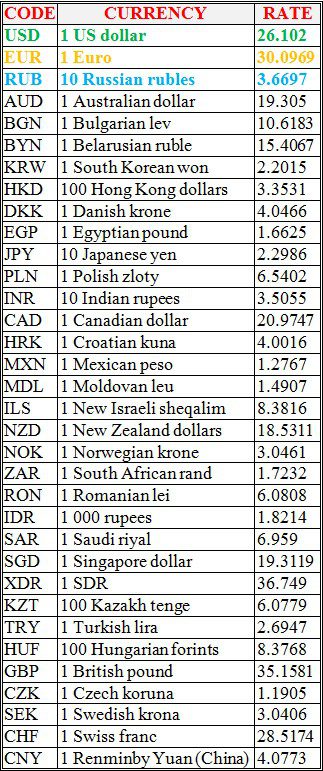

National bank of Ukraine’s official rates as of 08/11/21

Source: National Bank of Ukraine

A COVID certificate can be generated on the 15th day after the diagnosis of COVID-19 is established within 105 days.

This is confirmed by changes in the procedure for the formation and use of a COVID certificate confirming vaccination against COVID-19, as well as a negative test result or a person’s recovery from this disease.

The adopted changes, in particular, provide that a COVID certificate can be generated no more than twice in one calendar year (if it is technically possible to record the generated COVID certificates).

As reported, in the last four days of October, Ukrainians generated 1 million COVID certificates in the Diia application, their total number has already reached 5 million and continues to grow.

Earlier, the government made it easier to obtain COVID-certificates in Diia: now this does not require an electronic signature, in particular, Diia.Signature, which required proof of identity using a Photo ID.

The decree of President of Ukraine Volodymyr Zelensky on planting 1 billion trees within three years from the start of its implementation in June of this year as of November 8 was executed by 3.53%, in total 35.38 million trees were planted (plus 8.14 million over the past week) on a total area of 6,078 hectares.

The relevant information has been posted on the website of the state program Green Country.

It is clarified that the leading regions in forestation are Zhytomyr region, where 12.69 million trees have been planted, as well as Volyn (3.25 million), Chernihiv (2.27 million), Lviv (2.24 million), Kyiv (2.07 million) and Rivne (1.98 million) regions.

The least number of trees were planted in Kherson and Mykolaiv regions: 19,000 and 46,000 trees respectively.

As reported, Zelensky in June 2021 signed a decree on the implementation of the Green Country project in Ukraine to increase the number of forests in Ukraine. The goal of the project is to increase the forest area by 1 million hectares in 10 years. It is also planned to plant 1 billion trees in Ukraine in the next three years.

According to head of the State Agency for Forest Resources Yuriy Bolokhovets, planting 1 billion trees is necessary to minimize the effects of global climate change, create protective belts of trees to protect against dust storms, as well as increase the country’s forest cover from the current 15.9% to the minimum required 20%.

Former coach of the Ukrainian national football team Andriy Shevchenko has taken over the leadership of the Italian Serie A club Genoa.“Genoa CFC announces that Andriy Shevchenko has reached an agreement with 777 Partners [an American investment company, the recent owner of the club] and will lead the ‘griffins’ until June 30, 2024,” a message posted on the club’s website says.According to Italian media, Shevchenko’s assistants will be Mauro Tassotti and Luigi Nocentini, who also helped him in the Ukrainian national team.After 12 rounds of Serie A, Genoa is in 18th place with nine points.Shevchenko as a player played for Dynamo Kyiv, Milan and Chelsea in 1994-2012. He is the winner of the 2004 Golden Ball title and the Hero of Ukraine. He headed the Ukrainian national team in 2016-2021, with which he reached the quarter final match of the European Championship 2020.

On Sunday, the United Nations Children’s Fund (UNICEF) delivered to Ukraine 2,930,300 doses of mRNA vaccine from COVID-19 manufactured by Moderna, the Health Ministry of Ukraine said on its website.“Ukraine receives vaccines under the COVAX Facility free of charge. COVAX is an unprecedented initiative of solidarity among the international community to support access to effective and safe COVID-19 vaccines for all countries,” the message reads.“So far, 11 million Ukrainians have received at least one dose of COVID-19 vaccine … Moderna is the fourth vaccine available in Ukraine for vaccination against COVID-19. I thank the international partners for their systematic support and common desire to overcome the pandemic,” said Viktor Liashko, Minister of Health of Ukraine.Together with the newest supply, UNICEF has delivered 7,415,810 doses of vaccines by various manufacturers (Pfizer, Moderna, AstraZeneca and Sinovac) as part of COVAX.“We hope all educators complete their vaccination as soon as possible, including with vaccines from this batch, so schools are open and children return to classrooms … According to the latest UNICEF survey, 42% of Ukrainians who have not been vaccinated yet are ready to get vaccinated, which is encouraging. Please get protection now,” said Murat Sahin, UNICEF Representative in Ukraine.In turn, the World Health Organization (WHO) welcomes the delivery of the Moderna vaccine at the COVAX initiative to Ukraine. With everybody’s efforts, there are now vaccines available to administer a hundred thousand vaccines daily,” said Dr. Jarno Habicht, WHO Representative and Head of WHO Country Office in Ukraine.In-country storage and logistics of shipments of mRNA vaccines from COVAX, in accordance with the correct cold chain requirements, are provided by USAID. COVAX, the vaccines pillar of the Access to COVID-19 Tools (ACT) Accelerator, is co-led by the Coalition for Epidemic Preparedness Innovations (CEPI), the Vaccine Alliance Gavi, and the World Health Organization (WHO) – working in partnership with UNICEF as key implementing partner, as well as civil society organisations, vaccine manufacturers, governments of US, UK, European Union, World Bank, and others.