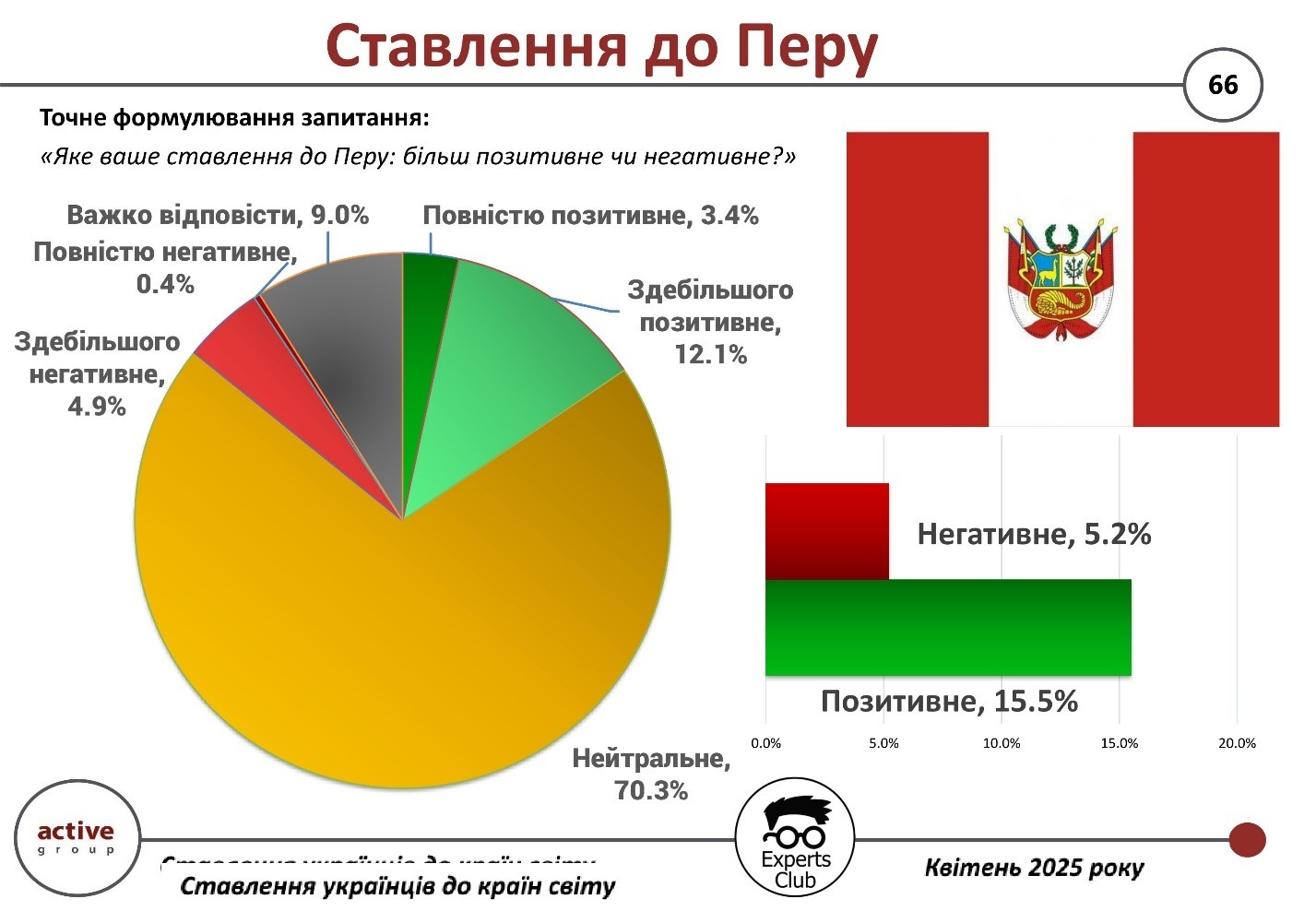

The results of a sociological survey conducted by Active Group in collaboration with Experts Club show that most Ukrainians do not have a formed opinion about Peru.

Thus, 70.3% of respondents chose a neutral position, while another 9.0% were unable to answer. Such a high level of neutrality indicates limited knowledge about the country among the general public.

