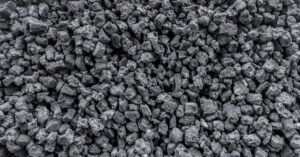

In January-April of this year, Ukraine increased imports of coke and semi-coke in physical terms by 64.2% compared to the same period last year – to 256,628 thousand tons from 156,255 thousand tons.

According to statistics released by the State Customs Service (SCS) on Tuesday, imports of coke in monetary terms increased by 47.8% during this period, to $82.920 million. It was mainly imported from Poland (86.87% of supplies in monetary terms), Indonesia (11.54%), and the Czech Republic (1.57%).

During the period in question, Ukraine exported 3 tons of coke worth $2,000 to Albania.

As reported, Metinvest suspended the operations of the Pokrovsk Coal Group in January this year due to changes in the situation on the front line, power shortages, and the deterioration of the security situation.

Last year, Ukraine increased imports of coke and semi-coke in physical terms by 2.01 times compared to 2023, to 661,487 thousand tons, importing it mainly from Poland (84.76% of supplies in monetary terms), Colombia (7.74%), and Hungary (2.69%). In monetary terms, imports increased by 81.9% to $235.475 million.

In 2024, the country exported 1,601 thousand tons of coke, 84.76% of which went to Moldova ($368 thousand) to Moldova (99.18%) and Latvia (0.82%), while in January, March, October, and November 2024, there were no exports, whereas in 2023, exports amounted to 3,383 tons worth $787 thousand.

Imports of electric generator sets and rotary electric converters (HS code 8502) to Ukraine in January-April 2025 increased sevenfold in monetary terms compared to the same period in 2024, reaching $516.31 million, according to statistics from the State Customs Service (SCS).

According to SCS data, electric generators and converters were most often imported from the Czech Republic (18% of total exports of these products, or $93.7 million), Austria (15.6%, or $80.3 million), and the United States (15%, or $77.3 million), while a year earlier it was the Czech Republic ($15.36 million), Austria ($15.2 million), and China ($14.1 million).

In particular, in April, imports of this equipment increased almost fivefold compared to April last year, but decreased by 6% compared to March this year, to $83.14 million.

Ukraine exported electric generators in January-April in insignificant volumes ($1.9 million), mainly to Latvia, Bulgaria, and Turkey.

In addition, according to the State Customs Service, imports of electric accumulators and separators to Ukraine increased 2.3 times in four months to $288.35 million, mostly from China (78.4%), as well as Taiwan (5.3%) and Bulgaria (4.1%).

At the same time, in April, imports of these products increased by more than 81% compared to April 2024, to $70.52 million, which is also 7% higher than in February 2025.

In four months, Ukraine exported batteries worth $17.1 million, mainly to Poland (27.9%), France (15.9%), and Germany (11.3%).

As reported, at the end of July 2024, Ukraine exempted the import of electric generator equipment and batteries from customs duties and VAT.

According to the State Customs Service, in 2024, imports of electric generators and converters to Ukraine increased by 3.7% compared to 2023, to $732.5 million, and batteries more than doubled, to $950.6 million.

In January-April of this year, Ukraine significantly increased imports of aluminum ore and concentrate (bauxite) in physical terms compared to the same period last year, to 13,494 thousand tons from 163 tons.

According to statistics released by the State Customs Service (SCS) on Tuesday, during this period, imports of bauxite in monetary terms increased 10.9 times, to $1.476 million from $136 thousand.

At the same time, imports came mainly from Turkey (82.24% of supplies in monetary terms) and China (17.76%).

Ukraine did not re-export bauxite in 2025, as in 2024 and 2023.

As reported, in 2024, Ukraine increased imports of bauxite in physical terms by 77.4% compared to 2023, to 35,173 thousand tons, and in monetary terms by 74%, to $4.107 million. Imports were mainly from Turkey (78.48% of supplies in monetary terms), China (19.48%), and Spain (1.9%).

In 2023, Ukraine imported 19,830 tons of bauxite worth $2.360 million.

In 2022, Ukraine reduced imports of aluminum ores and concentrates (bauxite) in physical terms by 81.5% compared to the previous year, to 945,396 tons. Imports of bauxite in monetary terms decreased by 79.6% to $48.166 million. Imports came mainly from Guinea (58.90% of supplies in monetary terms), Brazil (27.19%), and Ghana (7.48%).

