Corporate bonds of NovaPay, a non-bank financial institution that is part of the Nova Group, have been purchased by about 2,000 Ukrainians for UAH 365.5 million through the company’s app in the four months since their placement, the company’s press service said on Thursday.

“Under the agreements that have already expired, customers have already been paid UAH 255.1 million. Most often, clients prefer medium-term bonds. 56% of clients invest in bonds repeatedly,” CFO Igor Prikhodko said in a release on Thursday.

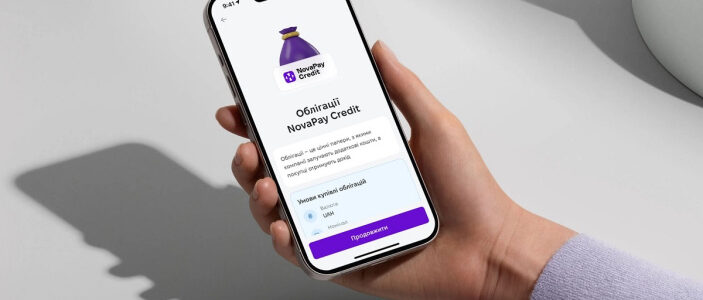

As reported, on February 20, NovaPay announced the start of bond sales. It was noted that they can be purchased for a period of 1 to 12 months for the amount of UAH 1000. The interest rate for investments for one, two and three months was 16% per annum, six months – 17% per annum and 12 months – 18% per annum. The issuer stated that it intends to actively use the bonds in repurchase agreements for a period of one month to one year, creating a convenient alternative to deposits, and to launch their secondary market.

According to NovaPay’s latest release, 75% of bond investors are men, 25% are women, the average age is 37, and the oldest investor was 75. The average check for transactions through the app is UAH 41 thousand.

Currently, the investment rate for a month has been reduced to 13% per annum, for 2 months – to 14%, for 3 months – to 16%, for 6 and 12 months – to 16.5% per annum.

In 2023, NovaPay registered three public issues of interest-bearing bonds of series A, B, and C for UAH 100 million each. In 2024, the company issued three more issues of such securities – series D, E and F. The rating agency Standard-Rating assigned them a credit rating of uaAA.

Founded in 2001, NovaPay is an international financial service that is part of the Nova group and provides online and offline financial services at Nova Poshta offices. According to its website, the company employs about 13 thousand people in more than 3.6 thousand Nova Poshta offices across Ukraine. According to the National Bank of Ukraine, the company accounts for 35% of the total volume of domestic money transfers.