At the same time, 15.5% of Ukrainians demonstrated a positive attitude (of which 12.1% were mostly positive and 3.4% were completely positive). A negative attitude was expressed by 5.2% (mostly moderately negative).

“Peru is associated with exoticism, Inca heritage, and Machu Picchu, but it is not an active player in the Ukrainian information space. Because of this, it arouses curiosity but not strong emotions,” notes Maksim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

Most Ukrainians have a neutral attitude toward Peru, but the proportion of those who like it exceeds the proportion of those who are critical. This creates a basis for potential improvement in intergovernmental contacts in the future.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

As of May 9, Ukraine has sown 4.32 million hectares with spring grain and leguminous crops, which is in line with last year’s figure and accounts for 76% of the plan, the Ministry of Agrarian Policy and Food reported on Friday.

According to its data, 1.07 million hectares were sown during the week, reducing the gap with last year’s sowing schedule by 6.1%.

As noted by the Ministry of Agrarian Policy, 2.9 million hectares have already been sown with corn (1.92 million hectares a week earlier), 733,400 hectares with barley (715,200 hectares), 212,600 hectares with spring wheat (207,900 hectares), 208,900 hectares with peas (205,700 hectares), and 157,000 hectares with oats (157,000 hectares). ha (207.9 thousand ha), peas – 208.9 thousand ha (205.7 thousand ha), oats – 157 thousand ha (157 thousand ha), buckwheat – 16.3 thousand ha (7 thousand ha), millet – 15.7 thousand ha (6 thousand ha).

According to the plan, corn sowing reached 73%, barley – 94%, spring wheat – 93%, peas – 96%, oats – 97%, buckwheat – 18%, millet – 20%.

Last year, as of May 10, corn was sown on 2.84 million hectares, barley – 779,900 hectares, spring wheat – 244,900 hectares, peas – 161,600 hectares, oats – 165,000 hectares, buckwheat – 14,800 hectares, millet – 28,500 hectares.

According to information from the Ministry of Agrarian Policy, the Poltava region leads in terms of sowing rates with 509,700 hectares, followed by the Kirovograd region with 352,000 hectares, the Chernihiv region with 349,700 hectares, the Cherkasy region with 339,800 hectares, and the Sumy region with 294,300 hectares.

Technical crops were sown on an area of 5.2 million hectares, compared with 3.432 million hectares a week earlier and 5.42 million hectares last year on the same date.

In particular, sunflower crops reached 3.5 million hectares (2.36 million hectares a week earlier and 3.96 million hectares last year), soybeans – 1.3 million hectares (0.73 million hectares and 1.20 million hectares), and sugar beet – 1.2 million hectares (0.73 million hectares and 1.20 million hectares). ha (2.36 million ha a week ago and 3.96 million ha last year), soybeans – 1.3 million ha (0.73 million ha and 1.20 million ha) and sugar beets – 0.22 million ha (0.22 million ha and 0.25 million ha).

The Ministry of Agrarian Policy notes that sunflower crops currently account for 69% of the plan, soybeans – 55.9%, and sugar beets – 99%.

According to the Ministry of Internal Affairs (MIA), Ukrainians lost more than 3,100 mobile phones in the first quarter of 2025. This is almost 34% less than in the same period last year. In total, almost 20,000 phones were stolen or lost in Ukraine in 2024. Almost 70% of all lost phones are XIAOMI, SAMSUNG, and IPHONE.

3,191 mobile phones have already been stolen and lost in Ukraine since the beginning of 2025. This is almost 34% less than in the same period last year.

Overall, the number of smartphone thefts and losses is decreasing year by year. In 2024, 19,463 phones were stolen or lost, which is 33% less than in 2023.

The largest number of stolen or lost mobile phones this year was recorded in Kyiv — 352 cases (11% of the total). Zaporizhzhia (331 cases) and Kyiv (330 cases) regions accounted for 10% of smartphone thefts. The fewest mobile phones were stolen in the Kherson region (only 4 cases).

For four years in a row, XIAOMI, SAMSUNG, and IPHONE have been the most sought-after brands among thieves. They account for almost 70% of all lost phones this year. In the first quarter of 2025, thieves stole or Ukrainians lost 997 XIAOMI phones, 638 SAMSUNG phones, and 573 IPHONE phones.

