The international vertically integrated pipe and wheel company Interpipe in January-March of this year reduced its net profit by 90.4% compared to the same period last year, to $ 12.826 million from $ 133.064 million.

According to the company’s interim report on operating and financial results for the three months of 2021, in January-March 2021 revenue decreased by 19.9%, to $ 200.952 million.

According to the company’s press release, following the results of Q1, 2021, EBITDA decreased by 53%, to $ 40 million, the amount of capital investments increased by 58%, to $ 17 million.

Net debt was $ 53 million with a net leverage ratio (net debt to EBITDA) of 0.2x.

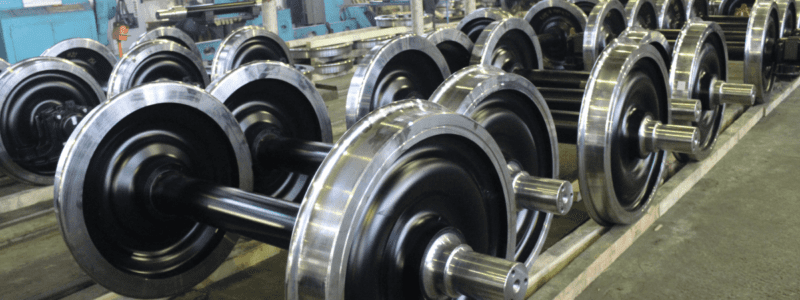

The press release notes that in the first quarter of 2021 Interpipe continued to operate in difficult market conditions, which affected its financial results. Total revenues decreased by 20%, mainly due to the deterioration in the performance of the railway division after the imposition by Russia of embargo on the import of Ukrainian railway products. Thus, the revenues of the railway products division fell by 53%, while sales volumes decreased by 32%.

As a result, EBITDA for the first quarter of 2021 decreased by 53%. An additional negative effect is associated with the continuing global growth in market prices for goods and metal products. At the same time, the selling prices for steel pipes and railway products lagged behind the rise in production costs.

At the same time, Interpipe increased its capital investment by investing $ 17 million in overhaul and production development.

As of March 31, 2021, the company’s total debt fell to $ 110 million following the full redemption of 2024 eurobonds on January 26, 2021, keeping the net leverage ratio (net debt to EBITDA) at a low 0.2x.