Over the past six months – from September 2024 to March 2025 – the debt of the state-owned enterprise Guaranteed Buyer (Guaranteed Buyer) to renewable energy producers operating at the feed-in tariff has decreased by 37.7% to UAH 22.3 billion from UAH 35.8 billion.

This was announced by Artem Nekrasov, Head of Guaranteed Buyer, at a meeting of the Energy Development League press club on March 27.

According to him, the state-owned enterprise’s settlements with renewable energy generation have increased to 93% since the beginning of 2025, compared to 86% last year. In turn, NPC Ukrenergo’s payments to Guaranteed Buyer for renewable energy services in 2025 increased to 85.2% from 72.9% in 2024.

“There are positive developments. For the first time in my memory, a weighted tariff for electricity transmission services (for Ukrenergo – IF-U) was approved for this year. In addition, we started signing contracts with Ukrenergo not in 1.5-2 years, as it used to be before, but, for example, the January contract has already been signed and payments have already been made,” the CEO said.

According to Nekrasov, the development of the renewable energy market largely depends on the repayment of debts that have historically been accumulated after 2020.

He recalled that in 2020, the government and investors in renewable energy signed a memorandum in which the state confirmed payment guarantees. In particular, the government decided to add an additional part of the funds to the system operator’s tariff, which the state will compensate from the state budget. However, every year, when adopting the state budget, MPs exclude this provision from consideration, which has resulted in the NPC’s tariff remaining underfunded for several years, and Guaranteed Buyer’s debts to market participants are equal to Ukrenergo’s debts to Guaranteed Buyer.

Nekrasov said that Guaranteed Buyer will continue its activities to resolve the debt problem, for which a special roadmap will be developed in a dialogue with market participants.

“Regarding the debts of previous periods, it should be understood that no one in a country at war will immediately raise UAH 15-20 billion to repay them. However, a memorandum or a roadmap for debt repayment will be developed at the level of renewable energy companies, Guaranteed Buyer, Ukrenergo, the Ministry of Energy and the National Energy and Utilities Regulatory Commission, which establishes the sources of payments,” the Chairman summarized. According to him, such a map will include reasonable repayment periods and clear sources of funding.

In turn, the positive dynamics in Guaranteed Buyer’s settlements with market participants was also confirmed at the meeting by the heads of specialized associations and owners of renewable energy installations.

“The development of solar energy is facilitated by the gradual reduction of debt to renewable energy sources, as well as the fact that solar equipment can be installed quite quickly and in many cases does not require special permits,” said Vladyslav Sokolovskyi, Chairman of the Board of the Solar Energy Association of Ukraine.

For his part, Andriy Konechenkov, Chairman of the Board of the Ukrainian Wind Energy Association, said that wind energy will receive a new wave of development in 2025, which will yield qualitative results in 2026-2027.

“Currently, six wind farms are under construction in different regions of Ukraine,” he added.

The event was supported by the information and analytical center Experts Club.

EXPERTS CLUB, Guaranteed Buyer, RENEWABLES, UKRENERGO, ГОЛІЗДРА, Некрасов

Dnipropetrovs’k Rolling Mill JSC (DZPV) ended 2024 with a loss of UAH 58.32 million, which is 2.5 times higher than in 2023, according to the information on the agenda of the company’s general meeting of shareholders scheduled for April 29.

According to the draft decision of the meeting, the loss is planned to be covered by profits of future periods.

“Dividends based on the results of the financial and economic activities of JSC “RPE” for 2024 shall not be accrued and paid due to the lack of net profit,” the draft decision says.

The owners of equal stakes in DZPV JSC (49.669% each) are a large manufacturer of iron castings, Ferrum-Steel LLC (Novomoskovsk, Dnipro region), and a distributor of spare parts for agricultural machinery, Kewpart LLC (Dnipro).

As reported, Kewpart and Ferrum-Style recently announced their intention to compulsorily buy out minority shares through a squeeze-out procedure at a price of UAH 18.21 per share with a par value of UAH 1.05.

The relevant public irrevocable request to buy back shares from minority shareholders was sent to the company on March 17.

Founded in the late 19th century, DZPV produces cast iron rolls for hot rolling mills, non-metallurgical rolls, and cast iron grinding balls.

The plant’s net income, according to the Clarity-project, decreased by 48.6% in 2024 compared to 2023, to UAH 58.45 million (in pre-war 2021, this figure was UAH 288 million).

According to the Opendatabot Index 2025, the top healthcare companies received more than UAH 14 billion in total revenue. This is 37% more than in 2023. The top list includes 4 chains of medical centers and 6 chains of diagnostic laboratories. Dobrobut Medical Center is among the leaders this year.

The total revenue of the top ten healthcare companies amounted to UAH 14.59 billion. Earnings of the top 10 businesses in the Opendatabot 2025 Index increased by 36.7% compared to 2023. The rating includes 4 medical center chains and 6 diagnostic laboratory chains.

