Ukrainian steelmakers increased production of rolled steel in January-February this year by 6.3% year-on-year, up to 957 thousand tons from 900 thousand tons, according to preliminary data.

According to Ukrmetallurgprom on Saturday, steel production during this period increased by 9.9% to 1.183 million tons, and pig iron production by 8.4% to 1.139 million tons.

In February, the company produced 476.9 thousand tons of rolled products, 571.8 thousand tons of steel, and 544.4 thousand tons of pig iron, compared to 480.2 thousand tons of rolled products, 610.8 thousand tons of steel, and 594.8 thousand tons of pig iron in the previous month.

As reported, in 2024, Ukraine increased production of rolled steel by 15.8% year-on-year to 6.222 million tons from 5.372 million tons. During this period, steel production increased by 21.6% to 7.575 million tons, and pig iron production by 18.1% to 7.090 million tons.

In 2023, Ukraine increased production of total rolled products by 0.4% compared to 2022, to 5.372 million tons, but reduced steel production by 0.6% to 6.228 million tons and pig iron by 6.1% to 6.003 million tons.

In 2022, the country reduced production of total rolled products by 72% compared to 2021 to 5.350 million tons, steel by 70.7% to 6.263 million tons, and pig iron by 69.8% to 6.391 million tons.

In 2021, the company produced 21.165 million tons of pig iron (103.6% compared to 2020), 21.366 million tons of steel (103.6%), and 19.079 million tons of rolled products (103.5%).

TAS Neil LLC (Khmelnytsky), a manufacturer of nails and various fasteners from the TAS Group of Sergey Tigipko, has issued B series bonds for a total nominal value of $0.5 million.

The National Securities and Stock Market Commission (NSSMC), which registered the report on the results of the issue on March 3, toldInterfax-Ukraine that the placement was closed, with the face value of one bond at $1,000.

The bonds have a maturity of October 22, 2026, and no information on the yield is available.

According to the NSSMC database, in early August last year, it registered two issues of TAS Neil bonds – series A and B for $0.5 million each. The report on the results of the Series A issue was registered on November 28 last year.

“TAS Nail (formerly Nail) was founded in 1994 as a nail manufacturer. In addition to traditional construction, carpentry and roofing nails, the company produces special types of nails – in coils and loose nails used in the production of wooden containers and pallets, as well as self-tapping screws, screws, confirmations, bolts, nuts, washers, threaded rods, anchors, drills, etc.

TAS Group announced its intention to acquire Neil in early 2022.

According to the YouControl system, in 2024, TAS Neil increased its revenue by 9.3% to UAH 362.86 million, but its loss increased 5 times to UAH 46.78 million.

In 2025, Agrotrade Agroholding will plant 24.32% of its acreage under corn, given its profitability in 2024, and refused to grow spring wheat, the company’s press service reported on Facebook.

“Last season, favorable weather conditions allowed us to minimize the cost of corn processing. This year, we expect high profitability of the crop again, so we have increased the area under its sowing. Traditionally, we allocate significant areas for soybeans, as they show consistently high profitability. At the same time, this year we refused to plant spring wheat, as we sowed enough winter wheat, so we focused on other crops,” said Oleksandr Ovsyanyk, Director of Agrotrade’s Agricultural Department.

In 2025, the agroholding allocated 25.2% of its acreage for winter wheat, 24.32% for corn, 23.58% for soybeans, 17.84% for sunflower, 7.4% for winter rapeseed, 1.02% for mustard, 0.56% for industrial hemp, etc.

“We continue to work to optimize the structure of crops for sustainable development and efficient use of the land bank,” the agricultural holding assured.

Agrotrade Group is a vertically integrated holding company with a full agro-industrial cycle (production, processing, storage and trade of agricultural products). It cultivates over 70 thousand hectares of land in Chernihiv, Sumy, Poltava and Kharkiv regions. The company’s main crops are sunflower, corn, winter wheat, soybeans and rapeseed. It has its own network of elevators with a one-time storage capacity of 570 thousand tons.

The group also produces hybrid seeds of corn and sunflower, barley, and winter wheat. In 2014, a seed plant with a capacity of 20 thousand tons of seeds per year was built on the basis of Kolos seed farm (Kharkiv region). In 2018, Agrotrade launched its own brand Agroseeds on the market.

The founder of Agrotrade is Vsevolod Kozhemiako.

In 2024, 251,286 tourists used the services of one of Ukraine’s largest tour operators, Join UP! This is the best figure for the last three years of war: almost 7% more than in 2023 and 58.3% more than in 2022, the company’s press service toldInterfax-Ukraine.

“2024 was the period of maximum adaptation of Ukrainian tourists to travel from neighboring countries. People have realized that traveling from another country, even with transfers, is already commonplace. We have seen an increase in demand for air tours and budget bus trips to nearby destinations. All of this shows the flexibility of Ukrainian tourists who have learned to plan their trips under restrictions,” comments Iryna Mosulezna, Managing Director of Join UP! Ukraine”.

The peak season in 2024 was traditionally the summer season. Most tourists traveled in June and July – 35,544 and 36,229 respectively. The quietest month last year, as in 2023, was February, when 8,518 tourists used the tour operator’s services. At the same time, this is 21.24% more than in the previous year, when only 7,026 tourists traveled, which indicates a gradual recovery of interest in travel even in winter.

Turkey, Greece, Bulgaria and Montenegro remained the most popular summer destinations. Year-round Egypt also remained in the top preferences of Ukrainians for summer vacations. Over 100 thousand tourists chose this destination last year. In winter, in addition to Egypt, where Ukrainians traveled most often, they also chose the exotic UAE, Tanzania, Sri Lanka, and the Dominican Republic. The popularity of these destinations demonstrates the willingness of tourists to invest in exotic travel and discover new cultures despite economic instability.

