Despite strategic partnership and large-scale support during the war, Ukrainians’ attitudes toward the US are becoming increasingly complex and ambiguous. This is evidenced by the results of a nationwide poll conducted by Active Group in conjunction with the Experts Club information and analytical center in April 2025.

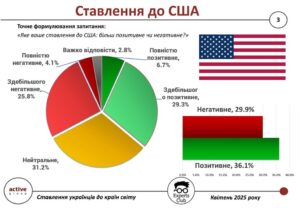

According to the survey, 36.1% of Ukrainian citizens have a generally positive view of the United States (29.3% mostly positive, 6.7% completely positive). At the same time, 29.9% of respondents have a negative attitude (25.8% mostly negative, 4.1% completely negative). Another third — 31.2% — remain neutral, and 2.8% were unable to give a definite answer.

“For many Ukrainians, the US is still a guarantor of support, but it is also a country with an ambivalent role in global conflicts, which can cause mixed reactions in society,” said Experts Club founder Maxim Urakin.

“These data show that Ukrainians recognize the important role of the US in supporting our country during the war, but at the same time remain critical of Washington’s current actions in global politics,” said Alexander Pozniy, co-founder of Active Group.

The poll was part of a broader study examining Ukrainians’ international sympathies and antipathies in the context of contemporary geopolitics.

The study can be found at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

The Ukrainian Chamber of Commerce and Industry is advocating the creation of military risk insurance mechanisms for exporters and investors. As Chamber President Gennady Chizhikov said in an exclusive interview with the Interfax-Ukraine news agency, this will stimulate the return of international capital to the Ukrainian economy.

“This is critically important in times of instability. Investors need to see predictability and have guarantees that their assets will be protected. We are putting together proposals for the government and international partners,” he said.

For more details, see the interview at https://interfax.com.ua/news/interview/1069297.html

OTP Bank (Kyiv) received UAH 1.19 billion in net profit in January-March 2025, which is 24% or UAH 0.37 billion less than in the first quarter of 2024.

According to the bank’s financial statements for the first quarter of 2025, pre-tax profit amounted to UAH 1.59 billion, which is 23.7%, or UAH 0.49 billion, less than in the same period of 2024.

OTP’s net interest income for the reporting period increased by 5.5% to UAH 2.26 billion, while net commission income increased by 10.7% to UAH 0.27 billion.

It is noted that in the first quarter of 2025, the bank’s profit from foreign currency transactions decreased by 21.4% to UAH 0.05 billion, while profit from foreign currency revaluation amounted to UAH 0.25 billion, compared to a loss of UAH 0.14 billion in the first quarter of 2024.

At the same time, in January-March this year, OTP recorded a net loss from transactions with financial instruments at fair value and an impairment loss of UAH 0.28 billion and UAH 0.15 billion, respectively, while in January-March last year, profits from these two items amounted to UAH 0.20 billion and UAH 0.28 billion, respectively.

The bank’s expenses for employee compensation increased by 12.5% to UAH 0.51 billion, while other operating and administrative expenses increased by 8.8% to UAH 0.16 billion.

According to the report, OTP increased its loans and advances to banks from UAH 10.8 billion to UAH 24.22 billion during the reporting period, while investments in securities decreased from UAH 62.37 billion to UAH 50.73 billion. Loans and advances to customers increased by 3.6% and amounted to UAH 32.41 billion.

OTP’s total assets since the beginning of the year increased by 4.7%, or UAH 5.34 billion, to UAH 119.25 billion, while liabilities increased by 4.2%, or UAH 3.93 billion, to UAH 93.20 billion.

Thanks to profitable operations, the bank’s equity increased by 6.8%, or UAH 1.4 billion, to UAH 22.01 billion in the first three months of this year, including retained earnings of UAH 13.39 billion.

According to the National Bank of Ukraine (NBU), as of early February 2025, OTP Bank ranked among the top 10 leaders in terms of total assets among 61 banks, with UAH 121.97 billion.

The association of trade union health and wellness facilities of Ukraine, Ukrprofzdravnitsa, reported a net profit of UAH 14.6 million in 2024, compared with a loss of UAH 60.9 million in 2023.

According to the association’s disclosure to the National Securities and Stock Market Commission (NSSMC), its net income increased by 25.4% to UAH 17.2 million.

According to the report, Ukrprofzdravnitsa’s assets grew by 8.2% in 2024, to UAH 927 million. At the same time, current liabilities decreased by 0.2%, to UAH 93.4 million, while long-term liabilities were absent at the end of the year.

The PJSC’s uncovered loss last year decreased by 6.3% and amounted to UAH 282.1 million.