For the second year in a row, the rating is headed by Dobrobut Polyclinic Medical Center, owned by Oleg Kalashnikov. This chain accounts for a quarter of the top ten’s revenue: UAH 3.34 billion. However, even though its revenue grew 1.5 times over the year, the company has been unprofitable for three years in a row.

“Dobrobut is a leader in private healthcare, and we are well aware that leadership means, among other things, a great responsibility to our patients, doctors, partners and the state. That is why we are a white business that has paid more than UAH 1 billion in taxes to the state budget of Ukraine during the years of full-scale war alone. We continue to develop and grow: in particular, last year we launched a Mental Health Center, opened two in-house laboratories and strengthened our ophthalmic surgery. We also signed our first major contract with the NHSU for the free infertility treatment program. Very soon we will open another large medical center in Kyiv, and we plan to expand our cooperation with the NHSU,” says Serhiy Orel, CEO of Dobrobut Medical Network.

The second place is occupied by DILA medical laboratory chain, owned by Owell Establishment (Liechtenstein) and Zoya Musatova. Last year, the company’s revenue increased by 35% to UAH 2.75 billion. Dila became the most profitable company in the rating: its net profit amounted to UAH 137.5 million.

“Being a leader is not only about finances, but also about honesty, sustainability and responsibility. In 2024, we paid almost UAH 381 million in taxes and allocated UAH 56 million for social initiatives. Is it difficult for us? Yes, probably, like any other Ukrainian business. But the country’s development is a shared responsibility. So, despite the challenges, we are investing in its future, because now it is important to be strong, stable and act,” comments Mykhailo Bogatyr, CEO of DILA.

Cinevo Ukraine, a network of laboratories owned by the Swedish holding Medicover, completes the top three. Last year, the company’s revenue amounted to UAH 2.35 billion, 22% more than in 2023. At the same time, the company suffered a loss of UAH 77.8 million, although in 2023 it had a profit of UAH 40.6 million.

Medicover Group is represented in the rating by another company – Cinevo Vostok. Its revenue in 2024 increased by 25% to UAH 795.8 million, while profit remained at UAH 130 million. In total, the two companies of the Medicover holding earned UAH 3.14 billion.

The Eskulablaboratory network grew the most: by 1.7 times, which allowed it to rise from 10th to 6th place in the 2025 Index. In 2024, the company’s revenue amounted to UAH 942.4 million, and its profit increased 4.7 times to UAH 87 million. The company is owned by Sergiy Dyadyushko, Stanislav Lugovskiy and Denys Melnyk.

“In times of war, we feel even more responsible to our customers and want to unite and support each other and our country. That is why we have been implementing social initiatives for four years now, when clients can take tests for 1 UAH and take care of their health,” emphasizes Eskulab.

The Smartlab network of laboratories has been steadily increasing its revenue from year to year. Over the year, the company’s revenue grew by 38% and reached UAH 1.17 billion. However, profitability is still significantly lower than before the start of full-scale operations. While the company had UAH 144 million in profit back then, in 2024 it had only UAH 27.7 million.

The Mother and Child clinic chain was included in the Index for the first time. In 2024, its revenue grew by 28% (to UAH 627.2 million), while its profit remained stable (UAH 36 million).

“In times of challenges, we do the most important thing – we help Ukrainian families become parents. Our team of doctors changes people’s lives for the better every day. We not only develop, but also support those in need: as part of our social project “The Stork Will Come”, we help families who cannot use state IVF programs, and for the military we ensure the preservation of reproductive material,” the Mother and Child network comments.

Odrex Medical House is growing steadily and rises higher in the ranking every year. Last year, the company’s revenue increased by 36% to UAH 1.1 billion. Profit amounted to UAH 130.2 million, which is 1.5 times more than in 2023. The company is owned by Iryna Zaikova, Tigran Harutyunyan, Larysa Mysotska, and Yevhen Savytskyi.

“Over the past 2 years, our hospital has risen in the ranking by 2 steps and eventually entered the top five. For us, these are not just numbers – it is a confirmation that trust in us is growing and that we are on the right track. Since the beginning of the full-scale war, Odrex has paid more than UAH 345 million in taxes – we consider it our duty not only to provide quality services but also to support the country’s economy,” the Medical Home representatives note.

Who else was included in the 2025 Index:

The pharmaceutical company PJSC SIC Borshchahivskiy Chemical Pharmaceutical Plant (BCPP, Kyiv) increased its net profit by almost 17% in 2024 compared to 2023, to UAH 273.402 million.

As the company reported in the information disclosure system of the National Securities and Stock Market Commission (NSSMC), the shareholders will consider the company’s performance results at a meeting on April 30.

