The state-owned stake of 100% of the authorized capital of United Mining and Chemical Company JSC was offered to be paid UAH 39 million more than the starting price of the privatization auction of the State Property Fund of Ukraine.

NADRA.INFO reports with reference to the data of the UBIZ.ua platform, accredited by Prozorro.Sale JSC.

The price offer of UAH 3,938,351,581 was received from Cemin Ukraine LLC, a member of the NEQSOL Holding group of Nasib Hasanov (Azerbaijan) (YouControl).

NEQSOL Holding in Ukraine is headed by Volodymyr Lavrenchuk. The group is a member of the EBA Subsoil Committee.

Cemin Ukraine was the only bidder to buy UMCC (Minutes).

“NEQSOL Holding has taken this step as a potential strategic investor, which, if recognized as the winner, plans to implement plans for modernization, development of new products using deep processing of raw materials and expansion in global markets along with fulfilling all privatization obligations covering social, environmental and technical aspects. Currently, NEQSOL Holding is waiting for the privatization process to be completed and its official results to be announced in accordance with the applicable procedures,” Volodymyr Lavrenchuk, Regional Director of NEQSOL Holding in Ukraine, told NADRA.INFO.

THE NEWS HAS BEEN UPDATED:

At 22:41 on Tuesday, 08.10.2024, the State Property Fund of Ukraine published an announcement on the redemption of UMCC shares on its Facebook page:

“The team of the State Property Fund of Ukraine held an online privatization auction for the sale of a state-owned stake of 100% of the authorized capital of United Mining and Chemical Company JSC. The purchase took place in the electronic system Prozorro.Sale.

…

the buyer is obliged to maintain the main activities of the enterprise, invest at least UAH 400 million in technical re-equipment and modernization. It is also obliged to pay off wage and budget arrears and repay overdue accounts payable.

The privatization of this enterprise opens up new opportunities for the development of Ukraine’s titanium industry. Attracting private capital will help improve the technological level of production, expand export opportunities and create new jobs. This will be an important step towards increasing the competitiveness of the Ukrainian industry on the global stage.

We have witnessed an important event for the economic development of the country, as all proceeds from the sale will go to the state budget of Ukraine, thereby strengthening our defense capabilities in the fight against the aggressor,” the SPFU said in a statement.

If a decision is made to privatize the facility through a buyout, VAT will be charged on the price offered by the bidder (sale price) in accordance with the Tax Code of Ukraine.

As a reminder, the Government has approved the starting price of the company at UAH 3.9 billion with the buyer’s investment obligations of at least UAH 0.4 billion.

DIM.RIA, the in-house analytical center of the Ukrainian real estate marketplace, has summarized the market results for September. We have analyzed the supply, demand and prices for the purchase of primary and secondary housing, as well as for rent in different regions of Ukraine.

