According to EastFruit analysts, the blueberry season in Ukraine in 2024 was unsuccessful for producers. The incredibly early flowering of blueberry plantations, followed by frosts, led to some yield reduction and damage to quality in some regions of the country, but in general, the harvest volume was higher than in 2023. And even though farmers had many problems with harvesting, the supply of berries on the market increased.

Against the backdrop of the ongoing military aggression against Ukraine, farmers also had a lot of problems with blueberry marketing. One of the main problems is the low capacity of the domestic market. Accordingly, domestic prices for blueberries largely depended on the efficiency of exports, which also had certain problems. After all, only a small number of blueberry producers can collect sufficient sales for direct export.

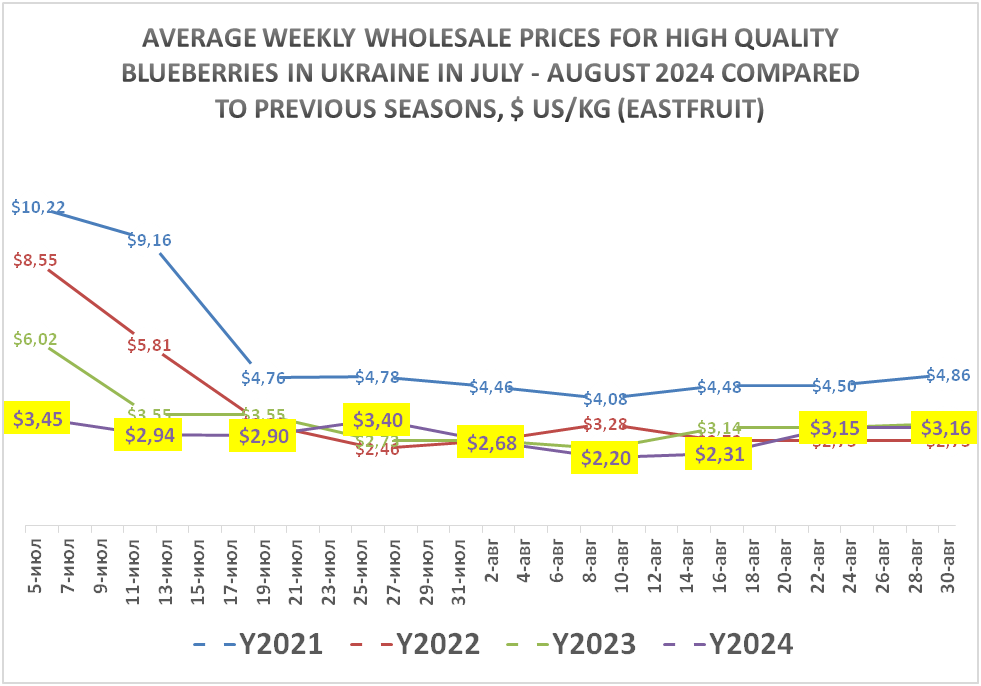

As a result, at the beginning of the season, blueberry prices plummeted to anti-record levels, as we wrote about in this article. We would like to remind you that in this article we will talk about prices only for blueberries of the highest quality, i.e. blueberries that can be sold both on the domestic and foreign markets. And even for these, as you can see in the graph below, prices were also extremely low.

It should be said that in the 2024 season, the early start of the harvest also led to an early end to the massive blueberry harvest. Therefore, for most farmers, the season was already over by mid-August, which allowed blueberry prices to recover somewhat and even exceed the levels of the 2022 season.