It should be noted that the rating of the most sought-after mobile phones, according to the network of household appliances and electronics stores Comfy, is slightly different. Buyers’ preference fell on SAMSUNG, APPLE, and REDMI.

https://opendatabot.ua/analytics/stolen-phones-2024

The results of a sociological survey conducted by Active Group in collaboration with Experts Club show that Ukrainians’ attitude toward Paraguay is mostly neutral or uncertain.

According to the study, 73.5% of respondents hold a neutral position, while another 10.3% were unable to give a clear answer. Together, this accounts for over 83% of those surveyed, indicating an almost complete lack of knowledge about the country.

Only 10.1% of Ukrainians have a positive attitude toward Paraguay, of which 7.3% chose “mostly positive” and 2.8% “completely positive.” A negative attitude is held by 6.2% — 5.8% “mostly negative” and 0.4% “completely negative.”

“Paraguay is a country that is rarely mentioned in the news or public discourse. As a result, most Ukrainians have no emotional or informational connection to it,” explains Maksim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

Ukrainians know almost nothing about Paraguay. This attitude is the result of an information vacuum, not established prejudices or sympathies.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

In April 2025, Express Insurance paid out UAH 46.6 million, including UAH 37.4 million for comprehensive motor insurance and UAH 9.3 million for compulsory civil liability insurance, according to the company’s website.

In April, the company settled 620 insurance claims under CASCO and MTPL agreements, of which 522 were under CASCO and 98 under MTPL.

Incidents under CASCO contracts in April mainly involved traffic accidents, as well as damage to vehicles due to falling objects, animal attacks, natural disasters, and the actions of third parties. Most of the claims came from Kyiv and the surrounding region, accounting for about 59% of all cases.

According to the report, the largest payouts in April included: UAH 3.6522 million for a car that veered off the road and overturned into a ditch in the Rivne region on the Kyiv-Lviv highway, UAH 2.616 million as a result of an accident at a roundabout in the Zhytomyr region, and UAH 993,200 for a collision with a roe deer in the Vinnytsia region.

In addition, Express Insurance continues to support customers outside Ukraine. In April, the company’s customers sought assistance from various European countries. Most often, they came from Portugal, Poland, Spain, and Italy. Individual cases were also settled in the Netherlands, Germany, France, Latvia, Moldova, the Czech Republic, Slovakia, and Hungary. Most of the cases involved traffic accidents or damage caused by external factors, and there was one case of car theft. In Italy, a customer left his car in a parking lot and later discovered that it was missing. The company confirmed the theft and paid compensation in the amount of UAH 4.69 million. In the Czech Republic, a customer’s car was hit by a garbage truck with a metal protrusion at a gas station (the payment amounted to UAH 185,600). In Slovakia, a customer was unable to avoid a collision with an obstacle while driving, and UAH 129,900 was paid out.

As for MTPL payments, in more than 66% of cases, the paperwork was completed with the participation of the police, and in about 34% of cases, the Europrotocol procedure was followed. Most claims were received from Kyiv, Dnipro, Odesa, Kropyvnytskyi, Zaporizhzhia, Ternopil, Uzhhorod, Lviv, Zhytomyr, Kharkiv, and Cherkasy.

Express Insurance was founded in 2008 and is part of the UkrAVTO group of companies. It specializes in car insurance. The consistently high speed of claims settlement is ensured by optimal interaction with partner service stations.

Since April 2012, Express Insurance has been an associate member of the Motor Transport Insurance Bureau of Ukraine.

