LLC “Zaporozhye Casting and Mechanical Plant” (ZLMZ), created on the basis of the production workshops of the department of the chief mechanic of PJSC “Zaporizhstal”, which is part of the Metinvest group, has resumed its work.

According to the company’s information on Sunday, earlier the Metinvest group decided to withdraw the main equipment of ZLMZ from the conservation regime, while before that only duty teams came to the workplace to maintain the equipment in proper condition.

“We have every reason to resume work: the military situation in Zaporozhye is under control, we have received both standard orders and unique requests from customers, so now we are making every effort to fulfill them,” the words of the acting are quoted in the message. Director General of ZLMZ Igor Dolgozvezda.

It is specified that the plant has resumed the work of the main divisions: a mechanical workshop, a metal structure workshop and a section for the production of shaped castings. Currently, the Zaporizhia Casting and Mechanical Plant is planning to produce and restore parts for Metinvest enterprises – Zaporizhstal, Kametstal, Metinvest Pokrovskugol and mining and processing plants of the Metinvest group. The company is also mastering the production of new types of products – spare parts for mining and lifting vehicles.

Yury Dmitriev, the head of the ZLMZ machine shop, pointed out that after the information about the resumption of production, the workers immediately expressed a desire to return to work, and some employees even began to return from abroad.

“Before the war, we worked on a day/night/48 or 5/2 schedule. Now our workers are ready to work around the clock to load the equipment to the maximum and produce the maximum product,” Dmitriev said.

Work shifts for employees have been adjusted to reflect the curfew. The enterprise provides centralized transportation of workers by corporate transport.

According to the decision of the company, the priority right to employment for open vacancies of scarce professions at ZLMZ is granted to specialists evacuated from Mariupol to Zaporozhye.

It is indicated that the company is gaining pre-war momentum and even working on new technologies so as not to depend on foreign supplies.

The press service also reports that ZLMZ employees, as volunteers, joined the work of the Center for the Coordination of the Humanitarian Mission of Metinvest in Zaporozhye from the first days of its creation, taking part in the reception, sorting and formation of cargo with humanitarian aid and coordinating the reception of internally displaced persons at social facilities companies in Zaporozhye.

LLC “Zaporozhye Casting and Mechanical Plant” (ZLMZ) was established on the basis of the foundry and mechanical shops, as well as the shop of metal structures of the plant “Zaporizhstal” in mid-2016. At the same time, the steel plant remains the main partner of the plant, which is a diversified enterprise with a closed production cycle.

ZLMZ specializes in the production of castings from cast iron, as well as from alloyed, low-alloyed and high-alloyed steels, metal structures and metal parts. The company produces a wide range of products, which includes molds for metallurgical plants, building structures, spare parts and prefabricated assemblies. The main consumers of the plant’s products are enterprises of the mining and metallurgical and other industries.

The plant is part of the Metinvest group, the largest mining and metallurgical holding in Ukraine. The main shareholders of Metinvest are the SCM group (71.25%) of Rinat Akhmetov and Smart Holding (23.75%) of Vadim Novinsky, who jointly manage the company.

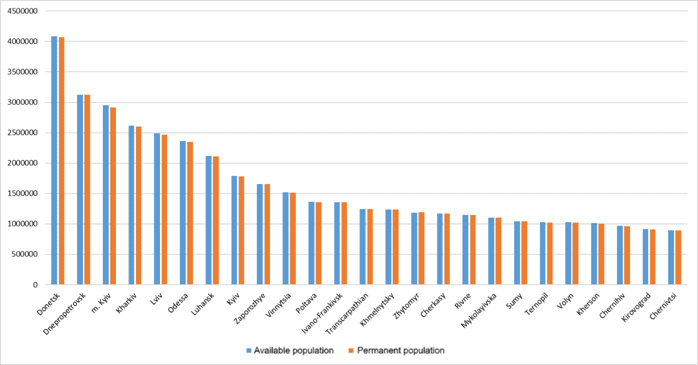

Ukrainian population by regions as of Dec 1, 2021 (graphically)

SSC of Ukraine

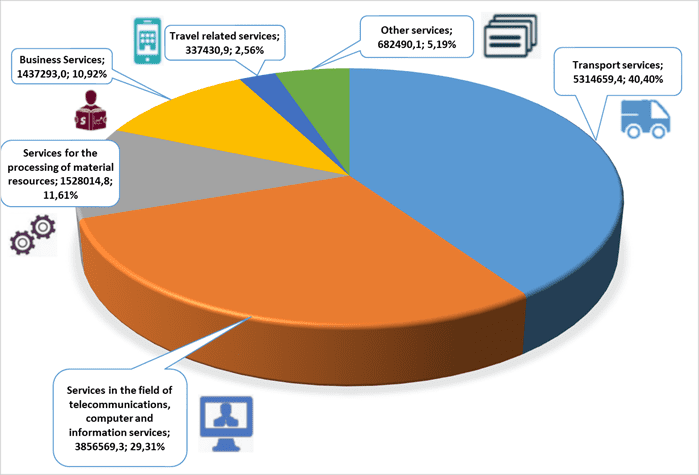

Structure of export of services in Ukraine in 2021

SSC of Ukraine

The reduction in expenditures of the general fund of the state budget-2022, which will allow UAH 73.32 billion to be allocated to the Reserve Fund, will affect a significant part of the managers, follows from the relevant resolution of the Cabinet of Ministers No. 401 of April 1, published on the government website on Sunday.