As reported, Join UP! LLC was established in 2013, with an authorized capital of UAH 72 million 671 thousand. The ultimate beneficiaries are Yuriy and Oleksandr Alba. According to the company’s annual reports, by the end of 2024, revenue decreased to UAH 376 thousand from UAH 16 million 639 thousand in 2023, and net loss – to UAH 217 million 451 thousand from UAH 233 million 341 thousand, respectively.

The brand’s international expansion covers eight markets: the Baltic States, Kazakhstan, Moldova, Poland, Romania, and the Czech Republic. Preparations for the launch of operations in Slovakia and Hungary are nearing completion. Last year, the brand also opened its first international franchise agency in Katowice, Poland.

The U.S. economy remains strong despite increased uncertainty, Federal Reserve (Fed) Chairman Jerome Powell said at an event at the University of Chicago Booth School of Business.

He reiterated that the Fed does not need to rush to cut the benchmark interest rate further.

“Despite rising uncertainty, the U.S. economy is still in good shape,” Powell said. – We don’t need to rush; we are quite prepared to wait for greater clarity.”

Federal Reserve Bank of Atlanta President Raphael Bostic said Friday that the Fed probably won’t have enough clarity on U.S. economic conditions until “late spring or summer” to continue adjusting monetary policy.

Bostic said it is difficult to predict at this point where the U.S. economy might move given the change in U.S. policy and will wait to see the effects of trade duties, weakening consumer confidence and lower immigration flows begin to be reflected in economic data.

Powell said in his speech that it is “the implications of these changes that will matter for the U.S. economy and monetary policy.”

He added that surveys of homeowners and businesses indicate growing concern about the outlook for the economy.

“We will just have to wait to see how all of this affects future spending and investment,” he said.

Powell also said progress in slowing inflation is likely to continue but will be uneven.

The Fed kept the benchmark rate in a range of 4.25-4.5 percent per annum at the end of its January meeting. The rate was cut by 1 percentage point last year.

The next meeting of the Fed will be held on March 18-19.

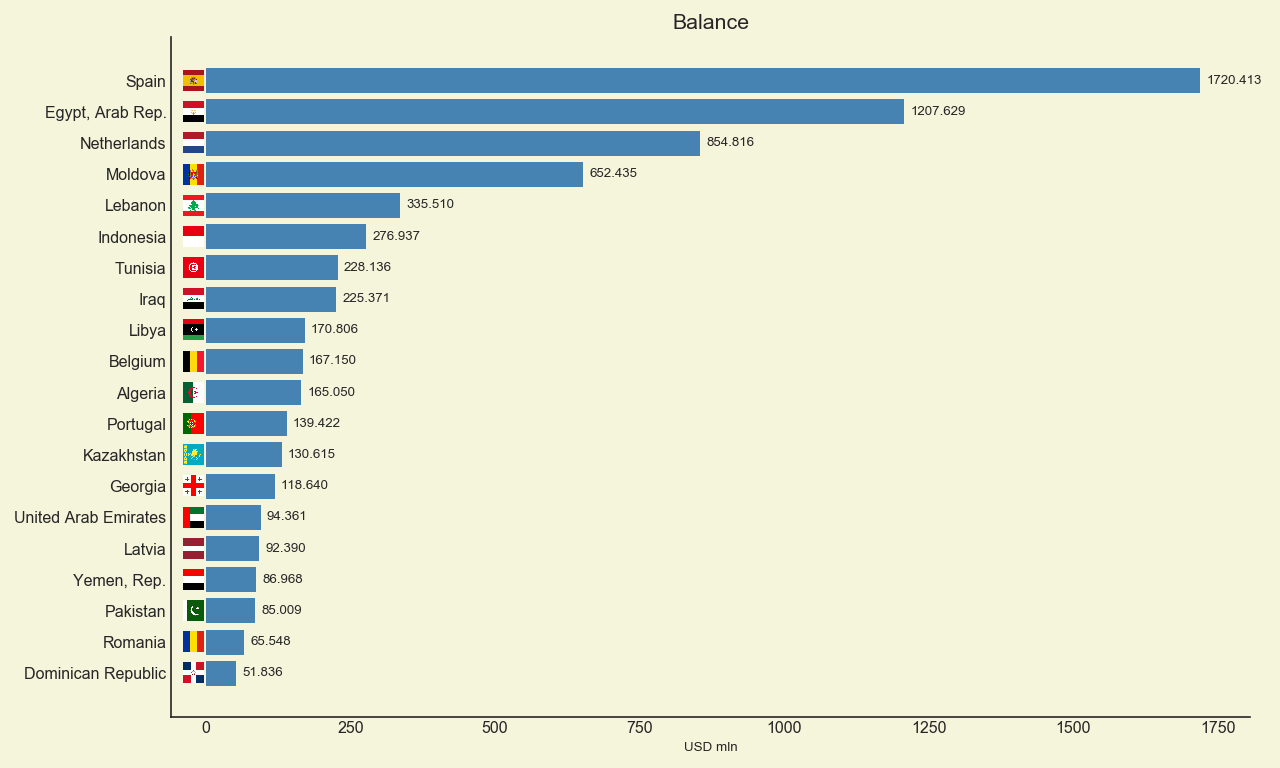

Geographical structure of Ukraine’s foreign trade (surplus) in January-October 2024, million USD

Source: Open4Business.com.ua