China plans to increase the penetration rate of 5G communication network among individual users to more than 85% by the end of 2027, according to an action plan developed by the Ministry of Industry and Informatization of China in cooperation with 11 other agencies. In three years, there will be 38 5G base stations for every 10 thousand people. At the same time, 5G will account for 75% of mobile Internet traffic, and the number of “Internet of Things” terminals connected to 5G will exceed 100 million.

The 5G penetration rate in large and medium-sized industrial companies will reach 45% by the end of 2027, according to a document cited by Xinhua.

The ministries’ plan is aimed, in particular, at actively promoting the large-scale development of 5G applications, popularizing and applying new generation information technologies.

According to the Ministry of Industry and Informatization, as of the end of September, the number of 5G base stations in the country amounted to about 4.09 million units, and the number of 5G mobile subscribers was 981 million. The 5G penetration rate among individual users has almost reached 70%, with the total population of the country at around 1.4 billion people.

On November 26, the Central Election Commission announced a tender for voluntary insurance of motor vehicles (CASCO) and compulsory motor third party liability insurance (MTPL), according to the Prozorro e-procurement system.

The total expected cost of the purchase of services is UAH 439.2 thousand.

The last day for receipt of bids is December 4.

The winner of a similar tender a year earlier on hull insurance was IC “Ultra Alliance”.

In January-October 2024, banks imported the equivalent of $12.88 billion in cash currency to Ukraine, which is 81.4% more than in the same period last year, according to statistics from the National Bank of Ukraine (NBU). The import of cash currency in the first ten months of 2024 is a record high since 2013, the only other record high was in the first 10 months of 2012, when the equivalent of $16.81 billion was imported. In particular, in October, banks imported the equivalent of $1.68 billion to Ukraine, compared to $1.30 billion in September and $1.09 billion in September.

According to the statistics, the US dollar and euro accounted for 68.3% and 31.6% of all imported cash in October, respectively, and 73.7% and 26.1% over the past 10 months.

Deliveries of dollars in October increased slightly compared to September, from $1.08 billion to $1.15 billion, while imports of euros almost doubled, from $229.6 million to $531.7 million.

As reported, since the beginning of 2024, the dollar has risen in price by 9.2%, or UAH 3.50, to UAH 41.5035/$1 at the official exchange rate, and by 13.5%, or UAH 4.93, since the National Bank switched to managed flexibility on October 3, 2023. Meanwhile, since the beginning of this year, the cash dollar has risen in price by about UAH 2.93 when buying to UAH 41.68/$, and by about UAH 2.33 when selling to UAH 41.75/$.

Metinvest Mining and Metallurgical Group is ready to invest in Europe and expand its presence in the market, including steel production, and is currently in the process of mergers and acquisitions of some European steel assets, said Alexander Vodovez, Chief Executive Officer of the Group, at the European Business Summit in Brussels.

“We are negotiating with several European companies to come to Ukraine. We are currently in the process of merging and acquiring some European steel assets, as we have a huge resource base and want to use it properly,” said the top manager.

According to the head of Metinvest’s CEO’s office, before the war, the group employed about 120,000 people and accounted for about 5% of Ukraine’s GDP. But with the start of the full-scale invasion, the company lost almost 50% of its enterprises, particularly in Mariupol and Avdiivka. Today, Metinvest employs about 60,000 people in Ukraine, Italy, the United States, Bulgaria and the United Kingdom. About 9,000 of the company’s employees serve in the Ukrainian Armed Forces, and about 1,000 employees have been killed. The group’s enterprises operate under the threat of shelling, with some facilities located just 10 km from the frontline.

Vodoviz emphasized the importance of entering the EU market, especially as Ukraine fights Russian aggression.

“Ukraine has the largest resource base on the European continent. And we can offer Europe access to these resources. In return, we want access to European technologies and the financial system to implement projects both in Ukraine and in the EU. But we do not need free money – we are ready to compete. We are ready to be part of the economic society of Europe and want this accession process to be completed as soon as possible,” stated the head of Metinvest’s CEO’s office.

At the same time, he clarified that the main obstacle for Ukraine on its way to European integration is the war: “We cannot simply turn a blind eye to the war, but our government has a homework assignment – to go through all the procedures for joining the European Union: monitoring, enforcement of laws, etc.” The top manager emphasized that Ukraine’s European integration will help ensure the strategic autonomy of the European steel industry from Russia.

