The number of “cash registers in a smartphone” is twice as high as traditional ones

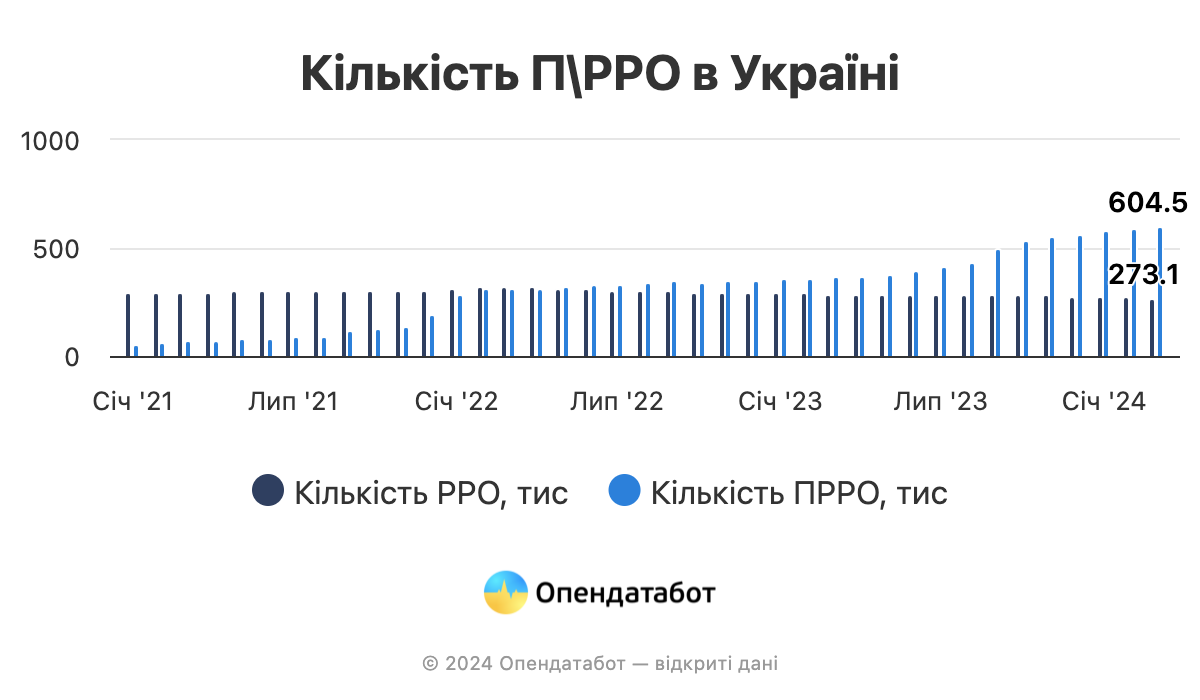

According to the Tax Service, 877.6 thousand cash registers are currently registered in Ukraine. Almost 70% of all registered financial accounting devices are PTRs, while the popularity of “traditional” cash registers is steadily declining. Back in 2021, the number of online cash registers was 8.5 times lower, indicating an increase in their popularity.

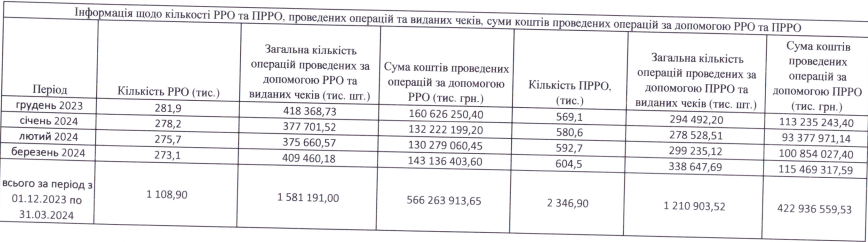

69% of the total number of cash registers, i.e. almost 605 thousand, are now PTRs. Their number increased 1.6 times over the year. Compared to the period before the full-scale invasion, in 2021, the number of “cash registers in smartphones” increased 8.5 times. It is worth noting that online cash registers appeared only in 2020.

At the same time, traditional cash registers have been losing popularity since March 2022. Over 2 years, their number has decreased by 15% – from 323.1 thousand to 273.1 thousand.