As noted, 17 sanatorium and resort facilities of the association carried out medical activities in 2024. The largest number of patients were admitted to the state-owned enterprise (SOE) Clinical Sanatorium Roscha (8,500 people), SOE Clinical Sanatorium Khmilnyk (7,100) and SOE Clinical Sanatorium Karpaty (6,300).

In addition, last year, Ukrprofzdravnitsa facilities accommodated 220 internally displaced persons, including 65 children. Also, 12,000 military personnel and their family members underwent health improvement in its facilities, of whom 11,400 underwent rehabilitation.

Ukrprofzdravnitsa was founded by the Federation of Trade Unions of Ukraine and the Social Insurance Fund of Ukraine for Temporary Disability. It is the largest association in the field of sanatorium and resort services in the country. It has 61 mineral water deposits and 13 therapeutic mud deposits at its disposal.

Telecom provider Vega, part of the VF Ukraine group (Vodafone Ukraine), increased its revenue by 28% in 2024 compared to 2023, to UAH 626.5 million, the company’s press service reported.

More than half of the company’s revenue came from B2B and B2C services using modern fiber-optic technologies, amounting to UAH 345 million compared to UAH 261 million a year earlier, according to a press release issued by Vega on Tuesday.

The main sources of cash flow remain broadband Internet access services using optical technologies, IP telephony for business customers, and revenue from the sale of electronic communications services to other operators/providers, the press service reported.

Vega’s OIBDA in 2024 doubled compared to 2023, reaching UAH 21.1 million. The company’s capital investments increased by 80% to UAH 506 million. Ninety percent of customers were provided with Internet access via GPON (Gigabit Passive Optic Network) technology. The company invested in the construction of new energy-efficient networks, the reconstruction of existing ones, and the provision of alternative power sources for technical sites.

The company is not only building new Internet access zones, but also actively modernizing its network, transferring subscribers from FTTx technologies to modern GPON, according to the press release.

“In 2024, we significantly strengthened our energy resilience by installing nearly 2,000 lithium-iron phosphate batteries and over 300 new alternative power systems. Thanks to this, Vodafone Gigabit Net home internet customers can stay online for over 72 hours even during power outages,” the Vega press service quoted the company’s CEO Sergey Skripnikov as saying.

According to him, in 2025, Vega will continue to expand GPON coverage and will use this technology to connect Vodafone mobile network base stations.

“This is a step towards a unified digital infrastructure that will ensure readiness for the introduction of 5G and future technologies,” Skripnikov emphasized.

In 2024, Vega expanded its presence to seven more cities: Poltava, Chernihiv, Rivne, Lutsk, Ternopil, Zhytomyr, and Ivano-Frankivsk. It built a GPON network in 4,227 apartment buildings (470,016 households). Its customer base grew by 64%. Vega is currently present in 22 regions of Ukraine.

The company continues to provide Wi-Fi access to over 100 shelters and bomb shelters, and supports military units and government agencies with communications. In total, since the start of the full-scale Russian invasion, Vega has provided approximately UAH 4 million in aid to the country.

In 2024, Vega paid 9% more taxes than in 2023 – UAH 134.9 million.

Earlier it was reported that in 2023, Vega increased its revenue by 15% compared to 2022, to UAH 491.2 million.

In addition to Vega, VF Ukraine also owns the internet provider Freenet, which it acquired in August 2023.

Insurance company Knyazha Vienna Insurance Group (Knyazha VIG, Kyiv) collected UAH 876.9 million in insurance payments in January-March 2025, which is 61.3% more than in the same period of 2024.

According to the company’s website, net premiums for the reporting period increased by 32.2% to UAH 453.8 million. UAH 312.4 million was transferred to reinsurance, which is 71.3% more than in the first quarter of 2024.

During the reporting period, the company paid out UAH 276.3 million in claims, which is 34.4% more than in the first quarter of 2024.

Administrative expenses in the first quarter amounted to UAH 17.454 million (+9.4%), while distribution expenses amounted to UAH 263.3 million (+23.2%).

Gross profit amounted to UAH 177.5 million (+28.9%).

The financial result from operating activities was UAH 43.6 million, the financial result before taxation was UAH 73.4 million (+3.3 times), and net profit was UAH 60.756 million, which is 3.4 times more than in the first quarter of 2024.

PJSC “IC ‘Knyazha Vienna Insurance Group’ is part of the Vienna Insurance Group Ukraine, whose main shareholder is Vienna Insurance Group AG Wiener Versicherung Gruppe (Austria). The group also includes PJSC “Insurance Company ‘Ukrainian Insurance Group’ – 100%, PJSC ‘Insurance Company ’KnyazhaLAIF Vienna Insurance Group” – 97.8%, LLC “USG Consulting” – 50.7%, LLC “VIG Services Ukraine” – 78.7%, LLC “Assistance Company ‘Ukrainian Assistance Service’ – 100%.