Stock indices of the largest countries in the Asia-Pacific region (APR) show a significant rise on Wednesday morning amid speculation that the world’s central banks may abandon the overly aggressive tightening of monetary policy.

A positive impetus to Asian markets was given by the increase in US indices by 2.8-3.3% on Tuesday. Wall Street had the best start to the quarter since 1938.

Investors evaluate the incoming statistical data, which often turn out to be worse than forecasts, and regard them as signals of a slowdown in the global economy. As a result, the world’s central banks may moderate the pace of interest rate hikes, Trading Economics notes.

Yesterday, the Reserve Bank of Australia (RBA) surprised the markets by raising its key rate by 25 basis points (bp) instead of the expected increase by 50 bp. The Australian Central Bank raised the rate by 50 bp. in June, July, August and September, in an effort to slow inflation, which the Central Bank expects to peak by the end of 2022 at around 8%.

On Wednesday it became known that retail sales in Australia rose by 0.6% in August compared to July after rising by 1.3% a month earlier. The index has been growing on a monthly basis for eight months in a row.

Meanwhile, New Zealand’s central bank on Wednesday again increased the rate by 50 bp, to the highest since April 2015 3.5% per annum. As the minutes of the meeting showed, the Central Bank management also discussed the possibility of raising the rate by 75 bp.

In South Korea, consumer prices (CPI index) in September rose by 5.6% in annual terms after rising by 5.7% in August, although analysts did not expect a change.

“We expect inflation to accelerate again in October. Gasoline prices may continue to decline, but gas and electricity tariffs were raised in early October, and the cost of fresh food is likely to increase ahead of winter,” said ING analyst Robert Carnell.

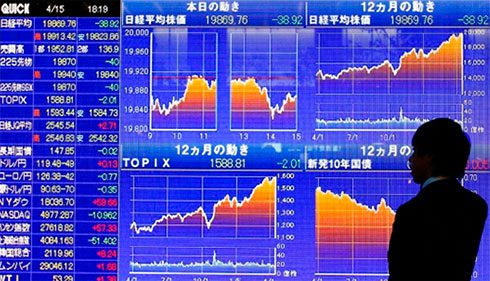

The value of the Japanese Nikkei 225 index rose by 0.6%.

The growth leaders among the components of the index are the shares of Nippon Yusen (+2.6%), Fast Retailing (+1.5%) and Keyence (+1.1%).

On Tuesday, Japanese Prime Minister Fumio Kishida urged Japanese companies to continue raising employee salaries at a rate in line with the country’s inflation rate.

The Hong Kong Hang Seng indicator soared 6.1%. On the eve of the Hong Kong stock exchange did not work, and the day before the index fell to a minimum in 11 years.

Pork producer WH Group jumped 7.8% in Hong Kong trading on news of the sale of its US and Canadian spice business to Saratoga Food.

Market value of Shenzhou Intl. Group climbs 12.4%, BYD Co. – by 9.3%, JD.Com – by 9.2%, Ping An Insurance – by 8.8%.

Exchanges in mainland China are closed due to the National Day holidays.

The South Korean Kospi index is growing by 0.4%.

The market value of one of the world’s largest chip manufacturers Samsung Electronics Co. increased by 1.1%, automaker Hyundai Motor – decreased by 2%.

The Australian S&P/ASX 200 added 1.7%.

The growth leader is the IT sector. Block Inc rose 7.3%, Seek Ltd – 5.9%, Xero Ltd. – by 3.5%. Shares of leading Australian banks are rising by more than 2%.

Fortescue Metals gained 2% after the mining company promised to double its planned investment in its green energy division.