Accordingly, there are now 2.2 times more cash registers than cash registers. For comparison, at the beginning of April 2021, the situation was radically different – the number of cash registers was 4.2 times higher than online cash registers. So then, every hundredth check was from a cash register, and in 2024 – every second.

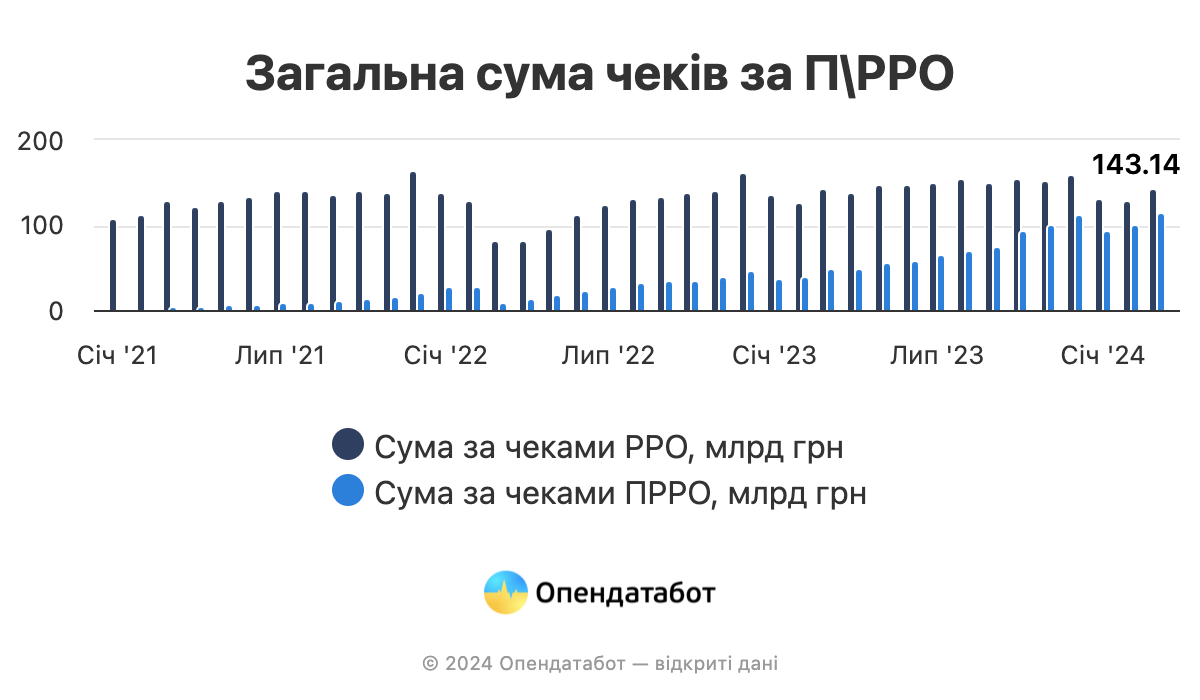

The average amount of cash register checks has also increased – 11 times in 3 years. If in 2021 it was UAH 9 billion, now it is UAH 103 billion.

In 2024, the total amount per month for PTRO checks averaged UAH 238.4 billion, almost half of which – 43% – was from online cash registers. For comparison, in 2021, this amount averaged UAH 142.8 billion, and the share of PTRs was only 6%.

“Businesses prefer cash registers for their convenience, easy installation, and lower price compared to fiscal machines. The fact that the Ministry of Finance is planning to limit the operation of cash registers – to ban the offline mode, to return paper accounting books and gluing receipts – in today’s situation looks like a shot in the foot. Instead of leaving Ukraine in the club of highly digitalized countries, they are trying to drag us back to the bureaucratic past, where doing business is expensive and difficult,” comments Rodion Yeroshek, CEO and co-founder of the Ukrainian restaurant automation company Poster.

Context.

As of October 1, 2023, the moratorium on inspections of the use of PTRs by entrepreneurs was lifted, and now it has become mandatory. If a tax audit of the documentation reveals that sole proprietors make a profit from the sale of goods unofficially, they will face a hefty fine. This condition partly explains the rapid growth in the popularity of using PTRs.

Currently, the Ministry of Finance of Ukraine plans to restrict the operation of “cash registers in a smartphone”.

https://opendatabot.ua/analytics/safe-prro