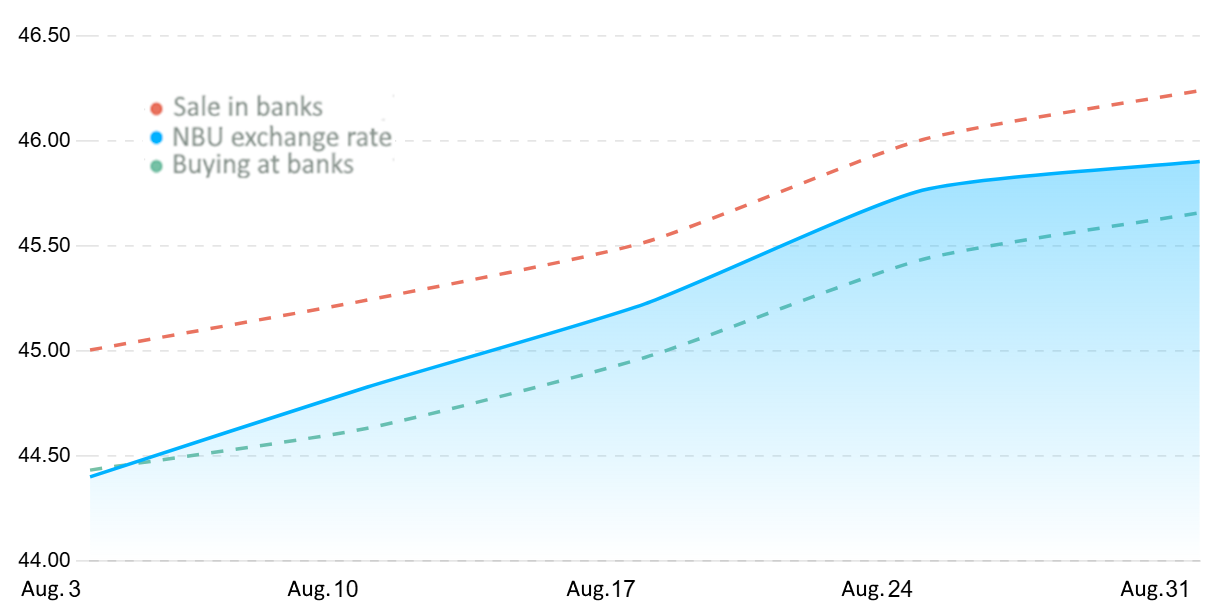

Quotes of interbank currency market of Ukraine (uah for €1, in 01.07.2024-30.07.2024)

Open4Business.com.ua

Housing commissioning in Ukraine in January-September 2024 increased by 23% compared to the same period in 2023 – up to 6 million 732.9 thousand square meters, the State Statistics Service reported.

According to the report, 3 million 504.8 thousand square meters of housing were put into operation in cities in nine months, which is 7.5% higher than in the first three quarters of last year. In rural areas, compared to last year, 47.2% more housing was commissioned – 3 million 228.1 thousand square meters.

In total, 79.1 thousand apartments were commissioned in January-September 2024, which is 18.9% more than in January-September 2023. At the same time, 53.1 thousand apartments were commissioned in apartment buildings. In cities, 49.2 thousand apartments were commissioned, in villages – 29.9 thousand.

In the first nine months of the year, Kyiv region commissioned the most housing – 1 million 395.1 thousand square meters, or 14.9 thousand apartments (20.7% of the total), exceeding the figure for the comparable period in 2023 by 38.4%. Next comes Lviv region with 783.3 thousand square meters, or 9.2 thousand apartments (11.6% and +44.4%, respectively); Ivano-Frankivsk region – 457.1 thousand square meters, or 5.2 thousand apartments (6.8%, +13.6%); Vinnytsia region – 347.2 thousand square meters, or 4.7 thousand apartments (5.2%, minus 46%).

In Kyiv, 814.4 thousand square meters of housing, or 12.1 thousand apartments (12.1%, minus 2.9%), were commissioned in the first nine months of the year.

According to the State Statistics Service, the largest increase in housing commissioning in January-September was recorded in Kherson region, where the figure increased 11 times compared to the same period in 2023, to 3.4 thousand square meters (0.1% of the total), as well as in Donetsk region – six times, to 19.7 thousand square meters (0.3%), and in Zaporizhzhia region – four times, to 33.2 thousand square meters (0.5%).

The data are based on housing commissioned in accordance with the temporary procedure for commissioning houses built without a building permit, as well as excluding the territories temporarily occupied by the Russian Federation and parts of the territory where hostilities are ongoing, the State Statistics Service reminds.

As reported, by the end of 2023, the commissioning of housing in Ukraine increased by 3.8% compared to 2022 – up to 7 million 380.7 thousand square meters.