The Embassy of the Republic of Indonesia in Ukraine, together with the National Academy of Culture and Arts Management (NAKAKIM), held a formal reception in Kyiv to mark National Batik Day, recognized by UNESCO as part of the intangible cultural heritage of humanity.

The event was attended by about 150 guests, including representatives of the diplomatic corps, government authorities, students, and the scientific community.

In his welcoming speech, Arif Muhammad Basalamah, Ambassador Extraordinary and Plenipotentiary of Indonesia to Ukraine, noted that batik is not just a fabric, but a cultural heritage that embodies the history, values, and identity of the Indonesian people.

“Batik is a story of harmony, creativity, and wisdom passed down through generations. By wearing batik, we carry within ourselves values and identity that have been nurtured for centuries,” the diplomat emphasized.

NAKKKiM Rector Valery Marchenko congratulated the Indonesian delegation and awarded the ambassador the title of Honorary Professor of the Academy, noting the importance of cultural exchange and further development of academic cooperation.

The program of the celebration included a presentation on batik, dance and vocal performances by students, as well as the performance of the national anthems of Indonesia and Ukraine on the Ukrainian bandura. An exhibition of batik and the tools used to create it was organized in the university lobby. The event concluded with a tasting of traditional Indonesian dishes—nasi goreng, mie goreng, bakwan, and kue lumpur.

Diplomatic relations between Ukraine and Indonesia were established on June 5, 1992. The Ukrainian Embassy in Jakarta opened in 1995, and the Indonesian Embassy in Kyiv began operating in 1994.

In recent years, the countries have also been developing cooperation in the fields of education, culture, and tourism. In 2024–2025, Indonesia signed two protocols on market access for Ukrainian products — peas and aquatic biological resources — which should stimulate further growth in trade in agricultural products.

In January-August 2025, DTEK Energy allocated UAH 4.9 billion to the development of coal enterprises, which made it possible to maintain production capacity and introduce modern technologies.

“To maintain an adequate level of coal production, the company continues to prepare new longwalls. Since the beginning of the year, 14 new longwalls have been put into operation, which makes it possible to maintain the necessary volume of fuel production for Ukraine’s thermal power generation,” the company said in a press release.

Since the start of the full-scale war, the company’s investments in supporting mines, repairing and modernizing equipment, and improving staff safety have totaled nearly UAH 23 billion.

“We continue to invest in the restoration of generating capacities and coal enterprises, because our main goal on the eve of the new heating season is to maintain the reliability of thermal power generation and the energy system as a whole,” said DTEK Energy CEO Alexander Fomenko.

DTEK Energy provides a closed cycle of electricity production from coal. As of January 2022, the installed capacity in thermal power generation was 13.3 GW. A complete production cycle has been created in coal mining: coal extraction and enrichment, machine building, and maintenance of mining equipment.

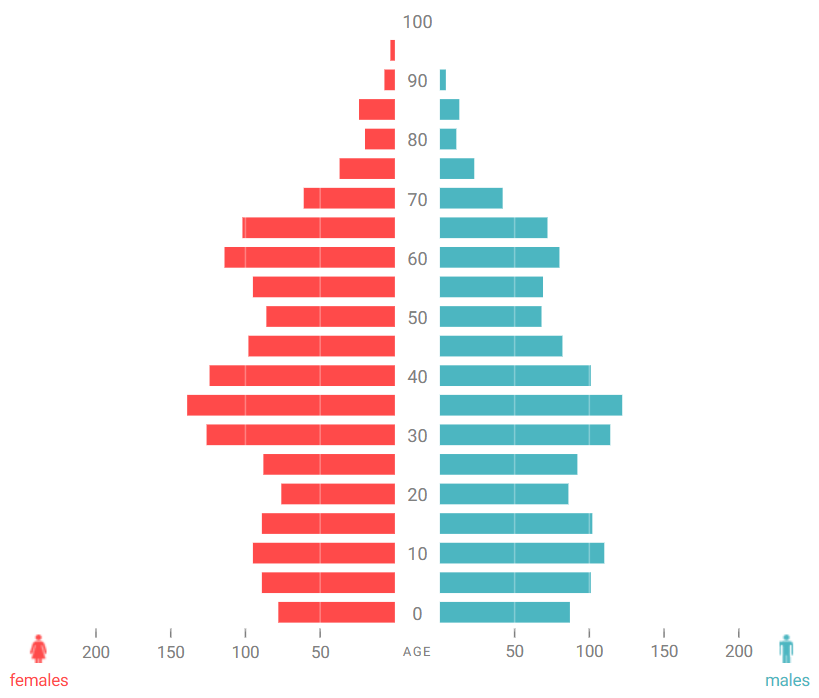

Age-sex pyramid of the population of Ukraine for 2024 (thousand people)

Source: Open4Business.com.ua

In September 2025, most dairy products rose in price in Ukraine amid limited domestic demand, according to the Association of Milk Producers (AMP).

