On average, three people a day ask to be declared insolvent

The number of people deciding to declare themselves bankrupt is growing in Ukraine. According to the Supreme Court, more than 2,900 Ukrainians have become bankrupt in the last five years. 577 Ukrainians have already filed for bankruptcy in the first six months of 2025. In 52% of cases, it is men who are asking to be declared insolvent. The highest number of bankruptcies this year is in Kyiv, Kyiv Oblast, and Lviv Oblast.

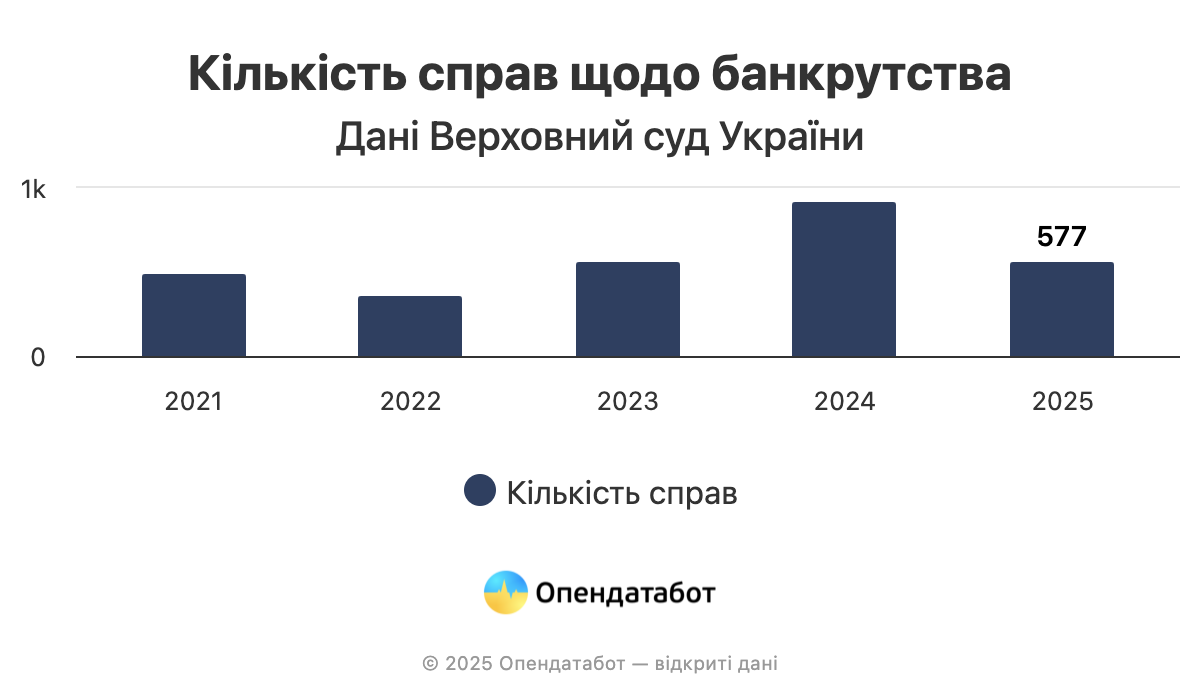

577 Ukrainians went bankrupt in the first half of 2025 in Ukraine. Such cases increased by 33% compared to the same period in 2024. In general, the largest number of people went bankrupt last year: 926 cases, but this year risks catching up with these figures.

On average, three new bankruptcy cases are opened every day this year.

A total of 2,948 bankruptcy cases involving citizens have been opened in the last five years. Although the bankruptcy procedure was officially introduced in 2019, Ukrainians only began to actively use it in 2021.

Fifty-two percent of cases since 2021 involve men, and 48% involve women. The gender gap is not critical and remains almost the same every year. For example, in 2021, men dominated (57.9%), while in 2022 and 2025, women slightly outnumbered men.

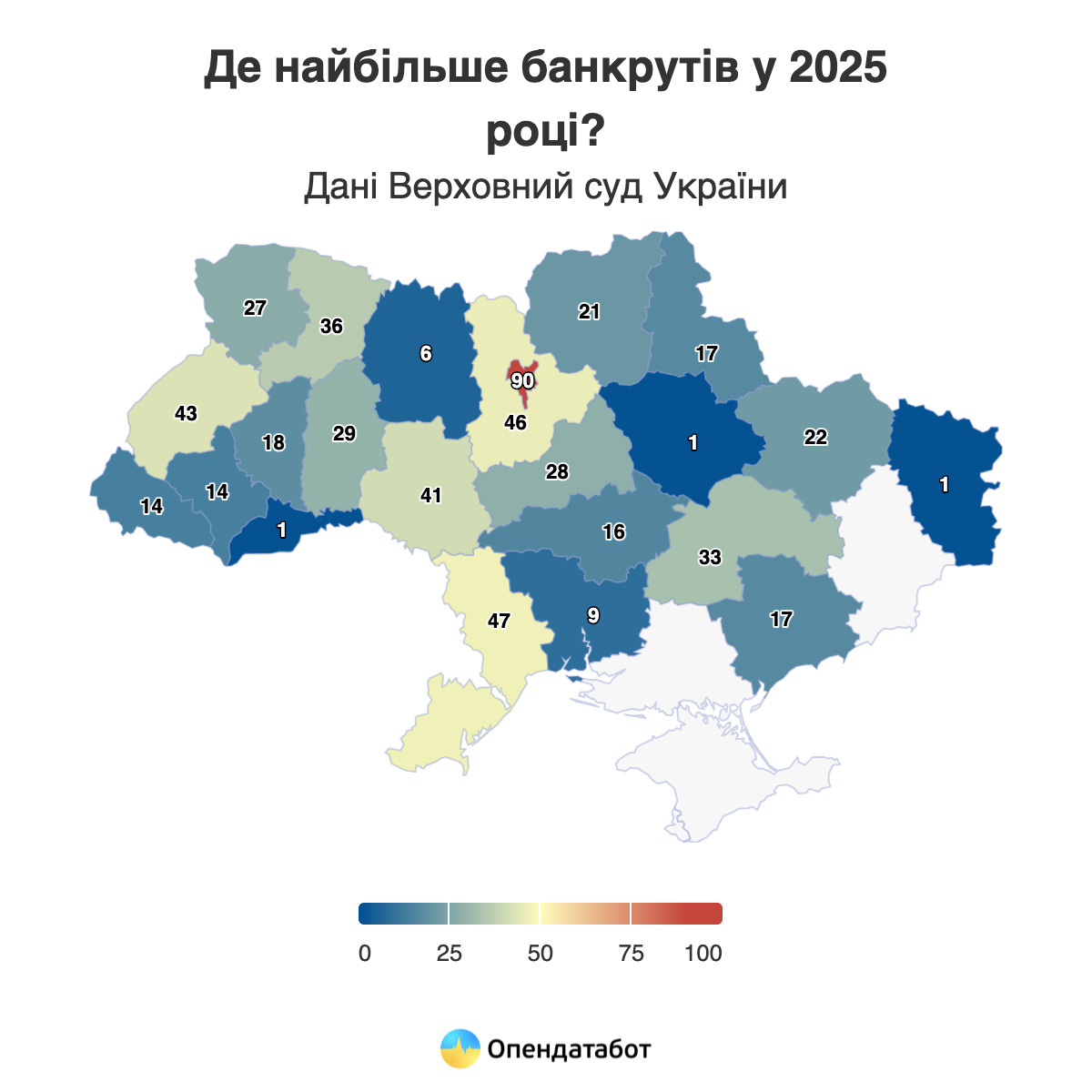

The largest number of bankruptcy cases in 2025 were opened in Kyiv — 128. Kyiv region is in second place with 83 cases, followed by Lviv, where 73 applications were filed.

You can check whether a person is bankrupt in OpenDataBot — just enter their TIN and you will receive complete information in a matter of seconds.

“The current increase in the number of bankruptcy cases is part of a steady trend that has been going on for several years. The procedure is gradually becoming more predictable: judicial practice is being developed, participants in the process are gaining experience, and the mechanism itself is working more smoothly. At the same time, creditors — banks and financial institutions — are becoming more demanding in terms of debt write-off or restructuring conditions. It is important to understand that bankruptcy is not a panacea for easy and painless “debt write-offs.” The consequences of insolvency will affect a person for at least several years,” comments Denys Pavlovych Lykhopok, lawyer, arbitration manager, member of the Qualification Commission of Arbitration Managers, and bankruptcy specialist.

According to him, there are still gaps in the procedure that need to be addressed. In particular, these relate to the tax consequences of restructuring and debt write-offs, as well as interaction with enforcement proceedings and other related court cases, which often remain outside the scope of insolvency cases.

https://opendatabot.ua/analytics/bankrupts-2025-6

Prices for construction and installation work in Ukraine in April-June 2025 increased by 5.5% compared to the same period in 2024, the State Statistics Service (Gosstat) reported. According to the State Statistics Service, in the second quarter of 2025 compared to the second quarter of 2024, prices increased in all segments of construction: in residential construction growth amounted to 6.6%, in non-residential – 5.6%, in engineering – 5%. Compared to the previous quarter, prices increased by 1.9%, 1% and 0.7% respectively.

In June-2025 to June-2024, prices of construction work increased by 5.1%, particularly in the residential sector by 5.9%, non-residential by 5.1%, and engineering by 4.7%. Compared to the previous month, prices increased by 0.4%, 0.5% and 0.3% respectively.

According to the results of six months, prices increased by 6.1%: 6.9% in residential construction, 6.3% in non-residential construction, 5.7% in engineering construction.

As reported, in 2024, prices for construction works increased by 7.9% year-on-year, and in 2023 – increased by 15.8% to 2022.

The State Statistics Committee pointed out that the figures are given without taking into account the temporarily occupied territories and part of the territories where hostilities are (were) conducted.

Rozetka opened 33 new stores in January-June 2025 and plans to launch 10 more by the end of the year, according to its press service.

“Despite constant threats, Rozetka opened 33 new stores in the first six months of 2025: 22 of its own and 11 franchises. This is almost half of last year’s figure, when the company added 74 new stores and entered 35 new cities,” the company said in a statement.

It is noted that the new stores will also include relocated facilities.

In addition, Rozetka continues to develop its network of parcel terminals and partner delivery points.

“At the beginning of 2024, there were only four parcel terminals, but now there are already 104,” the company’s press service reported.

Rozetka, an online store for electronics and household appliances, was founded in 2005 in Kyiv by Vladislav and Irina Chechotkin, and later the fund managed by Horizon Capital became a co-owner of the company. Today, the company has transformed into a multi-category online marketplace, but is also developing a network of its own stores. As of August 1, 2025, the network has 549 stores in 166 cities.

Azerbaijani President Ilham Aliyev has signed a decree allocating funds equivalent to $2 million to the Ministry of Energy of the Republic of Azerbaijan for the purchase of Azerbaijani-made energy equipment, which will be transferred to Ukraine as humanitarian aid.

“To allocate funds in manats equivalent to 2.0 (two) million US dollars from the reserve fund of the President of the Republic of Azerbaijan, provided for in the state budget of the Republic of Azerbaijan for 2025, to the Ministry of Energy of the Republic of Azerbaijan for the purchase and shipment of electrical equipment manufactured in the Republic of Azerbaijan for the purpose of providing humanitarian aid to Ukraine,” reads the text of the decree dated August 11, published on the website of the President of Azerbaijan.

As reported, on July 28, 2025, Naftogaz of Ukraine signed an agreement with SOCAR Energy Ukraine on the purchase of Azerbaijani natural gas. Under the agreement, test supplies will be carried out via the Trans-Balkan route through the Bulgaria-Romania-Ukraine corridor.

Ukraine’s second-largest mobile operator, Vodafone Ukraine (“Vodafone Ukraine,” VFU), which on July 15 announced a third offer to buy back its Eurobonds at a price reduced to 85% of their face value in connection with the payment of dividends, received applications for $53.395 million and satisfied them in the amount of $5.208 million.

“All purchased bonds have been cancelled, and following such cancellation, the total nominal value of bonds remaining in circulation is $292,532,259.80,” the company said in a statement on Monday on the Irish Stock Exchange.

Vodafone Ukraine recalled that the scaling factor was 0.131545188948731, and the tender offer was settled on August 6.

The first two times, Vodafone Ukraine redeemed bonds for an amount equivalent to EUR1 million, and the third time for an amount equivalent to EUR1 million + $3.5 million.

The debut buyback was announced at 99% of par value, the second at 90% of par value, and the third at 85% of par value. The company did not announce the results of the second buyback on the exchange, while the scaling factor for the first buyback was 0.0040355668.

The buyback of Eurobonds is related to the fact that on April 24, 2025, VFU announced the payment of dividends to its shareholder in the amount of UAH 660.245 million ($15.9 million at the exchange rate specified in the announcement) for 2024. According to the restrictions of the National Bank, they will be paid in separate monthly dividend payments. Each such monthly dividend is expected to amount to the equivalent of EUR1 million in hryvnia.

The company emphasized that under the terms of the bond issue, in this case, it must offer all bondholders to submit an application for their sale for an amount equal to the amount of dividends paid outside Ukraine.

VFU previously recalled that a total of $300 million in bonds maturing in February 2027 with a nominal rate of 9.625% per annum were issued, of which the company currently holds $0.5 million in bonds.

As reported, VFU increased its revenue by 13.1% to UAH 24.44 billion in 2024, while reducing its net profit by 30.1% to UAH 3.54 billion.

In January-March 2025, revenue grew by 14% compared to the same period in 2024, to UAH 6.59 billion, while net profit fell by 24%, to UAH 697 million.

Ruukki ventilated facades now have a Global Warming Potential (GWP) rating, allowing architects and customers to monitor the environmental performance of materials and improve the sustainability of construction projects, according to Rauta.

GWP, expressed in kilograms of CO₂ equivalent per square meter, makes it possible to compare the environmental performance of different building materials and assess their impact on climate change within the life cycle assessment of a building.

“The availability of GWP allows customers to make informed choices in favor of the most environmentally friendly materials and earn additional points in certification according to international environmental standards LEED and BREEAM,” said Rauta Director Andriy Ozeychuk.

GWP data is available on the pages of the corresponding Ruukki ventilated facade products.

Rauta is a Ukrainian company specializing in the supply and implementation of modern building solutions using sandwich panels, steel structures, and energy-efficient technologies.

As the official representative of Ruukki in Ukraine, the company implements projects in industrial, commercial, and civil construction.