Primary market

Supply

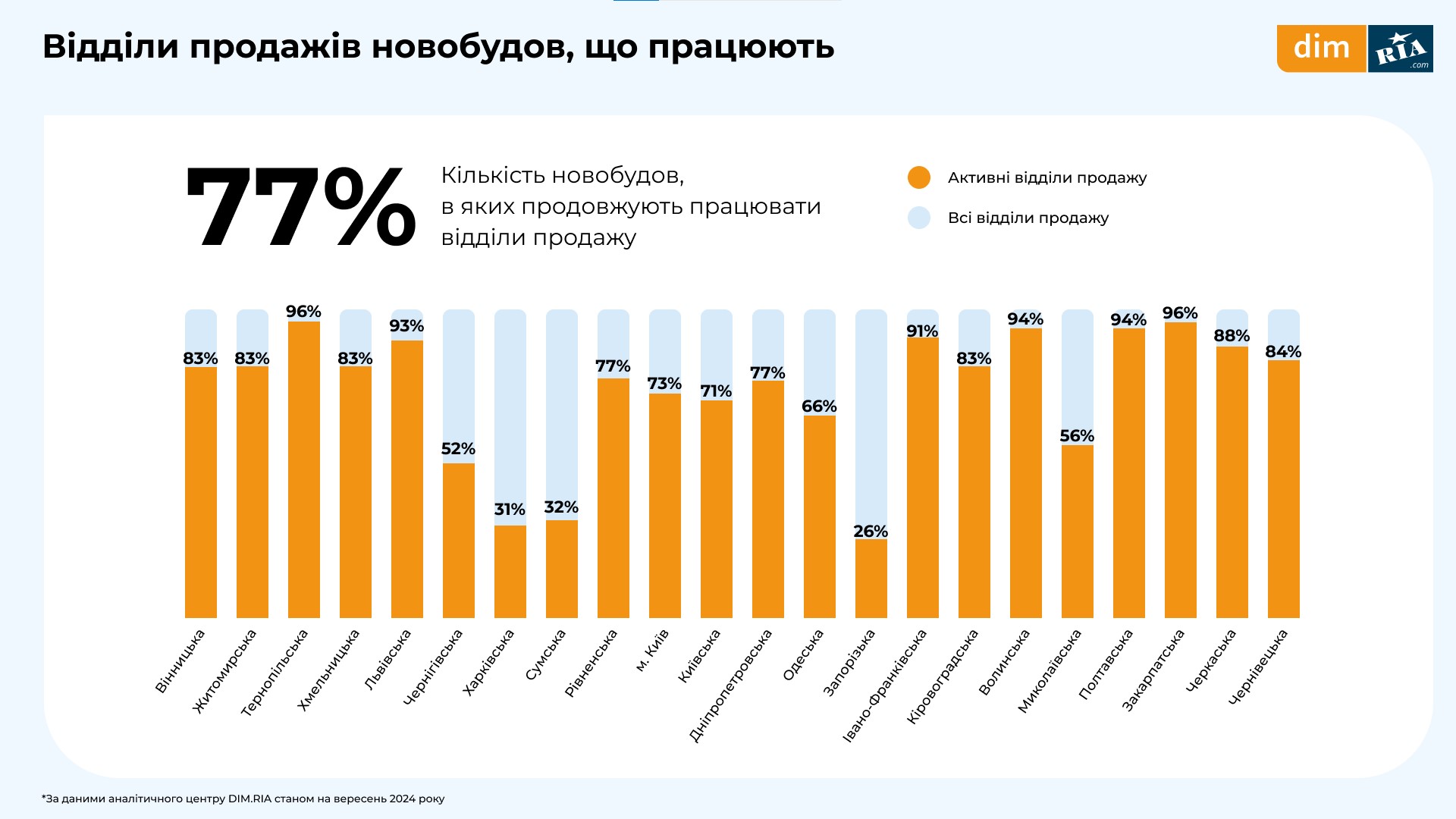

In September, the number of new buildings with active sales departments remained at the same level – 77%. In September, two new buildings were commissioned in Lviv region and one in Kyiv region, with a total of 6 sections.

Prices.

The average price per square meter in dollar terms mostly increased by 1-6% in September, depending on the region. Compared to September 2024 to September 2023, new buildings in Kirovohrad, Volyn and Ivano-Frankivsk regions rose in price the most. The highest average cost of new housing remained in Kyiv at $1,349 per m².

Demand

In September, marketplace users were much more interested in apartments in new buildings compared to August. The largest increase in search queries occurred in Mykolaiv and Kirovohrad regions. At the same time, on a yearly scale, the revival of interest was observed only in Kyiv region, excluding the capital, and in Vinnytsia region.

Secondary market

Supply.

In September, there were fewer people willing to sell their own homes compared to August or year-on-year. Compared to September 2023, the number of housing offers increased only in Chernihiv, Volyn, Lviv, Zakarpattia, Ivano-Frankivsk and Chernivtsi regions.

Price

The price indicated by owners in their offers for the sale of real estate in September increased in almost every region, mostly by 5-6%. Kyiv region showed no changes, and in Kyiv analysts noted a slight decrease in price by 1%. At the same time, the capital remains the city with the most expensive housing: the average price for a one-bedroom apartment based on September offers is $84,935. However, there are cheaper and more expensive offers on the market: an average of $45,060 in the Desnianskyi district and $113,553 in the Pecherskyi district.

Demand.

Users were more active in searching for housing offers in the central and western regions of Ukraine: demand there increased by more than 20% in some cases. Despite the fact that the total number of search queries has been on the decline throughout the year, in most regions of Ukraine there are still 5-10, and sometimes 20 responses per property ad.

Rental market

Supply.

According to the analytical center DIM.RIA, Ukrainians began to publish fewer rental offers. The most significant decline in September was recorded in Kirovograd, Ivano-Frankivsk and Ternopil regions. Over the year, the number of offers increased most significantly in Volyn, Zakarpattia and Chernivtsi regions.

Price.

The most expensive location for renting an apartment remains Kyiv with an average price tag of UAH 18,203 for a one-bedroom apartment. The cost of housing in the capital has not changed over the past month, but over the past year, the increase was 18%. Over the year, the price of renting a one-bedroom apartment has increased the most in Zakarpattia, Zhytomyr and Rivne regions – by more than 60% compared to September 2023.