Bauxite is an aluminum ore used as a raw material for the production of alumina, which is then used to produce aluminum. It is also used as a flux in ferrous metallurgy.

Bauxite is imported into Ukraine by the Mykolaiv Alumina Plant (MHP).

According to SERBIAN ECONOMIST, German pharmaceutical company Phoenix Pharma has announced plans to invest around €14 million in the construction of a modern distribution center in Leskovac, Serbia. The project involves the creation of a 1.5-hectare facility as part of the development of the Leskovac Green Zone, which is positioned as a key logistics and business hub for the region.

Strategic importance of the project

The new center will serve not only the local market but also the entire territory of Serbia, ensuring the efficient distribution of pharmaceutical products, including medicines, food supplements, cosmetics, and medical devices. It is expected to create around 120 jobs, which will be a significant contribution to the development of the region’s economy.

The mayor of Leskovac, Goran Cvetanovic, emphasized the importance of this investment project for the local economy, noting that it contributes to the creation of new jobs and strengthens the position of the “Green Zone” as a key business area.

Phoenix Pharma is a subsidiary of Phoenix Pharmahandel AG & Co KG, one of the largest pharmaceutical distributors in Europe. The company is headquartered in Mannheim, Germany. Phoenix Pharmahandel operates in more than 27 European countries, providing distribution services for pharmaceuticals, medical devices, and related products.

In the 2023 financial year, the group’s turnover exceeded €25 billion, and it employed more than 39,000 people. The company is actively investing in the expansion of its logistics network, including the construction of new distribution centers and the introduction of modern technologies to optimize supply chains.

Phoenix Pharmahandel has an extensive geographical presence, including countries such as Germany, France, Italy, Spain, the United Kingdom, the Netherlands, Belgium, Austria, Switzerland, Poland, the Czech Republic, Slovakia, Hungary, Romania, Bulgaria, Serbia, and others. The company serves more than 150,000 customers, including pharmacies, hospitals, and other medical institutions, ensuring the timely and reliable delivery of pharmaceutical products.

Source: https://t.me/relocationrs/963

PJSC Vinnytsia Dairy Plant Roshen, part of the Roshen confectionery corporation, will pay shareholders UAH 86.394 million in dividends from net profit for 2024.

“To pay annual dividends on the company’s ordinary registered shares in the amount of UAH 86 million 393 thousand 928.60 UAH from net profit for 2024 at a rate of 461.58 UAH per ordinary registered share,” according to the decision of the general meeting of shareholders published in the information disclosure system of the National Securities and Stock Market Commission (NSSMC) on Friday.

Dividends will be paid directly to shareholders within a period not exceeding six months from the date of the general meeting’s decision to pay dividends.

In addition, the shareholders extended the term of office of the supervisory board in its entirety: Volodymyr Yarandin was re-elected as chairman, and Serhiy Zaitsev and Valentina Vyshnevska retained their positions as members of the board. Yarandin and Zaitsev represent the interests of the shareholder

Ukrainian Confectionery Holding LLC, while Vyshnevska represents the state-owned enterprise Roshen Confectionery Company.

At the same time, the shareholders gave their preliminary consent to the private joint-stock company to enter into major transactions related to the issuer’s financial and economic activities, the subject of which may include, in particular, the purchase or sale of works or services whose value exceeds 25% of the value of assets according to the latest annual financial statements, with a maximum total value of UAH 10 billion. The transactions may be carried out within one year from the date of such decision.

PJSC Vinnytsia Milk Plant Roshen was founded in 1999 in Vinnytsia. The milk plant is the main supplier of raw materials for the corporation’s factories. The plant has a capacity to process 600 tons of milk per day and produce up to 50 tons of dry milk products, up to 30 tons of butter, up to 10 tons of milk fat, and up to 75 tons of condensed milk. Raw materials are supplied from 10 regions of Ukraine, for which the plant has its own motor transport enterprise.

The plant’s products are exported to more than 50 countries around the world, namely Eastern Europe, Asia, North America, and Africa.

According to Opendatabot, in 2024, the plant increased its revenue by 20.6% to UAH 4.322 billion, increased its net profit by 12.9% to UAH 226.023 million, and reduced its debt obligations by 1.1% to UAH 234.29 million. The company’s assets are estimated at UAH 1.221 billion. The plant employs 228 people.

The authorized capital is UAH 9.358 million.

The ultimate beneficiary of the company is Oleksiy Poroshenko, the son of the fifth president of Ukraine, Petro Poroshenko.