 (0.46%) higher than the closing price of the previous session. As a result of trading on Monday, these contracts rose by $3.72 (4.4%) to $88.86 per barrel.

The price of futures for WTI oil for November in electronic trading on the New York Mercantile Exchange (NYMEX) rose by this time by $0.24 (0.29%), to $83.87 per barrel. By the close of the market on Monday, the value of these contracts increased by $4.14 (5.2%) to $83.63 per barrel.

“We expect a significant reduction in the OPEC+ quota on paper, but in reality it will be much less,” said Warren Patterson, who is in charge of commodity markets strategy at ING Groep NV in Singapore.

“A decrease of 1 million b/d would mean a real decrease in production by less than 400,000 b/d,” Bloomberg quoted the expert as saying.

Since September last year, a number of OPEC+ countries have lagged behind their planned production levels due to lack of investment, due to military clashes and sanctions. At the same time, the overall OPEC + quota increased, which allowed countries that can increase production to do so. In September of this year, OPEC+ ministers decided to reduce the quota for October by 100,000 bpd.

Oil prices fell 25% in the past quarter amid signals of a weakening global economy as a result of the rapid tightening of monetary policy by global central banks, including the Federal Reserve System (Fed). Experts fear a global recession and, consequently, a decline in demand for oil.

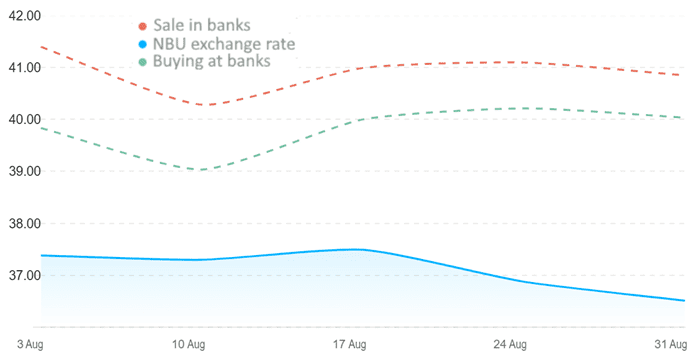

Quotes of interbank currency market of Ukraine (UAH for $1, IN 01.08.2022-31.08.2022)

graphics of the Club of Experts

The main stock indexes of the Asia-Pacific region (APR) are steadily rising during trading on Tuesday following the US stock market.

American stock indices finished the first trading session of the fourth quarter with a steady growth, the rise of the Dow Jones Industrial Average was the highest since February, amounting to 2.7%.

Mainland China’s stock exchanges are closed for the Founding Day of the People’s Republic of China holidays, Hong Kong’s stock exchanges for the Double Ninth Festival.

The value of the Japanese index Nikkei 225 to 8:27 CSK increased by 2.8%.

Among the components of the index, the growth leaders are Nippon Sheet Glass Co. Ltd. (+8.4%), Itochu Corp. (+7.9%) and Marubeni Corp. (+6.8%).

In addition, the price of securities of investment and technology SoftBank Group (+5.1%), consumer electronics manufacturer Sony (+2.3%), automotive Nissan Motor (+2%) and Toyota Motor (+2.7%) is rising.

The South Korean Kospi index increased by 2.4% by 8:30 am KSK.

Purchasing Managers Index (PMI) in the processing industry of South Korea, calculated by S&P Global, fell to 47.3 points in September from 47.6 points a month earlier. A PMI value above 50 points indicates an increase in activity in the sector, below – its weakening. Thus, activity in the sector has been declining for the third month in a row.

Quotes of securities of one of the world’s largest manufacturers of chips and consumer electronics Samsung Electronics Co. grew by 4%, while automaker Hyundai Motor – by 1.4%.

The Australian S&P/ASX 200 added 3.75%.

Shares of the world’s largest mining companies BHP and Rio Tinto increased by 3.8% and 3.1%, respectively.

The Reserve Bank of Australia (RBA) unexpectedly slowed down the pace of key interest rate hikes, noting the deterioration of the global economic outlook.

The rate was raised on Tuesday by 25 basis points (bp) to 2.6%. The vast majority of economists expected it to increase by 50 bp, writes The Wall Street Journal.

The RBA raised the bet by 50 bp. in June, July, August and September, in an effort to slow inflation, which the Central Bank expects to peak by the end of 2022 at around 8%.

Investors have withdrawn $70 billion from developing country bond funds since the beginning of 2022, according to an analysis by JPMorgan Chase & Co. based on data from EPFR Global.

This is the largest capital outflow since JPMorgan began tracking this data in 2005.

Last week alone, net outflows from emerging markets bond funds amounted to $4.2 billion.

The growth of interest rates in developed countries increases the attractiveness of their assets and reduces interest in less reliable securities of emerging markets, writes the Financial Times newspaper. At the same time, the strengthening of the US currency increases the cost of developing countries to service the dollar debt.

In September, JPMorgan raised its 2022 emerging market bond fund outflow forecast to $80 billion from $55 billion, and the bank’s emerging markets analyst Milo Gunasinghe notes that investor capital outflows are unabated so far.

Initial registrations of new commercial vehicles in Ukraine (trucks and special vehicles) in September increased by 21% compared to August of this year – up to 613 units, which, however, is 57% less than in September 2021, reports “Ukravtoprom” in the Telegram channel.

“The market for new trucks is reviving,” the association believes.

As reported, in August, registrations of such cars decreased by 15% compared to July 2022 – to 507 units, while in July there was an increase by 38% compared to June 2022 – to 593 units.

Renault remained the market leader in September (171 cars), followed by Mercedes-Benz (83 units), and Citroen third (51 units). This is followed by DAF with 38 cars and VOLVO with 36 registrations.

According to the statistics of the association, in September last year, the top five market leaders included Citroen, Fiat, Renault, Volkswagen and the Belarusian MAZ.

Ukravtoprom informs that a total of 4.9 thousand new commercial vehicles were registered in Ukraine in January-September 2022, which is almost 56% less than in the same period of 2021.

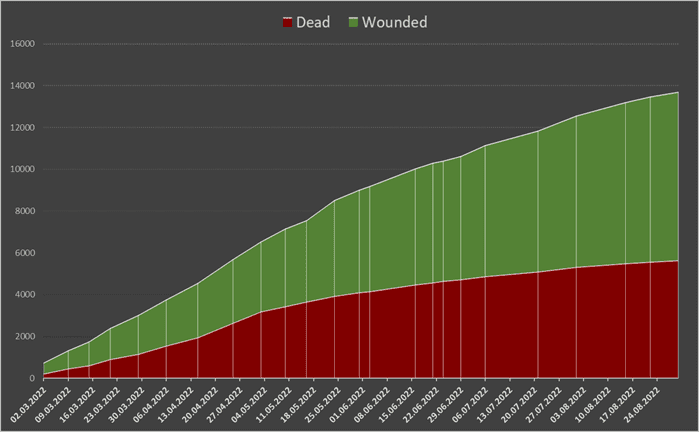

Number of dead and wounded civilians in Ukraine as a result of military actions from 24.02.2022 according to un data (per)

graphics of the Club of Experts