PJSC “Production Association “Stalkanat-Silur” (Odessa), following the results of work in 2021, increased its net profit by 2.8 times compared to the previous year – up to UAH 327.842 million.

According to the information for the annual general meeting of shareholders scheduled for September 30 of the current year, retained earnings as of December 31, 2021 amounted to UAH 116.580 million.

The meeting will be held remotely. The start date for shareholders voting on the agenda is September 19, the voting end date is until 18:00 on September 30, 2022.

Shareholders will consider a number of issues based on the results of work in 2021, in particular, the report of the CEO on the financial and economic activities of the company over the past year and the main areas of activity in 2022. They will also consider the report of the supervisory board of the company, approve the report and conclusions of the auditor of the company, approve the annual report, including the annual financial statements for the past year.

On all these issues, it is proposed to recognize the performance as satisfactory.

In addition, the shareholders will decide on the distribution of the company’s profit for 2021, which, according to the draft decision, a copy of which the Interfax-Ukraine agency has, is proposed to be left undistributed.

As reported, the plant in 2020 reduced its net profit by 21.3% compared to 2019 – to UAH 116.761 million from UAH 148.419 million, net income – by 7.6%, to UAH 2 billion 146.230 million.

The general meeting of shareholders held on September 3, 2021 decided to separate from PJSC “Stalkanat-Silur” and create a new company – PJSC “Stalkanat” with the transfer of part of the property, rights and obligations to it in accordance with the approved distribution balance.

Director General of Stalkanat-Silur Sergey Lavrinenko explained earlier to the Interfax-Ukraine agency that all shares of Stalkanat PJSC being created are distributed among all shareholders of Stalkanat-Silur PJSC. The shareholders agreed to spin off the Stalkanat company, to which the Odessa industrial site will be transferred. In turn, PJSC “Stalkanat-Silur” will also remain, on the balance of which “Silur” will be located in the temporarily uncontrolled territory (Khartsyzsk, Donetsk region).

PJSC “PA “Stalkanat-Silur” (Odessa) previously had two branches – in Odessa and in Khartsyzsk, Donetsk region on the tubing. “. Later, the management of PJSC “PA” Stalkanat-Silur “announced the seizure of the company’s branch in Khartsyzsk on the NKT, sent a corresponding statement to the National Police.

According to the NDU for the fourth quarter of 2021, David Nemirovsky (Ukraine) owns 50.0001% of the shares of PJSC “PO” Stalkanat-Silur”, Anton Mikhalenko – 23.7%, Ederi Liron (both – Israel) – 23, one%.

The authorized capital of PJSC “Stalkanat-Silur” is currently UAH 8.346 million.

The leaders in terms of premiums collected under compulsory motor third party liability insurance (OSAGO) contracts in the second quarter of 2022, as in the previous one, were IG TAS and NJSIC Oranta, according to the website of the Motor (Transport) Insurance Bureau of Ukraine (MTSBU).

At the same time, according to the published data, there have been a number of changes in the TOP-10 leading insurers of Ukraine for this type of insurance. The Ukrainian Fire and Insurance Company, which occupied the eighth position in the first quarter, left the TOP-10.

In addition, IC Euroins Ukraine returned to the top 10 sellers of OSAGO from the top ten in terms of collected premiums, IC Guardian rose from 10th position to seventh, USG – from seventh to fifth.

MTIBU is the only association of insurers that provides compulsory insurance of civil liability of land vehicle owners for damage caused to third parties. MTIBU members are 42 insurance companies.

Severe heat waves with dangerous temperatures for people during this century are likely to occur 3-10 times more often than now, CNN reported on Friday, citing a study by Harvard and Washington Universities.

Thus, more and more frequent heat waves are expected in the USA, China, Japan and Western Europe. In this case, the air temperature will reach 39.4 degrees Celsius.

This trend will be most pronounced in the countries of the tropics, where the number of days with extreme heat – with an air temperature of 51 degrees Celsius – will double.

Experts have made these predictions based on assumptions that average global temperatures will rise by 2 degrees Celsius: this is the limit set in the 2015 Paris climate agreement, within which humanity must keep the increase in temperatures.

Earlier it was reported that according to the Joint Research Center of the European Commission, the current drought seems to be perhaps the worst in the last 500 years. Final data at the end of the season may confirm this preliminary estimate.

The countries of Europe, which this summer are suffering from wildfires associated with abnormal heat and drought, in 2022 broke the record of destruction from fires: 662.8 thousand hectares were devastated by fire.

Among the states most affected by fires this year are Spain (246 thousand hectares of burned forests), Romania (150 thousand hectares), Portugal (75 thousand hectares) and France (61 thousand hectares).

Investors are awaiting a speech by US Federal Reserve Chairman Jerome Powell at the annual economic symposium in Jackson Hole. Powell is expected to reiterate the US central bank’s commitment to rapidly raising rates to curb inflation.