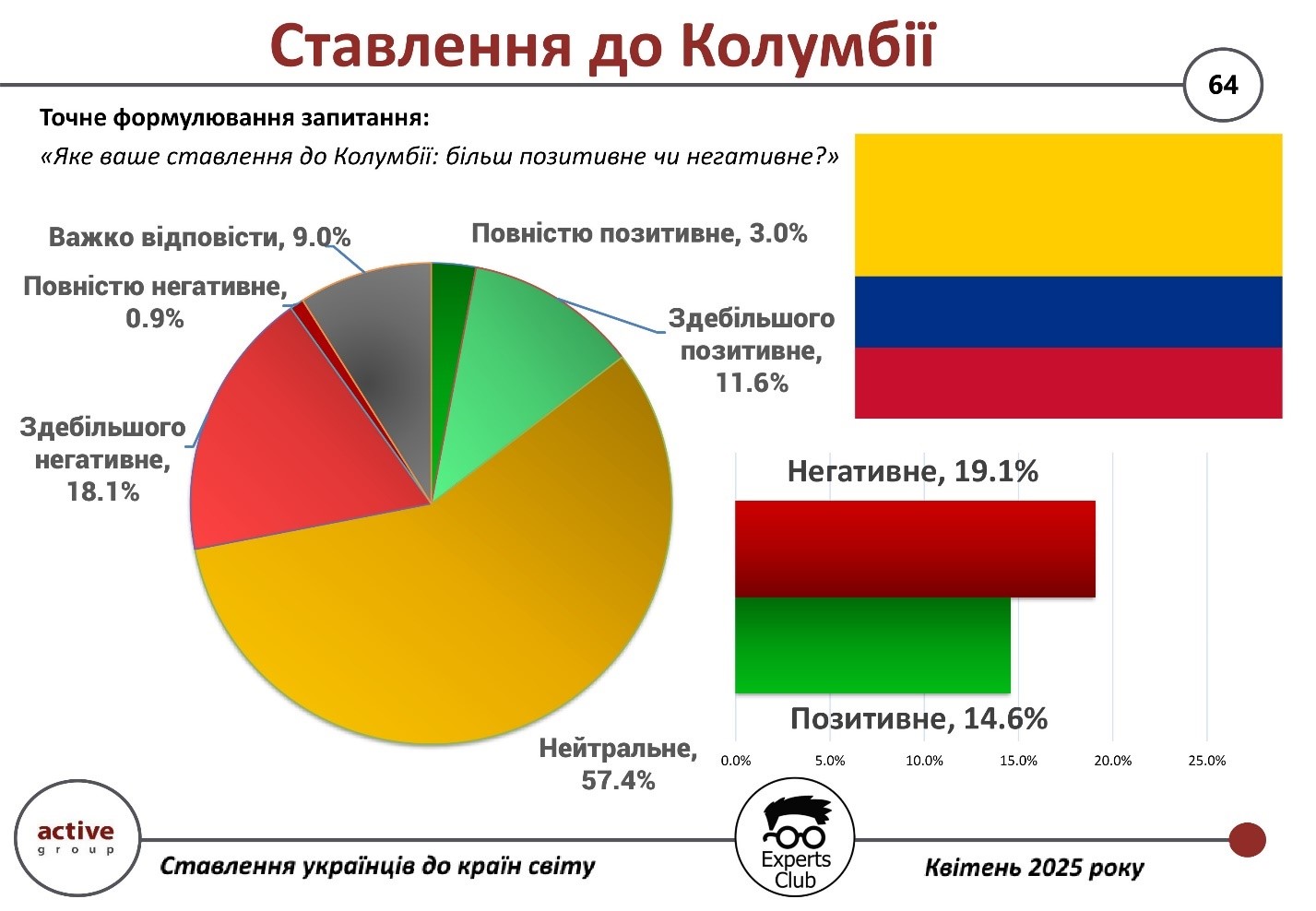

According to a survey conducted by Active Group in collaboration with the information and analytical center Experts Club, Ukrainians’ attitudes toward Colombia remain mostly neutral or negative.

According to the results, 57.4% of respondents hold a neutral position, while 19.1% expressed a negative attitude. Of these, 18.1% said their attitude was “mostly negative” and another 0.9% said it was “completely negative.”

A positive attitude is held by 14.6% of Ukrainians — 11.6% chose “mostly positive” and 3% “completely positive.” Nine percent of respondents were unable to decide on an answer.

“The image of Colombia in popular culture as a country with high crime rates, drug cartels, and political instability influences perceptions. Even with minimal news coverage, this associative framework remains,” comments Maxim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

Colombia has one of the highest levels of negative perception among Latin American countries. This demonstrates the power of stereotypes in shaping public opinion, even with a small amount of relevant information.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN