The bitcoin exchange rate exceeds $20,000 during trading on Tuesday, having reached a maximum value in more than a week, but cannot break through the narrow trading range indicated after the cryptocurrency’s sharp fall this summer.

The price of bitcoin, as of 13:40 Kyiv time, rose by 5.69% compared to the closing level of previous trading and amounted to $20.223 thousand.

Bitcoin has been fluctuating between $18,000 and $25,000 since mid-June, following a crash in the crypto market that has depreciated nearly $2 trillion since its peak in November last year, CNBC writes.

The decline in the market was caused by an increase in interest rates by the central banks of the world, aimed at combating high inflation, and a wave of bankruptcies and debt problems that swept through companies in the cryptocurrency sector.

Crypto investors are keeping an eye on changes in monetary policy as cryptocurrencies have been closely linked to the US stock market this year. Rising interest rates put pressure on the S&P 500 and Nasdaq, which spilled over to other risky assets, including cryptocurrencies.

This time, the rise in the cryptocurrency market, which began on Monday, is at odds with the dynamics of the stock market. American stocks continued to fall on Monday, and the Dow Jones Industrial Average ended trading in the bearish trend zone (that is, it fell 20% or more from the last peak) for the first time since the start of the coronavirus pandemic.

However, futures for US indices showed an increase on Tuesday, indicating that stocks may start to win back on the mood of investors to buy on the fall.

The rate of Ether (Ether) rose by 4.79% to $1388.50. On September 15, a cryptocurrency software update dubbed The Merge was activated. The update switched the Ethereum blockchain to a new algorithm, which should drastically reduce the consumption of electricity during mining.

Over 340,000 doses of influenza vaccines will be delivered to Ukraine in the current epidemiological season, Mikhail Radutsky, head of the parliamentary committee for the nation’s health, medical care and medical insurance, said.

In his Telegram channel on Tuesday, he specified that the Ministry of Health had reached an agreement with partners on the supply of 163,000 doses of the Vaxigripp vaccine from Sanofi as humanitarian aid and 30,000 doses of this vaccine as part of the PIVI project. In total, 193,000 doses of flu vaccines will be delivered to the country as aid.

In addition, according to Radutsky, in the current epidemiological season, 150,000 doses of the vaccine will be delivered to the private market of Ukraine – 100,000 GisiFlu and 50,000 Vaxigripp.

“Last year, more than 1 million doses of flu vaccines were purchased on the private market. This year, 150,000 doses are expected to be delivered. But if there is demand, I think private companies will buy more,” he added.

Radutsky also said that the Vaxigripp vaccine has already arrived at some pharmacies. At the same time, its cost is almost the same as last year – 300-400 UAH.

According to the estimates of the Ministry of Health, 4.7 million Ukrainians are recommended to be vaccinated against influenza for health reasons and medical indicators. Due to martial law and limited funding for public procurement, the critical need for vaccination of risk groups is set at 250,000 doses.

The risk group includes doctors, the Armed Forces of Ukraine, the Ministry of Internal Affairs, the Security Service of Ukraine and pregnant women. They, according to applications from family doctors, if they wish, will be able to receive a flu shot free of charge.

As of September 27, Ukrainian agricultural producers sowed the main winter crops on an area of 709 thousand hectares (15% of the forecast of 4.56 million hectares), 298 thousand hectares were sown over the past week on September 20-27, according to the website of the Ministry of Agrarian politics and food on Tuesday.

According to the agency, 16% of the planned area, or 622 thousand hectares (+258 thousand hectares for the week of September 20-27), barley – 65 thousand hectares (+33 thousand hectares, 10% of the area), rye – 27 thousand hectares (+11.7 thousand hectares, 31% of the area).

At the same time, it is specified that the most intensive sowing of winter grains is carried out in the Chernihiv region, where 33.1 thousand hectares, or 37% of the forecast, are sown.

In addition, the sowing of winter rapeseed has been fully completed in Ukraine, the final area under this crop amounted to 961 thousand hectares.

Thus, by September 27 in Ukraine, a total of 1.67 million hectares were sown with winter crops, or 18.8% of the last year’s figure. In 2021, Ukraine allocated 8.87 million hectares for winter crops, including 6.66 million hectares for wheat, 1.02 million hectares for barley, 160.6 thousand hectares for rye, and 1.03 million hectares for rapeseed.

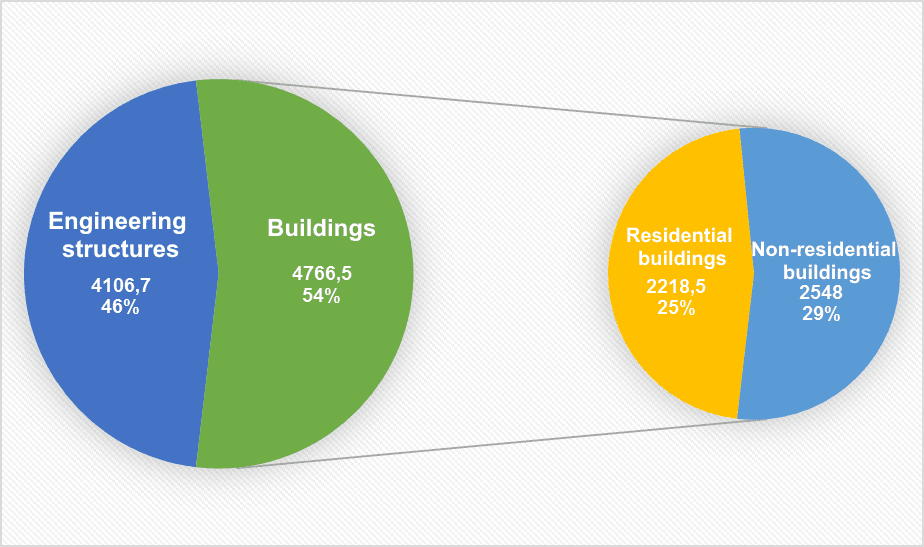

Volume of construction products produced by type in of Jan 2022 (mln UAH)

SSC of Ukraine

Stock indices of Western European countries are growing steadily during trading on Tuesday, recovering from last week’s falls.

The composite index of the largest companies in the Stoxx Europe 600 region rose by 1.16% by 11:00 Moscow time and amounted to 393.25 points.

The British stock index FTSE 100 grows by 0.61%, the German DAX – by 1.29%, the French CAC 40 – by 1.32%. The Italian FTSE MIB rose 1.06%, while the Spanish IBEX 35 rose 0.79%.

Investors are still worried about forecasts of a global economic recession amid persistently high inflation and aggressive measures by the largest central banks to contain it. Nevertheless, the market appeared to buy the shares that fell in price after the sale at the beginning of this week and during the previous week, writes Bloomberg.

Meanwhile, reports of problems with the operation of Nord Stream put pressure on traders. The prospects for a reduction in energy supplies to Europe are one of the main reasons for the growing economic crisis in the region.

Investors are also watching the dynamics of the British pound and government bonds. On Monday, the British currency paired with the US dollar updated a historical low on expectations of tax breaks in the country. Last week, Britain’s new Chancellor of the Exchequer, Quasi Kwarteng, announced a sweeping tax cut that would affect individuals and businesses and increase the budget deficit for the current fiscal year by more than £70bn.

The pound on Tuesday is growing by 1% to $ 1.0802 compared to $ 1.0688 a day earlier.

Among the growth leaders in the Stoxx 600 index, shares of the Italian Nexi S.p.A. are traded. (+6.8%). The company, which specializes in payments, expects to generate free cash flow of 2.8 billion euros between 2023 and 2025, which can be used for M&A deals and share buybacks.

The shares of the German energy company Uniper SE (+10.6%) and the Swiss network of online pharmacies Zur Rose Group AG (+6.7%) are also actively rising in price.

Meanwhile, shares of the British Admiral Group PLC (-6%), which specializes in auto insurance, are traded among the drop leaders.

Bank of Cyprus Holdings, the largest bank in Cyprus, fell 10% on the news that the private equity fund LSF XI Investments LLC (Lone Star) does not intend to improve the offer to buy the bank.

The Bloomberg Commodity Spot commodity price index fell to an eight-month low amid fears of a recession in the global economy.

The index, calculated on the basis of prices for a wide range of commodities – from oil and copper to wheat, on Monday fell by 1.6%, to a minimum since January 24. Its value has fallen by 22% from the peak level recorded in July. The rise associated with a jump in commodity prices immediately after the start of the Russian war in Ukraine has completely disappeared.

The continued strength of the dollar is making dollar-denominated commodities more expensive for overseas buyers, worsening demand prospects, Bloomberg said.

Experts see an opportunity for further decline in commodity prices, despite the fact that the supply of many commodities is limited. The unprecedented pace of raising key interest rates by world central banks, trying to contain the highest inflation in decades, raises fears of a recession in the global economy. The downturn, in turn, will worsen the outlook for energy demand and investor appetite for risk, economists warn.