Also in the spotlight is the news that British energy market regulator Ofgem will raise its electricity bill cap by 80% to £3,549 a year in October, after raising it by 54% in April.

The composite index of the largest companies in the region Stoxx Europe 600 by 10:59 Moscow time increased by 0.09% and amounted to 433.77 points.

The German DAX index rises by 0.32%, the French CAC 40 – by 0.27%, the British FTSE 100 – by 0.47%. The Italian FTSE MIB and the Spanish IBEX 35 are up 0.31% and 0.41% respectively.

French consumer confidence rose unexpectedly to 82 in August from 80 in July, the lowest level since June 2013. The indicator rose for the first time in eight months. Analysts on average predicted the indicator at the level of 79 points, writes Trading Economics.

Leading index of consumer confidence in Germany, calculated by the research company GfK, fell to a minimum since 1991, due to concerns about rising energy prices.

The value of the September index fell to minus 36.5 points compared to minus 30.9 points a month earlier. Analysts on average predicted a decline to minus 31.8 points, according to Trading Economics.

Shares of SAS AB rise in price by 1%. The Scandinavian airline increased its net loss in the third quarter of fiscal year 2022 due to flight cancellations and pilot strikes.

The price of Deutsche Lufthansa AG shares increases by 0.2%. The German carrier intends to continue talks with the union representing the company’s pilots amid wage disputes that threaten the company with strikes. Meanwhile, the union has already begun preparations for a strike.

Among the growth leaders in the composite regional index are traded shares of SKF AB, which produces health and hygiene products, (+6.2%), the Swedish oil and gas Orron Energy (+4.9%) and the Swiss online pharmacy Zur Rose Group AG (+ 3.8%).

Stock indexes of the largest countries in the Asia-Pacific region (APR) mostly rose in trading on Friday, with the exception of China’s Shanghai Composite, which fell after an initial rise.

Traders are awaiting a speech by US Federal Reserve Chairman Jerome Powell at the annual economic symposium in Jackson Hole.

The Japanese Nikkei 225 index rose 0.57% by the close of trading.

Among the components of the index, shares of polymer producer Unitika Ltd. rose the most. (+4.4%), chemical company Mitsui Chemicals Inc. (+3.1%) and special equipment manufacturer Komatsu (+3%).

China’s Shanghai Composite fell 0.3%, while Hong Kong’s Hang Seng rose 1%.

China has allocated 1 trillion yuan ($146 billion) to stimulate the economy, mainly focusing on infrastructure spending.

The State Council of China has unveiled a package of measures that includes an additional 300 billion yuan that state-owned banks can invest in infrastructure projects, on top of the 300 billion yuan announced at the end of June. In addition, regional authorities will receive 500 billion yuan in the form of special bonds from previously unused quotas. In turn, state-owned energy companies will be able to sell bonds worth 200 billion yuan. Meanwhile, the agricultural sector will receive 10 billion yuan in subsidies.

In Hong Kong, developer Longfor Group Holdings Ltd rose most significantly. (+5.7%), producing solar panels Xinyi Solar Holdings Ltd. (+5.4%) and biotech Wuxi Biologics (Cayman) Inc. (+5.3%).

Shares of CNOOC Ltd. fell by 1.1%, although China’s largest offshore oil and gas company more than doubled its net profit in the first half of 2022 thanks to rising oil prices.

South Korean index Kospi rose by 0.15%.

Shares of one of the world’s largest manufacturers of chips and consumer electronics Samsung Electronics Co. rose by 0.5%, automaker Hyundai Motor Co. – by 0.8%.

The Australian S&P/ASX 200 gained 0.8%.

The market value of the world’s largest mining company BHP rose by 1.5%, its competitor Rio Tinto Ltd. – by 1.4%.

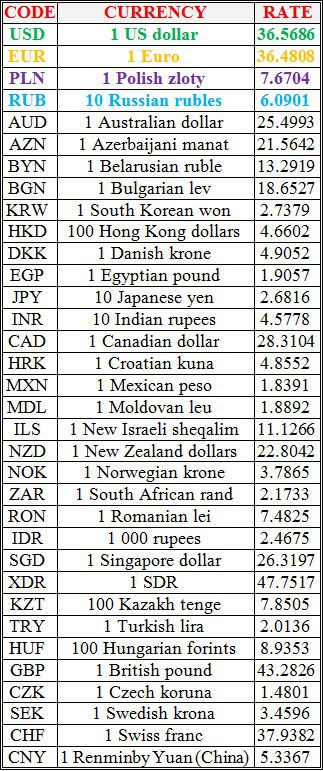

National bank of Ukraine’s official rates as of 26/08/22

Source: National Bank of Ukraine