The shareholders will consider the allocation of UAH 40.369 million from the net profit for 2024 to pay dividends.

In addition, the agenda includes the termination of the powers of the Supervisory Board (SB) members Tetyana Artemenko, Mykola Bezpalko, Oleg Goloborodko (all three are ultimate beneficial owners) and Dmytro Guz. The new composition of the SB will be proposed by shareholders and is not currently on the agenda of the meeting.

As reported, BCPP’s net profit in 2023 increased by 3.38% compared to 2022 to UAH 262.863 million.

As of the first quarter of 2023, 31.8% of BCPP shares were owned by the pharmaceutical company PrJSC “Pharmaceutical Firm ‘Darnitsa’ (Kyiv). Other shareholders of the company were Beldor Group (21.26%) and Lenik Group (20.32%).

According to the Opendatabot system, the ultimate beneficiaries of BCPP are Hlib Zahoriy, the beneficiary of the Darnitsa Pharmaceutical Company, Yevhen Sova, Tetiana Artemenko, Mykola Bezpalko and Oleh Holoborodko.

According to the results of 2024, Donbass Clay PrJSC (Dorozhne village, Donetsk region) increased its net profit three times compared to 2023 – up to UAH 247.477 million from UAH 81.997 million.

According to the agenda of the annual general meeting of shareholders of the company scheduled for April 29, which will be held in person at the company’s Kyiv office, published in the information disclosure system of the National Securities and Stock Market Commission (NSSMC), it is planned to consider the report of the executive body on the results of the company’s financial and economic activities for 2024 and make a corresponding decision.

In addition, the agenda includes consideration of the report of the Supervisory Board and the auditor, approval of the results of financial and economic activities for 2024, distribution of profits, and decision on the preliminary granting of consent to enter into significant transactions.

The draft resolutions, a copy of which is available to Interfax-Ukraine, propose, in particular, to distribute the company’s net profit among shareholders and consider the possibility of paying dividends, to approve the payment of net profit for 2024 as dividends to shareholders.

According to the information for the meeting, retained earnings at the end of 2024 amounted to UAH 557.511 million. In 2024, the company earned a net profit of UAH 247.477 million, with a per-share value of UAH 2 million 474.770 thousand and a number of shares of 100.

As reported earlier, in 2023, Donbass Clays PrJSC decreased its net profit by 2.5 times compared to 2022 to UAH 81.997 million, while net income decreased by 7.7% to UAH 371.889 million. Retained earnings at the end of 2023 amounted to UAH 310.034 million.

In 2022, Donbass Clays reduced its net profit by 9.4 times compared to 2021, to UAH 32.217 million from UAH 302.512 million. In 2021, the company increased its net profit by 51.1% compared to 2020, to UAH 302.512 million from UAH 200.216 million.

Donbass Clays was established in 1995. The company is engaged in the extraction and supply of clays and composites from deposits in Donetsk Oblast.

At the end of 2015, the Dutch Watts Blake Bearne International Holdings B.V., a part of the British Watts Blake Bearne (the world’s largest producer of lump clay – IF-U), increased its stake in the authorized capital of Donbass Clay PJSC to 99% from 49%.

According to the third quarter of 2024, Watts Blake Bearne International Holdings B.V. owns 99% of the shares in the company.

The authorized capital of Gliny Donbassa PrJSC is UAH 526.9 thousand, the nominal value of 1 share is UAH 5269.18.

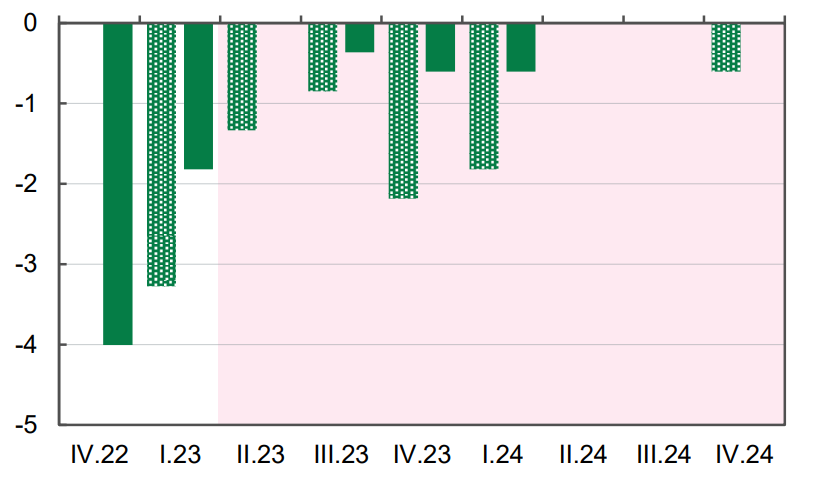

Impact of electricity deficit on real GDP vs no deficit, % (forecast up to 2024)