Read also: Blueberry sales season in Ukrainian farms will end earlier than usual

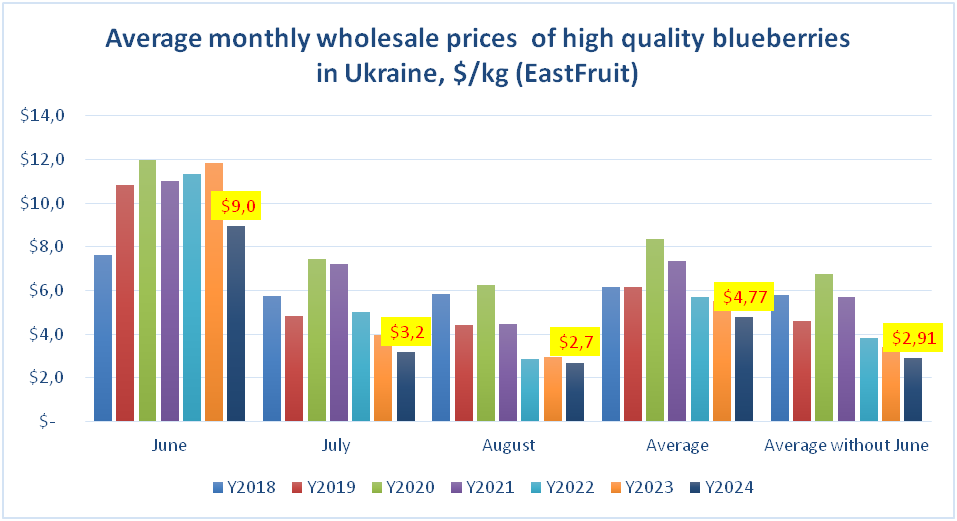

Nevertheless, if we take into account the average prices over the months, especially during the peak two months when up to 90% of the harvest is harvested, i.e. July and August, we see that the average price for blueberries in Ukraine in 2024 was the lowest for all years.

The following graph demonstrates the fall in blueberry prices in Ukraine

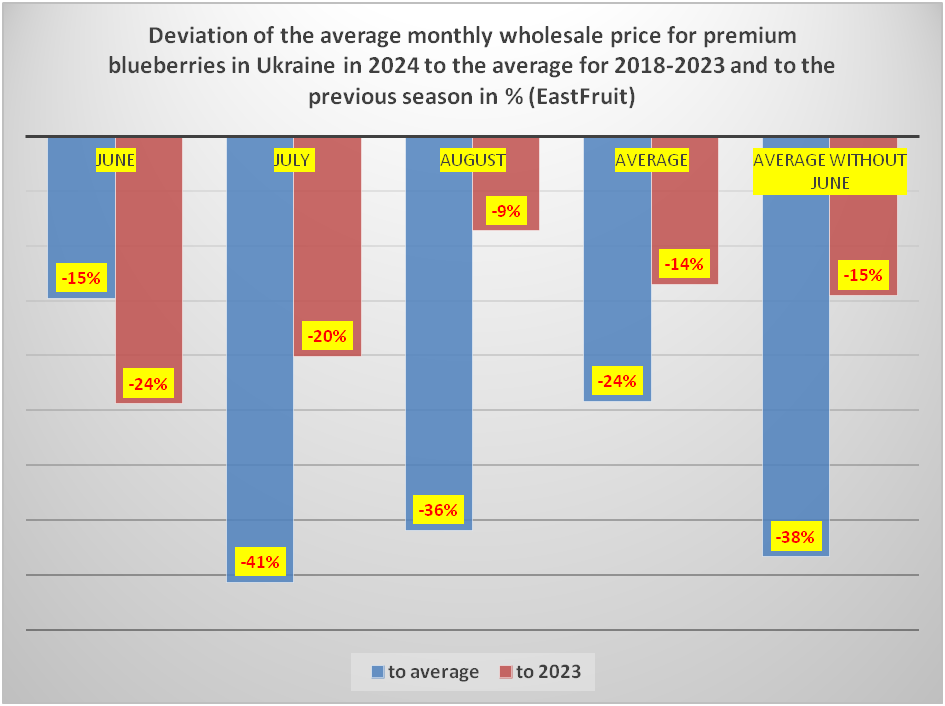

As you can see, the average wholesale price for premium blueberries in Ukraine during the peak months was 39% lower than the average for the six previous seasons (2018-2023) and 15% lower than in the not so successful season of 2023. At the same time, the sharpest drop in price to the average was observed in July, when the bulk of the blueberry harvest in Ukraine is harvested.

“To assess how significant the decline in blueberry prices is for farmers, several additional factors should be taken into account. Factor No. 1 is inflation, which was very significant even for the US dollar. Thus, every year the price reduction needs to be adjusted by another 4-5 percentage points to get a real comparable figure. The second factor is the growth of plantation productivity in most blueberry producers in Ukraine, which allows for a slight increase in production efficiency and partially compensates for the losses from lower prices. This is because most blueberry plantations in Ukraine are just entering full fruiting. However, it is already clear that a further decline in blueberry prices will make growing blueberries for small farms that do not have the ability to enter foreign markets directly far from as profitable as in 2018-2021, and some will even be at risk of loss,” says Andriy Yarmak, economist at the Investment Department of the Food and Agriculture Organization of the United Nations (FAO).

Although the blueberry season cannot yet be considered completely over, as technically in certain seasons Ukraine continues to actively export and sell berries on the domestic market in September and even some volumes in October, in 2024 the situation is such that the interim results of the season will be very close to the final ones.

This year, prices in September and October may well be quite high, because despite the resumption of blueberry production in Peru, massive supplies of blueberries from this country will go to Europe late to the usual time. Nevertheless, blueberry production in Europe and competition in this market from third countries such as Morocco, Georgia and even African countries continue to grow, which will continue to put pressure on prices.