The most expensive district for rent in the capital was Pecherskyi with an average cost of living in a one-bedroom apartment of UAH 24,219 per month, the most budgetary – Desnianskyi with a price tag of UAH 10,852.

Demand

Year-on-year and month-on-month, users are looking for rental housing less, but traditionally there are much more responses per ad. In Kyiv, it is more than 6 responses for each ad added in September.

IC “Express Insurance” (Kiev) in January-September 2024 made payments in the amount of UAH 379,2 mln, that is by 61,6% or by UAH 143,8 mln more than the indicator for the same period of 2023, the insurer’s website reports.

Including payments on hull insurance amounted to UAH 319 million (+55.5%), on MTPL – UAH 49.8 million (2.3 times more), on voluntary health insurance – UAH 4.5 million (-11.1%), payments under other insurance contracts – UAH 5.9 million (+65.2%).

At the same time, the company reports that in September 2024 payments to clients amounted to UAH 39 mln (+35.9%) more than in September 2023. In particular, the company paid UAH 31.6 mln (+28.9%) under hull insurance contracts, and UAH 5.5 mln (+58.4%) under CMTPL insurance.

Express Insurance ALC was founded in 2008 and is a part of UkrAVTO group of companies. The company specializes in automobile insurance. Stable high speed of events settlement in IC is provided by optimal interaction with partner service stations.

Since April, 2012 IC Express Insurance is an associated member of the Motor Transport Insurance Bureau of Ukraine.

Pharmacy sales in Ukraine in January-August 2024 increased by 13.1% in monetary terms compared to the same period in 2023 to UAH 125.712 billion, while in physical terms they decreased by 4.5% to almost 700.042 million packages.

Business Credit told Interfax-Ukraine that, according to its research, the weighted average price of pharmacy basket items during this period was UAH 163.25, up 18.47% compared to the same period in 2023.

At the same time, pharmacy sales of medicines in January-August 2024 amounted to UAH 98.565 billion, which is 13.3% more than in the same period in 2023, but in physical terms, pharmacy sales of medicines decreased by 4.9% to 537.982 million packs.

The weighted average retail price of medicines in January-August 2024 amounted to UAH 183.21 per unit, which is 19.22% higher than a year earlier.

Pharmacy sales of dietary supplements increased by 15% in monetary terms to UAH 12.846 billion over the eight months, while physical sales decreased by almost 2% to 64.658 million packs. The weighted average price in this segment in the first half of the year increased by 17.36% compared to the same period in 2023 to UAH 198.68 per unit.

At the same time, in the first half of the year, almost all segments of the pharmacy basket showed negative sales dynamics in physical terms.

As reported, in January-June 2024, pharmacy sales in Ukraine increased by 12.67% in monetary terms compared to the same period in 2023 – to UAH 94.784 billion, while in physical terms they decreased by 4.7% to 583.21 million packs. The weighted average price of pharmacy basket products during this period amounted to UAH 162.52, which is 18.25% more than in the same period of 2023.

At the same time, pharmacy sales of medicinal products in January-June 2024 amounted to UAH 74.258 billion, which is 12.68% more than in the same period of 2023, but in physical terms decreased by 5.13% to 408.796 million packs. The weighted average retail price of medicines in January-June 2024 amounted to UAH 181.65 per unit, which is 18.67% more than a year earlier.

Dnipro Metallurgical Plant (DMZ), a part of DCH Steel of businessman Aleksandr Yaroslavsky’s DCH group, reduced rolled steel production by 56.9% year-on-year to 35.8 thousand tons in January-September this year.

According to information in the corporate newspaper DCH Steel on Thursday, in September, the company produced 1.98 thousand tons of rolled steel, in August, the plant did not produce rolled metal, but rolling shop No. 2 shipped to consumers 2.3 thousand tons of steel products produced earlier. In September 2023, the company produced 8.6 thousand tons of rolled metal products.

“In September, rolling shop No. 1 was put into operation, where the company produced mainly R-34 ore rails and R-43 rails. The company is currently in the process of launching the rolling mill at Rolling Shop No. 2, which is scheduled to start in November,” the company said.

At the same time, coke production in the first nine months of 2024 decreased by 0.4% to 218.1 thousand tons. In September, coke production decreased by 1.2% compared to the previous month to 24.1 thousand tons. In August 2023, the plant produced 20.9 thousand tons of metallurgical coke.