The industry association noted that pasteurized milk with a fat content of up to 2.6% in film packaging costs an average of UAH 48.21/kg, which is UAH 2.75 (+6%) more than in the previous month, but UAH 8.89 (+23%) more than in the same period last year. This product in a plastic bottle costs UAH 65.42/kg, which is UAH 1.25 (+1.9%) more than in the previous month and UAH 12.50/kg (+24%) more than in the same period last year.

Kefir with a fat content of 2.5% in film costs an average of 56.74 UAH/kg, which is 97 kopecks (+2%) more than a month ago, but 9.53 UAH (+20%) more than last year. The cost of the product in a plastic bottle is currently 76.45 UAH/kg, which is 2.57 UAH (+3%) more than a month ago and 14.55 UAH (+25%) more than last year.

Sour cream with a fat content of 15% in cups costs an average of 187.22 UAH/kg, which is 0.93 UAH (+0.5%) more than last month, but 37.79 UAH/kg (+25%) more than last year.

The average price for drinking yogurt with a fat content of 1.6% to 2.8% in plastic bottles was 115.79 UAH/kg, which is 1.39 UAH (+1.2%) more than in the previous month, but 20.12 UAH (+21%) more than in the same period last year.

The average price of sour milk cheese with a fat content of 9% was UAH 293.44/kg, which is UAH 7.41 (+3%) more than in the previous month and UAH 64.38 (+28%) more than in the same period last year.

Domestic butter with a fat content of 72.5% to 73% costs an average of 586.64 UAH/kg, which is 7.58 UAH (+1.3%) more than in the previous month, but 123.36 UAH (+27%) more than last year.

Gouda cheese with a fat content of 45% from Ukrainian companies costs an average of 584.59 UAH/kg, which is 21.21 UAH (+4%) more than last month, but 95.38 UAH (+19%) more than last year.

“In Ukraine, in the second half of September, prices for most dairy products remain high, which may be due to food inflation. At the same time, domestic demand for dairy products is limited. There has been a decline in sales by retail chains and a decrease in demand for raw milk from milk processing enterprises,” explained Georgiy Kukhaleishvili, an analyst at the association.

He noted that imported cheeses, which are mainly imported into Ukraine from Poland, are more attractive in terms of price than products from domestic producers.

“With the suspension of milk exports to the EU, milk processing enterprises are working for stock, which, together with the decline in prices for exchange-traded goods on export markets, in particular butter, may put pressure on prices in the future. A certain revival of consumer demand for fresh dairy products is likely in winter,” the UDA concluded.

According to the results of the 2024-2025 marketing year (September 2024 – August 2025), Ukraine exported 158,000 tons of granulated beet pulp worth a total of $23.2 million, the National Association of Sugar Producers “Ukrtsukor” reported on Facebook.

The industry association noted that the largest importers of Ukrainian beet pulp were Germany with 22% of the total volume of its exports from Ukraine, Spain and Poland with 21% each, followed by Italy with 12% and the Netherlands with 9%.

According to the business association, the leaders in beet pulp exports were Radekhivsky Sugar, Almeida Group, and Ukrprominvest-Agro, which together exported 83% of the total volume.

“The production and export of granulated pulp is not only an effective use of a by-product of sugar production, which increases the profitability of the beet sugar industry as a whole, but also provides additional export revenue, which the country so badly needs today,” Ukrtsukor concluded.

On Thursday, October 2, Deputy Minister of Foreign Affairs of Ukraine Oleksandr Mishchenko accepted copies of the credentials of the newly appointed Ambassador of the Kingdom of Denmark to Ukraine, Thomas Lund-Sørensen, according to the press service of the Ministry of Foreign Affairs. According to the Foreign Ministry’s website, Mishchenko noted that the new ambassador’s extensive professional experience will be extremely valuable for the further development of bilateral relations.

He also praised Denmark’s leadership during its presidency of the EU Council in the second half of 2025 and its unprecedented support for Ukraine. Denmark is the absolute world leader in terms of aid relative to GDP – 2.89%, with total military aid reaching EUR9.4 billion.

In turn, Lund-Sørensen emphasized Denmark’s commitment to further support Ukraine, strengthen its defense capabilities, assist in its path to EU accession, and promote mutual benefits from the application of the “Danish model,” which is also an investment in the security of all of Europe.