In particular, according to it, spending on the Verkhovna Rada will be reduced by UAH 270.8 million, the State Administration of Affairs – by UAH 121.5 million, the economic and financial department of the Secretariat of the Cabinet of Ministers – by UAH 271.6 million, the State Judicial Administration – by UAH 1 billion 576.3 UAH million Office of the Prosecutor General – by UAH 1 billion 402.6 million.

In addition, expenses were reduced for such administrators as the Ministry of Economy – by UAH 689.4 million (mainly for the State Food and Consumer Service and anti-epizootic measures), the Ministry of Foreign Affairs – by UAH 562.7 million, the Ministry of Health – UAH 588.7 million, the Ministry of Energy – UAH 510.6 million (mainly in the coal industry), the Ministry of Agrarian Policy – UAH 552.4 million (mainly the formation of the Loan Guarantee Fund in the agro-industrial complex and land inventory for the State GeoCadastre).

This list also includes the Ministry of Sports – UAH 1 billion 258.4 million, the Ministry of Finance with tax, customs and State Financial Monitoring – UAH 2 billion 507.3 million, the Ministry of Justice – UAH 669.4 million, the Ministry of Culture – UAH 847.2 million, the Ministry of Reintegration – 437, UAH 6 million, the National Academy of Sciences – UAH 549.8 million, the State Space Agency – UAH 245.2 million (of which rocket fuel disposal – UAH 240 million) and a number of other government agencies with smaller spending cuts.

However, the main cuts are in general state spending supervised by the Ministry of Veterans – UAH 5 billion 496.1 million (mainly subventions to local budgets), the Ministry of Education and Science – UAH 14 billion 771.3 million (including educational subsidies to local budgets – 10.8 billion UAH) and the Ministry of Social Policy – UAH 32 billion 147.5 million (including the Pension Fund – UAH 20.1 billion).

In addition, UAH 3 billion 774.4 billion will be released at the expense of the Ministry of Infrastructure, mainly due to the article on guaranteeing flights to Ukraine (UAH 3.63 billion) introduced on the eve of the war.

As reported, in March, the government already carried out the first such sequestration of the budget for UAH 107 billion – these funds were also directed through the Reserve Fund to finance priority needs during the war, including support for the army. As Minister of Finance Sergei Marchenko explained, the government has such powers within the framework of martial law introduced in the country.

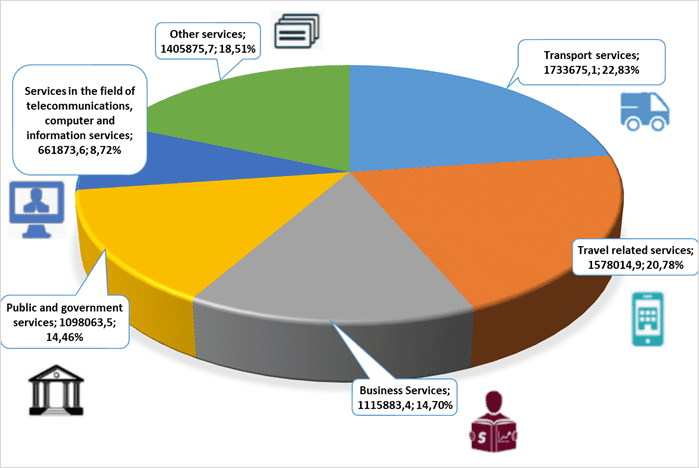

Structure of import of services in Ukraine in 2021

SSC of Ukraine

Minister of Foreign Affairs of Ukraine Dmytro Kuleba discussed with German Foreign Minister Annalena Baerbock the issues of toughening sanctions against the Russian Federation and strengthening the defense capability of Ukraine, and also thanked the German side for refusing to a demand of the Russian Federation to pay for energy in Russian currency.

“I spoke with Annalena Baerbock and thanked Germany for refusing to pay for Russian natural gas exports in rubles. Emphasized the need to impose new stiff sanctions on Russia. Informed on the frontline developments. The need to further strengthen Ukraine’s defense capabilities is urgent,” Kuleba wrote on Twitter on Saturday.