As reported, in 2023, DMZ increased its rolled metal output by 86.2% compared to 2022, up to 105.6 thousand tons, and coke by 38.5%, up to 292.7 thousand tons.

In 2022, the plant reduced rolled steel production by 74.2% compared to 2021, to 58.4 thousand tons, and coke production by 56.3%, to 211.3 thousand tons.

DMZ specializes in the production of steel, pig iron, rolled products and products made from them.

On March 1, 2018, DCH Group signed an agreement to buy Dnipro Metallurgical Plant from Evraz.

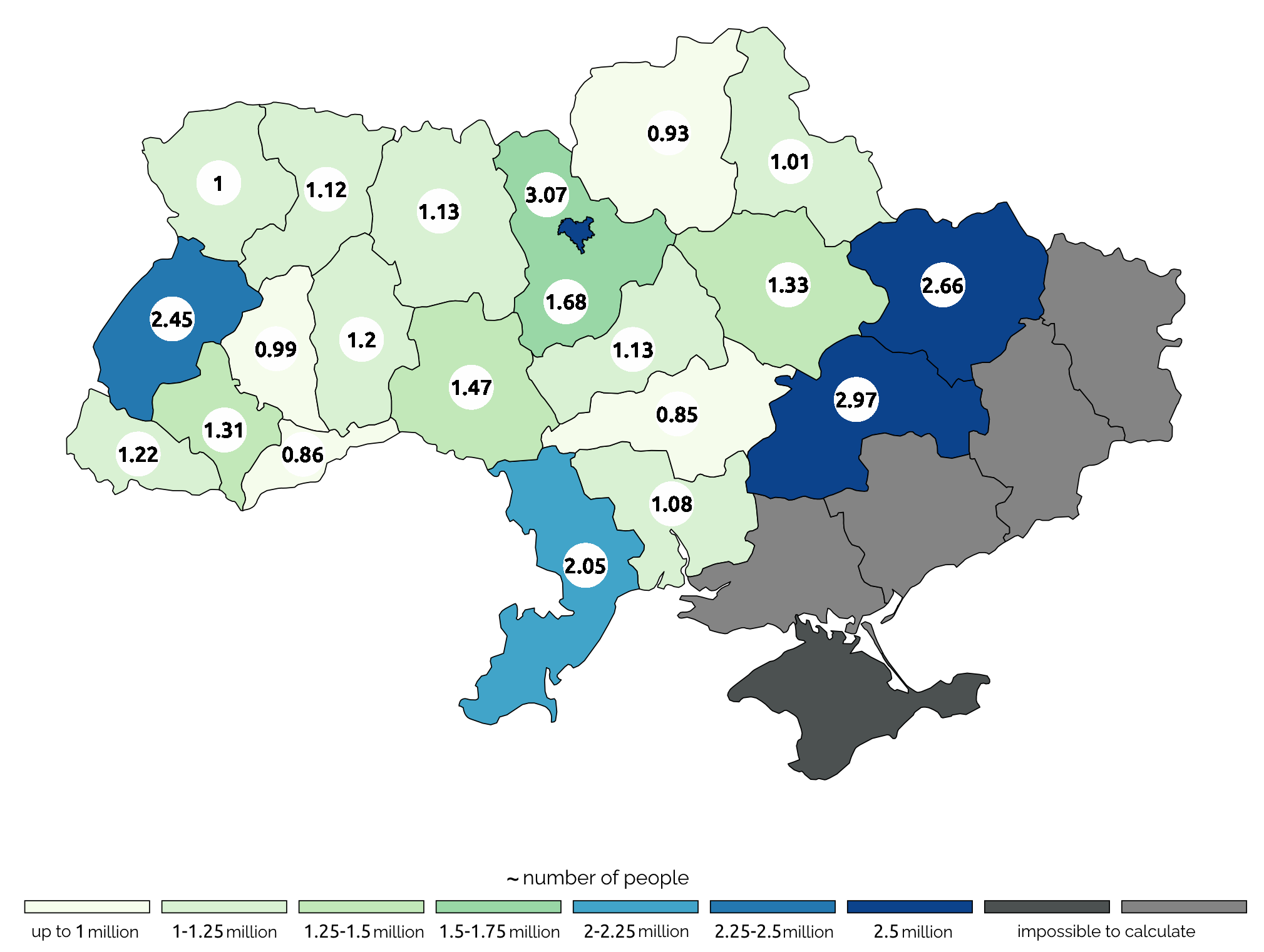

Estimated number of population in regions of Ukraine based on number of active mobile sim cards (mln)

Open4Business.com.ua